Press release

Reinsurance Market to Hit USD 598.85 Billion by 2033 | Munich RE, Swiss Re, Berkshire Hathaway Lead - Fact.MR

The global reinsurance market, valued at $437 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 4% to reach $598.85 billion by 2033. This steady expansion is driven by increasing frequency of natural disasters, rising insurance penetration in emerging economies, technological advancements in risk assessment, and regulatory changes emphasizing sustainability and capital requirements. The market plays a crucial role in stabilizing the insurance industry by enabling primary insurers to transfer risks, particularly in property & casualty and life & health segments. North America remains dominant with a 43.5% share, fueled by exposure to climate-related risks in the United States, while Asia Pacific's 28% share benefits from rapid economic growth in Singapore and Hong Kong. Challenges such as rising claims costs and geopolitical instability could temper growth, but opportunities in insurance-linked securities (ILS) and data analytics are poised to drive innovation and diversification.Want a Sample Before Buying? Download Free Sample: https://www.factmr.com/connectus/sample?flag=S&rep_id=9064

Reinsurance Market Technology Development:

Technological advancements are transforming the reinsurance landscape, with a strong emphasis on data analytics, artificial intelligence (AI), and machine learning for enhanced risk modeling and underwriting. The integration of AI and big data allows reinsurers to assess complex risks like cyberattacks, pandemics, and climate events more accurately, improving pricing and claims processing efficiency. For instance, advanced tools such as catastrophe modeling software and blockchain for transparent contract management are gaining traction, reducing operational costs and fraud. Insurance-linked securities (ILS) and catastrophe bonds have evolved with fintech integrations, providing alternative capital sources and diversifying risk portfolios. Sustainability-focused technologies, including ESG analytics platforms, align with global regulations like Solvency II in Europe, enabling reinsurers to incorporate climate risk into portfolios. In emerging markets, digital platforms facilitate faster treaty negotiations, while predictive analytics help mitigate losses from natural disasters. These innovations not only boost profitability but also ensure compliance with evolving standards, positioning tech-savvy players like Swiss Re and Munich RE as leaders in a data-driven era.

Reinsurance Market Demand and Impact Analysis:

Demand for reinsurance is surging due to the escalating complexity of global risks, including more frequent hurricanes, wildfires, and cyberattacks, which strain primary insurers' capacities. The rise in catastrophic events has heightened the need for robust risk transfer mechanisms, with property & casualty reinsurance leading at 55.9% market share in 2022. Emerging economies' insurance market growth, driven by economic expansion and middle-class rise, further amplifies demand, as reinsurers support local insurers in managing diversified portfolios. Regulatory frameworks, such as NAIC guidelines in the U.S. and Solvency II in Europe, mandate stronger risk management, boosting reinsurance uptake. However, restraints like persistent claims cost inflation-from medical expenses and litigation-challenge reinsurers' financial performance, potentially leading to higher premiums. Positive impacts include enhanced financial stability for insurers and opportunities in sustainable reinsurance products. Overall, the market's symbiotic role in global insurance expansion creates resilience, with demand projected to grow steadily amid urbanization and climate change.

Reinsurance Market Analysis by Top Investment Segments:

The reinsurance market is segmented by type (facultative and treaty reinsurance), product (property & casualty, life & health), distribution channel (broker and direct writing), and region. Treaty reinsurance emerges as a top investment segment, accounting for US$ 179 billion in 2022 and offering stable, long-term risk coverage, making it attractive for diversified portfolios. Property & casualty reinsurance, holding 55.9% share, is the most lucrative, projected to expand at 4.5% CAGR through 2033 due to high exposure to catastrophic risks and regulatory capital needs. The broker distribution channel, forecasted at 4.5% CAGR, represents strong investment potential through its expertise in complex negotiations and global reach. Regionally, North America (43.5% share) and Asia Pacific (28%) are prime for investments, with the U.S. market reaching US$ 187.5 billion by 2033 amid climate vulnerabilities. High-growth areas include life & health reinsurance in emerging markets, driven by pandemics and aging populations, and facultative reinsurance for specialized risks like cyber threats. Investors should prioritize segments with tech integration and ESG alignment for sustained returns.

Reinsurance Market Across Top Countries:

The reinsurance market shows regional dynamism, with key countries leading growth.

1.The United States dominates North America, with demand forecasted at US$ 187.5 billion by 2033, driven by hurricane and wildfire risks, and NAIC regulations promoting robust reinsurance.

2.China, in East Asia, benefits from insurance liberalization and massive market potential, contributing to Asia Pacific's 28% share through rapid urbanization.

3.Singapore and Hong Kong serve as Asia Pacific hubs, leveraging stable financial ecosystems and regulatory frameworks as gateways to Southeast Asia and China, respectively.

4.Germany and the UK in Europe (18% share) emphasize Solvency II compliance and sustainability, with steady demand from property risks.

5.Canada focuses on life & health reinsurance amid demographic shifts. These countries collectively drive global demand, with Asia Pacific leading due to economic growth and North America due to catastrophe exposure.

Leading Reinsurance Companies and Their Industry Share:

The reinsurance market is competitive, blending global giants with niche players. Key leaders include Munich RE, Swiss Re, and Berkshire Hathaway Inc., collectively holding significant shares through vast capital reserves and diversified portfolios. Munich RE and Swiss Re excel in innovation, with expertise in catastrophe modeling and ESG integration. Berkshire Hathaway strengthens its position via acquisitions like Alleghany in 2022, focusing on property & casualty. Other notables are Hannover Re, AXA XL, and SCOR, offering specialized solutions in life & health and treaty reinsurance. Regional players like China Reinsurance (Group) Corporation dominate in Asia. These firms engage in strategic alliances, such as Swiss Re's 2023 partnership with Benekiva for claims platforms, and M&A to expand reach. Multinationals command over 60% share, leveraging tech and compliance, while startups target insurtech niches like data analytics.

Reinsurance Market Historic and Future Pathway Analysis:

Historically, the reinsurance market grew from US$ 389 billion in 2022 to US$ 404.56 billion in 2023, driven by post-pandemic recovery and rising disasters, with a shift toward ILS and digital tools. From 2018 to 2022, CAGR hovered around 4%, amid regulatory evolutions and emerging risks. Looking ahead to 2033, the market will continue at 4% CAGR, propelled by climate change, tech adoption, and emerging market penetration. Future trends include AI-enhanced risk assessment, sustainable products, and diversified capital via catastrophe bonds. Challenges like claims inflation will necessitate innovation, while opportunities in Asia Pacific and cyber reinsurance promise growth. Companies must invest in R&D and partnerships to navigate volatility and capitalize on global insurance expansion.

Browse for A Report: https://www.factmr.com/report/reinsurance-market

Reinsurance Industry News:

Recent developments highlight the reinsurance sector's resilience and innovation.

1.In April 2025, Aon reported global reinsurer capital at a record $715 billion as of Q3 2024, signaling strong profitability and modest softening in property reinsurance for 2025.

2.AM Best projected dedicated reinsurance capital to reach $649 billion in 2025, driven by diverse capital deployment and robust operating profits.

3.In January 2025, Swiss Re's sigma report forecasted global real GDP growth at 2.8% in 2025, supporting insurance and reinsurance expansion amid economic stability.

Gallagher Re estimated a 6% increase in traditional reinsurance capital for 2025, fueled by profitability and investment returns. These updates reflect a stable, profitable market adapting to risks like U.S. casualty reserves and global volatility through innovation and capital growth.

Explore More Related Studies Published by Fact.MR Research:

Alexandrite Laser Treatment Market- https://www.factmr.com/report/870/alexandrite-gemstone-lasers-market

Aneurysm Clip Market- https://www.factmr.com/report/1122/aneurysm-clips-market

Pod Vape Market- https://www.factmr.com/report/3062/pod-vapes-market

Peak Flow Meter Market- https://www.factmr.com/report/4099/peak-flow-meter-market

Earwax Removal Aid Market- https://www.factmr.com/report/4100/earwax-removal-aid-market

Anti-cancer Drugs Market- https://www.factmr.com/report/4350/anticancer-drugs-market

Sleep Mask Market- https://www.factmr.com/report/4523/sleep-mask-market

Eco-Friendly Furniture Market- https://www.factmr.com/report/4730/eco-friendly-furniture-market

Alginate Dressing Market- https://www.factmr.com/report/alginate-dressing-market

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of Fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Reinsurance Market to Hit USD 598.85 Billion by 2033 | Munich RE, Swiss Re, Berkshire Hathaway Lead - Fact.MR here

News-ID: 4152079 • Views: …

More Releases from FactMR

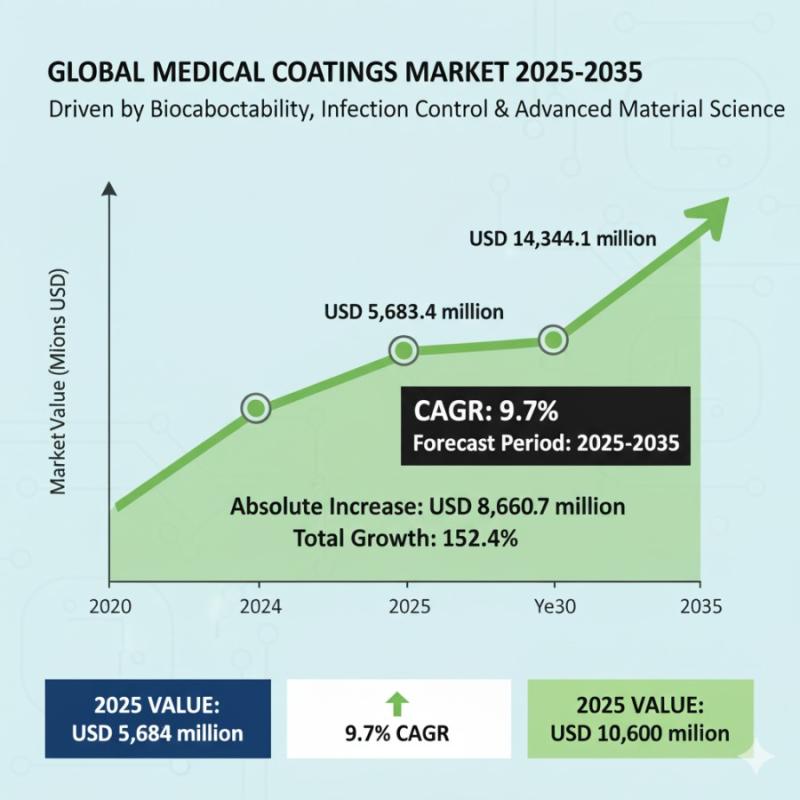

Medical Coatings Market to Hit USD 14,344.1 million by 2035- Growth Accelerates …

The global medical coatings market is set for sustained growth through 2035, powered by minimally invasive procedures, infection prevention priorities, and smart biocompatible innovations. According to Future Market Insights (FMI), the market is valued at USD 5,683.4 million in 2025 and is projected to reach USD 14,344.1 million by 2035, expanding at a compound annual growth rate (CAGR) of 9.7%.

The FMI report, "Medical Coatings Market Size, Share, and Forecast 2025-2035,"…

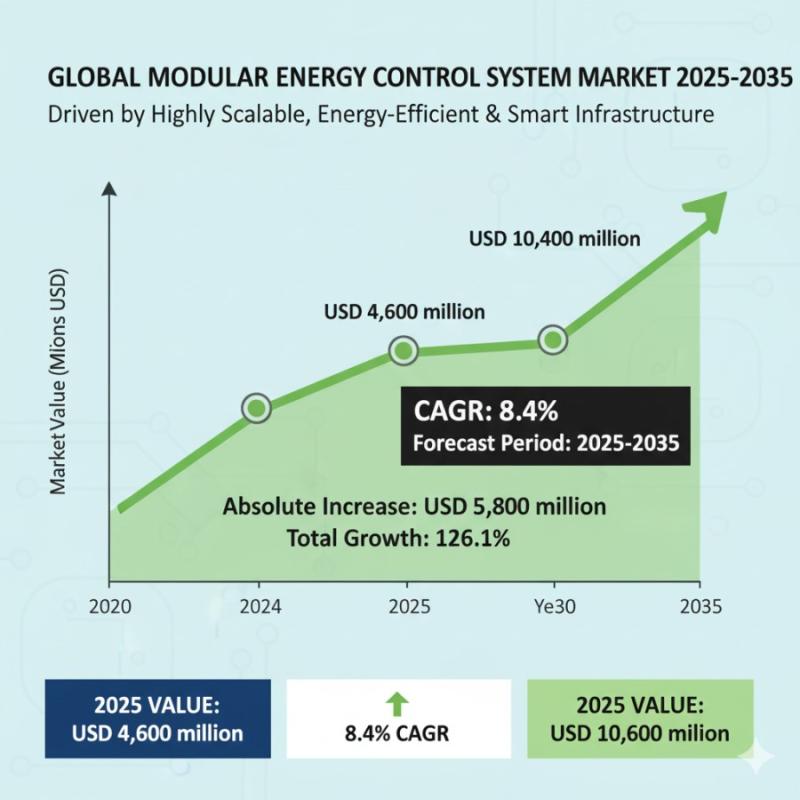

Modular Energy Control System Market to Hit USD 10,400 million by 2035- Growth A …

The global modular energy control system market is set for robust expansion through 2035, fueled by scalable infrastructure, real-time optimization, and seamless renewable energy integration. According to Future Market Insights (FMI), the market is valued at USD 4,600 million in 2025 and is projected to reach USD 10,400 million by 2035, expanding at a compound annual growth rate (CAGR) of 8.4%

The FMI report, "Modular Energy Control System Market Size, Share,…

Airborne Warning and Control System Market to Surpass USD 11,888.1 million by 20 …

The global airborne warning and control system (AWACS) market is accelerating toward a decade of robust expansion, driven by escalating geopolitical tensions, defense modernization, and AI-enhanced threat detection. According to Future Market Insights (FMI), the market is valued at USD 5,209.7 million in 2025 and is projected to reach USD 11,888.1 million by 2035, growing at a compound annual growth rate (CAGR) of 8.6%.

The FMI report, "Airborne Warning and Control…

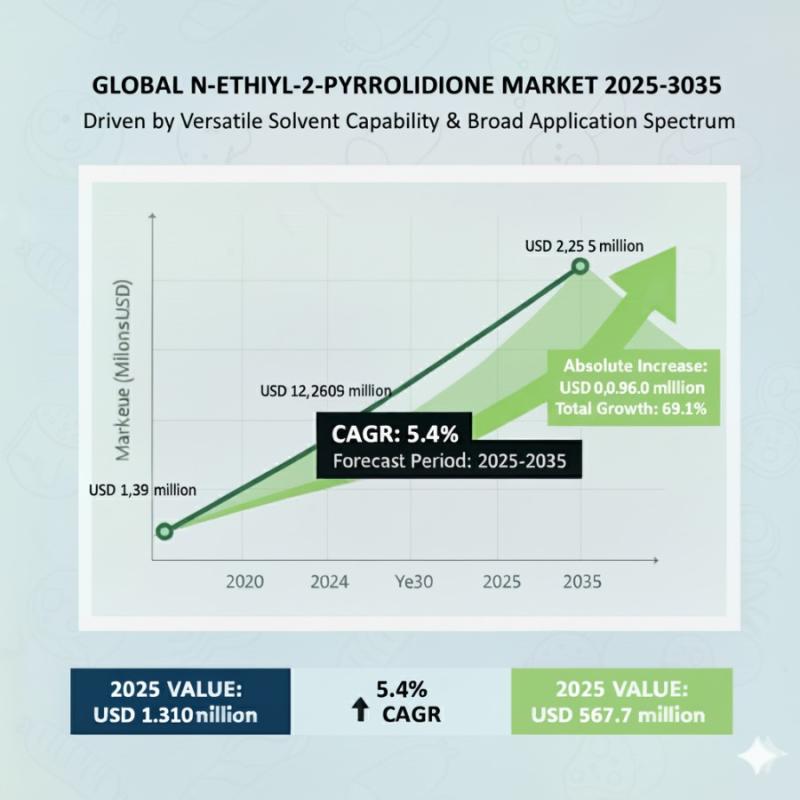

N-Ethyl-2-Pyrrolidone Market to Reach USD 2.35 million by 2035- Steady Growth Le …

The global N-Ethyl-2-Pyrrolidone (NEP) market is poised for consistent expansion through 2035, fueled by rising demand in high-purity electronics, lithium-ion battery production, and pharmaceutical synthesis. According to Future Market Insights (FMI), the market is valued at USD 1.39 million in 2025 and is projected to hit USD 2.35 million by 2035, growing at a compound annual growth rate (CAGR) of 5.4%.

The FMI report, "N-Ethyl-2-Pyrrolidone Market Size, Share, and Forecast 2025-2035,"…

More Releases for Reinsurance

Reinsurance Services Market SWOT Analysis by Key Players Hannover Re, Korean Rei …

The Latest research coverage on Reinsurance Services Market provides a detailed overview and accurate market size. The study is designed considering current and historical trends, market development and business strategies taken up by leaders and new industry players entering the market. Furthermore, study includes an in-depth analysis of global and regional markets along with country level market size breakdown to identify potential gaps and opportunities to better investigate market status,…

Crop Reinsurance Market Is Booming So Rapidly | Munich Reinsurance, Swiss Reinsu …

The Crop Reinsurance Market study with 65+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that…

Agriculture Reinsurance Market Is Booming Worldwide : Agroinsurance, Swiss Reins …

The Latest Released Agriculture Reinsurance market study has evaluated the future growth potential of Agriculture Reinsurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers, challenges,…

Recent Reinsurance Market Investment Activity From Established Companies Are to …

The latest release from WMR titled Reinsurance Market Research Report 2022-2028 (by Product Type, End-User / Application, and Regions / Countries) provides an in-depth assessment of the Reinsurance including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, key players company profiles, and strategies. Global Reinsurance Market study with 100+ market data Tables, Pie Chat, Graphs & Figures is now released BY WMR. The report presents a complete assessment…

Life Reinsurance Market is Going to Boom | Swiss Re, Munich Reinsurance, Korean …

Advance Market Analytics published a new research publication on “Life Reinsurance Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Life Reinsurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

Reinsurance Market To See Stunning Growth | Munich, Korean Reinsurance, Swiss

Latest Market Research on “Reinsurance Market” is now released to provide hidden gems performance analysis in recent years and years to come. The study explains a detailed overview of market dynamics, segmentation, product portfolio, business plans, and the latest development in the industry. Staying on top of market trends & drivers is always remain crucial for decision-makers and marketers to hold emerging opportunity.

Get the inside scoop with Sample report https://www.htfmarketreport.com/sample-report/3185812-global-reinsurance-market-26

Know…