Press release

Emerging Trends to Reshape the Accidental Death Insurance Market: Introduction Of Innovative Products By Key Players In The Accidental Death Insurance Market as a Key Influencer

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Accidental Death Insurance Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market size of accidental death insurance has consistently expanded over the past few years. It is projected to surge from $72.45 billion in 2024 to $74.74 billion in 2025, showcasing a compound annual growth rate (CAGR) of 3.2%. This growth experienced during the historic period can be linked to factors such as heightened awareness and education, the development of the insurance market, workplace hazards, and evolving lifestyles.

Accidental Death Insurance Market Size Forecast: What's the Projected Valuation by 2029?

The market size for accidental death insurance is forecasted to witness a consistent growth in the forthcoming years, reaching up to $87.11 billion by 2029 with a Compound Annual Growth Rate (CAGR) of 3.9%. The predicted growth during the forecast period can be credited to factors like risk management, adoption of digital platforms, health and wellness incentives, and travel and adventure. The major anticipated trends during this period involve digital distribution, customized coverage policies, bundled insurance products, and additional riders and add-ons.

View the full report here:

https://www.thebusinessresearchcompany.com/report/accidental-death-insurance-global-market-report

What Are the Drivers Transforming the Accidental Death Insurance Market?

The escalating perception of environmental problems is predicted to fuel the accidental death insurance market's expansion. Such problems include pollution, climate shift, deforestation, destruction of habitats, and the loss of biodiversity that have a detrimental effect on our natural world and ecosystems. It is anticipated that the increasing occurrence of natural calamities like floods, hurricanes, and wildfires will intensify the demand for accidental death insurance policies. For example, in May 2024, the Ministry for the Environment, a New Zealand-based agency, revealed that environmental issues are the fourth major concern for New Zealand's population, surpassed only by the cost of living, crime, and housing. The consciousness of these matters surged markedly from 20% in 2022 to 25% in 2024. Hence, the escalating awareness of environmental issues is predicted to fuel the growth of the accidental death insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2451&type=smp

What Long-Term Trends Will Define the Future of the Accidental Death Insurance Market?

Leading businesses in the accidental death insurance market are launching inventive products in order to establish a competitive advantage. Asteya, an income insurance specialist technology company based in the US, unveiled an innovative product in March 2022 - Accidental death coverage. Asteya's digital insurance platform is tailored to meet the requirements of the contemporary entrepreneur, providing them with affordable, efficient, and readily available insurance coverage to protect their income. Asteya's goal is to make income insurance universally accessible, with the end game of strengthening financial, physical, and mental wellbeing of individuals.

Which Segments in the Accidental Death Insurance Market Offer the Most Profit Potential?

The accidental death insurance market covered in this report is segmented -

1) By Application: Personal, Enterprise

2) By Product: Personal Injury Claims, Road Traffic Accidents, Work Accidents, Other Products

3) By Distribution Channel: Direct marketing, Bancassurance, Agencies, E-commerce, Brokers

Subsegments:

1) By Personal: Individual Policies, Family Policies, Group Policies

2) By Enterprise: Employee Benefits, Corporate Policies, Business Continuity Plans

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=2451&type=smp

Which Firms Dominate the Accidental Death Insurance Market by Market Share and Revenue in 2025?

Major companies operating in the accidental death insurance market include Allianz SE, Assicurazioni Generali SpA, China Life Insurance Company Limited, MetLife Inc., Ping An Insurance Company of China Ltd., AXA SA, Sumitomo Life Insurance Company, Aegon Life Insurance Company Limited, Dai-ichi Life Insurance Company Limited, Clinical Pharmacogenetics Implementation, Aviva plc, Munich Re Group, Zurich Insurance Group Ltd., Reliance Nippon Life Insurance Company, Gerber Life Insurance Company, American International Group Inc., Prudential Financial Inc., Mutual of Omaha Insurance Company, Aflac Inc., Transamerica Corporation, Fidelity Life Association, Hartford Financial Services Group Inc., Sun Life Financial Inc., Taiwan Life Insurance Co. Ltd., Massachusetts Mutual Life Insurance Company, Farglory Life Insurance Col Ltd., TruStage Financial Group Inc., Securian Financial Group Inc., American National Insurance Company, American Family Insurance, Amica Mutual Insurance Company, Erie Insurance Group

Which Regions Offer the Highest Growth Potential in the Accidental Death Insurance Market?

The countries covered in the accidental death insurance market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=2451

"This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work."

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Emerging Trends to Reshape the Accidental Death Insurance Market: Introduction Of Innovative Products By Key Players In The Accidental Death Insurance Market as a Key Influencer here

News-ID: 4151091 • Views: …

More Releases from The Business Research Company

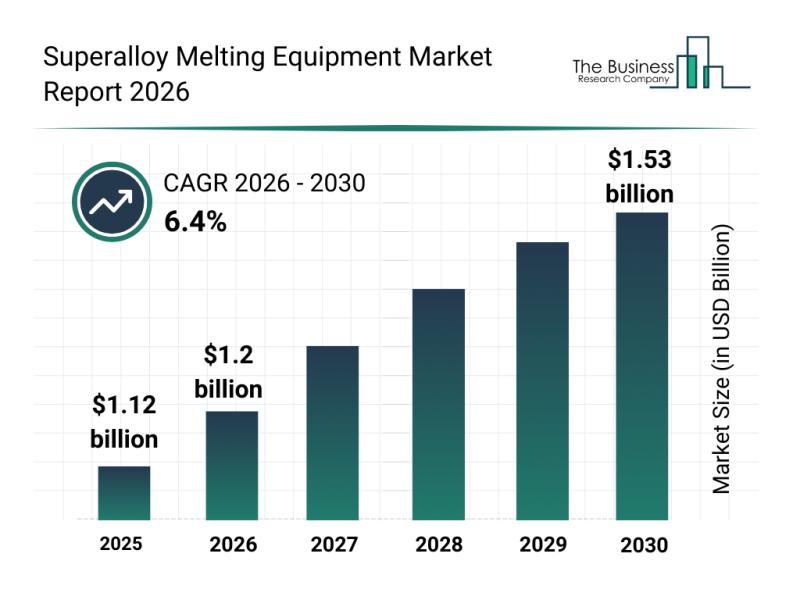

Segmentation Analysis, Market Trends, and Competitive Landscape in the Superallo …

The superalloy melting equipment market is poised for significant expansion over the coming years, driven by advancements in aerospace and energy sectors. As industries demand higher performance materials, the technology and capacity of melting equipment are evolving to meet these needs. Let's explore the market's size, key players, emerging trends, and the main segments shaping its growth through 2030.

Projected Market Size and Growth Outlook for Superalloy Melting Equipment

The superalloy…

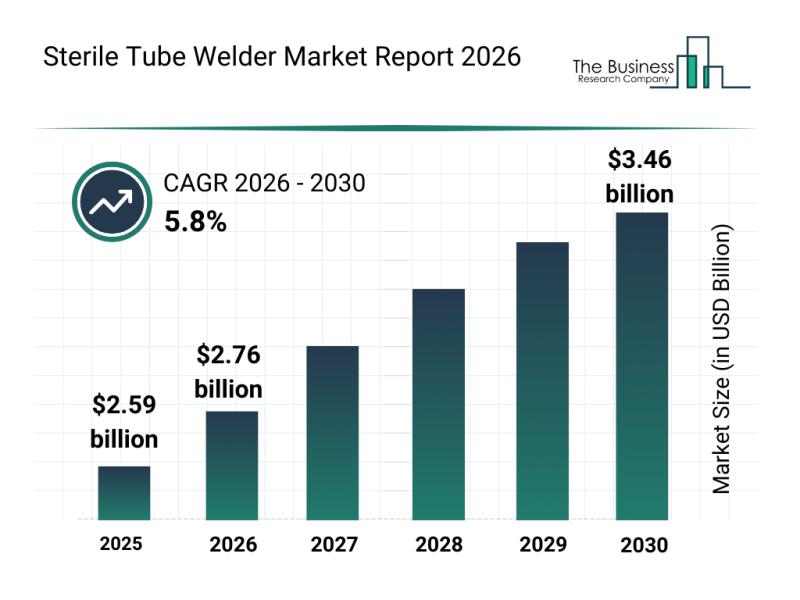

Analysis of Segments and Major Growth Areas in the Sterile Tube Welder Market

The sterile tube welder market is poised for significant expansion as advancements in biopharmaceutical manufacturing and diagnostic automation continue to accelerate. With increasing demand for contamination-free processing in cutting-edge therapies, this sector is expected to play a crucial role in supporting safe and efficient fluid transfer solutions. Let's explore the market's size, key players, current trends, and segmentation to understand its growth trajectory and opportunities.

Sterile Tube Welder Market Size Forecast…

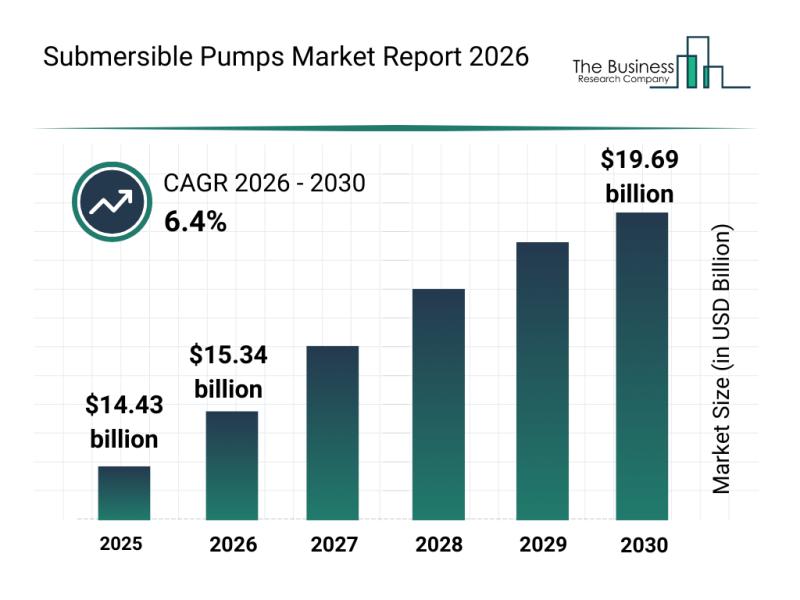

Emerging Sub-Segments Transforming the Submersible Pumps Market Landscape

The submersible pumps market is on track for significant expansion over the coming years, driven by advancements in technology and growing demand across various industries. This overview explores the market's projected size, key players, emerging trends, and important market segments shaping its future.

Forecasted Market Value and Growth of the Submersible Pumps Market

The submersible pumps market is anticipated to reach a valuation of $19.69 billion by 2030, growing at a…

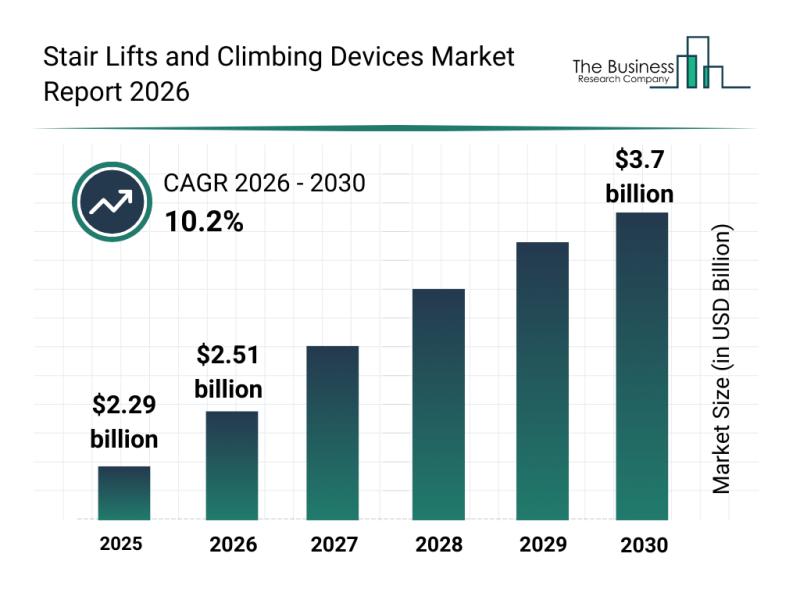

Emerging Growth Patterns Driving Expansion in the Stair Lifts and Climbing Devic …

The stair lifts and climbing devices industry is on track for significant expansion as the need for mobility solutions grows worldwide. With advancements in technology and increasing demand driven by demographic shifts, this market is set to experience notable growth through 2030. Let's explore the current market size projections, key players, emerging trends, and important segments defining this sector.

Projected Growth and Market Size for Stair Lifts and Climbing Devices

The…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…