Press release

Car Engine Timing Belt Market to Reach CAGR 42% by 2031 Top 15 Company Globally

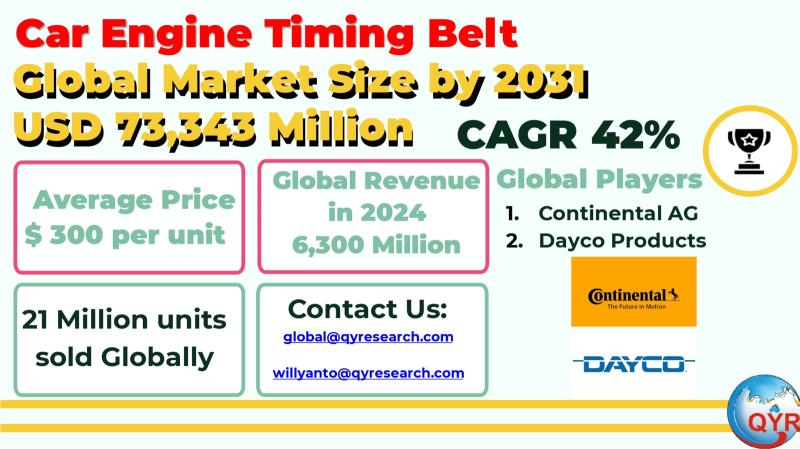

Car engine timing belts synchronize crankshaft and camshaft rotation to ensure accurate valve timing in internal combustion engines. They are mission-critical wear components in both OEM production and the global aftermarket, typically replaced between 60,000 and 120,000 kilometers depending on engine design and service conditions. The market spans belts, complete timing system kits (including tensioners, idlers, and often water pumps), and related components and services. The shift toward efficient, downsized, often turbocharged engines and the persistence of the global ICE parc keep timing belts economically relevant even as chains and electrification advance.In 2024, the global timing belt market was approximately USD 6,300 million, the market is expected to expand at roughly 42% CAGR through 2031, reaching USD 73,343 million. Translating value into volume, aftermarket kit parts pricing typically ranges around USD 300 for parts alone in a full replacement (labor excluded), an estimated 2024 global volume of about 21 million belt-equivalent units.

.

Latest Trends and Technological Developments

Recent product and portfolio moves underscore ongoing innovation and aftermarket expansion. On January 2025, Gates introduced belt-in-oil timing belt kits for popular Ford EcoBoost applications, reinforcing the wet-belt trend in compact, high-efficiency engines and expanding coverage in a critical parc. On August 2025, Gates also published its 2024 Sustainability Report, signaling continued R&D and lifecycle stewardship priorities. In September 2024, Continental announced a major product range expansion timed around Automechanika, adding ~700 part numbers by 2025 for broader engine management and drive coverage. Dayco expanded its timing chain kit line on July 2024, citing OE shifts from belts to chains in certain applications, which affects belt mix but also lifts comprehensive timing system service demand. SKF highlighted engine Masterkit packaging in late 2024 industry coverage, combining water pumps, timing belts and accessory components into complete service solutions supporting higher attach rates and reliability for workshops. Optibelts 2025 customer events and manufacturing expansion steps in late 2024 further illustrate capacity and service upgrades in the belt ecosystem.

Asia Pacific is the largest regional base, driven by Chinas, Japans, Indias and Koreas combined OEM output and a vast aftermarket. Multiple market trackers place Asia Pacific at roughly one-third or more of global revenue in 2024; for example, Precedence Research notes APAC at 35.14% share in 2024 with China growing at a brisk pace, while broader analyst narratives consistently rank APAC first by production and replacement opportunity. These dynamics are supported by persistent ICE parc growth outside premium segments, a robust independent aftermarket, and regional manufacturing clusters for belts, tensioners, and kits.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4784134

Car Engine Timing Belt by Type:

Dry Belt

Wet Belt

Car Engine Timing Belt by Application:

Commercial Vehicles

Passenger Vehicles

Global Top 15 Key Companies in the Car Engine Timing Belt Market

Continental

Habsit

SKF Group

AC Delco

Gates

INA

Hutchinson SA

Dayco Products

BRECO

OPTIBELT

Mitsuboshi Belting

Fuju Belt

BANDO

NOK

Ningbo Beldi Synchronous Belt

Regional Insights

Within Southeast Asia, replacement demand benefits from rising vehicle ownership, a large used-vehicle base, and tropical operating conditions that favor preventive maintenance. Indonesia, ASEANs largest market, shows a healthy aftermarket trajectory with overall parts demand projected at ~5.2% CAGR through 2030, which supports steady timing system replacements and kit sales. Regional distributors increasingly favor complete kit solutions to mitigate comebacks, and global suppliers are expanding SKU coverage tailored to high-volume Japanese marques prevalent across ASEAN.

The belt market faces three intertwined headwinds. First, timing chains retain or gain share in specific OEM programs, reshaping the new-vehicle mix and the long-term replacement pool; Daycos expansion of chain kits highlights this structural shift even as belts remain dominant in many segments. Second, electrification gradually reduces ICE service opportunities in markets with fast BEV adoption, although the impact is uneven across Asia and ASEAN where ICE and hybrids remain strong. Third, price inflation in rubber, cord and fabric inputs has prompted manufacturers such as Mitsuboshi to implement price increases (10% or more from May 2025), pressuring margins and raising end-market ASPs in some channels.

Suppliers can defend and grow share by densifying SKU coverage for regional top sellers, pushing comprehensive kit packaging to increase ticket size and reliability, and aligning with wet-belt applications in compact turbo engines, where OE designs demand specific materials and oil-compatible constructions. Expanding local inventory and technical training in Asia and ASEAN reduces downtime for installers and improves brand preference. Sustainability messaging and longer-life materials (e.g., advanced EPDM compounds and optimized fabric backings) can differentiate in fleet and professional channels where lifecycle cost matters..

Product Models

A car engine timing belt is a reinforced rubber belt with teeth that synchronizes the crankshaft and camshaft, ensuring valves open and close at the right time for efficient combustion.

Dry timing belts which operate externally, outside the oil system, and are widely used across many conventional gasoline and diesel engines. Notable products include:

Gates Synchro-Link® Timing Belt Gates Corporation: Renowned high-efficiency, low-maintenance belt used in various automotive overhead-cam engines.

ContiTech Timing Belt Continental / ContiTech: Durable OEM belt widely used across European and Asian carmakers.

INA / Schaeffler Timing Belt German Schaeffler Group (INA): High-precision automotive belts featured in German-engineered cars.

Bosch OEM Timing Belt Robert Bosch GmbH: Still offered in select parts catalogs for European vehicles.

Mahle Timing Belt Kit-Mahle: Often supplied as part of OE timing belt service kits, including water pump and tensioners

Wet timing belts designed to run immersed in engine oil to reduce friction, noise, and weight though they require more careful maintenance and carry unique failure risks. Examples include:

Ford 1.0L EcoBoost (Fiesta, Focus, Transit, Puma, Kuga): Introduced BIO systems to improve efficiency and reduce friction.

Citroën 1.2L PureTech (C3, Berlingo, C4, C5 Aircross): Also employs the same BIO system as Peugeot.

Vauxhall/Opel 1.2L PureTech (Corsa, Astra, Grandland): Uses PSAs oil-bathed timing belt in equivalent models.

Honda 1.0L Turbo (Civic): Equipped with a wet timing belt design in recent models.

Volkswagen TSI Engines (various models): Some versions include belt-in-oil systems, especially oil pump drives.

Despite powertrain transitions and chain adoption in specific programs, the timing belt market remains substantial and resilient through 2031 thanks to the vast installed ICE base and healthy aftermarket cycles, especially in Asia and ASEAN. With a 2024 value around USD 6,300 million and a projected 42% CAGR to 2031, the category offers stable, cash-generative growth anchored by recurring replacement, rising kit attach rates, and targeted innovation such as belt-in-oil solutions for newer engines.

Investor Analysis

For investors, the markets attractiveness lies in its durable, replacement-driven economics and regional concentration in Asia/ASEAN where ICE dominance and expanding vehicle fleets sustain volumes. What matters most is SKU coverage breadth, channel execution, and the ability to offer complete, high-reliability kits that lift average selling prices and margins. How value is captured is through aftermarket mix expansion, localized inventory and training that cut installer friction, and selective OE programs in growth niches like wet-belt engines. Why this benefits investors is the combination of predictable replacement cycles, pricing power observed in 20242025, and innovation-led differentiation that protects share even as chains and electrification subtly alter the long-term mix. Companies that marry product leadership with regional go-to-market precision particularly in Indonesia and broader ASEAN are positioned to outperform.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/4784134

5 Reasons to Buy This Report

It provides a defendable 2024 market size and a transparent, source-triangulated CAGR outlook to 2031 for robust planning and valuation.

It converts market value into an evidence-based estimate of global units and realistic price bands so you can model revenue per unit by channel.

It captures the very latest product and portfolio moves from leading brands, with dates, to inform competitive tracking and timing of initiatives.

It drills into Asia and ASEAN, including Indonesia, where growth and aftermarket dynamics materially shape global outcomes.

It translates trends and challenges chain adoption, input inflation, electrification into clear strategic levers investors can underwrite.

5 Key Questions Answered

What is the most credible 2024 global market size for car engine timing belts, and what CAGR should decision-makers use through 2031?

How many belt-equivalent units sold globally in 2024, and what ASP ranges are realistic across OEM belts versus aftermarket kits?

Which 2024 product launches and portfolio expansions matter most, and what do they signal about future demand and mix?

Where are the richest opportunities in Asia and ASEAN, including Indonesias aftermarket growth outlook and brand/channel implications?

How should investors underwrite risks from timing chain substitution, electrification, and input-cost inflation and which players are best positioned to mitigate them?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Car Engine Timing Belt Market to Reach CAGR 42% by 2031 Top 15 Company Globally here

News-ID: 4150930 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Belt

Belt Conveyor | Inclined Belt Conveyor | Flat Belt Conveyor - Technovision

General:

We specialize in manufacturing qualitative range of Belt Conveyor which find wide application in various fields to move diverse unit loads & bulk materials. Our conveyors are highly in demand in mining operation, foundries, bagasse handling in co-generation plants granaries, coal handling plants, bag handling in sugar godowns and packing industries. They are used in handling loads from one location to another within the process in line production. The Belt…

Belt Tensioners Market Report 2018: Segmentation by Type (Engine Belt Tensioner, …

Global Belt Tensioners market research report provides company profile for Toolee Industrial, Nozag AG, NTN, Dayco, Gates Europe, Mubea, Tsubakimoto, KMC Automotive, Pricol Limited, Madler GmbH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025,…

Seatbelt Retractors Market Report 2018: Segmentation by Type (Belt-In-Seat, Six- …

Global Seatbelt Retractors market research report provides company profile for Takata, Joyson Safety Systems, Robert Bosch, Denso, Continental, Tokai Rika, Autoliv, Hyundai Mobis, TRW Automotive, Toyoda Gosei and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to…

Active Seatbelt Market Report 2018: Segmentation by Type (Belt-In-Seat, Six-Poin …

Global Active Seatbelt market research report provides company profile for Special Devices, Far Europe, HYUNDAI MOBIS, ITW Safety, Iron Force Industrial, Autoliv, Tokai Rika, Bosch, Takata Corporation, DENSO and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018…

Belt Tension Meter Market Report 2018: Segmentation by Product (V belt, Flat bel …

Global Belt Tension Meter market research report provides company profile for HAAG-STREIT, Nidek, Icare, Kowa, Tomey, Keeler, Reichert, TOPCON and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation…

Six Sigma Green Belt | Six Sigma Green Belt Training

Green Belts are people that work on basic process improvement projects. Customarily, their activity would require less than 50% of their time be centered around Six Sigma ventures. Be that as it may, Green Belt parts and jobs prerequisites will fluctuate between organizations.

Six Sigma San Antonio https://www.6sigma.us/six-sigma-san-antonio-tx.php

A Green Belt certification is perfect for those that will be entrusted with enhancing existing procedures, these could be forms that are not…