Press release

North America Health Insurance Market Valuation Projected at US $2,408.49 billion by 2031, Leading Companies are AIA Group Limited, Allianz SE, Aviva Plc.

Market OverviewThe North America health insurance market is experiencing robust expansion as healthcare systems evolve and societies reckon with rising costs and complex patient needs. Grounded in the concept of offering financial protection against medical expenses, health insurance plays an indispensable role for individuals, families, and employers. It helps cover surging medical costs from surgeries and doctor visits to diagnostics, hospitalization, and pharmaceuticals enabling better access to essential care.

In North America particularly, the market is anchored by a deeply integrated insurance ecosystem, shaped by public programs like Medicare and Medicaid in the U.S., innovative private carriers, and a developing regulatory landscape that significantly influences product offerings and distribution.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.datamintelligence.com/download-sample/north-america-health-insurance-market?nrk

In 2023, the North America health insurance market reached a staggering US $1,621.35 billion, and it is projected to grow to US $2,408.49 billion by 2031, at a compound annual growth rate (CAGR) of 5.2% between 2024 and 2031. These impressive figures reflect both solid consumer demand and resilient structural support from public policy and private innovation.

Several key forces are fueling this growth. First, the rising prevalence of chronic conditions such as cancer, hypertension, and high cholesterol even among middle-aged and older adults is driving sustained demand for comprehensive insurance coverage. Second, the widespread adoption of digital health technologies including telemedicine, AI-powered diagnostics, and remote monitoring has reshaped the way insurance products are designed and delivered, enhancing efficiencies and accessibility.

Among market segments, private insurance continues to dominate in terms of revenue and uptake, especially in the U.S., driven by employer-provided plans and individual plans tailored for high-income demographics. Public insurance also plays a critical role, especially in providing broad-based coverage to lower-income or vulnerable populations, ensuring market balance. Geographically, the United States remains the leading region, thanks to its large population base, high healthcare spending, advanced medical infrastructure, and a complex mix of public and private payers.

Key Highlights from the Report

➤ Market size in 2023 was US $1,621.35 billion, projected to grow to US $2,408.49 billion by 2031 (CAGR: 5.2%).

➤ Private insurance continues to lead due to employer-sponsored and tailored plans.

➤ Public insurance remains a stabilizing factor by covering underserved populations.

➤ Chronic disease prevalence and aging populations are major growth catalysts.

➤ Digital health technologies and telemedicine are transforming insurance delivery.

➤ The United States remains the most dominant regional market due to infrastructure and spending.

Market Segmentation

By Provider

The North America health insurance market can be classified into public and private providers. Public providers include government-sponsored programs such as Medicare, Medicaid, and other state or federal schemes, which play a crucial role in offering affordable healthcare access to vulnerable populations, senior citizens, and low-income groups. On the other hand, private providers dominate in terms of revenue, supported by employer-sponsored plans, individual health plans, and specialized insurance products that cater to diverse needs.

By Coverage

Based on coverage, the market is segmented into diseases insurance and health insurance. Disease-specific insurance typically focuses on critical illnesses such as cancer, cardiovascular disorders, or diabetes, providing policyholders with financial security against the high treatment costs of these conditions. In contrast, general health insurance covers a broader range of medical expenses, including hospitalization, outpatient care, and preventive services, making it the most widely adopted coverage type in North America.

By Plan Type

The market offers a variety of plan types designed to meet different demographic and healthcare needs. Individual health insurance policies provide personalized coverage for single policyholders, while family floater health insurance extends protection to entire households under one plan. For the aging population, senior citizens' health insurance focuses on geriatric care, addressing chronic conditions and long-term healthcare costs. Critical illness insurance is designed to provide lump-sum payouts upon diagnosis of severe conditions, helping patients cover treatment and recovery expenses. Meanwhile, group health insurance often provided by employers-remains one of the most common forms of coverage, offering employees and their families a cost-effective way to access healthcare.

By Distribution Channel

In terms of distribution, health insurance is sold through individual agents, corporate agents, direct marketing, and other channels. Individual agents play a vital role in building personal relationships and guiding customers through policy selection. Corporate agents cater to large organizations and businesses, offering group insurance packages and customized solutions. Direct marketing, including online platforms, mobile applications, and insurer websites, has seen strong growth thanks to digital adoption and consumer preference for convenience.

Looking For A Detailed Full Report? Get it here: https://www.datamintelligence.com/buy-now-page?report=north-america-health-insurance-market

Regional Insights

United States

The U.S. dominates the North American health insurance landscape. A vast population, high per capita healthcare spending, complexity in insurance infrastructure, and robust private sector innovation drive the leadership position. Digital health innovations and employer-based plans further reinforce U.S. dominance, offering a competitive edge in both market growth and diversity of offerings.

Canada

Canada's health insurance market benefits from government-run universal healthcare systems, supplemented by private coverage for pharmaceuticals, dental care, and supplemental services. This dual approach is driving growth in private insurance sectors and stimulating competition among insurers offering add-on products.

Mexico

In Mexico, public schemes have historically provided broader coverage. However, private insurance is gradually growing, particularly among middle to upper segments seeking more comprehensive or expedited care. Economic growth and healthcare reform initiatives continue to expand the private health insurance footprint.

Market Dynamics

Market Drivers

Chronic illnesses such as cancer, cardiovascular conditions, and obesity-related health issues are increasingly pushing consumers and employers to invest in health insurance for financial protection. The aging population amplifies the demand for senior-focused and long-term care coverage. Meanwhile, the digital health revolution with telemedicine, AI diagnostics, and remote patient monitoring drives innovation in how health products are underwritten, delivered, and managed, further fueling market demand.

Market Restraints

High healthcare costs in North America strain both insurers and consumers, potentially limiting affordability and access, especially in high-premium segments. Regulatory complexity particularly within the U.S., where insurers must navigate federal, state, and regional laws adds compliance burdens and operational constraints. Additionally, despite digital gains, issues related to data privacy and technological literacy could impede full adoption of digital health solutions.

Market Opportunities

Growth potential lies in expanding telehealth packages, mental health and wellness add-ons, and personalized insurance plans enabled by big data and AI analytics. Bundled packages targeting chronic disease management, senior citizens, and rural populations also offer fertile ground. Moreover, emerging technologies such as predictive analytics and value-based care models present opportunities for insurers to optimize risk management and enhance consumer value.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/north-america-health-insurance-market

Frequently Asked Questions (FAQs)

◆ How big is the North America health insurance market?

◆ What is the projected growth rate (CAGR) of the North America health insurance market?

◆ What are the key growth drivers behind North America health insurance market expansion?

◆ Which region is estimated to dominate the North America health insurance industry through the forecast period?

◆ Who are the key players in the North America health insurance market?

Company Insights

• Aetna Inc. (CVS Health Corporation)

• AIA Group Limited

• Allianz SE

• Aviva Plc

• Berkshire Hathaway Inc.

• Cigna Corporation

• International Medical Group Inc.

• Prudential Plc

• UnitedHealth Group Inc.

• Zurich Insurance Group AG

Recent Developments:

The accelerating shift toward digital health and telemedicine prompted by the COVID-19 pandemic has significantly reshaped insurer strategies toward remote care and teleconsultation platforms.

Rising incidence of chronic and critical illnesses, such as cancer and cardiovascular conditions-exacerbated by lifestyle shifts and aging demographics-is strongly driving product innovation and market expansion.

Conclusion

In summary, the North America health insurance market stands at a pivotal growth juncture. With its solid foundation of both private and public insurance models, increasing healthcare demand driven by chronic diseases and an aging populace, and the transformative power of digital health technologies, the market is poised for steady, long-term expansion. The United States continues to lead by magnitude and innovation, while Canada and Mexico are experiencing gradual but meaningful growth spurred by structural reforms and expanding private coverage.

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release North America Health Insurance Market Valuation Projected at US $2,408.49 billion by 2031, Leading Companies are AIA Group Limited, Allianz SE, Aviva Plc. here

News-ID: 4150322 • Views: …

More Releases from DataM Intelligence 4market Research LLP

Biomass Briquette Market to Grow at 7% CAGR from 2025 to 2031, Led by North Amer …

The Biomass Briquette Market is expected to expand at a CAGR of about 7% from 2025 to 2031 as industries and households increasingly adopt sustainable and eco‐friendly solid fuel alternatives to traditional fossil fuels, driven by rising energy demand and environmental concerns.

Growth is supported by increasing demand across key applications such as industrial fuel, power generation, cooking fuel, and residential heating, driven by abundant agricultural and forestry residues that are…

Protein Engineering Market to Grow at 15.6% CAGR from 2025 to 2033, Driven by No …

The global protein engineering market reached US$ 2,854.54 Million in 2024 and is expected to reach US$ 8,646.10 Million by 2033, growing at a CAGR of 15.6 % from 2025 ro 2033 as demand for tailored biological solutions accelerates across pharmaceuticals, biotechnology, diagnostics, and industrial applications.

Growth is supported by increasing adoption of advanced protein modification, design and synthesis techniques to develop high‐efficacy therapeutics, enzymes, and biomaterials, driven by rising…

Substation Automation Market to Reach USD 67B by 2031 at 6.5% CAGR | Driven by R …

According to DataM Intelligence, the Substation Automation Market reached USD 41 billion in 2022 and is expected to reach USD 67 billion by 2031, growing at a CAGR of 6.5% during the forecast period (2024-2031).The global Substation Automation Market is undergoing a significant transformation as utilities and grid operators modernize aging infrastructure and transition toward digital substations. Substation automation systems (SAS) integrate intelligent electronic devices (IEDs), communication networks, SCADA platforms,…

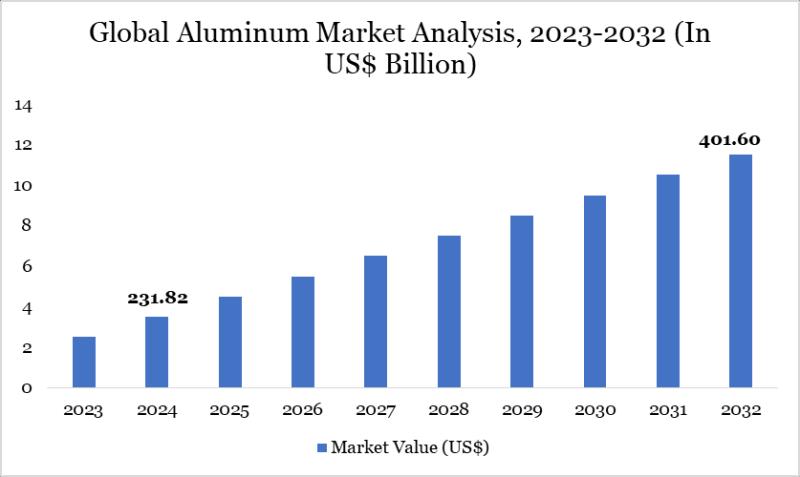

Aluminum Market to Reach US$ 401.60 Billion by 2032 Driven by Infrastructure Gro …

The Aluminum Market reached US$ 231.82 billion in 2024 and is expected to reach US$ 401.60 billion by 2032, growing at a CAGR of 7.11% during the forecast period 2025-2032.

Growth is driven by rising demand across construction, automotive, aerospace, packaging, and electrical industries, where aluminum is valued for its lightweight properties, corrosion resistance, high strength-to-weight ratio, and recyclability. Increasing focus on vehicle lightweighting, electric vehicle production, and sustainable packaging solutions…

More Releases for North

Man and Van North London: Your Go-To Moving Solution in North London

North London, London - June 23, 2025 - Looking for a stress-free and efficient moving experience in North London? Look no further than Man and Van North London, the trusted, reliable moving service that's changing the way people approach relocation. Based in the heart of North London at 2 Abbotsbury, the team at Man and Van North London provides affordable, hassle-free moving services designed to fit every need.

Whether you're moving…

North America Biosimulation Market

The global biosimulation market is experiencing rapid expansion, driven by advancements in technology and the increasing demand for computational tools that can accelerate drug discovery, clinical trials, and regulatory processes. As of 2023, the market was valued at USD 3.5 billion and is projected to reach USD 14.1 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of 16.90% from 2024 to 2032.

Biosimulation, which involves the use of…

Entirewire Electrician North Canton Offers Top-Tier Electrical Services for Nort …

Image: https://www.getnews.info/wp-content/uploads/2024/09/1726505467.png

Entirewire Electrician North Canton provides high-quality electrical services to residential and commercial clients in North Canton, OH. Specializing in electrical panel replacement, repairs, and installations, their team of certified electricians ensures safe, reliable, and efficient solutions, making them a trusted choice for all electrical needs in the local community.

North Canton, OH - Entirewire Electrician North Canton continues to provide exceptional electrical services for residents and businesses in the…

Web Design North: Providing Exceptional Graphic Design Services in North Bay

Web Design North, a leading digital marketing and SEO agency, provides peerless graphic design services in North Bay.

Specific and highly effective digital solutions can help solve the challenges businesses encounter in reaching their target audience. With the combination of these solutions and the expertise of digital professionals, business owners can rest assured that they will make more progress and thrive among their competitors. Web Design North is a dedicated marketing…

Web Design North Offers Digital Marketing Services in North Bay, Canada

Web Design North is a reputable company that provides digital marketing solutions and website development services in Canada.

Web Design North is excited to debut its updated website, showcasing a more modern and user-friendly design. The new site features easy navigation, allowing potential clients to easily browse and learn about the company's services and view their impressive portfolio of work. As a leading web design company, Web Design North understands the…

Web Design North Now Offers North Bay Website Designing Services

Web Design North has successfully worked with businesses of all sizes across North America and internationally.

Web Design North, a leading digital marketing agency in Canada, is proud to announce its expertise in web designing and SEO marketing for businesses in various industries across the country. With a team of experienced professionals, Web Design North has helped numerous clients establish a strong online presence and drive significant traffic to their websites.…