Press release

Ewing Sarcoma Market Outlook 2034 - Clinical Trials, Market Size, Medication, Prevalence, Companies by DelveInsight

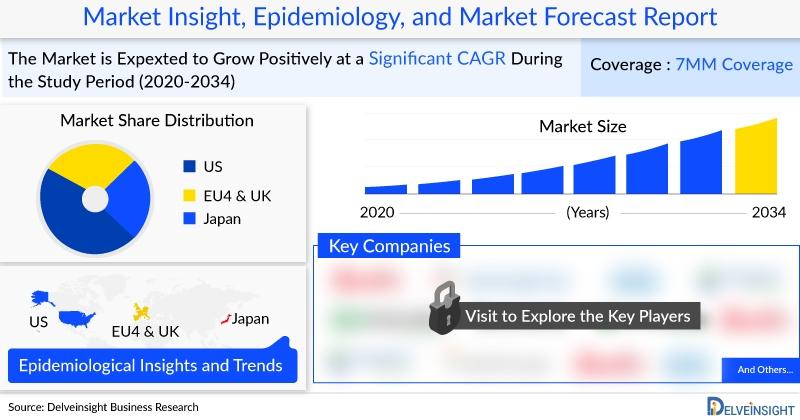

Ewing Sarcoma Market Size in the 7MM is approximately USD 30 million in 2023 and is projected to increase during the forecast period (2024-2034).Ewing Sarcoma Market Summary

In 2023, the US held the largest share (53%) of the Ewing sarcoma treatment market across the 7MM. Ewing sarcoma primarily affects individuals under 20, making molecular-targeted therapies with fewer long-term toxicities highly desirable. Current treatment largely relies on chemotherapy and local therapy (surgery or radiation), with the VDC/IE regimen improving survival. However, metastatic cases still face poor outcomes, driving the need for novel therapeutics. The 5-year survival rate is 70-80% for localized disease but only 30-40% for metastatic cases. The updated NCCN guidelines (v2.2023) added lurbinectedin as a second-line option for relapsed or metastatic disease, though no approved therapies exist, leaving room for significant market opportunities. Development efforts are led by companies like Salarius, Jazz, Pfizer, Eli Lilly, and others, with focus on second-line and beyond. However, challenges such as off-label therapy use and clinical trial setbacks, including Salarius halting seclidemstat trials in 2023, remain.

DelveInsight's report, "Ewing Sarcoma Market Insights, Epidemiology, and Market Forecast-2034," offers a comprehensive overview of Ewing Sarcoma, including historical data, forecasted epidemiology, and evolving market trends across the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan. The study highlights current treatment approaches, emerging therapeutic options, and the market share of individual therapies. It also provides detailed epidemiological projections for the 7MM (US, EU5, and Japan) from 2020 to 2034. Additionally, the report features an extensive pipeline analysis, covering drugs in Phase II and Phase III development, outlining emerging trends, clinical profiles, competitive landscapes, estimated launch timelines, and ongoing product development activities.

Uncover key insights into the Ewing Sarcoma market. Explore current treatments, emerging therapies, pipeline developments, and market opportunities across the 7MM @ Ewing Sarcoma Market Forecast [https://www.delveinsight.com/report-store/ewing-sarcoma-market?utm_source=abnewswire&utm_medium=pressrelease&utm_campaign=apr]

Key Takeaways from the Ewing Sarcoma Market Report

* According to DelveInsight, Ewing Sarcoma market is expected to grow at a decent CAGR by 2034.

* The total Ewing Sarcoma Market Size in the 7MM is approximately USD 30 million in 2023 and is projected to increase during the forecast period (2024-2034).

* The leading Ewing Sarcoma Companies include Eisai, Salarius Pharmaceuticals, Tyme, Jazz Pharmaceuticals, Pfizer, Eli Lilly and Company, Cellectar Biosciences, Inc., Valent Technologies, LLC, Sumitomo Pharma Oncology, Inc., Bristol-Myers Squibb, Ono Pharmaceuticals, Nektar Therapeutics, Inhibrx, Inc., Gradalis, and others.

* Promising Ewing Sarcoma Pipeline Therapies include Vigil EWS, Eribulin mesylate, Seclidemstat, SM-88, Lurbinectedin, CP-751,871, Abemaciclib, CLR 131, VAL-413, TP-1287, Nivolumab, Bempegaldesleukin, INBRX-109, and others

* According to DelveInsight's analysis, men are more frequently effected than women (with 3:2), in case of Ewing Sarcoma.

* Additionally, more than 80% of Ewing's sarcomais attributed to bone, often in femur, pelvis, ribsetc. Extra-osseous affects the soft tissues aroundthe bones, such as cartilage or muscle.

* In July 2025, Actuate Therapeutics, Inc. (NASDAQ: ACTU) ("Actuate" or the "Company"), a clinical-stage biopharmaceutical company focused on developing therapies for the treatment of high-impact, difficult-to-treat cancers through the inhibition of glycogen synthase kinase-3 beta (GSK-3), today announced the end of the Phase 1 portion of its clinical study evaluating elraglusib monotherapy or in combination with irinotecan, irinotecan plus temozolomide, or with cyclophosphamide plus topotecan in pediatric patients with refractory malignancies (Actuate-1902). Following encouraging signals of activity, particularly in treatment-refractory Ewing Sarcoma (EWS), a small round cell sarcoma that forms in soft tissue and bone, the Company will seek to advance the clinical development program towards a Phase 2 study in children, adolescents, and adults with relapsed/refractory EWS.

* In February 2025:- Sarcoma Oncology Research Center:- The primary objective is to evaluate the efficacy of SM-88, a combination metabolic cancer treatment, measured as positive efficacy events, including overall response, maintaining stable disease for greater than or equal to 3 months, or progression free survival at least 1.5 times longer than the last prior line of treatment.

* In February 2025:- Eli Lilly and Company:- The purpose of this study is to measure the benefit of adding abemaciclib to chemotherapy (irinotecan and temozolamide) for Ewing's sarcoma that has come back or did not respond to treatment. This trial is part of the CAMPFIRE master protocol, which is a platform to speed development of new treatments for children and young adults with cancer. Your participation in this trial could last 11 months or longer, depending on how you and your tumor respond.

* In February 2025:- Merck Sharp & Dohme LLC:- Substudy 01A is part of a platform study. The purpose of this study is to assess the efficacy and safety of zilovertamab vedotin in pediatric participants with relapsed or refractory B-cell acute lymphoblastic leukemia (B-ALL), diffuse large B-cell lymphoma (DLBCL)/Burkitt lymphoma, or neuroblastoma and in pediatric and young adult participants with Ewing sarcoma.

* On November 12, 2024, Actuate Therapeutics, Inc. announced that the U.S. Food and Drug Administration (FDA) has granted Rare Pediatric Disease Designation to elraglusib, a novel glycogen synthase kinase-3 beta (GSK-3) inhibitor, for the treatment of Ewing sarcoma (EWS).

* On November 12, 2024, the FDA granted rare pediatric disease designation to elraglusib (9-ING-41), a novel GSK-3 inhibitor, as a potential treatment for patients with Ewing sarcoma.

Ewing Sarcoma Overview

Ewing sarcoma is a rare and aggressive cancer that primarily affects the bones or the soft tissues surrounding bones. It most commonly occurs in children, adolescents, and young adults, with peak incidence between ages 10 and 20. The most frequent sites of occurrence include long bones like the femur, pelvis, ribs, and scapula.

The exact cause of Ewing sarcoma is unknown, but it is associated with specific genetic changes, most commonly a translocation between the EWSR1 gene on chromosome 22 and the FLI1 gene on chromosome 11. This fusion gene leads to uncontrolled cell growth.

Ewing sarcoma Symptoms include localized pain and swelling, often worse at night, and can be accompanied by fever, fatigue, and unintentional weight loss. In advanced stages, the cancer may spread to other parts of the body, such as the lungs, bone marrow, or other bones. Ewing sarcoma Diagnosis involves imaging studies (X-ray, MRI, or CT scans), biopsy for histological examination, and genetic testing to confirm the diagnosis.

Ewing sarcoma Treatment typically combines chemotherapy, surgery, and/or radiation therapy. Multimodal therapy aims to eradicate the primary tumor and any metastases. While advancements in treatment have improved survival rates, early diagnosis and comprehensive care are critical to achieving favorable outcomes in Ewing sarcoma.

Stay ahead in the evolving oncology landscape! Explore in-depth insights into the Ewing Sarcoma Market, including pipeline therapies, clinical trial updates, leading companies, market growth projections, and unmet needs shaping the future @ Ewing Sarcoma Treatment Market [https://www.delveinsight.com/sample-request/ewing-sarcoma-market?utm_source=abnewswire&utm_medium=pressrelease&utm_campaign=apr]

Recent Developmental Activities in the Ewing Sarcoma Treatment Landscape

* Vigil: Gradalis

Gradalis is developing and testing Vigil, a fully personalized, patient-specific cancer immunotherapy that can be applied to virtually any cancer. Vigil utilizes the patient's own cancer cells to create a fully personalized cancer immunotherapy with the goal to activate the patient's own T-cells against their cancer cells. When those cells are reintroduced back into the patient, the two modifications are designed to help activate the immune system to detect and kill any cancer cells that may remain locally and in circulation. All together, the goal is to stimulate the existing components of the immune system with the intent to improve their anti-tumor responses. Vigil enhances specific functions that assist in cancer antigen recognition and dampen other functions that cancer cells often employ to evade the immune system. A Phase III clinical trial of Vigil in combination with irinotecan and temozolomide for the treatment of patients with Ewing's sarcoma (EWS) is currently ongoing.

* ONCT216: Oncternal Therapeutics

ONCT-216 (formerly called TK216) is a first-in-class small molecule inhibiting the biological activity of ETS-family (E26 Transformation Specific) transcription factor oncoproteins in a variety of tumor types. It is currently being evaluated in the Phase II portion of a study in patients with relapsed or refractory Ewing sarcoma, a serious pediatric bone cancer. ONCT-216 was developed based on the discoveries of Jeff Toretsky, MD, at Georgetown University, who identified a small molecule that was shown to kill Ewing sarcoma cells and inhibit growth of tumors in preclinical studies. Oncternal scientists developed and tested a large series of derivatives of the research molecule and after extensive evaluation, ONCT-216 was selected as a lead product candidate. ONCT-216 has been extensively evaluated in preclinical studies, where it has been confirmed to kill Ewing sarcoma cells and inhibit Ewing sarcoma tumors in animal models. The company continues to collaborate with Dr. Toretsky and his colleagues in order to advance the research underlying the molecular pathways of ONCT-216 and optimize its development across multiple tumor types.

* SP-2577: Salarius Pharmaceuticals

SP-2577 is being studied in an ongoing Phase I/II trial treating three different patient groups with sarcomas, including Ewing Sarcoma, Myxoid Liposarcoma and additional FET-rearranged soft tissue sarcomas. These are cancers with high-unmet need and represent Salarius' "speed-to-market strategy" given the potential for accelerated approval. Salarius' LSD1 technology was licensed from the University of Utah Huntsman Cancer Institute where it was developed in the laboratory of Dr. Sunil Sharma.

Ewing Sarcoma Epidemiology

In 2023, there were approximately 1,200 incident cases of Ewing sarcoma across the 7MM, with numbers expected to rise during the forecast period. The United States contributed the largest share (~41%), while within the EU4, Germany recorded the highest incidence (~15%) and Italy the lowest. In the US, children aged 10-14 years accounted for the largest proportion of cases (30%), followed by adolescents aged 15-19 years (26%). Ewing sarcoma was found to be more common in males, with around 300 new male cases reported in the US in 2023.

Ewing Sarcoma Epidemiology Segmentation in the 7MM

* Ewing Sarcoma Incident Cases

* Ewing Sarcoma Subtype-specific Cases

* Ewing Sarcoma Age-Specific Cases

* Ewing Sarcoma Gender-Specific Cases

Download the report to understand which factors are driving Ewing Sarcoma epidemiology trends @ Ewing Sarcoma Prevalence [https://www.delveinsight.com/report-store/ewing-sarcoma-market?utm_source=abnewswire&utm_medium=pressrelease&utm_campaign=apr]

Ewing Sarcoma Market Insights

In 2023, the Ewing Sarcoma treatment market in the 7MM was valued at USD 30 million, with growth expected through 2034. Germany leads the EU4 market (~25%), while Seclidemstat + TC is projected to dominate the 2L+ setting by 2034. The arrival of targeted therapies, immunotherapies, and combination regimens is set to expand the treatment landscape and improve patient outcomes.

Advancements in chemotherapy, surgery, and radiation have improved survival in Ewing Sarcoma, but outcomes remain limited, especially for high-risk patients. Challenges include the rarity of the disease, incomplete understanding of high-risk biology, and difficulty conducting large-scale trials. Currently, there is no standardized second-line treatment, though salvage regimens with agents like topotecan, cyclophosphamide, irinotecan, and temozolomide, as well as high-dose chemotherapy with stem cell transplantation, have shown promise. Emerging strategies include RNA interference, protein degraders, and immunotherapy targeting novel epitopes. Despite available modalities, the lack of effective treatments highlights the urgent need for innovation. The dynamics of Ewing Sarcoma market is expected to change due to the improvement in the diagnosis, incremental healthcare expenditure across the world and expected launch of emerging therapies during the forecast period of 20222034. Companies all over the globe are persistently working towards the development of new treatment therapies and some of the key players at the global level are Tyme, Gradalis, Oncurious, Eisai, and others.

Ewing Sarcoma Market Landscape

The future Ewing Sarcoma treatment landscape is expected to broaden with novel classes such as DR5 agonist antibodies, CDK inhibitors, LSD1 inhibitors, and AXL inhibitors. These therapies are designed to overcome limitations of earlier drugs by leveraging tumor-specific apoptosis through DR5 activation, a key pro-apoptotic receptor for TRAIL.

Learn more about the FDA-approved drugs for Ewing Sarcoma @ Ewing Sarcoma Therapies and Medication [https://www.delveinsight.com/sample-request/ewing-sarcoma-market?utm_source=openpr&utm_medium=pressrelease&utm_campaign=apr]

Ewing Sarcoma Market Drivers

* Rising incidence of Ewing Sarcoma cases across the 7MM, particularly among children and adolescents.

* Advances in chemotherapy, radiation, and surgical techniques improving survival in some patient groups.

* Growing research interest in novel targets (e.g., CDK, LSD1, AXL inhibitors, DR5 agonists).

* Entry of emerging therapies like Seclidemstat + TC in the 2L+ setting.

* Increasing focus on early diagnosis, awareness, and patient screening.

* Expanding use of combination regimens, immunotherapies, and targeted therapies to reduce toxicity and resistance.

Ewing Sarcoma Market Barriers

* Low prevalence (orphan disease status) limits large-scale clinical trials.

* Lack of standardized second-line treatment for relapsed/refractory patients.

* High-risk and rare subtypes poorly understood, restricting therapeutic development.

* Limited participation in retrospective or single-arm trials, reducing robust evidence.

* Toxicities of conventional chemotherapy hinder patient adherence and quality of life.

* Funding challenges due to small patient pool and high R&D costs.

Scope of the Ewing Sarcoma Market Report

* Coverage- 7MM

* Ewing Sarcoma Companies- Gradalis, Eisai (TSE: 4523), Salarius Pharmaceuticals (NASDAQ: SLRX), Tyme (formerly NASDAQ: TYME), Jazz Pharmaceuticals (NASDAQ: JAZZ), Pfizer (NYSE: PFE), Eli Lilly and Company (NYSE: LLY), Cellectar Biosciences, Inc. (NASDAQ: CLRB), Valent Technologies, LLC, Sumitomo Pharma Oncology, Inc. (a subsidiary of Sumitomo Pharma, TSE: 4506), Bristol-Myers Squibb (NYSE: BMY), Ono Pharmaceuticals (TSE: 4528), Nektar Therapeutics (NASDAQ: NKTR), and Inhibrx, Inc. (NASDAQ: INBX), and others

* Ewing Sarcoma Pipeline Therapies- Vigil EWS, Eribulin mesylate, Seclidemstat, SM-88, Lurbinectedin, CP-751,871, Abemaciclib, CLR 131, VAL-413, TP-1287, Nivolumab, Bempegaldesleukin, INBRX-109, and others

* Ewing Sarcoma Market Dynamics: Ewing Sarcoma Market Drivers and Barriers

* Ewing Sarcoma Market Access and Reimbursement, Unmet Needs, and Emerging Drugs

Discover more about Ewing Sarcoma Drugs in development @ Ewing Sarcoma Clinical Trials and FDA Approvals [https://www.delveinsight.com/sample-request/ewing-sarcoma-market?utm_source=openpr&utm_medium=pressrelease&utm_campaign=apr]

Table of Content

1. Key Insights

2. Executive Summary of Ewing Sarcoma

3. Competitive Intelligence Analysis for Ewing Sarcoma

4. Ewing Sarcoma: Market Overview at a Glance

5. Ewing Sarcoma: Disease Background and Overview

6. Ewing Sarcoma Patient Journey

7. Ewing Sarcoma Epidemiology and Patient Population

8. Treatment Algorithm, Current Treatment, and Medical Practices

9. Ewing Sarcoma Unmet Needs

10. Key Endpoints of Ewing Sarcoma Treatment

11. Ewing Sarcoma Marketed Products

12. Ewing Sarcoma Emerging Therapies

13. Ewing Sarcoma: Seven Major Market Analysis

14. Attribute analysis

15. 7MM: Ewing Sarcoma Market Outlook

16. Access and Reimbursement Overview of Ewing Sarcoma

17. KOL Views

18. Ewing Sarcoma Market Drivers

19. Ewing Sarcoma Market Barriers

20. Appendix

21. DelveInsight Capabilities

22. Disclaimer

23. About DelveInsight

About DelveInsight

DelveInsight is a leading Life Science market research and business consulting company recognized for its off-the-shelf syndicated market research reports and customized solutions to firms in the healthcare sector.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=ewing-sarcoma-market-outlook-2034-clinical-trials-market-size-medication-prevalence-companies-by-delveinsight]

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/primary-research-services

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Ewing Sarcoma Market Outlook 2034 - Clinical Trials, Market Size, Medication, Prevalence, Companies by DelveInsight here

News-ID: 4149786 • Views: …

More Releases from ABNewswire

ECI Jewelers Introduces Streamlined Selling Experience with Same-Day Offers and …

ECI Jewelers has enhanced its luxury watch and jewelry buying service with same-day market-based offers and instant payment options for sellers nationwide. The concierge-style approach includes free valuations, full insurance coverage during transit, and expert assessment from the company's New York City Diamond District location, simplifying the selling process for owners of premium timepieces from brands like Rolex, Patek Philippe, and Audemars Piguet.

Elegant Creations Inc, operating as ECI Jewelers, has…

DivorceGO Simplifies the Uncontested Divorce Process Across Ontario

DivorceGO Family Law Offices is helping Ontario couples move forward with clarity and efficiency through its streamlined uncontested divorce services.

DivorceGO Family Law Offices is helping Ontario couples move forward with clarity and efficiency through its streamlined uncontested divorce services. Designed for spouses who agree on ending their marriage, the firm's approach focuses on minimizing conflict, reducing stress and guiding clients through the legal process with transparency and fixed-fee pricing.

An uncontested…

Half a Century of Roots: Antelope Valley Honors Tip Top Arborists with "Best of …

Tip Top Arborists, Lancaster's longest-standing tree care company, has been nominated for the Antelope Valley Press Best of 2026 awards as it marks 50 years in business. Founded in 1976, the TCIA-accredited company employs ISA-Certified Arborists, holds a 4.9-star rating, and provides true 24/7 emergency service. Community members can vote at avpress.com/bestof2026 through March 3, 2026.

LANCASTER, Calif. - February 27, 2026 - In a rapidly changing world, few things remain…

Marco Robinson Launches Public 'Proof of Work' Portal to Enable Independent Veri …

Primary-source documentation published to support independent review by media, partners and the public

LONDON - Feb. 27, 2026 - British entrepreneur, author and media producer Marco Robinson today opened a public Proof of Work portal containing primary-source documentation intended to enable independent verification of his business activities, media projects and legal record.

The portal, which is published on Robinson's official website, presents source documents rather than commentary, including solicitor correspondence, court outcomes…

More Releases for Ewing

Pioneering Advances Propel the Ewing Sarcoma Drugs Market to New Heights

The global Ewing sarcoma drugs market is poised for remarkable growth over the next decade, driven by scientific breakthroughs, robust pipeline portfolios, and an increasing focus on targeted therapies. Once a niche segment within oncology, treatments for Ewing sarcoma-an aggressive bone and soft-tissue tumor predominantly affecting children, adolescents, and young adults-are rapidly evolving from broad-spectrum chemotherapeutic regimens to precision medicines that promise improved outcomes and reduced toxicity.

The global Ewing sarcoma…

Mad Max Publishing Announces Newest Best-Selling Author Hunter Ewing

Image: https://www.abnewswire.com/upload/2025/04/6dbb7a2237180d135128f8603075b1f4.jpg

Doral, FL - Mad Max Publishing, announced its newest bestselling author Hunter Ewing, who's recently released book, "The Playmaker" quickly climbed the charts to become a number one bestseller.

Published, Promoted and Reached #1 National Bestseller on Amazon.

Hunter Ewing is the #1 Best-Selling Author of The Playmaker , a powerful guide that equips business owners with branding strategies to rise above their competition and dominate their niche. A former college…

Ewing Sarcoma Pipeline, FDA Approvals, Clinical Trials, and Companies 2024 (Upda …

DelveInsight's, "Ewing Sarcoma Pipeline Insights 2024" report provides comprehensive insights about 25+ Ewing Sarcoma companies and 25+ pipeline drugs in the Ewing Sarcoma pipeline landscape. It covers the Ewing Sarcoma pipeline drug profiles, including clinical and nonclinical stage products. It also covers the Ewing Sarcoma pipeline therapeutics assessment by product type, stage, route of administration, and molecule type. It further highlights the inactive pipeline products in this space.

Key Takeaways…

Ewing Sarcoma Pipeline, FDA Approvals, Clinical Trials Developments, and Compani …

DelveInsight's, "Ewing Sarcoma Pipeline Insights" report provides comprehensive insights about 25+ Ewing Sarcoma companies and 25+ pipeline drugs in the Ewing Sarcoma pipeline landscape. It covers the Ewing Sarcoma pipeline drug profiles, including clinical and nonclinical stage products. It also covers the Ewing Sarcoma pipeline therapeutics assessment by product type, stage, route of administration, and molecule type. It further highlights the inactive pipeline products in this space.

Key Takeaways from…

Ewing Sarcoma Drugs Market is Booming Worldwide with CAGR of 5.6%

The global and Middle East Africa Ewing Sarcoma Drugs Market is the most recent research report from USD Analytics that analyses market risk side data, highlights opportunities, and uses that data to support tactical as well as strategic decision-making. A thorough investigation was conducted to provide the most recent information on the market's key characteristics for Ewing Sarcoma Drugs. Regarding revenue size, production, CAGR, consumption, gross margin, pricing, and other…

Global Ewing Sarcoma Drugs Market Size, Share, Growth & Forecast 2023-2032

In the forecasted period from 2022 to 2030, the market for medications to treat ewing sarcoma is anticipated to expand at a CAGR of 5.5%. The rise in ewing sarcoma cases, more knowledge of the disease and its treatments, and the introduction of innovative therapeutics for the illness are all factors contributing to the market's expansion. Based on type, application, and location, the market for ewing sarcoma medications is divided…