Press release

Insurance (Providers, Brokers and Re-Insurers) Market Poised to Hit $155.63 Billion by 2029 with Accelerating Growth Trends

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Insurance (Providers, Brokers and Re-Insurers) Market Size Growth Forecast: What to Expect by 2025?

In recent times, the insurance market, encompassing providers, brokers, and re-insurers, has witnessed substantial growth. The prediction is that it will rise from $7751.02 billion in 2024 to an impressive $8307.01 billion in 2025, documenting a compound annual growth rate (CAGR) of 7.2%. The historic expansion is majorly due to factors such as increasing prevalence of diabetes, advancements in insulin delivery, the penchant of patients for convenience, and an aging population.

How Will the Insurance (Providers, Brokers and Re-Insurers) Market Size Evolve and Grow by 2029?

In the forthcoming years, the insurance market (comprising providers, brokers and re-insurers) is projected to experience robust growth. By 2029, it is forecasted to achieve a market size of $10832.92 billion with a Compound Annual Growth Rate (CAGR) of 6.9%. The anticipated growth within this period can be associated to factors such as the evolution of emerging markets, regulatory backing and reimbursement strategies, precision medicine, and value-driven healthcare. Key trends projected for the forecast period comprise the merging of artificial intelligence, the use of handheld and wireless ultrasound tools, 3D/4D imaging technology, and fusion imaging.

View the full report here:

https://www.thebusinessresearchcompany.com/report/insurance-providers-brokers-and-re-insurers-global-market-report

What Drivers Are Propelling the Growth of Insurance (Providers, Brokers and Re-Insurers) Market Forward?

The worldwide payments sector is experiencing a swift surge in the acceptance of EMV technology. This rise is attributed to the superior data protection provided by EMV chip and PIN cards as opposed to conventional magnetic strip cards. EMV serves as a safety benchmark for various kinds of payment cards, such as debit, credit, charge, and prepaid cards. The chip accommodates cardholder and account information, safeguarded through a combination of hardware and software security mechanisms. For example, Thales Group, a France-based enterprise specializing in electrical systems, reported that 69.25% of all payment cards distributed worldwide in 2022 were equipped with EMV chips. The proportion of EMV card transactions grew from 77.52% in 2021 to 87.19% in 2022.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=1887&type=smp

Which Emerging Trends Are Transforming the Insurance (Providers, Brokers and Re-Insurers) Market in 2025?

Leading firms in the insurance market are employing innovation to develop new technological products such as robotic errors and omissions insurance to fortify their market stance. This specialized insurance product offers targeted professional liability protection for robotics services. An example of this is seen with Koop Technologies, an insurance tech firm based in the US, which unveiled its robotic errors and omissions Insurance Product in September 2022. This professional liability insurance is tailored for manufacturers, handlers, and service providers of robots and autonomous off-road vehicles across various sectors. The coverage is centered around automation risks and caters to the distinctive requirements of the robotics ecosystem. Additionally, it provides coverage for legal expenses if a third party alleges that a financial loss was induced by a robotics company.

What Are the Key Segments in the Insurance (Providers, Brokers and Re-Insurers) Market?

The insurance (providers, brokers and re-insurers) market covered in this report is segmented -

1) By Type: Insurance Providers, Insurance Brokers And Agents, Reinsurance Providers

2) By Mode: Online, Offline

3) By End User: Corporate, Individual

Subsegments:

1) By Insurance Providers: Life Insurance, Health Insurance, Property And Casualty Insurance, Auto Insurance, Commercial Insurance, Others (Travel Insurance, Pet Insurance)

2) By Insurance Brokers and Agents: Independent Brokers, Captive Agents, Direct Brokers, Online Brokers

3) By Reinsurance Providers: Life Reinsurance, Non-life Reinsurance, Facultative Reinsurance, Treaty Reinsurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=1887&type=smp

Who Are the Key Players Shaping the Insurance (Providers, Brokers and Re-Insurers) Market's Competitive Landscape?

Major companies operating in the insurance (providers, brokers and re-insurers) market include UnitedHealth Group, Axa S.A., Munich Re, Allianz SE, Generali Group, Swiss Re Ltd., Hannover Reinsurance S.E., Berkshire Hathaway Assurance, Progressive Corporation, Allstate Corporation, Liberty Mutual Insurance Group, The Travelers Companies Inc., USAA, Chubb Limited, Nationwide Mutual Insurance Company, American International Group Inc., American Family Insurance Group, Erie Insurance Group, Auto-Owners Insurance Group, CNA Financial Corporation, The Hartford Financial Services Group Inc., State Auto Financial Corporation, Cincinnati Financial Corporation, Mercury General Corporation, AmTrust Financial Services Inc., AXIS Capital Holdings Limited, Taiping Reinsurance Co. Ltd., Marsh McLennan Companies Inc., Aon plc, Willis Towers Watson Holdings plc, Arthur J. Gallagher & Co., Hub International Limited, Brown & Brown Inc., Lincoln Financial Group.

What Geographic Markets Are Powering Growth in the Insurance (Providers, Brokers and Re-Insurers) Market?

North America was the largest region in the insurance (providers, brokers, and re-insurers) market in 2023. Asia-Pacific was the second largest region in the global insurance (providers, brokers, and re-insurers) market. The regions covered in the insurance (providers, brokers, and re-insurers) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=1887

"This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work."

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance (Providers, Brokers and Re-Insurers) Market Poised to Hit $155.63 Billion by 2029 with Accelerating Growth Trends here

News-ID: 4149555 • Views: …

More Releases from The Business Research Company

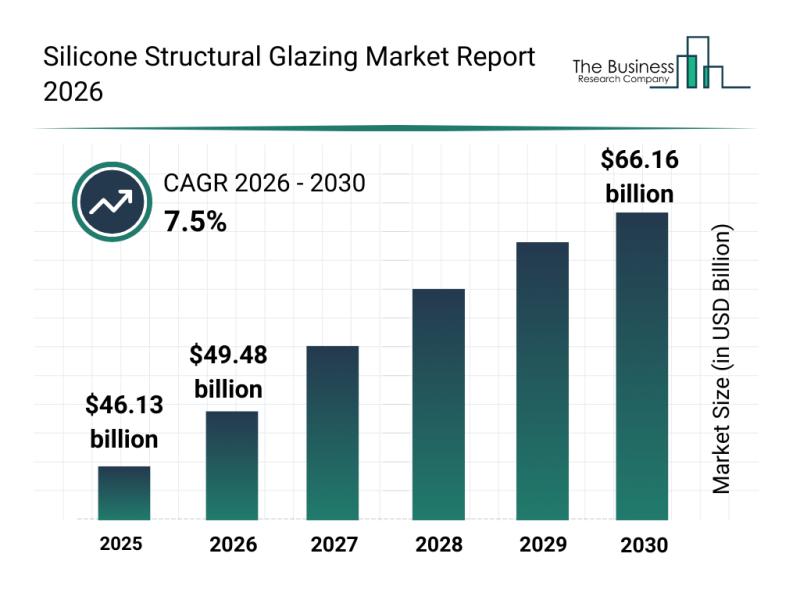

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

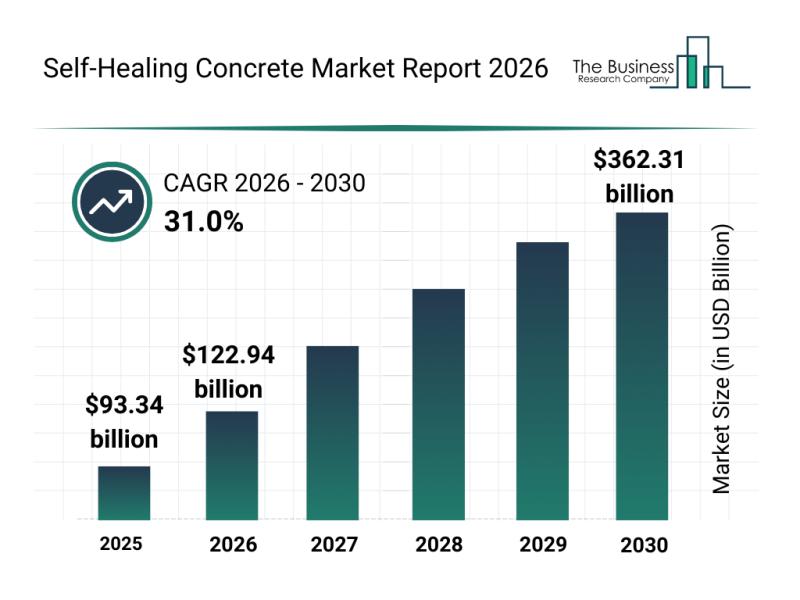

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

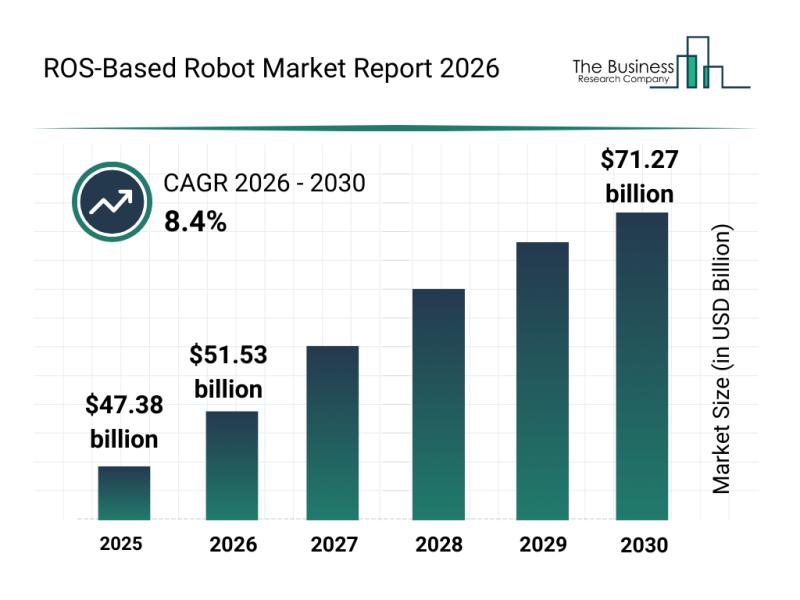

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

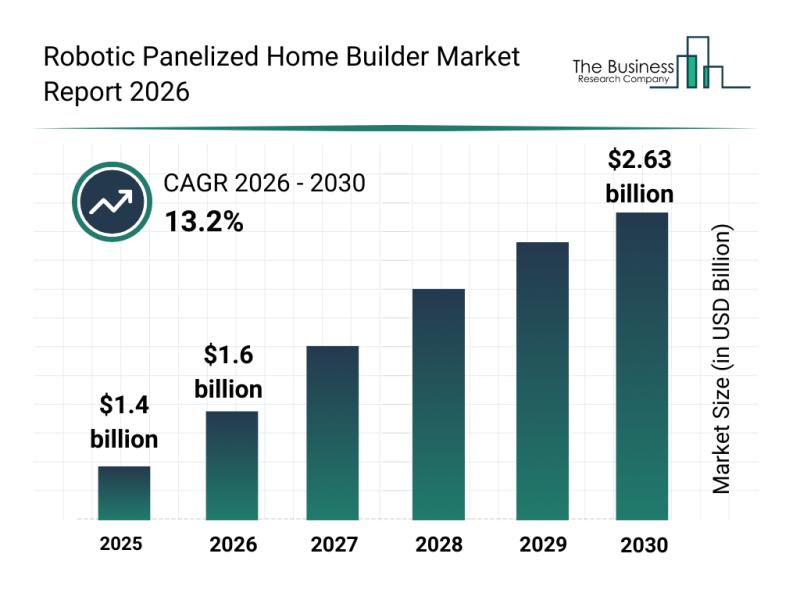

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…