Press release

GFH First Half 2025 Net Profit Rises 10 Percent to 67 Million Dollars

GFH Financial Group B.S.C ("GFH" or "the Group") (Bahrain Bourse: GFH) today announced its financial results for the second quarter ("the quarter") and first six months of the year ("the period") ended 30 June 2025.Net profit attributable to shareholders was US$ 37.10 million for the second quarter of the year compared to US$ 33.61 million in the second quarter of 2024, an increase of 10.38%, driven by strong growth in commercial banking, treasury and proprietary investment income. Earnings per share for the second quarter were US cents 1.06 compared with US cents 0.93 in the second quarter of 2024, anincrease of 13.98%. Total comprehensive income attributable to shareholders was US$ 51.7 million for the second quarter of 2025 versus US$ 31.41 million in the second quarter of 2024, an increase of 64.62%. Total income was US$ 186.12 million for the second quarter of the year compared with US$ 169.26 million in the second quarter of 2024, an increase of 9.96%. Consolidated net profit for the second quarter was US$ 39.02 million compared with US$ 37.55 million in the second quarter of 2024, an increase of 3.91%. Total expenses for the quarter were US$ 91.91 million compared with US$74.69 million in the prior-year period, an increase of 23.05%.

The Group reported net profit attributable to shareholders of US$67.24 million for the first six months of the year compared with US$60.75 million in the same period of 2024, an increase of 10.69%,reflecting sustained growth in core banking and improved contributions from treasury and proprietary investments. Earnings per share for the six-month period was US cents 1.93 compared to US cents 1.71 for the first half of 2024, an increase of 12.87%. Total comprehensive income attributable to shareholders was US$ 78.91million for the first six months of the year compared with US$ 67.31 million in the same period in 2024, an increase of 17.23%. Total income for the period was US$ 357.07 million, an increase of 7.48% from US$ 332.23 million year-on-year. Consolidated net profit for the first six months of the year was US$ 69.72 million compared with US$ 67.90 million in the corresponding period of 2024, an increase of 2.68%. Total expenses for the six-month period were US$ 181.35million compared with US$ 163.87 million in same period of 2024, an increase of 10.67%. Total equity attributable to shareholders was US$ 1,002.60 million at 30 June 2025 compared with US$ 980.94million at 31 December 2024, an increase of 2.21%. Total assets of the Group were US$ 12.36 billion compared with US$ 11.03 billion at 31 December 2024, an increase of 12.06%.

Currently, GFH manages more than US$ 23.75 billion of assets and funds including a global portfolio of investments in logistics, healthcare, education and technology in the MENA region, Europe and North America.

The Group's financial results in full can be found at www.bahrainbourse.com [http://www.bahrainbourse.com/]. Shares of GFH are traded under the ticker "GFH" on the Abu Dhabi Securities Exchange, Bahrain Bourse, Boursa Kuwait and Dubai Financial Market.

Image: https://www.globalnewslines.com/uploads/2025/08/31802dd29a81431c5bc6cc05c5081632.jpg

Mr. Abdulmohsen Rashed Al Rashed

Chairman, GFH Financial Group

"We are delighted to announce the Group's financial results for the second quarter and first half of 2025, which reflect the strength of our diversified business model. Broad-based growth across commercial and investment banking, alongside improving contributions from treasury and proprietary activities, delivered higher profitability and resilient earnings, underpinned by prudent risk management, healthy liquidity and a robust capital position.

As we look ahead, we are scaling platforms in logistics and healthcare, deepening our footprint in the GCC and US, and consolidating strategic holdings such as Seef Properties. Continued investment in digital capabilities and governance will support disciplined growth, selective capital deployment and value-accretive exits, positioning GFH to deliver sustainable returns and remain a trusted partner for our shareholders and stakeholders."

Mr. Hisham Alrayes

CEO and Board Member, GFH Financial Group

"We are honoured to announce results that demonstrate continued operational momentum across the Group. In H1 2025 we achieved higher financing income, stronger proprietary and dividend flows, and a marked improvement in treasury performance. We tightened cost discipline while investing in data, automation and a next-generation conversational assistant, which is accelerating onboarding on the GFH: Investment Banking App and broadening investor access across our platforms, supported by solid asset quality and liquidity.

Looking to the second half, we will deploy capital selectively into logistics and healthcare through our US and GCC funds, advance our partnership with Al Tijaria, and pursue disciplined realisations to recycle capital. We will further strengthen funding diversity, liquidity and risk hedging, while deepening our presence in the Kingdom of Saudi Arabia and the UAE. Our focus remains on compounding recurring income and delivering consistent, market-leading returns, with rigorous governance and stakeholder

Business Unit Highlights

The Group continued to deliver sound performance andcontributions from across its core business lines during the second quarter of 2025.

Investment Management:

- GFH increased the Group's ownership in Seef Properties B.S.C., one of the leading real estate development and commercial centres management companies in the Kingdom of Bahrain to 27.98%. This strategic move aligns with the Group's expanding investment portfolio. This aims to create additional value for our shareholders within the real estate portfolios operating in the same sector.

- GFH Capital ("GFHC"), a KSA-based Subsidiary of GFH signing strategic partnership with The Commercial Real Estate Company K.P.S.C. ("Al Tijaria"), a prominent Kuwait-based real estate company will act as a technical advisor for one of GFHC's Logistics Funds and will gain exposure to the Group's growing investments and exposures in the warehousing and logistics sector across Saudi Arabia and the wider Gulf region.

- GFH Capital also acquired assets as well as development opportunities in KSA and UAE with total value US$125 million. The assets in KSA include a fully leased warehouse facility in South Riyadh.

- GFH Partners, the DIFC based global asset management arm of GFH with US-based partners, acquired a healthcare asset portfolio valued at over US$195 million, majority leased to investment-grade tenants. The assets are located across Texas, Arizona, and Colorado.

- GFH Partners invested US$190m in a portfolio of logistics and industrial assets in Q2 2025. The assets include fiber optic manufacturing facility and include multiple transportation logistics facilities designed for diverse uses such as truck servicing, parking, and outdoor storage.

Commercial Banking:

- The Group's commercial banking arm, Khaleeji Bank, delivered stronger performance over the first six months, with net profit attributable to shareholders increasing by 9.26% to US$ 14.93 million, underpinned by higher income from financing contracts and enhancing asset quality in addition to tangible progress in the digital transformation and implementing innovative digital programs and expanding the range of banking products.

- Total comprehensive income attributable to shareholders rose over the six-month period by 26.75%.

- The balance sheet expanded in H1 2025, with total assets up 9.03%, investments in sukuk up 9.88%, and financing contracts up 13.46%.

Treasury & Proprietary Investments:

- Contributions from the Group's treasury and proprietary investment activities amounted to US$ 118.55 million in Q2 2025, taking H1 2025 contributions to US$ 181.17 million.

- Finance and treasury portfolio income totalled US$ 81.68 million in Q2 2025 (US$ 144.11 million in H1 2025)

- Income from proprietary investments amounted to US$ 59.75 million in H1 2025

ESG Highlights

The Group continued to effectively execute on its Environmental, Social and Governance (ESG) strategy undertaking key initiatives in the second quarter including:

- Strengthened Social Impact through Education Partnerships: GFH partnered with Dubai Cares to support the "Pack for Impact" initiative, assembling 2,000 school kits for underprivileged students in the UAE, reflecting the Group's commitment to inclusive education and volunteer engagement.

- Recognition for ESG Leadership and Innovation: Ranked among the top 3 ESG performers on the LSEG Index and listed as one of Bahrain's Top 50 Companies, GFH was also the first GCC investment bank to launch a conversational AI assistant within its investment app.

About GFH Financial Group B.S.C.

GFH Financial Group, licensed as an Islamic wholesale bank by the Central Bank of Bahrain and headquartered at GFH House, P.O. Box 10006, Manama Sea Front, Kingdom of Bahrain, is oneof the most recognised financial groups in the GCC region. Itsbusinesses include Investment Management, Commercial Banking and Treasury & Proprietary Investments, with assets and funds under management exceeding US$ 23.75 billion dollars. The Group's operations are principally focused across the GCC, NorthAfrica and India, along with strategic investment in the U.S.,Europe and the U.K. GFH is listed in Bahrain Bourse, Abu Dhabi Securities Exchange, Boursa Kuwait and Dubai Financial Market.

For more information, please visit www.gfh.com [http://www.gfh.com/].

Note: This press release may contain forward-looking statements. These statements are based on current expectations, estimates and projections about the operating environment and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially. Factors include, among others, market conditions, rates, regulatory developments, execution risks and other matters described in the Group's published financial statements. Forward-looking statements speak only as of the date of this release; the Group undertakes no obligation to update them except as required by applicable law.

Media Contact

Company Name: GFH Financial Group

Contact Person: Nawal Al Naji

Email: Send Email [http://www.universalpressrelease.com/?pr=gfh-first-half-2025-net-profit-rises-10-percent-to-67-million-dollars]

Phone: +97317538538

Country: Bahrain

Website: https://gfh.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. GetNews makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GFH First Half 2025 Net Profit Rises 10 Percent to 67 Million Dollars here

News-ID: 4148419 • Views: …

More Releases from Getnews

Two Powerful Works Illuminate Injustice Redemption and the Unseen Wounds of Urba …

Image: https://www.aionewswire.com/storage/images/ckeditor//81rGKMxE4aL._SL1500__1771341922.jpg

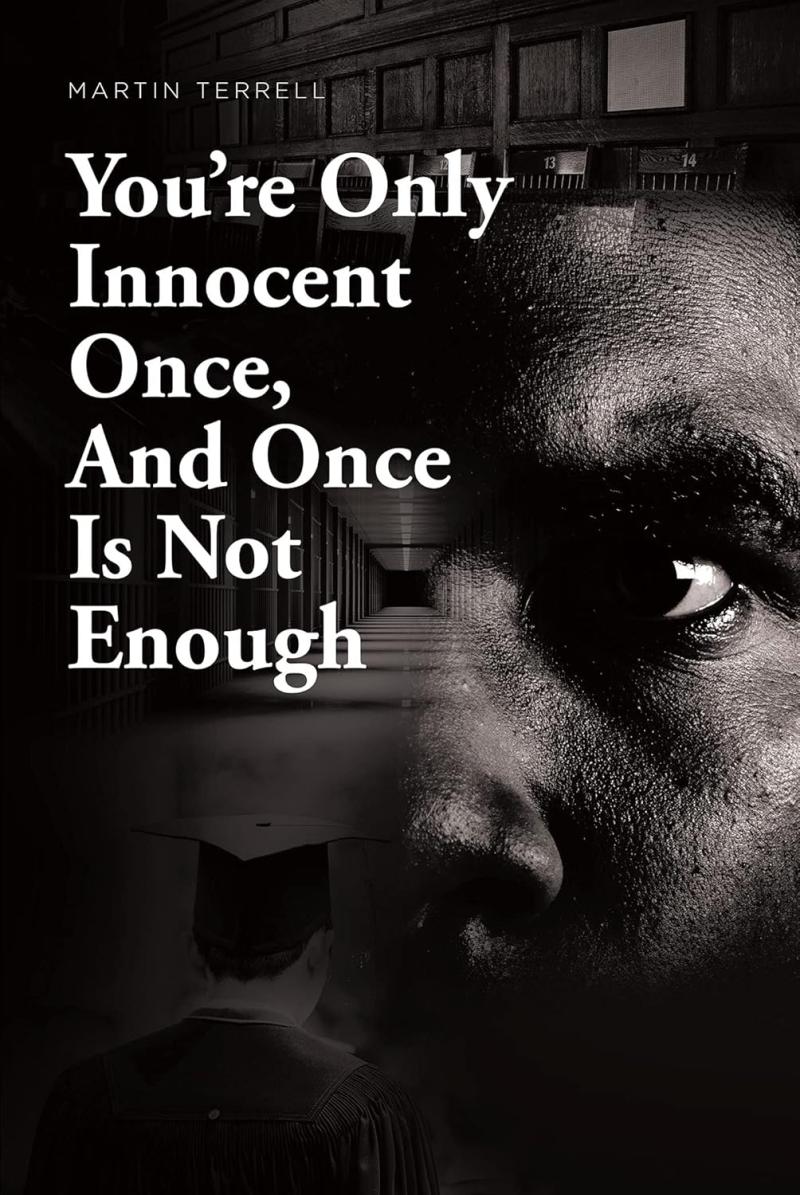

Two compelling literary works, You Are Only Innocent Once, and Once Is Not Enough [https://www.amazon.com/Youre-Only-Innocent-Once-Enough-ebook/dp/B09CG1BW43/ref] and Unseen Scars [https://www.amazon.com/Unseen-Scars-Martin-Terrell/dp/B0D9QKJ434/ref], offer unflinching examinations of injustice, resilience, and the lasting impact of systemic inequality in America. Together, these books provide timely and deeply human narratives that resonate amid ongoing conversations about criminal justice reform, racial bias, and personal redemption.

You Are Only Innocent Once, and Once Is Not Enough chronicles the extraordinary…

Apple Roofing Dallas Recognized for Top-Rated Roof Leak Repair Services in North …

Image: https://www.globalnewslines.com/uploads/2026/02/1771352421.jpg

Dallas, TX - February 17, 2026 - Apple Roofing Dallas [https://appleroof.com/dallas/], a leading provider of roofing services in the Dallas-Fort Worth area, has been recognized for delivering top-rated roof leak repair solutions backed by strong customer reviews and consistent quality workmanship. With hundreds of satisfied clients and an A+ rating from the Better Business Bureau, the company has cemented its reputation as one of the most trusted roofing contractors…

Top-Rated Laredo ATV Accident Lawyer Eric Ramos Law, PLLC Advocates for Victims …

Image: https://www.globalnewslines.com/uploads/2026/02/1771336564.jpg

Laredo, TX - February 17, 2026 - Eric Ramos Law, PLLC, of Laredo [https://ericramoslaw.com/laredo-personal-injury-lawyer/], a respected personal injury law firm serving South Texas, continues to strengthen its reputation as a top-rated ATV accident lawyer, providing aggressive legal representation to victims injured in serious off-road and rollover crashes. As ATV usage increases across ranches, rural properties, and recreational trails in the region, the firm is seeing a growing number of…

Pet Center, Inc. Highlights Key Dog Treat & Pet Health Trends - Tips for Dog Own …

Image: https://www.globalnewslines.com/uploads/2026/02/1771365671.jpg

Pet Center, Inc. Los Angeles, California

Pet Center, Inc., a Los Angeles-based dog treat manufacturer, urges pet parents to prioritize quality nutrition and responsible choices to support canine health and well-being.

Pet Center, Inc., a longtime leader in high-quality dog treats, today released a summary of major trends shaping how people feed and care for their dogs, interpreting what these developments mean for everyday pet owners - and offering practical actions…

More Releases for GFH

GFH Partners Invests in Cold-Link Logistics Alongside Slate Asset Management and …

GFH Partners Ltd. ("GFH Partners"), a Dubai International Financial Center ("DIFC") headquartered investment manager and the global real estate investment arm of GFH Financial Group, is pleased to announce the completion of its co investment in Cold Link Logistics, a leading cold storage owner operator and one of the ten largest privately held temperature controlled logistics platforms in North America, alongside Slate Asset Management, a global investor focused on essential…

Gaw Capital Partners and GFH Partners Form JV to Develop UAE Industrial and Logi …

Hong Kong & United Arab Emirates (UAE) - Gaw Capital Partners, a leading multi-asset investment management firm, and GFH Partners, a leading Dubai-based real estate investment firm specializing in thematic property solutions, announce to establish a UAE-focused industrial and logistics platform (the "Platform") through a joint venture partnership. Gaw Capital will hold a majority stake in the joint-venture company, which will serve as a gateway for the Asian capital to…

GFH Signs Partnership Agreement with Dubai Cares to Support Education of Childre …

Image: https://www.globalnewslines.com/uploads/2025/07/1752236537.jpg

As part of its ongoing commitment to creating a positive impact in the communities where it operates, GFH Financial Group (GFH) today signed a partnership agreement with Dubai Cares, part of Mohammed Bin Rashid Al Maktoum Global Initiatives (MBRGI), to support the organization's mission of providing children and youth with access to quality education.

The signing ceremony took place at Dubai Cares offices in Dubai, in the presence of Mr.…

Laser Beam Micromachining Market Strategic Insights and Analysis for Market Grow …

Global Laser Beam Micromachining Market Overview:

The Laser Beam Micromachining market is a broad category that includes a wide range of products and services related to various industries. This market comprises companies that operate in areas such as consumer goods, technology, healthcare, and finance, among others.

In recent years, the Laser Beam Micromachining market has experienced significant growth, driven by factors such as increasing consumer demand, technological advancements, and globalization. This growth…

Industrial Laser Micromachining Market Latest Research Report Provides Actionabl …

"

Global Industrial Laser Micromachining Market Overview:

The Industrial Laser Micromachining market is a broad category that includes a wide range of products and services related to various industries. This market comprises companies that operate in areas such as consumer goods, technology, healthcare, and finance, among others.

In recent years, the Industrial Laser Micromachining market has experienced significant growth, driven by factors such as increasing consumer demand, technological advancements, and globalization. This growth…

Laser Drilling Market Outlook to 2027 - Coherent and Rofin, EDAC Technologies, G …

A new research report titled, ‘Global Laser Drilling Market’ has been added to the vast repository The Insight Partners. The intelligence report provides an in-depth analysis of the global market on the basis of the different types of products, technologies, industry verticals, applications, and end-users. The Laser Drilling Market Report is a valuable source of information for businesses and individuals.

Laser drilling is the process of removing all over or a…