Press release

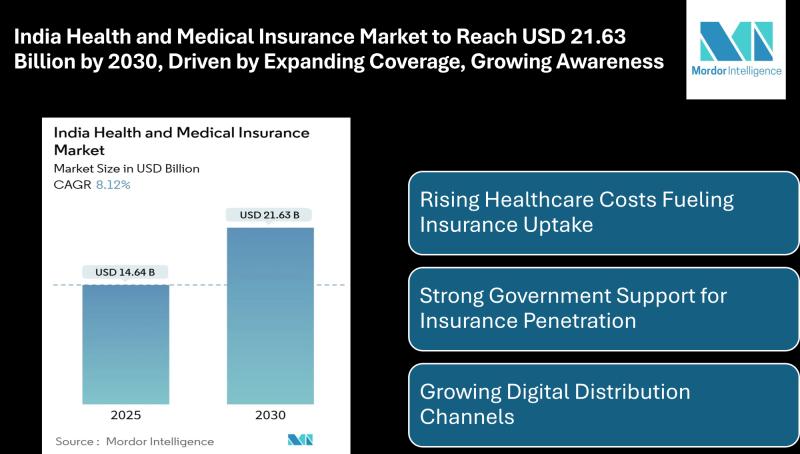

India Health and Medical Insurance Market to Reach USD 21.63 Billion by 2030, Driven by Expanding Coverage and Growing Awareness

Mordor Intelligence has published a new report on the "India Health and Medical Insurance Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction to the India Health and Medical Insurance Market

The India health and medical insurance market is witnessing robust expansion, reflecting the growing importance of financial security in healthcare. Valued at USD 14.64 billion in 2025, the market is projected to touch USD 21.63 billion by 2030, registering a steady CAGR of 8.12% during the forecast period. This upward trajectory is attributed to increasing healthcare costs, rising awareness of medical coverage, and supportive government initiatives.

Health insurance in India is no longer seen as a luxury but a necessity, especially as consumers become more aware of the risks of high medical expenses. The sector's growth is also being accelerated by innovations in policy offerings, digital distribution channels, and the introduction of products designed to meet the needs of diverse demographics.

Report Overview: https://www.mordorintelligence.com/industry-reports/india-health-and-medical-insurance-market?utm_source=openpr

Key Trends Shaping the India Health and Medical Insurance Market

Rising Healthcare Costs Fueling Insurance Uptake

One of the primary drivers of the Indian health insurance market is the steep rise in healthcare expenses. Hospitalization, treatments for lifestyle-related diseases, and advanced medical procedures are placing financial strain on households. As a result, both individuals and families are increasingly turning to insurance to mitigate risks and ensure access to quality healthcare.

Strong Government Support for Insurance Penetration

Government programs such as Ayushman Bharat, Pradhan Mantri Jan Arogya Yojana (PMJAY), and state-level health schemes have significantly improved insurance coverage across the country. These initiatives have expanded access to affordable healthcare, especially for low-income groups, thereby boosting health insurance industry growth in India.

Growing Digital Distribution Channels

The role of technology in the market cannot be understated. Online platforms, mobile apps, and digital policy management tools are simplifying the insurance purchase and claims process. Insurers are increasingly leveraging digital ecosystems to reach underserved populations and improve customer experience.

Rising Awareness Across Demographics

Awareness of the benefits of health and medical insurance is growing across both urban and rural areas. Younger demographics are opting for insurance at an earlier age, while older populations are seeking comprehensive coverage that caters to critical illnesses and long-term care. This broadening base is expected to support long-term health insurance market share in India.

Increasing Role of Private Insurers

Private sector companies are expanding their market presence by introducing specialized policies such as family floater plans, women-centric insurance, and wellness-linked products. Their ability to innovate and provide flexible coverage options has further accelerated the market's expansion.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/india-health-and-medical-insurance-market?utm_source=openpr

Market Segmentation of the India Health and Medical Insurance Market

The health insurance market size in India is structured across several policy types, coverage areas, demographics, providers, distribution channels, and regions. This segmentation reflects the industry's diversity and its ability to cater to a wide range of needs:

By Policy Type:

Individual Health Insurance

Family Floater Plans

Group Health Insurance

Other Specialized Policies

By Coverage Type:

In-Patient Hospitalization

Out-Patient & Day-Care Services

Critical Illness Coverage

Other Insurance Options

By Demographic:

0-18 Years

19-45 Years

46-60 Years

60+ Years

By Provider Type:

Public Sector Insurers

Private Sector Insurers

Others

By Distribution Channel:

Agents & Brokers

Bancassurance

Digital Platforms & Online Aggregators

Direct Sales

By Region:

North India

South India

East India

West India

This segmentation ensures insurers can customize policies to different target groups while consumers can select coverage suited to their individual needs.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players in the India Health and Medical Insurance Market

The competitive landscape of the Indian health insurance market features both long-established public insurers and dynamic private players. These companies are focusing on expanding policy portfolios, enhancing customer service, and leveraging digital platforms to stay ahead in a competitive environment.

New India Assurance Co. Ltd. - A leading public sector insurer with strong nationwide reach, offering diverse health and medical insurance policies.

Star Health and Allied Insurance Co. Ltd. - Known for its specialized health insurance products, it caters to individuals, families, and corporates with tailored plans.

ICICI Lombard General Insurance Co. Ltd. - A private sector leader with a strong focus on digital channels and innovative coverage solutions.

HDFC ERGO General Insurance Co. Ltd. - Offers comprehensive health insurance plans and emphasizes customer-centric digital platforms.

Bajaj Allianz General Insurance Co. Ltd. - Recognized for its broad product offerings and strong presence in both urban and semi-urban markets.

These companies collectively shape the market by introducing competitive products, strengthening distribution networks, and investing in customer engagement strategies.

Explore more insights on India health and medical insurance market competitive landscape: https://www.mordorintelligence.com/industry-reports/india-health-and-medical-insurance-market/companies?utm_source=openpr

Conclusion on the India Health and Medical Insurance Market

The India health and medical insurance market is on a sustained growth path, underpinned by rising healthcare costs, policy innovation, and growing awareness across diverse demographic groups. The sector is further supported by government-backed programs and the digitalization of insurance distribution channels.

As private and public players continue to expand their coverage options, the market is expected to witness deeper penetration and broader acceptance across urban and rural areas alike. The focus on tailored products, enhanced accessibility, and long-term wellness solutions will continue to define the next phase of growth in the Indian market.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/india-health-and-medical-insurance-market?utm_source=openpr

Industry Related Reports

UAE Health And Medical Insurance Market: The UAE Health and Medical Insurance Market is Segmented by Insurance Type (Individual, Group), by Service Provider (Private Health Insurance Providers, Public/Social Health Insurance Schemes), by Distribution Channel (Direct Sales, Online Sales, Brokers/Agents, and Banks), by End-User/Customer Type (Corporate/Employer, Individual/Families, and More), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/uae-health-and-medical-insurance-market?utm_source=openpr

US Health And Medical Insurance Market: The US Health and Medical Insurance Market is Segmented by Coverage Type (Employer-Sponsored, Individual (ACA / Non-Group), and More), Plan Type (HMO, PPO, EPO, and More), Insurance Type (Major Medical (Comprehensive), Medicare Supplement, and More), Distribution Channel (Direct To Consumer, Brokers & Agents, and More), and Region (Northeast, Midwest, and More)

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-health-and-medical-insurance-market?utm_source=openpr

Turkey Health and Medical Insurance Market: The Turkey Health and Medical Insurance Market Report is Segmented by Product Type (Private Health Insurance and Social Security Schemes), Term of Coverage (Short-Term and Long-Term), and Channel of Distribution (Brokers/Agents, Banks, Companies, Direct Purchases, and Other Channels of Distribution).

Get more insights: https://www.mordorintelligence.com/industry-reports/turkey-health-and-medical-insurance-market?utm_source=openpr

UK Health And Medical Insurance Market: The United Kingdom Health and Medical Insurance Market is Segmented by Policy Type (Individual Policies, Group/Corporate Policies), Coverage Type (In-Patient Only, Comprehensive, and More), Distribution Channel (IFAs, Direct-To-Consumer, Bancassurance & Affinity Partnerships, and More), End User (Individuals & Families, Smes, and More), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/united-kingdom-health-and-medical-insurance-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Health and Medical Insurance Market to Reach USD 21.63 Billion by 2030, Driven by Expanding Coverage and Growing Awareness here

News-ID: 4148380 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

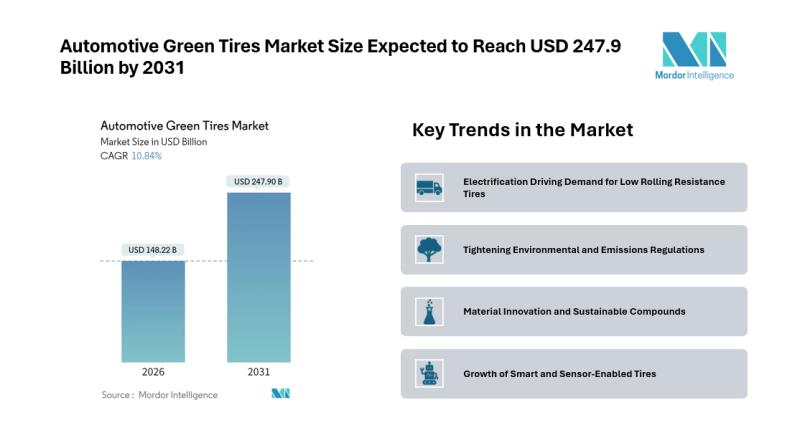

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…