Press release

Precious Metal Market to Reach US$ 481.6 Bn by 2032 Driven by Rising Industrial and Investment Demand

✅Global Precious Metal Market to Grow at 6.0% CAGR Fueled by Jewelry, Electronics, and Safe-Haven InvestmentsAccording to the latest study by Persistence Market Research, the global precious metal market is projected to be valued at US$ 320.3 Bn in 2025 and expand to US$ 481.6 Bn by 2032, growing at a CAGR of 6.0% during the forecast period. The market growth is being driven by the increasing use of precious metals such as gold, silver, platinum, and palladium across jewelry, industrial applications, and investment portfolios. The rising demand for safe-haven assets in times of economic uncertainty, coupled with technological advancements in electronics and automotive industries, is expected to accelerate global market expansion.

The precious metal market plays a pivotal role in global trade, finance, and industry. Precious metals like gold, silver, platinum, and palladium have historically served as both a medium of exchange and a store of value. In the modern era, while their role in currency systems has diminished, their significance as investment assets and industrial inputs has increased substantially. For instance, gold remains the most sought-after metal due to its dual role as a safe-haven investment and as a key material in luxury jewelry. Silver is widely used in industrial applications, particularly in electronics and solar panels, while platinum and palladium are essential in catalytic converters for automotive emission control.

🔗Dive deeper into the market data: https://www.persistencemarketresearch.com/market-research/precious-metals-market.asp

The global market is also shaped by geographical and cultural factors. Jewelry demand remains high in countries like India and China, while industrial demand dominates in North America and Europe. Among all segments, gold continues to dominate the market, accounting for the largest share due to its global appeal across investors, central banks, and jewelry consumers. Regionally, Asia Pacific leads the market, driven by massive consumer demand in India and China, rising investments in infrastructure, and expanding industrial use cases. The region benefits from strong cultural affinity toward gold and silver, combined with increasing manufacturing activities that drive platinum and palladium demand.

✅Key Market Insights

➤ Gold remains the dominant precious metal, accounting for the largest market share due to jewelry demand and investment.

➤ Silver is emerging as a critical metal for renewable energy, especially solar power, enhancing its industrial demand.

➤ Asia Pacific is the leading regional market, driven by strong jewelry consumption and rapid industrialization.

➤ Central banks worldwide are increasing gold reserves as part of diversification strategies, boosting demand.

➤ Technological advancements in electronics and automotive industries are creating new opportunities for platinum and palladium.

✅Why is the demand for precious metals rising globally?

The demand for precious metals is rising globally due to their diverse applications across jewelry, industrial, and investment sectors. Gold continues to be a preferred safe-haven asset during periods of financial instability, while silver is witnessing strong demand from renewable energy and electronics industries. Platinum and palladium play a vital role in catalytic converters as countries tighten emission regulations. Additionally, central banks are diversifying reserves by increasing gold holdings, further strengthening demand. Cultural affinity for precious metals in regions such as Asia Pacific also supports long-term growth, making them both industrially significant and financially valuable.

✅Market Dynamics

Drivers:

The primary drivers of the precious metal market include the rising demand for safe-haven assets during global economic uncertainty, expanding industrial applications, and the growing use of silver in renewable energy technologies. Additionally, stricter emission regulations are boosting platinum and palladium demand for automotive catalytic converters.

Market Restraining Factor:

Price volatility is one of the major restraining factors in the market. Precious metal prices are highly sensitive to global economic shifts, interest rates, and currency fluctuations, creating challenges for both investors and industries reliant on stable supply. Substitution by alternative materials in industrial applications can also act as a limiting factor.

Key Market Opportunity:

The most promising opportunity lies in the renewable energy sector, particularly with silver's increasing role in solar panels and electrical components. Additionally, advancements in hydrogen fuel cells offer growth avenues for platinum. Expanding consumer wealth in emerging economies also presents long-term growth potential for jewelry and investment markets.

✅Market Segmentation

The precious metal market is segmented based on metal type, application, and end-user industry. By type, the market includes gold, silver, platinum, and palladium. Gold leads the segment, driven by its global role in investment and jewelry markets. Silver follows, with increasing adoption in electronics and renewable energy. Platinum and palladium are gaining ground due to their irreplaceable use in catalytic converters and emerging applications in hydrogen fuel cells.

By application, the market is divided into jewelry, industrial, investment, and others. Jewelry remains the largest application, particularly in Asia Pacific, due to cultural traditions and rising disposable incomes. Industrial applications are expanding rapidly, with silver in solar panels and palladium in automotive catalytic converters leading the way. Investment demand also continues to grow as financial institutions and individuals diversify their portfolios with precious metals to hedge against inflation and market volatility.

✅Regional Insights

Asia Pacific dominates the global market, supported by massive demand in India and China, where gold and silver hold cultural and investment significance. The region also benefits from rapid industrialization, which boosts demand for platinum and palladium in automotive and electronics industries. North America follows, with high demand driven by investment, renewable energy, and technological innovation. Europe remains a strong market for platinum and palladium due to strict emission regulations and established automotive production. Meanwhile, the Middle East and Africa hold untapped potential, with growing gold mining activities and rising demand for luxury goods, while Latin America benefits from being a key source of precious metal supply.

🔗Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/4343

✅Competitive Landscape

The precious metal market is highly competitive, with companies focusing on mining, refining, investment services, and industrial applications. Leading players are investing in expanding mining operations, developing sustainable sourcing, and integrating digital platforms for trading.

✦ Newmont Corporation

✦ Barrick Gold Corporation

✦ Anglo American Platinum Limited

✦ Norilsk Nickel

✦ Sibanye Stillwater Limited

✦ Freeport-McMoRan Inc.

✦ Wheaton Precious Metals Corp.

✦ Impala Platinum Holdings Limited

✦ Kinross Gold Corporation

✦ Polymetal International plc

✅Key Industry Developments

Recent years have witnessed increased investments in renewable energy driving silver demand, particularly in photovoltaic cell production. Mining companies are expanding operations to meet the rising need, while refining companies are focusing on supply chain sustainability. Central banks globally are also enhancing their gold reserves, reshaping demand patterns.

Additionally, stricter environmental regulations in Europe and North America are bolstering platinum and palladium demand for catalytic converters. Companies are also forming strategic partnerships to enhance refining technologies, improve recycling of precious metals, and develop digital trading platforms, thereby boosting accessibility for both institutional and retail investors.

✅Innovation and Future Trends

The future of the precious metal market lies in technological integration and sustainability. Innovations such as blockchain-enabled tracking systems are being adopted to improve transparency in sourcing and trading. Moreover, recycling technologies are evolving to extract precious metals from electronic waste, supporting circular economy initiatives.

On the industrial side, the growing role of silver in renewable energy and the use of platinum in hydrogen fuel cells signal strong long-term demand. With rising global emphasis on sustainability and decarbonization, precious metals will continue to gain significance across industrial, financial, and cultural dimensions, shaping the evolution of this dynamic market.

✅Explore the Latest Trending Research Reports:

• Linear Alpha Olefin Market - https://www.persistencemarketresearch.com/market-research/linear-alpha-olefin-market.asp

• Polyisobutene Market - https://www.persistencemarketresearch.com/market-research/polyisobutene-market.asp

• Hydraulic Fluids Market - https://www.persistencemarketresearch.com/market-research/hydraulic-fluids-market.asp

• Renewable Naphtha Market - https://www.persistencemarketresearch.com/market-research/renewable-naphtha-market.asp

✅Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

✅About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Precious Metal Market to Reach US$ 481.6 Bn by 2032 Driven by Rising Industrial and Investment Demand here

News-ID: 4148221 • Views: …

More Releases from Persistence Market Research

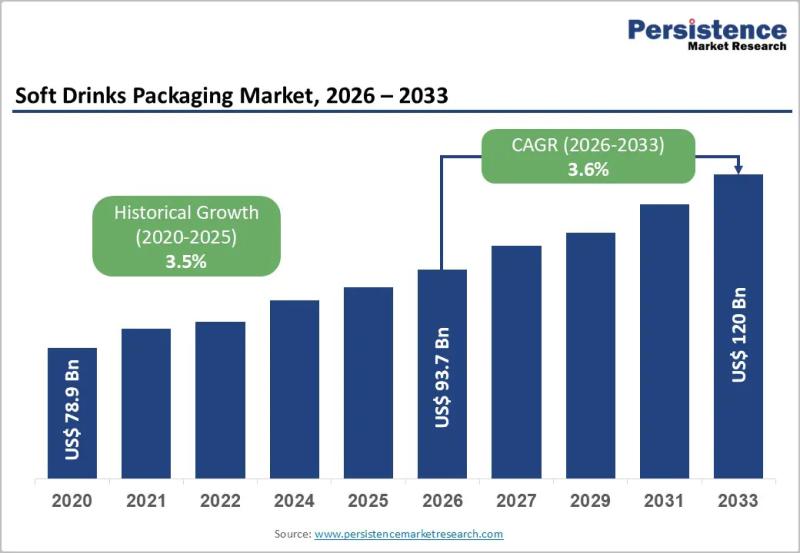

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

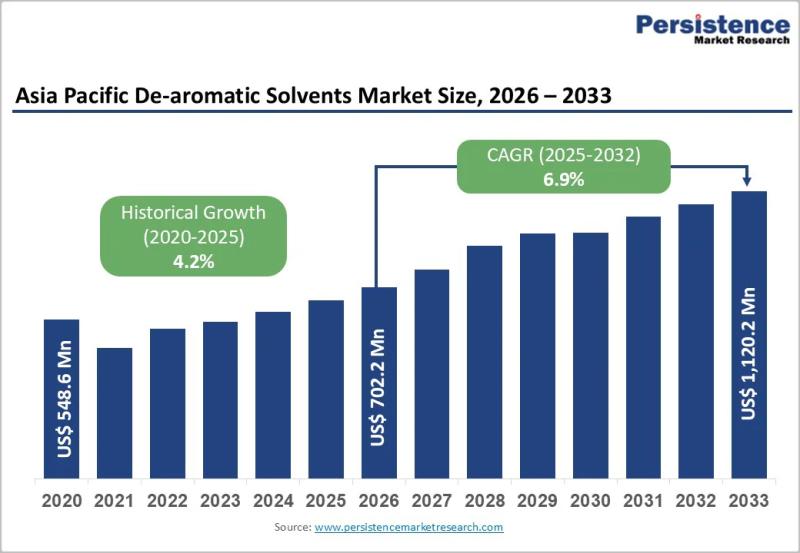

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Precious

Colloidal Precious Metals Market Trends, Size & Forecast 2025-2032 | Nanomateria …

The Colloidal Precious Metals industry has witnessed accelerated innovation driven by applications spanning medical, electronic, and chemical sectors. Recent advancements in nanotechnology and catalytic efficiency have propelled the adoption of colloidal precious metals in high-value manufacturing and healthcare products, contributing to dynamic shifts within the industry. The Global Colloidal Precious Metals Market size is estimated to be valued at USD 2.8 billion in 2025 and is expected to reach USD…

Discover MyRatna's Latest Collection of Precious Gemstones

MyRatna, India's trusted name in 100% original and lab-certified gemstones, proudly unveils its latest collection of premium precious gemstones, including the stunning Pukhraj (Yellow Sapphire), vibrant Panna (Emerald), and powerful Neelam (Blue Sapphire) stones. With a perfect fusion of Vedic tradition and royal Rajasthani craftsmanship, this collection also celebrates the art of Mewar Gem Art - a heritage style known for intricate detailing and timeless beauty.

Highlights of the New Collection:

🔸…

Global Precious Metal Recovery And Refining Market Size by Application, Type, an …

USA, New Jersey- According to Market Research Intellect, the global Precious Metal Recovery And Refining market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

Driven by rising demand for gold, silver, platinum, and palladium across electronics, automotive, and jewelry sectors, the precious metal recovery and refining…

Precious Metal Market Scope and Competitive Analysis Forecast through 2024-2031 …

The Precious Metal Market study by DataM Intelligence provides a comprehensive analysis of the market, delivering valuable insights, detailed statistics, historical trends, and industry-backed market data. The report explores the competitive landscape, focusing on key players in the industry. It evaluates aspects such as product offerings, pricing models, financial performance, product portfolios, growth strategies, and regional expansion to offer a thorough understanding of market dynamics and future trends.

Get a Free…

Precious and Base Metals Market Splendor and Strength: Unveiling the Precious an …

Precious and Base Metals Market to reach over USD 2,300.9 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Precious and Base Metal Market" in terms of revenue was estimated to be worth $915.4 billion in 2023 and is poised to reach $2,300.9 billion by 2031, growing at a CAGR of 12.34% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @…

Precious Pairs: Global Disaster Relief Campaign

Precious Pairs, a non-profit organization based in San Francisco, has announced its active engagement in global emergency disaster relief efforts. Founded recently, the organization is dedicating its resources to provide immediate support in response to natural disasters around the world, a mission that is both urgent and capital-intensive.

Given the resource-heavy nature of emergency disaster relief, Precious Pairs is reaching out for support. Contributions are vital for procuring supplies, managing logistics,…