Press release

Unemployment Insurance Market Growth Accelerates: Strategic Forecast Predicts $138.96 Billion by 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Unemployment Insurance Industry Market Size Be by 2025?

The market volume of unemployment insurance has witnessed robust growth in the past few years. It is projected to expand from $98.38 billion in 2024 to $105.71 billion in 2025, maintaining a compound annual growth rate (CAGR) of 7.5%. This substantial increase in the historical phase can be associated with factors such as rising inflation rates, escalating living costs, a surge in bankruptcies, growth in job outsourcing to foreign countries, and frequent economic downturns.

What's the Long-Term Growth Forecast for the Unemployment Insurance Market Size Through 2029?

It is anticipated that the unemployment insurance market will experience significant expansion in the coming years, with projections showing a growth to $138.97 billion in 2029, reflecting a compound annual growth rate (CAGR) of 7.1%. Factors likely to spur this growth during the forecast period include augmentation in workforce automation, a rise in the trend of remote work, growing globalization, more investments channelled into smart city infrastructure, and heightened cyber threats. On a larger scale, the forecast period will also see key trends like technological advancements, the embracing of artificial intelligence and blockchain technology, the emergence of augmented reality, and the assimilation of the Internet of Things.

View the full report here:

https://www.thebusinessresearchcompany.com/report/unemployment-insurance-global-market-report

What Are the Key Growth Drivers Fueling the Unemployment Insurance Market Expansion?

The unemployment insurance market is anticipated to grow due to escalating job insecurity. Job insecurity is the apprehension or doubt of an individual regarding potential job loss or downsizing of employment status, including a decrease in working hours or salary. This increase in job insecurity can be attributed to economic instability, contract and gig jobs, organisational restructuring, challenges specific to certain sectors, and modifications in the workplace. Unemployment insurance (UI) serves as a shield against the impacts of job insecurity, providing financial aid and security to those who have lost their job or have experienced a decline in work hours. For example, Lancaster University, a public university in the UK, reported in February 2024 that the UK insecure work index expanded by 500,000 individuals in 2022 and by 600,000 individuals in 2023. Therefore, the surge in job insecurity is fuelling the expansion of the unemployment insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19743&type=smp

What Are the Key Trends Driving Unemployment Insurance Market Growth?

Companies that have a leading role in the unemployment insurance market are concentrating their efforts on creating advanced digital solutions such as online insurance platforms. These platforms are intended to simplify applications and boost accessibility. They are digital services that give users the opportunity to buy, administer, and monitor insurance policies online. For instance, in March 2024, the Oregon Employment Department (OED), an agency of the US government, introduced a new online system for handling the unemployment insurance benefits called Frances Online. This digital platform not only facilitates the management of unemployment insurance benefits and Paid Leave Oregon applications but also allows employees and claimants to apply for benefits online, upload necessary documents, and track their claims. The launch of Frances Online represents a significant upgrade in the processing of unemployment and paid leave claims in Oregon and exemplifies the broader move towards digital solutions in public services.

How Is the Unemployment Insurance Market Segmented?

The unemployment insurancemarket covered in this report is segmented -

1) By Type: Structural Unemployment, Cyclical Unemployment, Frictional Unemployment, Other Types

2) By Insurance Type: Involuntary Unemployment Insurance, Mortgage Unemployment Insurance

3) By Distribution Channel: Agents Or Brokers, Direct Response

Subsegments:

1) By Structural Unemployment: Skill-Based Unemployment, Geographic Unemployment, Industry-Specific Unemployment, Long-Term Unemployment

2) By Cyclical Unemployment: Recession-Induced Unemployment, Seasonal Cyclical Unemployment, Expansion Or Recovery Unemployment

3) By Frictional Unemployment: Job Transition Unemployment, First-Time Job Seekers, Re-entrants to the Workforce, Short-Term Unemployment

4) By Other Types of Unemployment: Voluntary Unemployment, Seasonal Unemployment, Technological Unemployment, Hidden Unemployment, Underemployment

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=19743&type=smp

Which Companies Are Leading the Charge in Unemployment Insurance Market Innovation?

Major companies operating in the unemployment insurance market are Cigna Corporation, Allianz SE, State Farm Mutual Automobile Insurance Company, The Allstate Corporation, Banco Bilbao Vizcaya Argentaria S.A., Achmea B.V., Banco Bradesco S.A., CNP Assurances S.A., Assurant Inc., Cook County Government, Great American Insurance Group, Hiscox Ltd., American Association of Retired Persons, Anadolu Hayat Emeklilik A.S., BNP Paribas Cardif, Allied Solutions LLC, G&A Partners, Paisabazaar.com, Garanti BBVA Emeklilik ve Hayat A.S., AlfaStrakhovanie, Axcet HR Solutions, Aegon Asset Management, Flex HR LLC, LifeQuote Inc., Personnel Planners

Which Regions Are Leading the Global Unemployment Insurance Market in Revenue?

North America was the largest region in the unemployment insurance market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the unemployment insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19743

"This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work."

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Unemployment Insurance Market Growth Accelerates: Strategic Forecast Predicts $138.96 Billion by 2029 here

News-ID: 4147857 • Views: …

More Releases from The Business Research Company

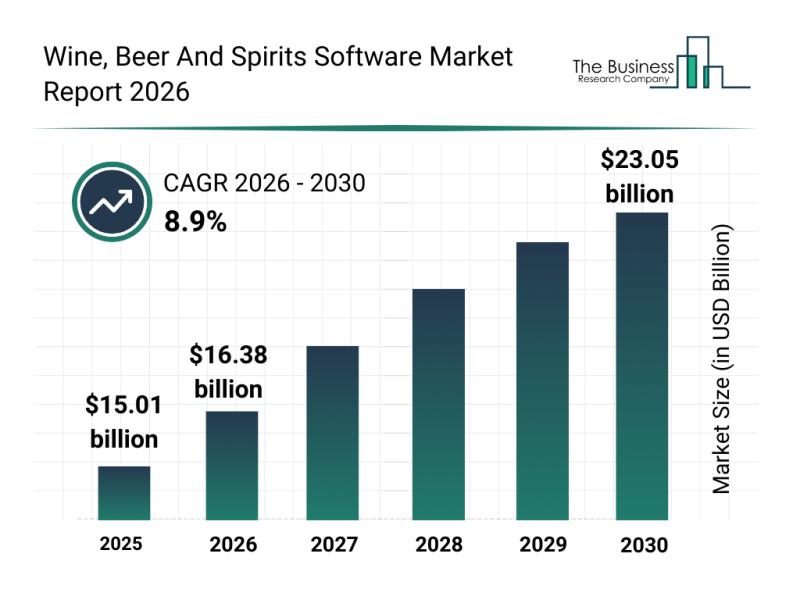

Global Drivers Overview: The Rapid Development of the Wine, Beer, and Spirits So …

The wine, beer, and spirits software sector is positioned for significant expansion over the coming years, driven by technological advancements and evolving industry demands. This market is witnessing a transformation as beverage businesses increasingly adopt digital solutions to streamline operations, ensure compliance, and enhance customer engagement. Let's explore the market size, key players, emerging trends, and growth segments shaping this dynamic industry.

Projected Growth Trajectory of the Wine, Beer, and Spirits…

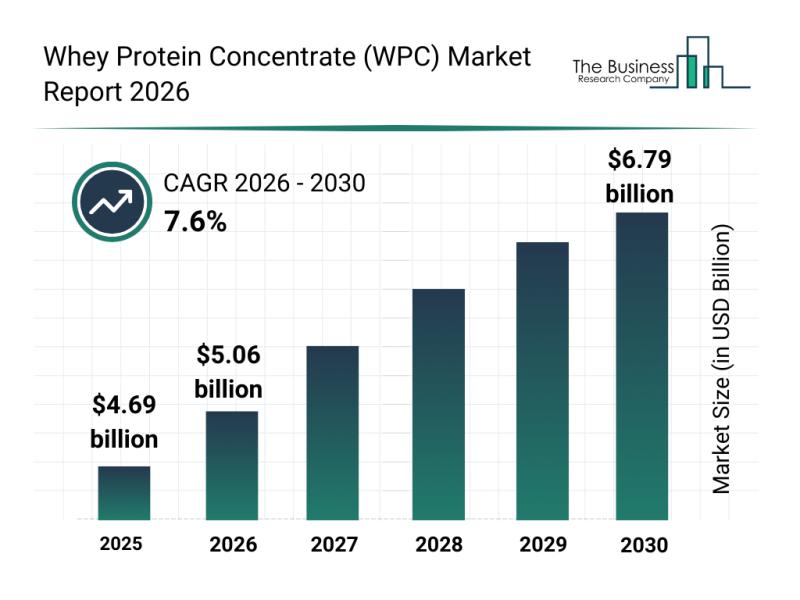

Whey Protein Concentrate (WPC) Market Overview, Key Trends, and Major Player Ana …

The whey protein concentrate (WPC) market is set to experience significant expansion over the coming years, driven by increasing health awareness and consumer demand for high-quality protein products. As more people adopt protein-rich diets and seek convenient nutritional solutions, the market is gearing up for robust growth and innovation. Let's explore the market size projections, leading players, emerging trends, and detailed market segmentation shaping the WPC industry.

Strong Growth Outlook for…

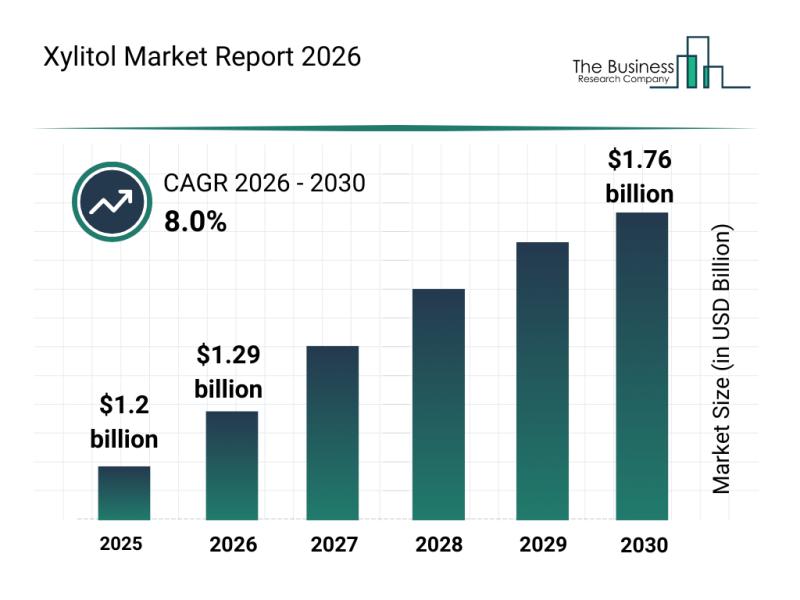

Market Trend Analysis: The Impact of Recent Developments on the Xylitol Market

The xylitol market is set for a promising expansion over the coming years, driven by evolving consumer preferences and growing industrial applications. As demand for healthier sugar alternatives rises, various sectors are increasingly incorporating xylitol, enabling sustained growth through to 2030. This overview delves into the market's future size, leading players, key trends, and segmentation details.

Strong Growth Outlook for the Xylitol Market Size Through 2030

The xylitol market is…

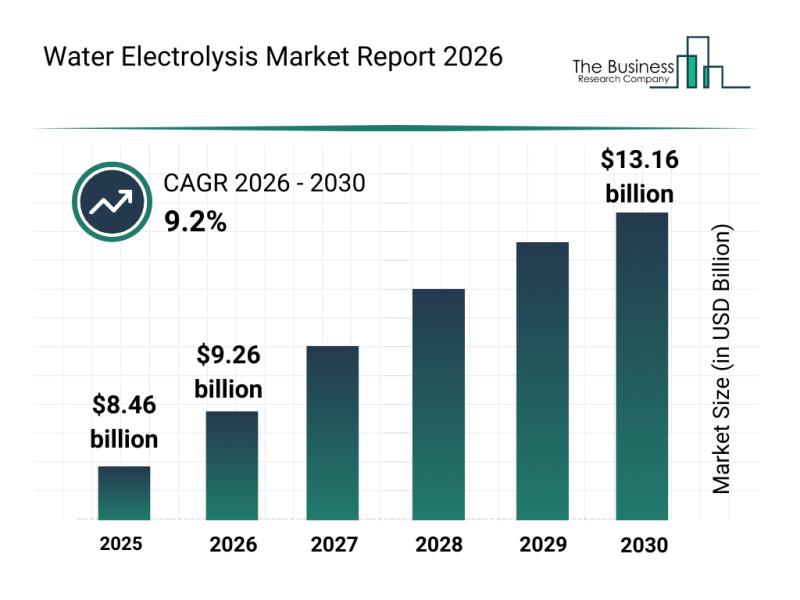

Leading Industry Participants Enhancing Their Presence in the Water Electrolysis …

The water electrolysis sector is gaining significant momentum as the world increasingly turns toward sustainable energy solutions. With a growing emphasis on hydrogen as a clean fuel and energy storage option, this market is set to experience rapid expansion over the coming years. Let's explore the current market valuation, key players, emerging trends, and the main segments shaping the future of water electrolysis.

Market Size and Growth Projections for the Water…

More Releases for Unemployment

Top Factor Driving Unemployment Insurance Market Growth in 2025: Impact Of Risin …

What industry-specific factors are fueling the growth of the unemployment insurance market?

The escalation of job instability is anticipated to fuel the expansion of the unemployment insurance market in the future. Job instability embodies the apprehension or uncertainty of a person potentially losing their job or experiencing a downgrade in their employment status, such as lower income or reduced work hours. Factors like economic instability, contractual and gig work, company reorganization,…

How NanoEdge is Fighting Unemployment in Nigeria

With youth unemployment soaring and crime rates on the rise, Nigeria is grappling with a critical challenge: how to equip its young population with the skills needed to secure sustainable income. NanoEdge, an innovative digital job platform, is addressing this issue by offering Nigerian students and young professionals access to high-demand skills and remote job opportunities that pay in stable currencies.

The problem is massive. Millions of young Nigerians face unemployment…

YMCA Proposes Solutions to Youth Unemployment Crisis

YMCA publishes 2 reports proposing a new approach to meaningful work for youth

Image: https://www.abnewswire.com/uploads/05c62db23b8c56e9f6c26a111115f441.png

GENEVA - July 17, 2024 - YMCA [https://www.ymca.int/] has published two reports to set out the challenge of - and a proposed response to - the global issue of employment, under-employment, and unemployment for young people.

The context of these reports is a world in which 1 in 5 young people are not in employment, education, and training…

Turn Unemployment to Self-Employment with Joulebook

FOR IMMEDIATE RELEASE: May 26, 2020

Joulebook Inc.

www.joulebook.com

(609)-388-8369

joulebook@joulebook.com

Turn Unemployment to Self-Employment with Joulebook

The USA premier marketplace for skills launches its services

Medford, New Jersey: May 26, 2020 -- Today, Joulebook announced the release of their revolutionary skill marketplace across the USA. The company's target is to become the next version of social media where people cheer, share, give and get opportunities for jobs, skills and personal growth to others. Joulebook skill…

Reduced Unemployment Only Possible With Economic Growth

March 7, 2012 - Pasadena, CA - Even though job numbers have been on the rise in recent months, people are still hurting and unemployment is still a real problem. In fact, Ben Bernake, the Federal Reserve Chairman, recently noted that the unemployment rate wouldn't continue to drop unless new jobs were created and more companies hired employees. While many companies are afraid of taking the risk, others just can't…

Taiwan’s April unemployment rate drops to 4.29 percent

By Meg Chang

Taiwan’s jobless rate fell 1.1 percentage points year on year to 4.29 percent in April, its lowest level since October 2008, according to the Directorate-General of Budget, Accounting and Statistics May 23.

“This improvement can be partly attributed to the seasonal effect,” said Chen Min, deputy director of the DGBAS Fourth Department. “Taiwan’s lowest unemployment rate tends to occur in either April or at the end of the…