Press release

Myth Vs Fact, In Ricardo Salinas False Narrative Of USD $110 Million Loan Drama

MYTH vs. FACT: The Truth About the Astor Loan with Ricardo Salinas as told by Val SklarovNew York/London/Mexico City - In light of recent public statements and speculation, Val Sklarov sets the record straight on the July 28, 2021 loan agreement with Ricardo Salinas Pliego and Astor Asset Management 3 Ltd ("Astor 3").

⸻

MYTH #1: That Astor 3 or Val Sklarov had stated that Val Sklarov or Astor 3 is descendant of Astor 3.

FACT: Astor 3 was formed in Canada at the request of Salinas. He had signed 2 identical loan agreements and had decided he wanted a Canadian based lender. He then requested that Astor 3 of Canada is formed as a Special Purpose Vehicle (SPV) just for him. Val Sklarov never said anything about any Astor family and this is pure fabrication and this is true fact.

⸻

MYTH #2: The shares pledged as collateral could not be rehypothecated.

FACT: The agreement granted unconditional rehypothecation rights. From day one, Astor 3 could rehypothecate, barter, pawn, charge, lend, re-pledge, transfer or lend the shares without further consent. That's how the loan contract is written and this is true fact.

⸻

MYTH #3: Salinas did not give a Power of Attorney (POA) over his pledge account.

FACT: False. Salinas had signed two documents titled Custodian Management Agreement (CMA) which is identical to a POA, giving Astor 3 unrestricted rights and control over the pledge account containing the securities and this is true fact.

⸻

MYTH #4: Rehypothecation was limited or restricted.

FACT: There were no restrictions. The rights were absolute, permanent, and acknowledged by Mr. Salinas in the contract he signed after his lawyers reviewed it and approved it. He allegedly has 300 lawyers working for him. Astor 3 had absolute Rehypothecation rights and this is true fact.

⸻

MYTH #5: Salinas was unaware of his rights.

FACT: His legal team consisting of 300 lawyers reviewed, negotiated and approved all the loan documents. The rights were stated in plain language. The idea that he "didn't know" is not credible and this is true fact.

⸻

MYTH #6: All the interest and loan fees were paid for by Salinas according to contract terms.

FACT: Not true. Salinas paid interest only two times in 3 years and never paid other mandatory fees. As a banker, he should know to pay on time, but he didn't, being late 1 year the two times he paid and this is true fact.

⸻

MYTH #7: Default meant Salinas could still redeem the shares.

FACT: The agreement contained a waiver of redemption rights. Upon default, Astor 3 had zero obligation to return any collateral - it could liquidate immediately and retain all proceeds up to full repayment and this is true fact.

⸻

MYTH #8: The terms were one-sided or exploitative.

FACT: Both parties were sophisticated and represented by top legal counsel. Astor 3 bore significant risk, including market risk on volatile Elektra shares. Terms reflected that risk, as in any institutional securities-backed lending deal and this is true fact.

⸻

MYTH #9: The deal was secretive or unusual.

FACT: The structure was standard for institutional finance. The only "unusual" element was that Mr. Salinas personally requested a Canadian SPV be created for the transaction, after rejecting earlier U.S. and St. Kitts SOV's for tax and jurisdiction reasons and this is true fact.

⸻

MYTH #10: The lender couldn't call for more collateral.

FACT: The agreement allowed margin calls if the market value of Elektra shares dropped, ensuring the loan-to-value ratio stayed within agreed limits and this is true fact.

⸻

MYTH #11: That Salinas complied with all the terms of the loan.

FACT: Salinas had failed to comply with many provisions of the loan. He refuses to address the 20 breaches of the loan agreement and keeps making reference to Astor family in order to detract from the contract breaches and this is true fact.

⸻

MYTH #12: The contract lacked legal safeguards for the lender.

FACT: It contained multiple waivers - fiduciary duty, unjust enrichment, implied covenant, and broad limitation of liability - plus a balance of equities clause favoring the lender in any dispute and this is true fact.

⸻

MYTH #13: The deal was somehow not binding.

FACT: The loan was valid, binding, and enforceable from the moment it was signed. It complied fully with UK law governing pledge of collateral in a loan and this is true fact.

⸻

MYTH #14: Salinas is owed money because Astor 3 did not fund in full.

FACT: Salinas has been funded in full, the sum of US $110 million and does not allege to be owed any money and this is true fact.

⸻

MYTH #15: Salinas wants his collateral back.

FACT: Salinas has already used the loan proceeds and had repurchased all the pledged shares back for less than the loan amount. Salina's repurchased all the shares for approximately US $68 million, while the loan was for US $110 million. Effectively, Salinas made a profit of US $42 million and this is true fact.

⸻

MYTH #16: Salinas believed he was dealing with the famous Astor family.

FACT: Neither Val Sklarov, nor Astor 3 has ever spoken to Salinas. What he believed is a figment of his imagination fed to Salinas by his own trusted agents and this is true fact.

⸻

MYTH #17: Salinas does not know why he defaulted.

FACT: Salinas has been sent 8 Amended Notices of Default. He refuses to respond to them and this is true fact.

⸻

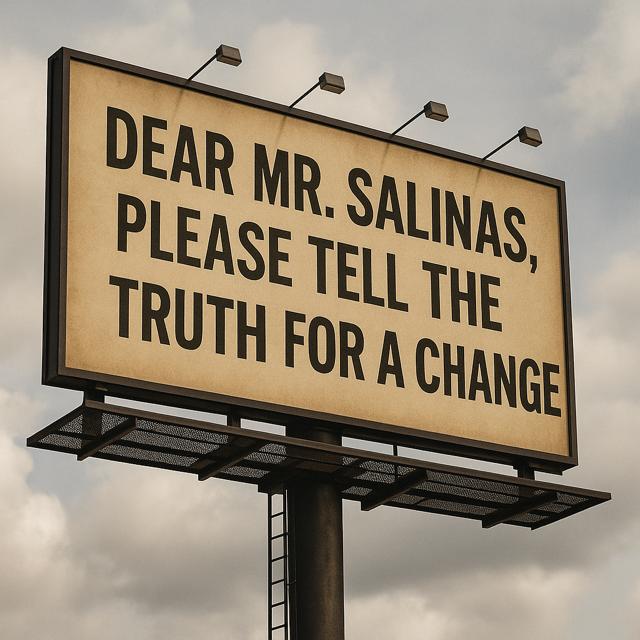

MYTH #18: Lawyers representing Salinas have always told the truth.

FACT: Unfortunately, that's not the case. Salinas lawyers have been fabricating events at the instruction of Salinas and this is true fact. The misrepresentations made by Salinas lawyers to UK court have caused us to repeatedly resort to media to deliver the truth and this is true fact.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family and I never met or spoken to Salinas. Any claim otherwise is fiction."

⸻

40-44 Floral Street

Covent Garden, London WC2E 9TB

Investigative Reporting Service

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Myth Vs Fact, In Ricardo Salinas False Narrative Of USD $110 Million Loan Drama here

News-ID: 4146795 • Views: …

More Releases from Investigative Reporting

Ricardo Salinas' Use of Black Cube to Spy on Defense Counsel Sparks Unprecedente …

London, 18 August 2025 - A widening scandal threatens to reshape UK civil litigation after it emerged that Mexican billionaire Ricardo Salinas Pliego allegedly hired Black Cube, the controversial Israeli-linked intelligence outfit, to entrap and covertly record the defense lawyer for Astor Asset Management 3 Ltd in a US $115 million loan dispute.

New complaints have now been filed with the Solicitors Regulation Authority (SRA), the Bar Standards Board (BSB), and…

Val Sklarov Sets the Record Straight on the Astor Loan with Ricardo Salinas

LONDON/NEW YORK/MEXICO CITY - Aug. 18, 2025 - - In recent weeks, Ricardo Salinas Pliego has made a series of public claims about his July 28, 2021 loan agreement with Astor Asset Management 3 Ltd ("Astor 3").

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts…

More Releases for Salina

Dunaliella Salina Market Growth Projecting a $69.60 million Valuation by 2031

Meticulous Research® has released a comprehensive analysis of the Dunaliella Salina market, forecasting a robust growth trajectory over the coming years. According to the latest report, the global Dunaliella Salina market is poised to achieve a compound annual growth rate (CAGR) of 4% from 2024 to 2031, with market revenues expected to reach $69.60 million by the end of the forecast period. In terms of volume, the market is anticipated…

Dunaliella Salina Market Growth, Size, Share, Trends, Report and Forecast 2021-2 …

The Dunaliella salina market is expected to grow at a CAGR of 4% from 2021 to 2028 to reach $122.9 million by 2028. Also, in terms of volume, the Dunaliella salina market is expected to grow at a CAGR of 3.7% from 2021 to 2028 to reach 1,691.6 tons by 2028. The growth of this market is mainly attributed to the increasing demand for natural-source beta carotene, the rising need…

Diverter Valves Market - A Comprehensive Study by Leading Key Players: Salina Vo …

Latest Study on Industrial Growth of Worldwide Diverter Valves Market 2024-2030. A detailed study accumulated to offer the Latest insights about acute features of the Worldwide Diverter Valves market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future…

Dunaliella Salina Market to Reach $122.9 Million by 2028

The Dunaliella Salina Market is expected to reach $122.9 million by 2028, at a CAGR of 4% during the forecast period 2021 to 2028. Also, in terms of volume, the Dunaliella salina market is expected to record a CAGR of 3.7% from 2021 to 2028 to reach 1,691.62 tons by 2028. The increasing demand for naturally sourced beta carotene, the rising need for natural colorants, and the growing use of…

Diverter Valves Market 2019 SWOT Analysis by Players: GEA, Coperion, FLSmidth, D …

QY Research Groups has announced the addition of the “Global Diverter Valves Market 2019-2025” The report focuses on global major leading industry players with information such as company profiles, product picture and specification.

The global Diverter Valves market is valued at 170 million US$ in 2017 and will reach 240 million US$ by the end of 2025, growing at a CAGR of 4.6% during 2018-2025.

This report studies the Diverter Valves market,…

Global Dunaliella Salina Market 2017 : NutriMed Group, Evolutionary Health, Gong …

Global Dunaliella Salina market competition by top manufacturers, with production, price, revenue (value) and market share for each manufacturer; the top players including

NutriMed Group

Evolutionary Health

Gong BIH

Plankton Australia Pty Ltd

Nutra-Kol

Parry bio

The survey report by Market Research Store is an overview of the global Dunaliella Salina market. It covers all the recent trends including key developments in the global market in present and in future. Analyses of the global Dunaliella Salina market…