Press release

2025 Merchant Acquiring Market Outlook: Key Indicators Shaping Growth Through 2034

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts._x000D__x000D_

What Will the Merchant Acquiring Industry Market Size Be by 2025?_x000D_

In recent times, the merchant acquiring market has experienced significant growth. The market value is predicted to rise from $25.43 billion in 2024 to $28.2 billion in 2025, constituting a compound annual growth rate (CAGR) of 10.9%. This substantial growth during the historic period is primarily due to the surge in demand for cross-border e-commerce, expansion of peer-to-peer (p2p) payment systems, advancement of digital banking and fintech innovations, growth in e-commerce sector, and the escalating demand for cash alternatives._x000D_

_x000D_

What's the Long-Term Growth Forecast for the Merchant Acquiring Market Size Through 2029?_x000D_

There is anticipated to be a significant expansion in the merchant acquiring market in the coming years, projected to increase to $42.16 billion by 2029, reflecting a compound annual growth rate (CAGR) of 10.6%. Several factors are influencing this expected growth in the upcoming period, including the rise in smartphone usage and mobile payments, the spread of contactless payment methods, growing demand for digital transactions, an increased requirement for secure and s*cam-proof payment systems, and a surge in investment in payment technology. Key trends anticipated within this period encompass technological progress, the incorporation of artificial intelligence, subscription-oriented models, digital currencies, and contactless wearable devices._x000D_

_x000D_

View the full report here: _x000D_

https://www.thebusinessresearchcompany.com/report/merchant-acquiring-global-market-report_x000D_

_x000D_

What Are the Key Growth Drivers Fueling the Merchant Acquiring Market Expansion?_x000D_

The surge in digital payments is projected to boost the expansion of merchant acquiring in the future. Digital payments involve the electronic exchange of funds between one entity and another utilizing digital technology, eliminating the need for tangible cash or checks. The escalating demand for digital payments results from factors such as e-commerce growth, the advent of contactless payment methods, and ubiquitous internet connectivity. Implementing digital payments in merchant acquiring streamlines the transaction process, minimizes cash keeping, and improves payment security, thereby enhancing business efficiency. For example, in September 2023, the Consumer Financial Protection Bureau, a government agency in the US, reported that American shoppers used Google Pay (a mobile payment service developed by Google, aimed at enabling in-app, online, and in-person contactless purchases through mobile gadgets) to shell out $65.2 billion in retail outlets in 2022, a jump from $24.8 billion the previous year. As such, the surge in demand for digital payments is propelling the merchant acquiring market's growth._x000D_

_x000D_

Get your free sample here:_x000D_

https://www.thebusinessresearchcompany.com/sample.aspx?id=19582&type=smp_x000D_

_x000D_

What Are the Key Trends Driving Merchant Acquiring Market Growth?_x000D_

Leading businesses in the merchant acquiring market are concentrating on developing strategic partnerships to obtain a superior market position. This approach typically involves alliances between financial institutions, payment processors, and tech service providers aiming to strengthen payment solutions and broaden their market presence. For example, in July 2024, a notable collaboration took place between Shift4 Payments, Inc., an American payment processing firm, and Phos, a software company based in Bulgaria. The central objective was to fortify Phos' acquiring abilities and accelerate the usage of its SoftPOS solution among European merchant customers. Thanks to this partnership, Phos clients can now leverage Shift4's global acquiring and payment processing services, giving them the ability to accept payments via global card networks and digital wallets._x000D_

_x000D_

How Is the Merchant Acquiring Market Segmented?_x000D_

The merchant acquiringmarket covered in this report is segmented - _x000D_

_x000D_

1) By Type: Digital Commerce, Traditional Commerce_x000D_

2) By Payment Method: Visa, Mastercard, American Express, Discover, Japan Credit Bureau, Local Card Networks, Alternative Payment Models _x000D_

3) By Sales Channel: Direct Channel, Distribution Channel_x000D_

4) By Application: Small And Medium Enterprises, Large Enterprises, Other Applications_x000D_

_x000D_

Subsegments:_x000D_

1) By Digital Commerce: E-commerce Payment Gateways, Mobile Payment Solutions, Online Point-of-Sale (POS) Systems, Digital Wallet and NFC Payments, Subscription-Based Payment Solutions, Peer-to-Peer (P2P) Payment Platforms _x000D_

2) By Traditional Commerce: In-Store POS Systems, Card-Not-Present (CNP) Transactions, Retail Payment Solutions, Contactless Payment Solutions, Terminal-Based Payment Systems, Multi-Channel Payment Processing_x000D_

_x000D_

Tailor your insights and customize the full report here:_x000D_

https://www.thebusinessresearchcompany.com/customise?id=19582&type=smp_x000D_

_x000D_

Which Companies Are Leading the Charge in Merchant Acquiring Market Innovation?_x000D_

Major companies operating in the merchant acquiring market are Commercial and Industrial Bank of China, JPMorgan Chase & Co., Bank of America Merchant Services, Citi Merchant Services, American Express Company, ING Group N.V., Banco Bilbao Vizcaya Argentaria S.A., Fiserv Inc., Fidelity National Information Services Inc., Global Payments Inc., Sberbank, The Royal Bank of Scotland plc, Shift4 Payments Inc., Worldpay Group plc, Heartland Payment Systems Inc., Adyen N.V., Paysafe Group, Elavon Inc., Crédit Agricole S.A., Zettle by PayPal, Chase Paymentech Solutions LLC, PayCommerce Inc. _x000D_

_x000D_

Which Regions Are Leading the Global Merchant Acquiring Market in Revenue?_x000D_

North America was the largest region in the merchant acquiring market in 2024. The regions covered in the merchant acquiring market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa._x000D_

_x000D_

Purchase the full report today:_x000D_

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19582_x000D_

_x000D_

"This Report Supports:_x000D_

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions._x000D_

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning._x000D_

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks._x000D_

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work."

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2025 Merchant Acquiring Market Outlook: Key Indicators Shaping Growth Through 2034 here

News-ID: 4146712 • Views: …

More Releases from The Business Research Company

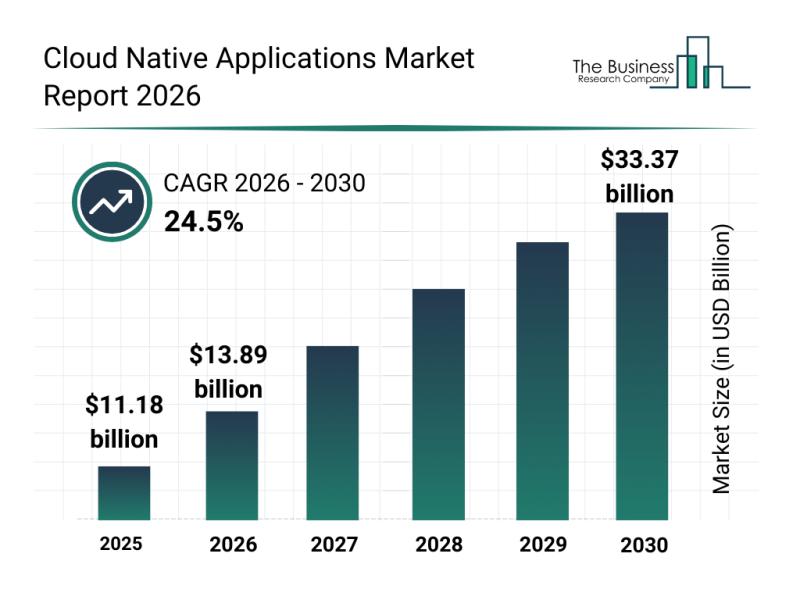

Analysis of Segments and Major Growth Areas in the Cloud Native Applications Mar …

The cloud native applications market is on track for significant expansion as businesses increasingly adopt cloud-first strategies and seek agility in software development. This sector is rapidly evolving with innovations that enable faster delivery, improved security, and seamless management of applications across diverse cloud environments. Let's explore the market's size projections, key players, trends driving growth, and important segmentations shaping its future.

Projected Size and Growth Trajectory of the Cloud Native…

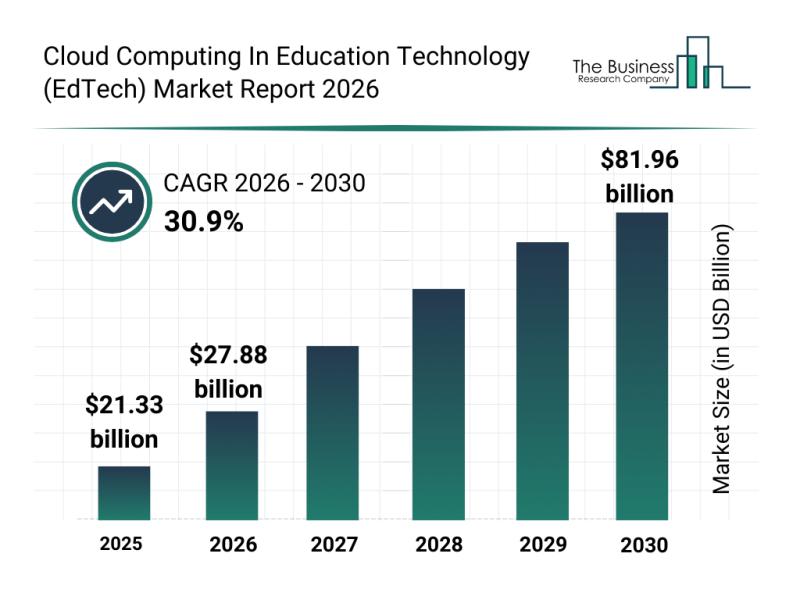

Key Strategic Developments and Emerging Changes Shaping the Cloud Computing Land …

The education technology sector is undergoing a remarkable transformation, largely fueled by the rapid adoption of cloud computing. As institutions embrace digital solutions, the integration of cloud-based tools is reshaping teaching and learning methods. This evolution promises significant market growth and new opportunities through 2030.

Cloud Computing in Education Technology Market Size and Growth Outlook

The cloud computing segment within education technology is projected to experience explosive growth, reaching a…

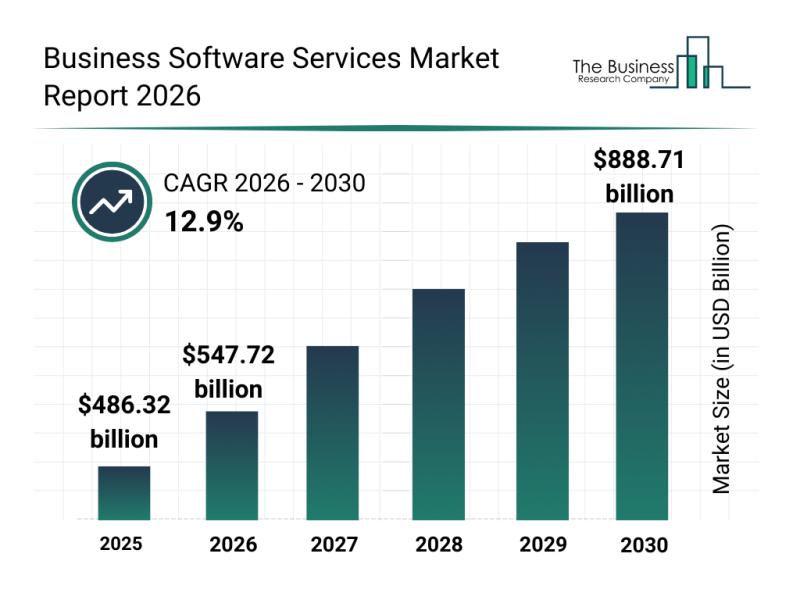

Leading Companies Fueling Growth and Innovation in the Business Software Service …

The business software services sector is on track for remarkable expansion as technological advancements and evolving enterprise needs drive demand. With innovations reshaping how companies operate, this market promises substantial growth and transformation by the end of the decade. Let's explore its current size, key players, emerging trends, and important market segments to understand where this industry is headed.

Projected Market Size and Growth Drivers in Business Software Services

The…

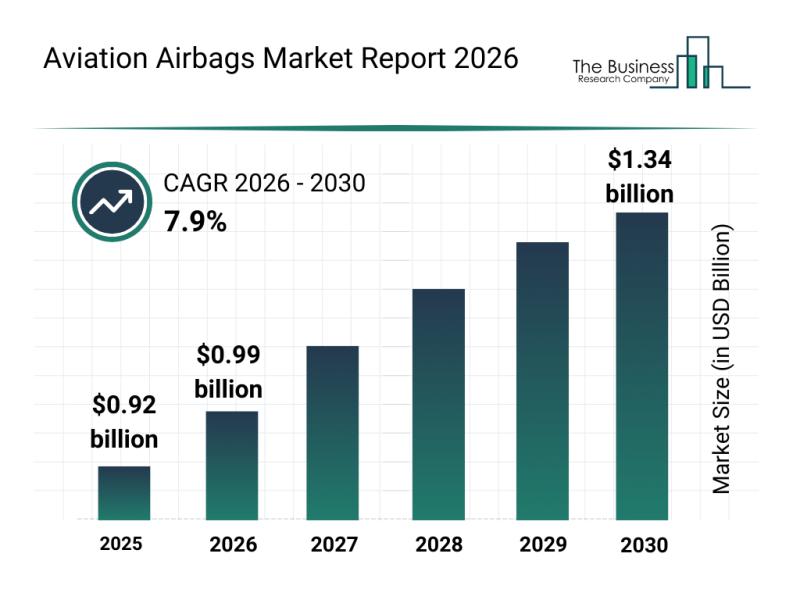

Aviation Airbags Market Overview: Major Segments, Strategic Developments, and Le …

The aviation airbags market is positioned for significant expansion as safety regulations tighten and air travel continues to increase globally. Innovations and evolving demands within the aviation sector are driving the development of advanced airbag technologies designed to improve passenger safety and aircraft integrity. Let's explore the market size projections, leading players, emerging trends, and detailed segment classifications shaping this industry's future.

Projected Growth and Market Size of the Aviation Airbags…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…