Press release

Orta Asya Investment Holding Releases Strategic Update Following $6.2 Billion Hydropower Agreement with Kyrgyz Republic

Image: https://www.globalnewslines.com/uploads/2025/08/1755183504.jpgChairman of the Board of Directors of Orta Asya Investment Holding (Left) and Minister of Energy of the Kyrgyz Republic (Right)

The Update Highlights Alignment with EU Taxonomy and Global Green Investment Goals

Istanbul/Bishkek - Following the public announcement made on August 11, 2025 by Ihlas Holding regarding two major Investment Agreements signed between Orta Asya Investment Holding and the Government of the Kyrgyz Republic, Orta Asya today issued a strategic update detailing the international relevance and long-term sustainability vision of the landmark hydropower initiative.

The agreements, which encompass the development of six utility-scale hydropower plants across two distinct cascades totaling 2,217 MW in installed capacity, mark one of the most signiicant private-sector energy investments in the region's history, with a total capex of approximately USD 6.3 billion.

In a statement released today, Orta Asya Investment Holding emphasized the project's alignment with the EU Taxonomy for sustainable activities, underlining its eligibility for future green inancing mechanisms and international partnerships.

It is accentuated that the investment is not only seen as the implementation of an infrastructure project, but as a major step toward enabling Central Asia's clean energy transition in line with global sustainability frameworks. The investments are rather construed as a "transformative initiative", in close collaboration with the Kyrgyz government, with a commitment to transparency, international best practices and long-term impact.

Strategic Framework and Green Investment Relevance

Structured under long-term 20-year Power Purchase Agreements (PPAs) with full sovereign guarantees and backed by comprehensive iscal incentives, the projects have been officially recognized by the Kyrgyz Republic as "National Investment Projects", underscoring their critical role in advancing energy security, climate resilience and inclusive economic growth.

Both hydropower clusters are designed in full alignment with the EU Taxonomy, contributing directly to SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action). Once operational, the projects are expected to generate over 9 billion kWh annually, displacing an estimated 5.2 million tons of CO2 equivalent emissions per year compared to coal-based generation alternatives.

In addition to stabilizing regional power grids, the hydropower assets will serve as key enablers of cross-border energy cooperation and support the objectives of the EU-Central Asia Global Gateway Strategy, which emphasizes green investment and resilient infrastructure across the region.

Institutional Oversight and Project Management

To ensure disciplined execution, transparency and adherence to international standards from the outset, Orta Asya Investment Holding has appointed Hill International as the independent Project Management Ofice (PMO) for both hydropower cascades.

This early engagement reflects Orta Asya's commitment to institutional-grade governance, with clearly deined oversight structures and quality assurance protocols embedded throughout the project lifecycle. As a globally recognized infrastructure consultancy, Hill International supports the implementation process through integrated planning, performance monitoring and risk management systems, helping to safeguard delivery targets and investor conidence.

Project Breakdown

- Kazarman Hydropower Cascade (Jalal-Abad Region) - 912 MW

- 3 plants: Alabuga (600 MW), Karabulun-1 (149 MW), Karabulun-2 (163 MW)

- Estimated capex: USD 3.0 billion

- 20-year PPA with JSC "National Electric Grid of Kyrgyzstan" (NESK)

- Sovereign guarantees, tax exemptions, and structured IP handover at end of term

- Construction timeline: 6 years post-feasibility

- Kokomeren Hydropower Cascade (Chuy & Naryn Regions) - 1,305 MW

- 3 plants: Karakol (33 MW), Kokomeren-1 (360 MW), Kokomeren-2 (912 MW)

- Estimated capex: USD 3.265 billion

- 20-year PPA with NESK; state-backed offtake guarantee

- Investor protection clauses, arbitration under SIAC, legal framework aligned with Kyrgyz law

- Construction timeline: 6 years post-feasibility

Platform for Institutional Partnerships and Climate Finance

Feasibility studies for both project clusters have already been commenced. As this work progresses, Orta Asya Investment Holding will initiate formal engagement with International Financial Institutions (IFIs) and Development Finance Institutions (DFIs) to explore strategic inancing collaborations.

Parallel outreach to ESG-aligned institutional investors, Export Credit Agencies (ECAs) and Tier-1 EPC contractors and turbine manufacturers is also underway, with the goal of securing partnerships that reflect the project's long-term vision and sustainability goals.

Key project de-risking elements include:

- 20-year sovereign-backed offtake agreements

- Five-year tax exemptions (corporate income tax, import VAT, customs duties)

- International arbitration provisions (SIAC)

- Commitment to local beneits, including 1% free electricity allocation to communities and targeted social investments

About Orta Asya Investment Holding

Orta Asya Investment Holding is a Central Asia-focused energy and infrastructure platform, developing sustainable, high-impact projects in partnership with host governments, multilateral institutions and private-sector investors. The Holding is backed by leading shareholders including Ihlas Holding; and is committed to delivering climate-resilient, economically viable infrastructure across emerging markets.

Contact for Media and Investment Inquiries

Media & Investor Relations Abdullah Tugcu

Member of Board

Orta Asya Investment Holding

abdullah.tugcu@ihlas.com.tr [mailto:abdullah.tugcu@ihlas.com.tr]

+90 212 454 2422

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: Orta Asya Investment Holding

Contact Person: Abdullah Tugcu

Email: Send Email [http://www.universalpressrelease.com/?pr=orta-asya-investment-holding-releases-strategic-update-following-62-billion-hydropower-agreement-with-kyrgyz-republic]

Country: Turkey

Website: https://ortaasyainvest.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. GetNews makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Orta Asya Investment Holding Releases Strategic Update Following $6.2 Billion Hydropower Agreement with Kyrgyz Republic here

News-ID: 4146624 • Views: …

More Releases from Getnews

Two Powerful Works Illuminate Injustice Redemption and the Unseen Wounds of Urba …

Image: https://www.aionewswire.com/storage/images/ckeditor//81rGKMxE4aL._SL1500__1771341922.jpg

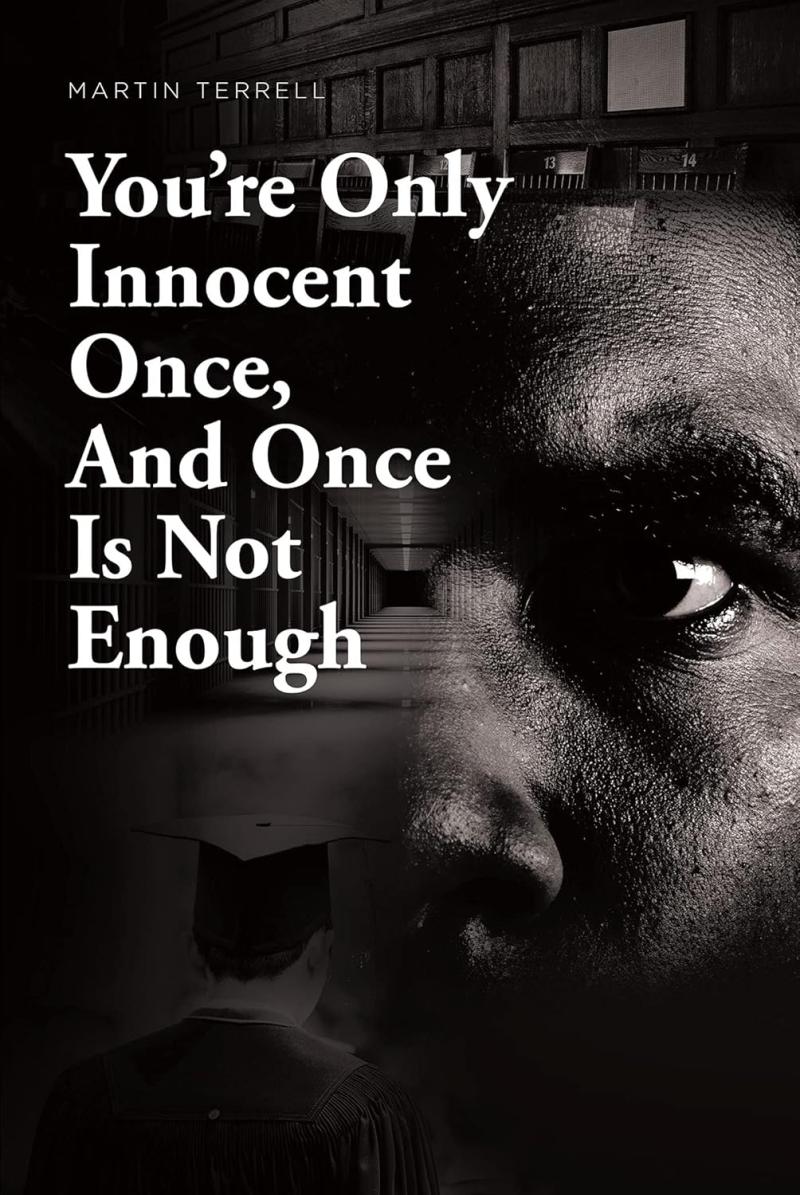

Two compelling literary works, You Are Only Innocent Once, and Once Is Not Enough [https://www.amazon.com/Youre-Only-Innocent-Once-Enough-ebook/dp/B09CG1BW43/ref] and Unseen Scars [https://www.amazon.com/Unseen-Scars-Martin-Terrell/dp/B0D9QKJ434/ref], offer unflinching examinations of injustice, resilience, and the lasting impact of systemic inequality in America. Together, these books provide timely and deeply human narratives that resonate amid ongoing conversations about criminal justice reform, racial bias, and personal redemption.

You Are Only Innocent Once, and Once Is Not Enough chronicles the extraordinary…

Apple Roofing Dallas Recognized for Top-Rated Roof Leak Repair Services in North …

Image: https://www.globalnewslines.com/uploads/2026/02/1771352421.jpg

Dallas, TX - February 17, 2026 - Apple Roofing Dallas [https://appleroof.com/dallas/], a leading provider of roofing services in the Dallas-Fort Worth area, has been recognized for delivering top-rated roof leak repair solutions backed by strong customer reviews and consistent quality workmanship. With hundreds of satisfied clients and an A+ rating from the Better Business Bureau, the company has cemented its reputation as one of the most trusted roofing contractors…

Top-Rated Laredo ATV Accident Lawyer Eric Ramos Law, PLLC Advocates for Victims …

Image: https://www.globalnewslines.com/uploads/2026/02/1771336564.jpg

Laredo, TX - February 17, 2026 - Eric Ramos Law, PLLC, of Laredo [https://ericramoslaw.com/laredo-personal-injury-lawyer/], a respected personal injury law firm serving South Texas, continues to strengthen its reputation as a top-rated ATV accident lawyer, providing aggressive legal representation to victims injured in serious off-road and rollover crashes. As ATV usage increases across ranches, rural properties, and recreational trails in the region, the firm is seeing a growing number of…

Pet Center, Inc. Highlights Key Dog Treat & Pet Health Trends - Tips for Dog Own …

Image: https://www.globalnewslines.com/uploads/2026/02/1771365671.jpg

Pet Center, Inc. Los Angeles, California

Pet Center, Inc., a Los Angeles-based dog treat manufacturer, urges pet parents to prioritize quality nutrition and responsible choices to support canine health and well-being.

Pet Center, Inc., a longtime leader in high-quality dog treats, today released a summary of major trends shaping how people feed and care for their dogs, interpreting what these developments mean for everyday pet owners - and offering practical actions…

More Releases for Investment

ST Investment Co., Ltd: Pioneering the Global Investment Trend

Since its establishment in 2017 in the United Kingdom, ST Investment Co., Ltd has rapidly emerged as a shining star in the global investment sector. Through its diversified business portfolio and exceptional financial services, the company provides a comprehensive wealth growth platform for clients worldwide. Its services span key sectors such as artificial intelligence-based smart contracts, private equity, gold investments, and wealth management, all aimed at delivering stable and diverse…

Lakshmishree Investment: Common Investment Mistakes When Markets Are High

One big mistake many investors make is taking too much risk because they fear missing out.

Stock markets around the world are on fire! From the bustling streets of Wall Street to the vibrant Bombay Stock Exchange (BSE), markets are scaling new highs, leaving many investors excited and bewildered. While this bull run is thrilling, it can also be confusing. Should you jump in and buy more? Hold on tight…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

China Investment Bank, China Investment Consultant, China Investment Corporation …

Pandacu is a company that specializes in cross-border investment in China. The company was founded in china and has since grown to become one of the leading cross-border investment firms in China. Pandacu offers a wide range of services to its clients, including investment advisory, market research, due diligence, and post-investment support.

http://pandacuads.com/

Investment banking consultant

Email:nolan@pandacuads.com

Cross-border investment in China can be a complex and challenging process, as the country has a unique…

Trident Steels - Investment Casting, Stainless Steel Investment Casting, Steel I …

With decades of experience in this industry, we have become the preferred partner for global companies who look for high-end metal casting manufacturing from India. Our investment casting company in India offers best-in-class quality products and services to our customers. We are a customer-centric company and invest in our people, processes, and technology to provide high-quality products every time. This has helped us to become the preferred partner for companies…

Investment Management Market Growth Improvement Highly Witness | NWQ Investment …

Investment management is designed to help investors or owners to recognize, manage, and communicate the performance and risks of assets and related investments. As an alternative to spending time pursuing data and manually creating reports, fund managers, owners, and operators can focus on maximizing performance.

Investment Management market size is expected to grow at a compound annual growth rate of xx% for the forecast period of 2021 to 2028.

Market IntelliX report…