Press release

How to Spend Less and Save More in 2025

Saving money in 2025 isn't just a smart habit - it's essential. With economic uncertainty, fluctuating prices, and daily costs continuing to stretch household budgets, Americans are seeking more efficient, trustworthy, and convenient ways to make every dollar go further.From smarter shopping habits to digital tools that work behind the scenes, this year offers more ways than ever to take control of your personal finances. Whether you're managing a family, living solo, or just trying to stretch your paycheck, here are the most effective and realistic money-saving strategies for 2025.

Image: https://www.abnewswire.com/upload/2025/08/440d703980e61d0ac86b62852b1d68d2.jpg

1. Start Every Purchase with a Discount Search

One of the fastest ways to cut your spending is by using online coupon platforms - especially when shopping online. Thousands of retailers offer promo codes and limited-time offers, but most consumers don't have the time to search for them manually.

That's where a centralized and reliable discount hub becomes invaluable. A platform like Valuecom [https://www.valuecom.com/] helps users find updated promo codes, seasonal deals, and brand discounts across a wide range of categories - from fashion and tech to groceries and home goods - all without browser extensions or downloads.

In 2025, smart consumers start their shopping journey with coupon research. Even a quick two-minute check before checkout can result in substantial savings.

2. Plan Purchases Around Seasonal Discounts

Every major shopping category has a seasonal cycle. For example:

* January-February: fitness gear, winter clothing

* April-June: home improvement items, outdoor furniture

* August-September: back-to-school essentials

* November-December: holiday gift bundles

By timing big purchases with these seasonal windows - and pairing them with coupon platforms like Valuecom - you can avoid paying full price when demand is highest.

3. Set a Weekly Spending Limit

Budgeting doesn't have to be tied to complicated spreadsheets or monthly summaries. Many people find success by setting weekly spending caps for categories like food, entertainment, transportation, and impulse buys.

For example, giving yourself $100 a week for groceries and tracking it closely makes it easier to stay within budget. Use free mobile note apps or even physical envelopes - whatever keeps you mindful while spending.

4. Cook at Home (The Efficient Way)

One of the biggest hidden expenses is food delivery and takeout, which often costs 2-3x more than a home-cooked meal.

This doesn't mean cooking every night - just being intentional helps:

* Batch-cook and freeze leftovers.

* Prepare quick "assembly meals" like wraps or salads.

* Create a grocery list based on pantry inventory and stick to it.

Impulse shopping at the supermarket is a sneaky money trap, so plan before you shop.

5. Cut Unused Subscriptions

Streaming platforms, fitness apps, and newsletters can quietly eat into your budget. Take time once a month to review subscriptions and ask:

* Do I use this often?

* Can I find a free alternative?

* Can I share this plan legally with someone else?

The average American can save $20-$50 per month by trimming unnecessary subscriptions.

6. Automate Your Savings

While automatic bill payments are common, don't forget to automate savings too. Many banks let you schedule small transfers - even $10-$25 - to savings each week.

Automated savings work quietly in the background, making it easier to build an emergency fund, a vacation budget, or holiday reserves.

7. Buy Secondhand or Trade Locally

Buying new isn't always necessary. Gently used clothing, furniture, and electronics can be found at thrift shops, yard sales, or community trading groups.

With environmental concerns rising, many Americans are buying less but better - and secondhand goods often cost a fraction of retail prices. Check local community boards or online neighborhood groups before making large purchases.

8. Shop with Intention

Impulse buying is a major budget breaker. In 2025, personalized ads and "limited time offers" are more convincing than ever.

Before clicking "add to cart," ask yourself:

* Do I need this now?

* Can I wait 48 hours?

* Is this the best price?

Pair intentional thinking with a visit to Valuecom for maximum savings.

9. Be Energy-Aware at Home

Even small energy-conscious habits can lead to long-term savings:

* Switch to LED lighting.

* Unplug idle electronics.

* Wash clothes in cold water.

* Run the dishwasher only when full.

Check with your utility provider for rebates on smart thermostats or efficient appliances - many states still offer incentives in 2025.

10. Focus on Small Wins That Add Up

It's easy to assume only big changes - like refinancing - matter, but small consistent actions add up. Saving $5-$10 here and there can mean hundreds or thousands saved in a year.

Every discount code, every avoided fee, and every dollar saved on groceries contributes to long-term financial health.

Final Thoughts

2025 presents both challenges and opportunities for personal finance. While prices may remain high in certain areas, the tools available to consumers are smarter and more accessible than ever.

Shift from "saving when convenient" to "saving by default" and you'll not only take control of your money but also reduce financial stress. Start by bookmarking a reliable savings hub like Valuecom [https://www.valuecom.com/] - that one step can spark a year of smarter spending.

Media Contact

Company Name: Valuecom

Contact Person: Media Relations

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=how-to-spend-less-and-save-more-in-2025]

Country: United States

Website: https://www.valuecom.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How to Spend Less and Save More in 2025 here

News-ID: 4146087 • Views: …

More Releases from ABNewswire

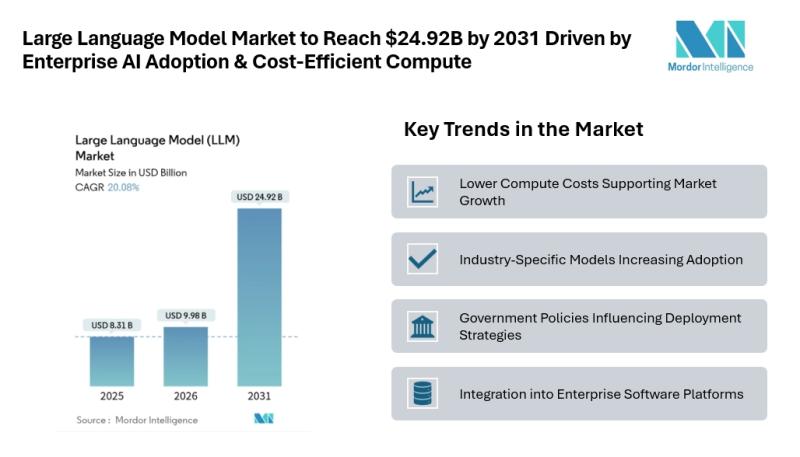

Large Language Model Market to Reach $24.92B by 2031 Driven by Enterprise AI Ado …

Mordor Intelligence has published a new report on the large language model market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Large Language Model Market Outlook

According to Mordor Intelligence, the LLM market size [https://www.mordorintelligence.com/industry-reports/large-language-model-llm-market?utm_source=abnewswire] was valued at USD 8.31 billion in 2025 and is estimated to grow to USD 9.98 billion in 2026, reaching USD 24.92 billion by 2031 at a CAGR of 20.08% during the forecast period.…

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

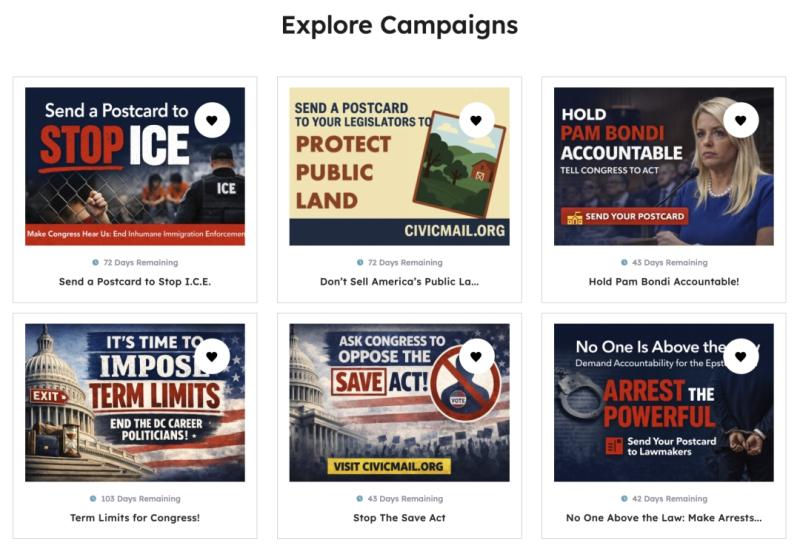

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

More Releases for Valuecom

Smart Shopping Habits That Help Consumers Save and Thrive

Image: https://lh7-rt.googleusercontent.com/docsz/AD_4nXfUUPVbvtixosaKNDcKifSf7zbXl9Ipnyvw79BaWf7e7FZb0Nlfihs7AaTfNa6rwZos2N3jTwmymbIJqw7n8oNhfNMT7-9l8da2cpujSKx4rCxrfDmWLgg8T87HuUoXtSvQRneM2Q?key=cqmkLqcN17xO-TLzLdQflQ

Modern consumers are navigating a world filled with endless shopping choices, from in-store promotions to e-commerce flash sales and app-exclusive deals. Retailers constantly compete for attention, and the average buyer has more options than ever before. But with this abundance comes a challenge-how can shoppers make the most of their budgets without sacrificing quality or missing out on great opportunities?

The answer lies in cultivating smart shopping habits that combine…

Christianbook Reinforces the Enduring Value of Christian Literature in Today's D …

In an era where fast content, viral trends, and algorithm-driven recommendations dominate much of what we consume, the quiet and steady growth of faith-based reading might seem surprising to some. Yet, across North America and beyond, spiritual literature-ranging from classic theological texts to modern devotionals-continues to attract dedicated readers from all walks of life.

At a time when many are overwhelmed by digital noise, more individuals are turning toward books that…