Press release

Singapore's New Friend in the Block Redefines Venture Capital

Valven Studio is a Singaporebased venture studio redefining VC. Instead of making many bets, it invests in a few highconviction startups and embeds its partners in the team. A rigorous threestage diligence and scorecard choose founders; then playbooks for product or distribution guide growth. Matthew Chew, Michel Padron and Juan Roldan provide handson product, growth and tech expertise to help founders go from 0.5 to 1.Singapore - 13 August, 2025 - Valven Studio, a venture studio headquartered in Singapore, announces its arrival as a new alternative to venture capital. Born from the frustrations of the traditional VC model-where more than 75 % of VCbacked startups never return capital and founders are often left without operational support (1) [https://valvenstudio.com/posts/venture-studio-early-stage-startup-support/#:~:text=Why%20Traditional%20VC%20Is%20Failing,Modern%20Startups] - Valven offers a founderfriendly partnership that blends capital with handson execution.

"We're not here to spray and pray; we're here to build," said Matthew Chew, General Partner and Product Visionary. "Our approach embeds experienced operators directly into the startup team to turn data into decisive action and tackle overlooked problems."

Beyond VC: How the Model Works

Valven's model starts with a structured diligence process to evaluate potential partners. The three stages include:

*

Founder & Vision Interview - an assessment of character, resilience and coachability (2) [https://valvenstudio.com/posts/selection-process/screening/#:~:text=The%20first%20stage%20of%20Valven%E2%80%99s,vision%2C%20and%20most%20importantly%2C%20coachability]. Valven looks for founders who combine clear vision with intellectual humility and openness to strategic feedback.

*

Business & GTM Deep Dive - pressuretesting the business model, unit economics and gotomarket strategy. The team assesses revenue streams, pricing, distribution engine and the founder's ability to acquire customers.

*

Product & Tech Deep Dive - a comprehensive review of the product's current state, architecture and scalability. Valven classifies the technical maturity as build, scale or rebuild, evaluating code quality, infrastructure and security.

Findings from the diligence process feed into the Valven Scorecard, which quantifies factors such as founder excellence, business model maturity, distribution readiness and technical foundation (3) [https://valvenstudio.com/posts/onboarding/partnership-foundation/#:~:text=Step%201%3A%20The%20Valven%20Scorecard]. Opportunities with strong scores move forward into one of two operational playbooks:

*

Playbook A - Strong Product, Weak Distribution. For startups with validated products but limited customer acquisition, Valven's Growth Partner leads the development of a scalable distribution engine, from founderled content strategies to paid growth campaigns. The Technical Partner ensures the product infrastructure can support rapid growth.

*

Playbook B - Strong Distribution, Weak Product. For ventures with proven customer acquisition but technical gaps, Valven's Technical Partner acts as interim head of engineering, defines the roadmap, builds the team and upgrades the product, while the Growth Partner optimizes revenue from existing channels.

Unlike typical VCs that make dozens of bets and hope a few hit, Valven invests in fewer ventures and commits deeply. Venture studios worldwide show that studiobacked companies have about 30 % higher success rates than typical VCbacked startups, with average IRRs of 53-60 % versus 21-22 % for traditional funds. Valven's approach aims to replicate these outcomes in Southeast Asia.

HandsOn Partners, Not Just Investors

Valven's general partners bring complementary expertise honed through building and scaling ventures:

*

Matthew Chew - General Partner & Product Visionary. A serial founder and product strategist, Matthew believes entrepreneurship is about building tools that render old ways obsolete. He emphasizes rigorous analysis married with swift action and invites founders to harness technology to build a future that matters.

*

Michel Padron - General Partner & Growth Strategist. Michel has built, scaled and exited ventures across fintech, AI and blockchain, learning from successes and failures. As a fractional founder, he merges engineering precision with business leadership to help startups avoid common growth pitfalls. He helps founders build distribution engines and optimize customer acquisition.

*

Juan Roldan - General Partner & Technical Strategist. Fascinated by how things work since childhood, Juan approaches the CTO role as a business enabler. He ensures technology decisions support the company's vision, builds products that are both technically sound and commercially successful and thrives on bridging the gap between code and customer.

From 0 to 0.5 Is Easy - Valven Takes You from 0.5 to 1

Many accelerators and incubators help founders build a minimum viable product. Valven focuses on the messy 0.5-to-1 phase-where companies have an MVP and initial customers and need to scale quickly (4) [https://valvenstudio.com/about/#:~:text=Screening%20We%20start%20by%20screening,Learn%20more%20%E2%86%92]. By embedding its partners directly into the team, Valven provides technical leadership, gotomarket strategy and funding architecture, giving founders a cobuilder rather than just a cheque. The firm's resource deployment model emphasises deep integration and shared accountability: Valven team members work alongside founder teams, sharing both the risk and the upside.

Structured Yet Flexible Engagement

After a playbook is selected, Valven helps founders secure the capital necessary for execution. Playbook A typically requires US$50K-US$250K for marketing, growth hiring and infrastructure; Playbook B needs US$100K-US$400K to hire engineers and build a robust product (5) [https://valvenstudio.com/posts/onboarding/funding-plan/#:~:text=Capital%20Requirements%20by%20Playbook]. Funding may come from existing company capital, a bridge investment from Valven's partners or an orchestrated angel round. Before fully engaging, a fivestage engagement sequence ensures both sides are ready-covering diligence and vote, funding plan, letter of intent, capital confirmation and definitive agreements. This sequencing protects resources, validates readiness and aligns expectations.

A Catalyst for Singapore's Startup Ecosystem

Singapore has long been a hub for venture capital and innovation, yet many founders remain underserved by traditional investors. Valven Studio aims to bridge the gap between early traction and scalable success, bringing an AIenabled venture studio model that prioritizes diversity, founder empowerment and operational excellence. By investing in fewer, higherconviction bets and providing handson operators, Valven offers investors a more thorough duediligence process and founders a partner who will build alongside them. The team invites ambitious founders and forwardthinking investors to learn more and explore detailed insights in Valven's Diligence Process , Partnership Evaluation and Playbook Execution series.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: Valven Studio

Contact Person: Michel Padron

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=singapores-new-friend-in-the-block-redefines-venture-capital]

Country: Singapore

Website: https://valvenstudio.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Singapore's New Friend in the Block Redefines Venture Capital here

News-ID: 4144262 • Views: …

More Releases from ABNewswire

Interior Painting Services See Shift in Bonney Lake as Homeowner Preferences Lea …

Fresh Coat Painters of Bonney Lake reports increased demand for custom painting solutions as Pierce County families adapt homes for multi-generational living, requiring specialized color schemes and durable finishes.

Interior painting services [https://www.google.com/search?&oq=interior+painting+services&kgmid=/g/11xgg317nt] in Pierce County are experiencing a notable transformation as more families adapt their homes to accommodate multiple generations under one roof. Fresh Coat Painters of Bonney Lake has observed this shift firsthand, with an increasing number of homeowners…

Meridian Chiropractor Reports Surge in Same-Day Appointments for Chronic Pain Ma …

Haycock Chiropractic in Meridian reports rising demand for same-day appointments as residents prioritize immediate pain relief through accessible, whole-body treatment approaches combining adjustments and massage therapy.

A chiropractor meridian [https://www.google.com/search?&oq=chiropractor+meridian&kgmid=/g/11xklhn50] clinic is experiencing unprecedented demand as healthcare providers across the area witness a significant shift in how residents approach pain management. Haycock Chiropractic has reported a notable increase in patients seeking immediate relief through same-day appointments, reflecting broader changes in community…

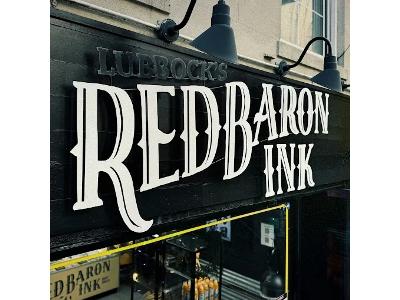

Tattoo Shops NYC: Red Baron Ink Tattoo and Piercing Marks Over a Decade of Artis …

Red Baron Ink Tattoo and Piercing celebrates over 10 years of serving NYC with custom tattoos and professional piercing from internationally trained artists in Chelsea's artistic community.

Tattoo shops NYC residents trust don't just appear overnight, they're built through years of dedication, artistry, and community connection. Red Baron Ink Tattoo and Piercing [https://www.google.com/maps/place/Red+Baron+Ink+Tattoo+and+Piercing/@40.7391273,-74.0017116,949m/data=!3m2!1e3!4b1!4m6!3m5!1s0x89c2597720e0921d:0x54e2e5139c5e3f07!8m2!3d40.7391273!4d-74.0017116!16s%2Fg%2F1hjggx1l6!5m1!1e1?entry=ttu&g_ep=EgoyMDI1MTIwOC4wIKXMDSoKLDEwMDc5MjA3MUgBUAM%3D] continues to stand as a beacon of artistic craftsmanship in New York City's Chelsea district, having served the…

Frameless Glass Fencing Dallas: Revelation Glass Pool Fences and Railings Raises …

Revelation Glass Pool Fences and Railings delivers superior pool safety solutions throughout the Dallas-Fort Worth area using premium tempered glass and expert installation, backed by comprehensive warranties.

Frameless glass fencing Dallas homeowners' trust for pool safety has become increasingly vital as drowning incidents remain a leading cause of accidental death for children across Texas. Revelation Glass Pool Fences and Railings addresses these concerns head-on by providing advanced safety solutions that don't…