Press release

Guardian Life Introduces Innovative Retirement Annuity To Enhance Financial Security Industry Trends Gaining Momentum in the Global Annuity Market

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Annuity Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

In recent times, the annuity market has witnessed significant expansion. The market is projected to increase from $6.08 billion in 2024 to $6.45 billion in 2025, with a compound annual growth rate (CAGR) of 6.2%. Factors contributing to this development over the historic period include improved life expectancy, an uptick in disposable income, heightened worries about social security insolvency, a surge in the retiree population, and an increase in the number of financial advisors.

Annuity Market Size Forecast: What's the Projected Valuation by 2029?

Expectations are high for the annuity market to experience robust expansion in the forthcoming years. Its size is projected to swell to $8.12 billion by 2029, representing a compound annual growth rate (CAGR) of 5.9%. Factors attributed to the growth expected in the forecast period include a burgeoning elderly population, the rise in the use of digital platforms, variable annuities becoming more prevalent, escalating healthcare costs impacting retirement planning, and innovation surging in annuity product offerings. Emerging trends for the forecast period consist of advancements in technology, the implementation of blockchain technology, the rise of digital annuity platforms, hybrid annuity products, and the use of robo-advisors.

View the full report here:

https://www.thebusinessresearchcompany.com/report/annuity-global-market-report

What Are the Drivers Transforming the Annuity Market?

The increasing necessity for financial cover propels the growth of the annuity market as the demand for insurance soars. The heightened awareness of financial protection and the growing uncertainties amidst life, health, property, and business risks have prompted the surge in insurance demand. Annuities serve a crucial role in insurance as they offer policyholders a secure income stream, particularly during retirement periods, thereby, ensuring their long-term financial well-being. For example, in May 2023, Allianz SE, a German financial services company, reported that the global insurance sector saw a remarkable growth rate of 7.5% in 2023, indicating the world's fastest growth phase since the Global Financial Crisis. The insurance companies worldwide amassed €6.2 trillion ($6.7 trillion) in premiums covering various segments including life at €2,620 billion ($2,835 billion), property and casualty at €2,153 billion ($2,329 billion), and health at €1,427 billion ($1,545 billion). Accordingly, the growth of the annuity market is being fueled by the escalating demand for insurance.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19290&type=smp

What Long-Term Trends Will Define the Future of the Annuity Market?

The main players in the annuity market are now concentrating on the creation of advanced offerings like long-term, tax-deferred retirement packages, to set them apart from their competitors. Such a product is essentially a financial tool tailored to aid individuals in saving and investing for retirement, effectively deferring taxes on the appreciation of their investments until they make withdrawals. These offerings are designed to grow funds over a considerable time frame, facilitating compounded growth free of immediate tax liabilities. For instance, the US-based Guardian Life Insurance Company of America introduced a novel financial offering in May 2024 known as Guardian MarketPerform - a Registered Index-Linked Annuity (RILA), aimed at enhancing individual retirement planning. This product is skillfully devised to offer a balance between growth potential and market risk protection, responding to the growing worry many Americans express about their retirement savings.

Which Segments in the Annuity Market Offer the Most Profit Potential?

The annuitymarket covered in this report is segmented -

1) By Type: Immediate Annuities, Deferred Annuities, Fixed Annuities, Variable Annuities

2) By Distribution Channel: Insurance Agencies And Brokers, Banks, Other Distribution Channels

3) By Application: Child, Adult, Elder

Subsegments:

1) By Immediate Annuities: Single Premium Immediate Annuities (SPIA), Periodic Payment Immediate Annuities, Life-Only Immediate Annuities, Joint and Survivor Immediate Annuities

2) By Deferred Annuities: Fixed Deferred Annuities, Variable Deferred Annuities, Fixed Indexed Deferred Annuities, Multi-Year Guarantee Annuities (MYGA)

3) By Fixed Annuities: Fixed-Rate Annuities, Fixed Indexed Annuities, Immediate Fixed Annuities, Deferred Fixed Annuities

4) By Variable Annuities: Variable Annuities With Equity Investment Options, Variable Annuities with Bond Investment Options, Indexed Variable Annuities, Guaranteed Minimum Withdrawal Benefit (GMWB) Variable Annuities.

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=19290&type=smp

Which Firms Dominate the Annuity Market by Market Share and Revenue in 2025?

Major companies operating in the annuity market are New York Life Insurance Company, TIAA-CREF Life Insurance Company, Massachusetts Mutual Life Insurance Company, USAA Life Insurance Company, Corbridge Financial, Lincoln National Life Insurance Company, Pacific Life Insurance Company, Jackson National Life Insurance Company, Athene Annuity and Life Company, Brighthouse Financial Inc., Western & Southern Life Assurance Company, F&G Annuities & Life Inc., Allianz Life Insurance Company of North America, ICICI Prudential Life Insurance Company Limited, Ameritas Life Insurance Corporation of New York, American National Insurance Company, Global Atlantic Financial Group, Atlantic Coast Life Insurance Company, Securian Life Insurance Company, OneAmerica Financial Partners Inc., Aspida Life Insurance Company, CL Life and Annuity Insurance Company, Clear Spring Life and Annuity Company, Nationwide Mutual Insurance Company

Which Regions Offer the Highest Growth Potential in the Annuity Market?

North America was the largest region in the annuity market in 2024. The regions covered in the annuity market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19290

"This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work."

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Guardian Life Introduces Innovative Retirement Annuity To Enhance Financial Security Industry Trends Gaining Momentum in the Global Annuity Market here

News-ID: 4143928 • Views: …

More Releases from The Business Research Company

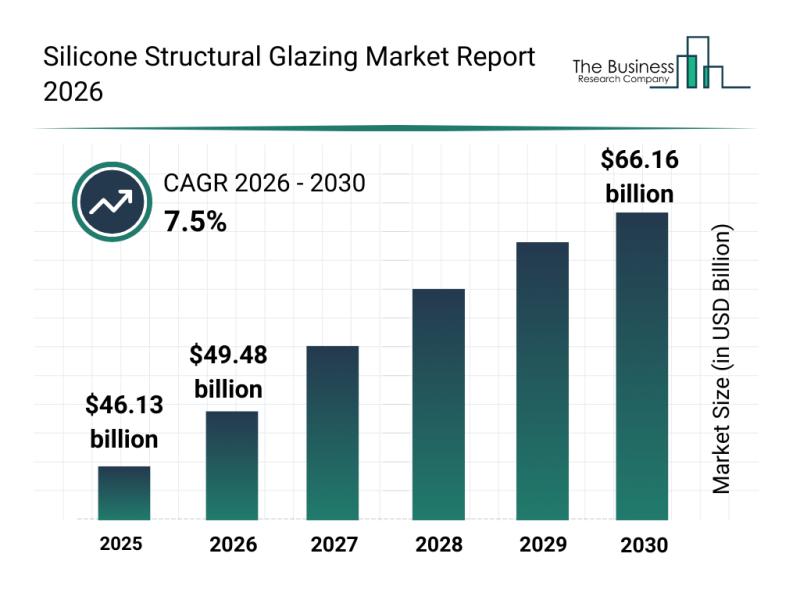

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

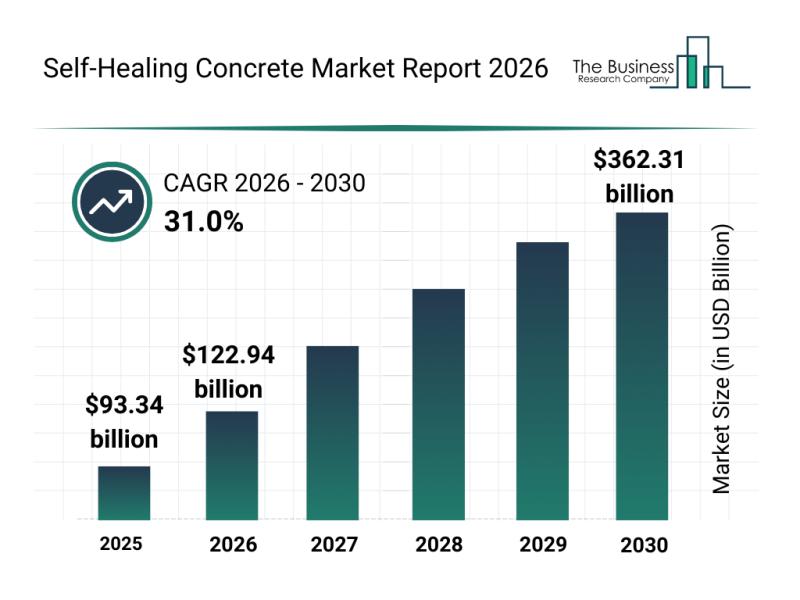

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

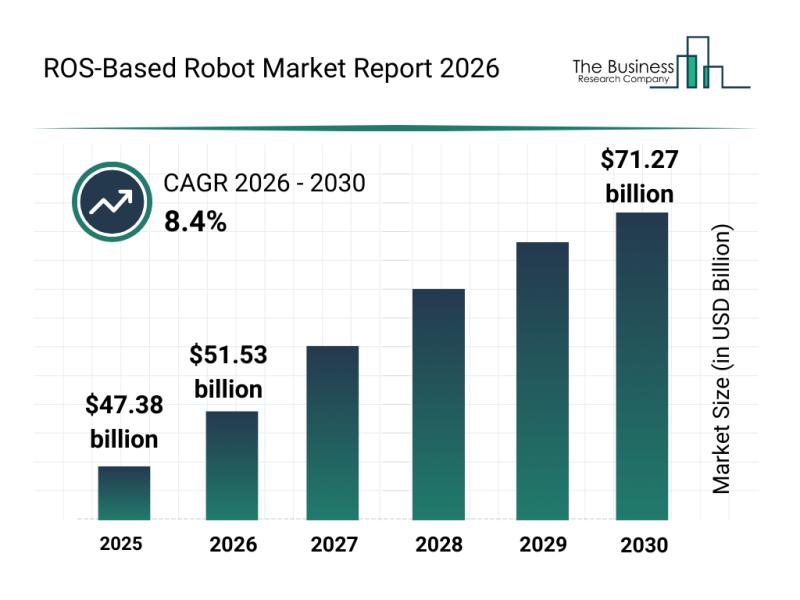

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

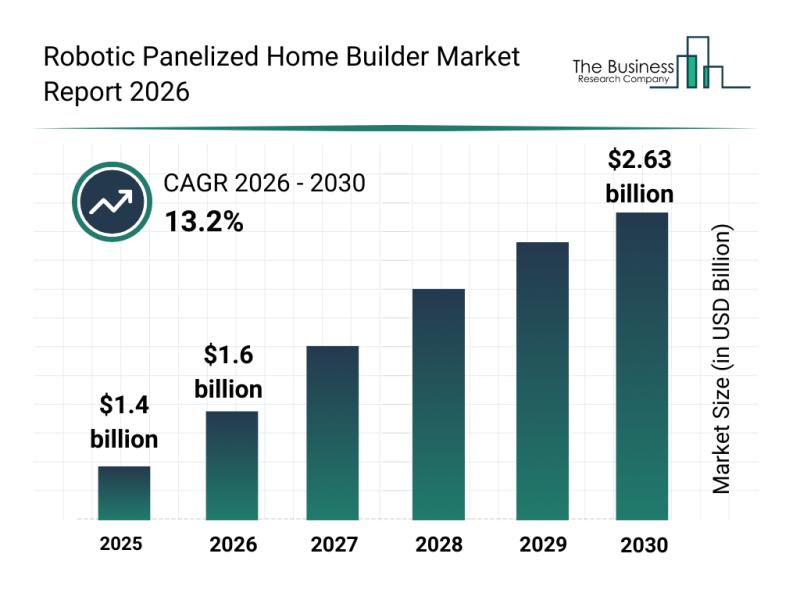

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Annuities

Cary Annuities Agents Publish 2025 Guide Comparing MYGAs & Fixed Annuities

Image: https://www.globalnewslines.com/uploads/2025/10/1759743671.jpg

Matador Insurance Services has released a new blog post to help pre-retirees in Cary, NC, and beyond understand the key differences between MYGAs and Fixed Annuities when planning for retirement.

Cary, NC - October 6, 2025 - The experienced Cary, North Carolina annuities [https://matador-insurance.com/cary-nc/annuities/] agents at Matador Insurance Services recently published a new educational blog titled MYGAs vs. Fixed Annuities [https://matador-insurance.com/blog/myga-vs-fixed-annuity-what-pre-retirees-should-know-2025/]. The 2025 guide is designed to inform pre-retirees about…

Annuities Insurance Market Boosting the Growth Worldwide | OneAmerica, Fidelity, …

Advance Market Analytics published a new research publication on "Global Annuities Insurance Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Annuities Insurance market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Annuities Insurance Market Next Big Thing | American National., Fidelity., John …

Advance Market Analytics published a new research publication on "Annuities Insurance Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Annuities Insurance market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the report, request…

Annuities Insurance Market to see Booming Business Sentiments | John Hancock Ann …

Advance Market Analytics published a new research publication on "Global Annuities Insurance Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Annuities Insurance market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Seniors With Annuities Can Benefit From Long-Term Care Insurance Planning Strate …

Millions of seniors who currently own non-qualified annuities can now benefit from a new strategy that can reduce future tax liabilities and increase benefits should long-term care be needed.

A non-qualified annuity is funded with after-tax dollars. The money used to purchase the annuity has already been taxed by the Internal Revenue Service. With non-qualified annuities, the earnings grow tax-deferred until withdrawals are made. At that time, the earnings portion of…

Annuities Insurance Market is Set To Fly High in Years to Come

Advance Market Analytics published a new research publication on "Annuities Insurance Market Insights, to 2027″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Annuities Insurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…