Press release

Mozambique Oil and Gas Market Report 2018-2032: Field-Wise Production, Refining, LNG, Pipelines, and Strategic Supply-Demand Analysis

Mozambique Oil and Gas Market to 2032: Industry Growth, Market Share, Capacity & Production Data, Competitive Landscape, and Long-

Request Free Sample:

https://www.oganalysis.com/industry-reports/mozambique-oil-and-gas-market

The country's oil and gas value chain is concentrated in the upstream and midstream sectors, with downstream activities still emerging. The upstream segment is anchored by TotalEnergies' Mozambique LNG, Eni's Coral South FLNG, and ExxonMobil's Rovuma LNG. Coral South, Africa's first floating LNG platform, was launched in late 2022, marking a milestone in monetizing offshore gas. While TotalEnergies' onshore project remains paused due to security risks, preparations for a restart are underway as conditions improve. In the midstream, LNG liquefaction facilities, subsea pipelines, and port expansions at Afungi and Pemba are key infrastructure priorities to enable exports to Asia and Europe. On the downstream side, Mozambique is promoting gas-to-power initiatives and domestic distribution networks to enhance local utilization. Planned pipelines and city gas systems aim to foster industrial growth and reduce dependence on imported fuels, paving the way for a more integrated national energy system.

Customize This Report @:

https://www.oganalysis.com/industry-reports/mozambique-oil-and-gas-market

Report Key Takeaways -

Mozambique is among Africa's most promising LNG producers, with over 100 trillion cubic feet of proven gas reserves in the Rovuma Basin positioning it as a future global LNG leader.

The market is driven by three mega-projects: TotalEnergies' Mozambique LNG (Area 1), Eni's Coral South FLNG, and ExxonMobil's Rovuma LNG, each playing a critical role in export ambitions.

Coral South FLNG began operations in late 2022, marking Africa's first floating LNG platform and a milestone in offshore gas monetization.

The planned restart of TotalEnergies' Area 1 project would add 13.1 mtpa of LNG capacity, contingent on sustained security improvements in Cabo Delgado.

Coral Norte FLNG received government approval, with FID targeted for late 2025 and first LNG expected in Q2 2028.

ExxonMobil's revised FID timeline to 2026 reflects investor caution but long-term confidence in Mozambique's LNG potential.

Security challenges remain the primary barrier to timely project execution and foreign investment inflows.

Financing for major developments is largely secured, with 70-80% of Area 1's funding confirmed, including $4.7 billion from the U.S. Ex-Im Bank.

Domestic gas-to-power and distribution initiatives are in early development to improve electricity access and reduce fuel imports.

LNG sector infrastructure includes liquefaction plants, subsea pipelines, and port facilities at Afungi and Pemba, aimed at serving Asian and European markets.

The report provides asset-by-asset coverage of all oil and gas fields, LNG terminals, pipelines, refineries, and storage facilities in Mozambique.

Historic and forecasted supply-demand trends for crude oil, natural gas, and refined products are analyzed for 2015-2032.

Market segmentation covers upstream (exploration, production), midstream (LNG, pipelines, storage), and downstream (refining, distribution).

Detailed LNG sector assessment includes capacity utilization, contracted volumes, and future expansion potential.

SWOT and benchmarking analysis identify sector strengths, challenges, opportunities, and competitive positioning.

Investment feasibility studies outline growth potential, required capital, and project viability for both ongoing and planned developments.

Competitive profiling examines the strategies, market share, and performance of leading industry players.

Infrastructure benchmarking evaluates capacity, utilization, and concentration across LNG, refining, pipeline, and storage assets.

The analysis addresses key market questions, including Mozambique's evolving role in the global LNG trade and the timeline for realizing its export-led economic transformation.

Related Reports:

https://www.oganalysis.com/industry-reports/tanzania-oil-and-gas-market

https://www.oganalysis.com/industry-reports/south-africa-oil-and-gas-market

https://www.oganalysis.com/industry-reports/angola-oil-and-gas-market

https://www.oganalysis.com/industry-reports/nigeria-oil-and-gas-market

Contact Us:

John Wilson

Phone: 88864 99099

Email: sales@oganalysis.com

Website: https://www.oganalysis.com

Follow Us on LinkedIn: linkedin.com/company/og-analysis/

OG Analysis

1500 Corporate Circle, Suite # 12, Southlake, TX-76377

About OG Analysis:

OG Analysis has been a trusted research partner for 14+ years delivering most reliable analysis, information and innovative solutions. OG Analysis is one of the leading players in market research industry serving 980+ companies across multiple industry verticals. Our core client centric approach comprehends client requirements and provides actionable insights that enable users to take informed decisions.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mozambique Oil and Gas Market Report 2018-2032: Field-Wise Production, Refining, LNG, Pipelines, and Strategic Supply-Demand Analysis here

News-ID: 4143653 • Views: …

More Releases from OG Analysis

Global glucuronolactone-market Report Insights and Growth Outlook to 2034 - Stra …

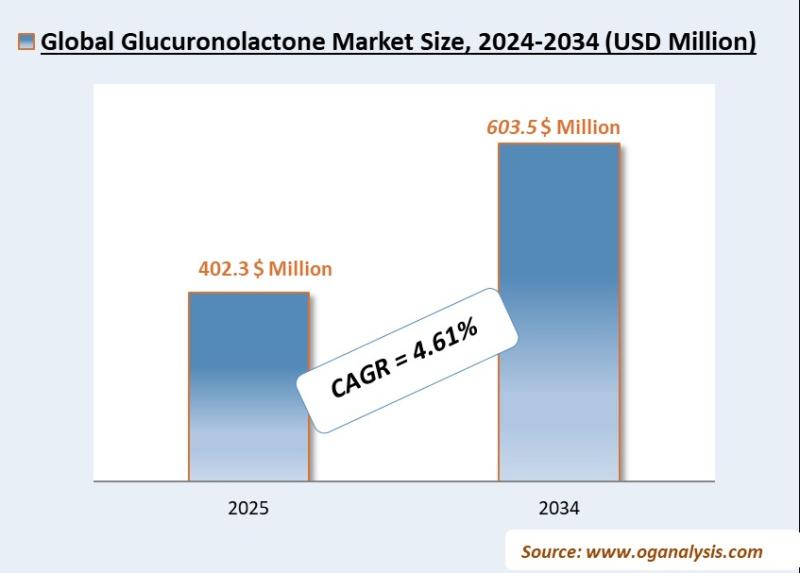

According to OG Analysis, a renowned market research firm, the Global glucuronolactone-market was valued at USD 383.7 Million in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 4.61%, rising from USD 402.3 Million in 2025 to an estimated USD 603.5 Million by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/glucuronolactone-market

glucuronolactone-market Overview

The glucose market covers the production and use of glucose (dextrose) and glucose syrups derived primarily…

Global Egg Sorting Machine Market Report Insights and Growth Outlook to 2034 - S …

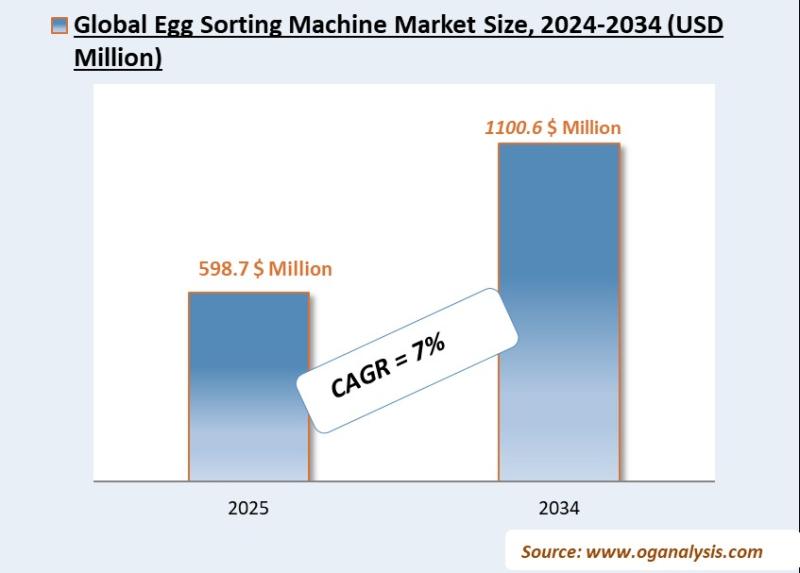

According to OG Analysis, a renowned market research firm, the Global Egg Sorting Machine Market was valued at USD 556.7 Million in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 7%, rising from USD 598.7 Million in 2025 to an estimated USD 1100.6 Million by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/egg-sorting-machine-market

Egg Sorting Machine Market Overview

The egg sorting machine market supports commercial egg processing by…

Global Glucose Market Report Insights and Growth Outlook to 2034 - Strategic Tra …

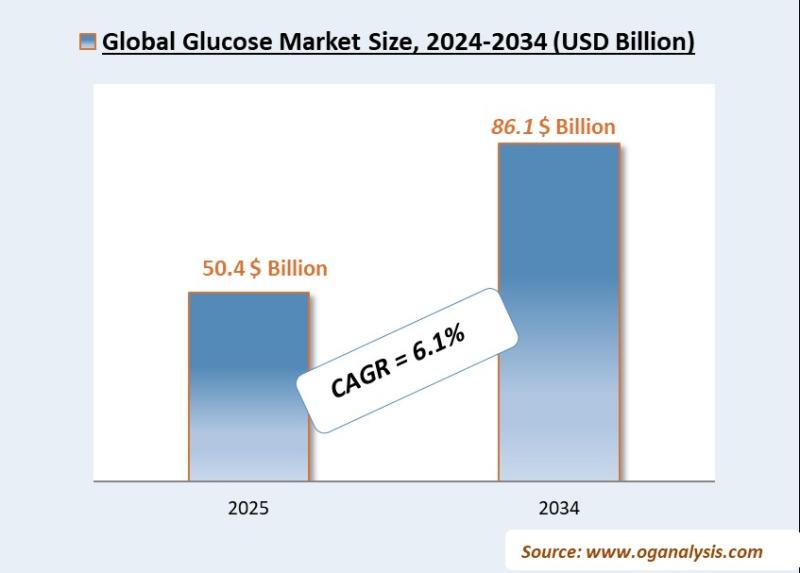

According to OG Analysis, a renowned market research firm, the Global Glucose Market was valued at USD 47.3 Billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 6.1%, rising from USD 50.4 Billion in 2025 to an estimated USD 86.1 Billion by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/glucose-market

Glucose Market Overview

The glucose market covers the production and use of glucose (dextrose) and glucose syrups…

Global Food Glazing Agents Market Report Insights and Growth Outlook to 2034 - S …

According to OG Analysis, a renowned market research firm, the Global Food Glazing Agents Market was valued at USD 5.7 Billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 6.8%, rising from USD 6.2 Billion in 2025 to an estimated USD 11.2 Billion by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/food-glazing-agents-market

Food Glazing Agents Market Overview

The food glazing agents market covers edible coatings applied to…

More Releases for LNG

LNG Bunkering Market Growth, Trends & Opportunities 2025 | Top key players - Tre …

LNG Bunkering Market, as analyzed in the study by DataM Intelligence, presents a detailed overview of the industry with in-depth insights, historical data, and key statistics. The report thoroughly examines market dynamics, competitive strategies, and major players, highlighting their product lines, pricing structures, financials, growth plans, and regional outreach.

The Global LNG Bunkering Market is expected to grow at a CAGR of 66.4% during the forecasting period (2024-2031).

Get a Free Sample…

Mea Floating Lng Power Vessel Market Emerging Trends and Growth Prospects 2034 | …

On April 8, 2025, Exactitude Consultancy., Ltd. released a research report titled "Mea Floating Lng Power Vessel Market". In-depth research has been compiled to provide the most up-to-date information on key aspects of the worldwide market. This research report covers major aspects of the Mea Floating Lng Power Vessel Market including drivers, restraints, historical and current trends, regulatory scenarios, and technological advancements. It provides the industry overview with growth analysis…

What's Driving the LNG Bunkering Market Trends? Key Companies are Skangass AS., …

A research report on 'LNG Bunkering Market' Added by DEC Research features a succinct analysis on the latest market trends. The report also includes detailed abstracts about statistics, revenue forecasts and market valuation, which additionally highlights its status in the competitive landscape and growth trends accepted by major industry players.

Request a sample of this research report @ https://www.decresearch.com/request-sample/detail/702

The size of LNG Bunkering Market was registered at USD 800 Million in…

LNG Bunkering Market Key Players Polskie LNG, Eagle LNG, ENN Energy, EVOL LNG, F …

The LNG Bunkering Market report add detailed competitive landscape of the global market. It includes company, market share analysis, product portfolio of the major industry participants. The report provides detailed segmentation of the LNG Bunkering industry based on product segment, technology, end user segment and region.

As per a recent news snippet, the Caribbean is one of the most lucrative regions for LNG bunkering market, as the shipping sector seeks compliance…

LNG Bunkering Industry to surpass $12bn by 2024:ENGIE,Polskie LNG,Eagle LNG, ENN …

LNG Bunkering Market size is set to exceed USD 12 billion by 2024.Growing demand for cleaner fuel coupled with strict emission regulations to reduce the airborne emissions predominantly in North America and Europe will stimulate LNG bunkering market. In 2015, International Maritime Organization (IMO) introduced Tier III norms to curb NOx emissions from marine vessels among Emission Control Areas (ECAs) under maritime boundaries.

Request for a sample copy of this…

Global Liquefied Natural Gas (LNG) Market 2018-22 : LNG bunkering, progressing L …

ResearchMoz presents Professional and In-depth Study of "Global Liquefied Natural Gas (LNG) Market: Industry Analysis & Outlook (2018-2022)" with coming years Industries Trends, Projections of Global Growth, Major Key Player and Case Study, Review, Share, Size, Effect.

' '

Liquefied Natural Gas (LNG) is a liquid form of natural gas, which is composed mainly of methane and other gases such as Ethane, Propane, Butane and Nitrogen. LNG liquefaction is a procedure…