Press release

2025-2034 Banking, Financial Services, And Insurance (BFSI) Crisis Management Market Roadmap: Insights for Competitive Advantage

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Banking, Financial Services, And Insurance (BFSI) Crisis Management Market Size By 2025?

The market size of crisis management in the banking, financial services, and insurance (BFSI) sector has seen a swift expansion in recent times. The value of this market is predicted to increase from $13.26 billion in 2024 to $15.45 billion in 2025, indicating a compound annual growth rate (CAGR) of 16.5%. This growth over the historical period is due to reasons like the emergence of a remote work environment, the surge in digital transformation of banking and financial services, more frequent and severe financial crises, escalating regulatory compliance, and the increased intricacy of the financial infrastructure.

How Big Is the Banking, Financial Services, And Insurance (BFSI) Crisis Management Market Size Expected to Grow by 2029?

Expect a swift expansion in the banking, financial services, and insurance (BFSI) crisis management market size over the next few years with an anticipated growth to $28.15 billion by 2029, and a compound annual growth rate (CAGR) of 16.2%. The growth for this period can be credited to the escalation of cybersecurity threats, greater awareness in BFSI organizations, increasing necessity for operational resilience, the desire for improved customer experience, and the fast-paced transition to online financial services. The forecast period will be characterized by major trends including cloud-based technology, advancements in technology, the integration of artificial intelligence (AI), the inclusion of machine learning, and the adoption of big data analytics.

View the full report here:

https://www.thebusinessresearchcompany.com/report/banking-financial-services-and-insurance-bfsi-crisis-management-global-market-report

Which Key Market Drivers Powering Banking, Financial Services, And Insurance (BFSI) Crisis Management Market Expansion and Growth?

The surge in cybersecurity threats is predicted to boost the expansion of the banking, financial services, and insurance (BFSI) crisis management market. These cybersecurity threats, which aim to steal, alter, or destroy computer systems, networks, or data, have escalated due to digital transformation, the sophistication of attacks, and regulatory compliance. In the BFSI sector, effectively managing crises is key to responding to cybersecurity threats, adhering to regulations, and maintaining stakeholder trust. For instance, the Federal Bureau of Investigation reported in March 2023 that complaints about investment fraud had surged by 127%, from $1.45 billion in 2021 to $3.31 billion in 2022. In addition, cryptocurrency investment fraud saw a rise from $907 million in 2021 to $2.57 billion in 2022. Hence, the increase in cyberattacks is fueling the growth of the banking, financial services, and insurance (BFSI) crisis management market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=19329&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Banking, Financial Services, And Insurance (BFSI) Crisis Management Market?

Leading organizations in the banking, financial services, and insurance (BFSI) crisis management sector are increasingly concentrating their efforts on the creation of climate technology. This aims to lessen the financial uncertainties brought about by environmental disruptions. Climate technology encompasses novel approaches and instruments to mitigate the consequences of climate change, including renewable energy, curbing emissions, and climate risk management frameworks. For example, Adaptive Insurance, a parametric insurance platform with a tech-focus based in the UK, introduced GridProtect in October 2024. Designed to shield policyholders from the effects of power failures due to environmental risks, this tech-based solution pledges to provide monetary reassurance in the wake of disruptions to the grid, an area not covered by conventional insurance policies. Adaptive Insurance highlighted the fact that in the US, power interruptions present a significant issue, impacting roughly 15 million businesses every month and resulting in substantial economic damages.

What Are the Emerging Segments in the Banking, Financial Services, And Insurance (BFSI) Crisis Management Market?

The banking, financial services, and insurance (BFSI) crisis management market covered in this report is segmented -

1) By Component: Software, Services

2) By Deployment: On-Premise, Cloud

3) By Enterprise Size: Large Enterprises, Small And Medium Enterprises

4) By Application: Risk And Compliance Management, Disaster Recovery And Business Continuity, Incident Management And Response, Other Applications

Subsegments:

1) By Software: Crisis Management Software, Risk Assessment and Management Software, Incident Management Software, Business Continuity Planning Software, Communication and Collaboration Tools

2) By Services: Consulting Services, Training and Awareness Programs, Incident Response Services, Recovery and Continuity Services, Compliance and Regulatory Advisory Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=19329&type=smp

Who Are the Global Leaders in the Banking, Financial Services, And Insurance (BFSI) Crisis Management Market?

Major companies operating in the banking, financial services, and insurance (BFSI) crisis management market are Deloitte Touche Tohmatsu Limited, PricewaterhouseCoopers International Limited, KPMG International Limited, Capgemini SE, SAS Institute Inc., Software AG, LogicGate Inc., Everbridge Inc., NCC Group, MetricStream Inc., CURA Software Solutions, Resolver Inc., Fusion Risk Management Inc., Beekeeper AG, 4C Group AB, Noggin Pty Ltd., RQA Europe Ltd., Veoci Inc., Konexus, Rockdove Solutions Inc.

Which are the Top Profitable Regional Markets for the Banking, Financial Services, And Insurance (BFSI) Crisis Management Industry?

North America was the largest region in the banking, financial services, and insurance (BFSI) crisis management market in 2024. The regions covered in the banking, financial services, and insurance (BFSI) crisis management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=19329

"This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work."

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2025-2034 Banking, Financial Services, And Insurance (BFSI) Crisis Management Market Roadmap: Insights for Competitive Advantage here

News-ID: 4143467 • Views: …

More Releases from The Business Research Company

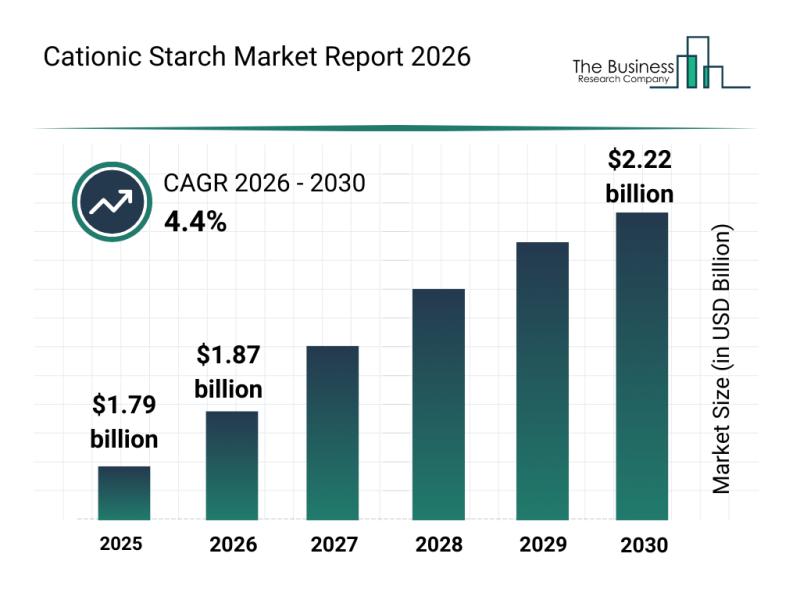

Analysis of Key Market Segments Influencing the Cationic Starch Market

The cationic starch market is positioned for steady expansion in the coming years, driven by a variety of industrial and environmental factors. As sustainability and innovation take center stage across different sectors, the demand for modified starches is becoming more pronounced, creating new opportunities for growth and development in this field.

Forecasted Market Size and Growth Rate of the Cationic Starch Market

The market for cationic starch is projected to…

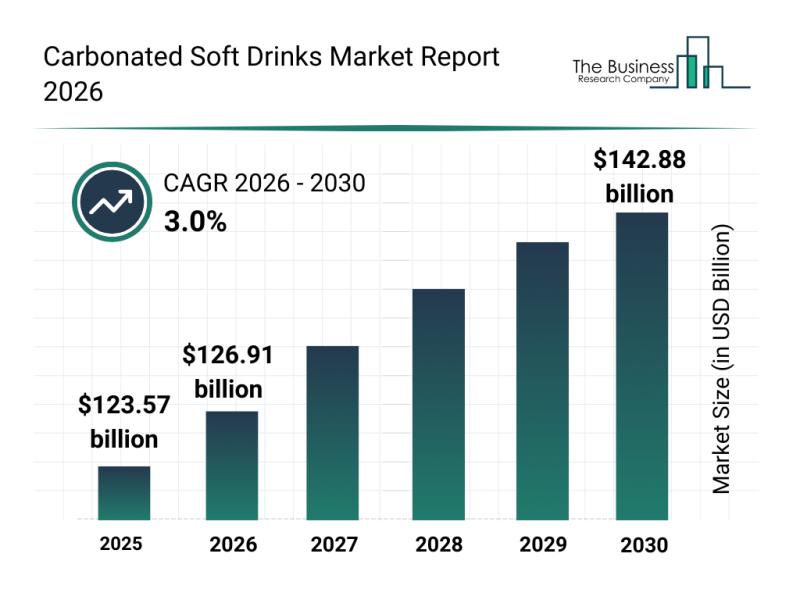

Market Trend Analysis: The Impact of Recent Innovations on the Carbonated Soft D …

The carbonated soft drinks industry is on track for steady expansion as consumer preferences evolve and innovation accelerates. With growing awareness around health and sustainability, the market is adapting by introducing new product varieties and packaging solutions. Here is a detailed overview of the market's expected growth, key players, prevailing trends, and segment breakdowns that highlight the future direction of this vibrant sector.

Projected Market Size and Growth Trajectory of the…

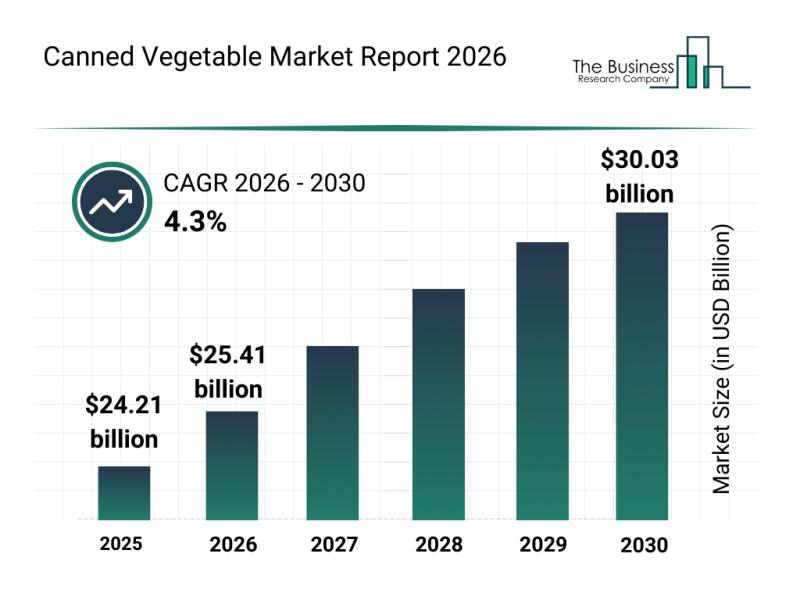

Segmentation, Major Trends, and Competitive Overview of the Canned Vegetable Mar …

The canned vegetable industry is on a steady upward trajectory, driven by evolving consumer preferences and technological advancements. As demand for convenient, nutritious, and sustainable food options grows, this market is set to expand significantly in the coming years. Let's explore the current market size, key players, emerging trends, and segment-wise analysis shaping the future of canned vegetables.

Projected Market Size and Growth of the Canned Vegetable Industry

The canned…

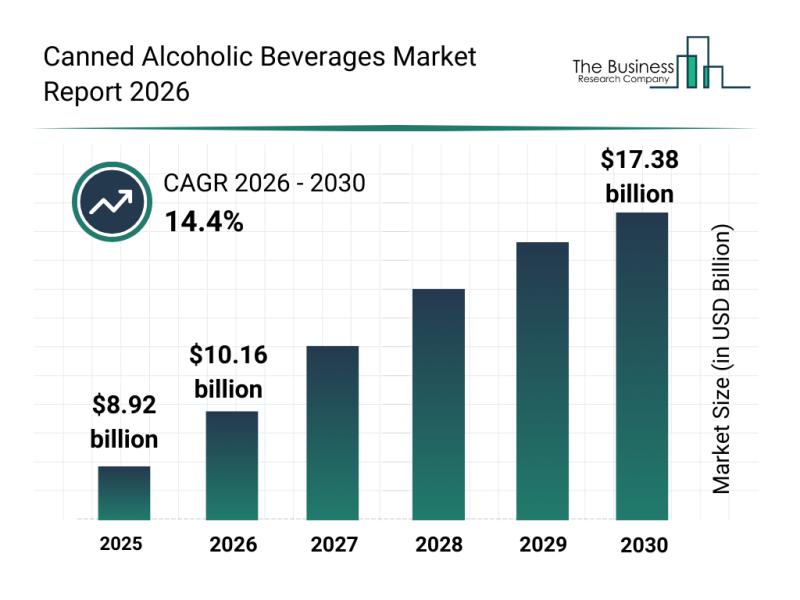

Competitive Landscape: Key Market Leaders and New Entrants in the Canned Alcohol …

The canned alcoholic beverages market is gaining strong traction as consumer preferences shift toward convenient and innovative drinking options. With increasing health consciousness and evolving tastes, this sector is set to experience substantial growth. Let's explore the market's projected valuation, key players, emerging trends, and important segments shaping its future.

Projected Market Size and Growth Outlook for the Canned Alcoholic Beverages Market

The canned alcoholic beverages market is poised for…

More Releases for BFSI

Evolving Market Trends In The Robotic Process Automation In BFSI Industry: Advan …

The Robotic Process Automation In BFSI Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Robotic Process Automation In BFSI Market Size During the Forecast Period?

In recent times, the market size for robotic process automation in bfsi has witnessed a significant surge.…

Evolving Market Trends In The Banking, Financial Services and Insurance (BFSI) S …

The Banking, Financial Services and Insurance (BFSI) Security Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Banking, Financial Services and Insurance (BFSI) Security Market Size During the Forecast Period?

The market size for security within the banking, financial services and insurance (BFSI)…

Key Trend Reshaping the AI in BFSI Market in 2025: Transforming The BFSI Sector …

What combination of drivers is leading to accelerated growth in the ai in bfsi market?

The anticipated surge in the AI in BFSI market may be traced back to the mounting use of AI in improving efficiency. Artificial intelligence (AI) comprises various technologies and algorithms that simulate human intelligence, including problem-solving, drawing insights from data, and making effective decisions. This growing usage of AI for enhancing efficiency could be attributed to…

Mumbai's BFSI Sector Gears Up for Transformation at the 24th Edition of BFSI IT …

Mumbai: The banking, financial services, and insurance (BFSI) sector in Mumbai is currently undergoing a profound transformation, fueled by rapid technological advancements and a significant increase in digital adoption. Emphasizing a strong commitment to digitalization, key stakeholders in Mumbai are championing initiatives akin to advancements in digital payments and the establishment of the Digital Banking Transformation Office. These efforts are propelling the BFSI landscape forward, fostering innovation and paving the…

Empowering BFSI Security: Safeguarding Futures Amid Evolving Threats, BFSI Secu …

Guarding the financial backbone against evolving cyber threats fuels the burgeoning, emergence of tailored solutions, biometrics, and IoT-based cybersecurity solutions significantly enhancing online banking Opportunities for the market.

The BFSI Security Market, valued at USD 61.6 billion in 2022, is poised to witness exponential growth, reaching USD 166.2 billion by 2030, reflecting a robust CAGR of 13.2%. This escalating trajectory is primarily attributed to the stringent regulatory environment governing the banking,…

IoT in BFSI Market : How the Business Will Grow in 2026?�Top Players in IoT in B …

The global internet of things (IoT) in banking, financial services, and insurance (BFSI) market is predicted to reach USD 116.27 billion by 2026, exhibiting a CAGR of 26.5% during the forecast period. The increasing investment of banks and financial institutions in IoT technologies will stimulate the growth of the market in the foreseeable future. According to the studies conducted by Tata consultancy services, financial institutions spend an average IoT budget…