Press release

Canada Credit Cards Market to Reach USD 784.77 Billion by 2030, Driven by High Card Penetration and E-Commerce Usage

Mordor Intelligence has published a new report on the "Canada Credit Cards Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction

The Canada credit cards market is a mature and stable payment ecosystem, with transaction value expected to grow from USD 605.03 billion in 2025 to USD 784.77 billion by 2030, reflecting a compound annual growth rate (CAGR) of 5.34% during the forecast period. Credit cards remain one of the most preferred payment instruments in the country, with an exceptionally high penetration rate among adults. Nearly nine out of ten Canadians own at least one credit card, underscoring the deep integration of card-based transactions in daily financial activity.

Credit cards in Canada are used not only as a line of credit but also as a convenient and trusted payment method for both in-store and online purchases. A significant share of cardholders pay their balances in full each month, indicating that cards are primarily being used as short-term, interest-free payment tools rather than long-term borrowing instruments. This combination of convenience, security, and rewards-based incentives has helped maintain their strong foothold in the Canadian financial landscape.

Report overview: https://www.mordorintelligence.com/industry-reports/canada-credit-cards-market?utm_source=openpr

Key Trends

1. High Ownership and Penetration Rates

Credit cards are almost ubiquitous in Canadian households. Approximately 90% of adults own at least one credit card, and many maintain multiple cards for different purposes-such as rewards, travel benefits, or retail store partnerships. This high penetration ensures that cards remain a dominant payment method, regardless of broader economic conditions.

2. Strong Balance-Clearing Culture

More than 70% of Canadian credit card users clear their balances in full each month. This behavior reduces interest costs for consumers and positions credit cards more as payment tools rather than long-term debt instruments. It also reflects a financially disciplined consumer base that values convenience and rewards over extended credit use.

3. Growth in E-Commerce Transactions

The rapid rise in online shopping has further cemented the role of credit cards as the preferred payment method for digital transactions. Cards offer fraud protection, ease of use, and the ability to earn points or cashback, making them the go-to choice for e-commerce spending. The increase in food delivery services, online grocery purchases, and streaming subscriptions has contributed to sustained transaction volume growth.

4. Rewards and Loyalty Programs Driving Usage

Canadians are highly responsive to reward structures, whether in the form of cashback, travel points, or retail-specific loyalty programs. This has prompted both banks and retailers to design competitive incentive schemes that encourage card usage for a wide variety of purchases, from everyday expenses to luxury spending.

5. Expansion of Contactless and Digital Payments

Contactless payment adoption in Canada is among the highest globally, with many consumers preferring tap-to-pay methods for speed and hygiene. Mobile wallet integration with credit cards has also increased, enabling users to link their cards to smartphones and smartwatches for seamless transactions.

6. Competitive Yet Low Concentration Market

The market is characterized by a mix of large banks, retail chains, and global payment networks, creating a competitive but not overly concentrated environment. This allows for variety in product offerings and ensures that consumers can choose from a broad range of credit card types tailored to specific needs.

7. Travel and Cross-Border Spending Recovery

As travel and tourism activity continues to rebound, credit card usage for booking flights, hotels, and related services is on the rise. Many card providers are enhancing travel-related perks such as airport lounge access, insurance coverage, and foreign transaction benefits to attract frequent travelers.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/canada-credit-cards-market?utm_source=openpr

Market Segmentation

The Canada credit cards market is segmented into the following categories:

By Card Type

General Purpose Credit Cards - Widely accepted cards used for everyday purchases and bill payments, offering broad merchant acceptance both domestically and internationally.

Specialty & Other Credit Cards - Cards tailored for niche uses such as store-branded cards, co-branded airline cards, or cards tied to specific loyalty programs.

By Application

Food & Groceries - Everyday spending category where cards are frequently used for rewards on essential purchases.

Health & Pharmacy - Payments for prescriptions, over-the-counter medications, and health services.

Restaurants & Bars - Dining and entertainment spending, often tied to rewards in travel or lifestyle categories.

Consumer Electronics - Purchases of gadgets, home appliances, and tech accessories.

Media & Entertainment - Subscription services, online streaming, and ticket bookings.

Travel & Tourism - Flights, hotels, car rentals, and vacation packages.

Other Applications - Miscellaneous expenses including home improvement, personal services, and education-related payments.

By Provider

Visa - One of the largest payment networks in Canada, accepted globally with a wide variety of card products.

MasterCard - Offers a diverse portfolio with strong global acceptance and competitive rewards programs.

Other Providers - Includes American Express and retail-specific networks that cater to niche segments.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players

The Canada credit cards market is served by a mix of major banking institutions and retail brand issuers, each contributing to the diversity of offerings:

Canadian Tire Corporation - Issues store-branded cards that integrate closely with its retail ecosystem, often bundled with loyalty incentives.

Triangle Rewards - Operates as a loyalty and rewards program closely tied to Canadian Tire and its partner retailers, encouraging repeat purchases and brand loyalty.

CIBC - A leading Canadian bank offering a broad range of Visa and MasterCard products with competitive rewards, travel perks, and low-interest options.

Royal Bank of Canada (RBC) - Canada's largest bank by market capitalization, with an extensive selection of credit cards targeting different customer profiles, from everyday users to premium clients.

Scotiabank - Known for its travel rewards programs and international partnerships, offering cards that cater to both domestic spenders and frequent travelers.

These players compete on multiple fronts, including interest rates, rewards structures, annual fees, and value-added benefits such as insurance coverage, purchase protection, and concierge services.

Explore more insights on Canada credit cards market competitive landscape: https://www.mordorintelligence.com/industry-reports/canada-credit-cards-market/companies?utm_source=openpr

Conclusion

The Canada credit cards market stands out as a well-established and highly penetrated payment ecosystem, underpinned by strong consumer trust and a preference for card-based transactions. High ownership rates, disciplined repayment habits, and growing e-commerce adoption have reinforced credit cards as a preferred payment choice for both everyday spending and larger purchases.

With a competitive mix of global networks, national banks, and retail-specific offerings, consumers have access to a broad range of products that cater to varying needs-whether for rewards, travel perks, or specialized benefits. As digital and contactless payments continue to rise, and loyalty programs become increasingly sophisticated, the credit card sector in Canada is set to maintain its central role in the country's consumer and retail payment landscape well into the next decade.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/canada-credit-cards-market?utm_source=openpr

Industry Related Reports

Europe Credit Cards Market: The Europe Credit Cards Market report segments the industry into By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Other Applications), By Provider (Visa, MasterCard, Other Providers), and By Country (UK, Germany, France, Italy, Spain, Rest of Europe).

Get more insights: https://www.mordorintelligence.com/industry-reports/europe-credit-cards-market?utm_source=openpr

Japan Credit Cards Market: The Japan Credit Cards Market report segments the industry into By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Other Applications), and By Provider (Visa, MasterCard, Other Providers)

Get more insights: https://www.mordorintelligence.com/industry-reports/japan-credit-cards-market?utm_source=openpr

Hong Kong Credit Cards Market: The Hong Kong Credit Cards Market report segments the industry into By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Other Applications), and By Provider (Visa, MasterCard, Other Providers).

Get more insights: https://www.mordorintelligence.com/industry-reports/hong-kong-credit-cards-market?utm_source=openpr

Israel Credit Cards Market: The Israel Credit Cards Market report segments the industry into By Card Type (General Purpose Credit Cards, Specialty & Other Credit Cards), By Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism, Other Applications), and By Provider (Visa, MasterCard, Other Providers).

Get more insights: https://www.mordorintelligence.com/industry-reports/israel-credit-cards-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Canada Credit Cards Market to Reach USD 784.77 Billion by 2030, Driven by High Card Penetration and E-Commerce Usage here

News-ID: 4142367 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

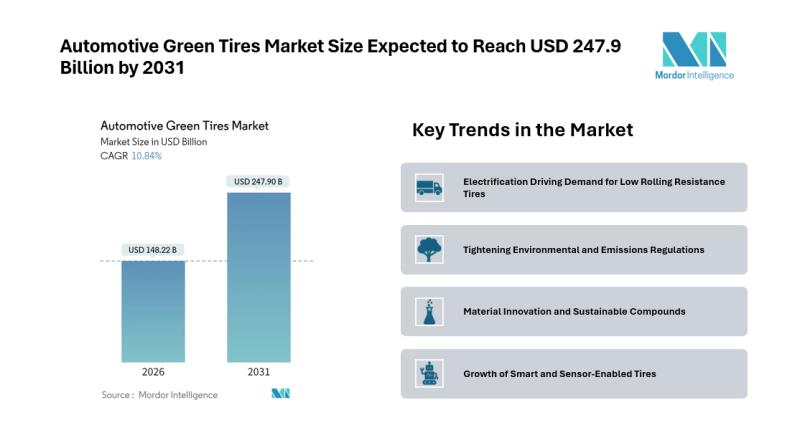

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…