Press release

Mobile Phones Fueling Growth In The Video Banking Service Market: Core Growth Enabler in the Video Banking Service Market, 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts._x000D__x000D_

What Will the Video Banking Service Industry Market Size Be by 2025?_x000D_

The market size of the video banking service has seen a swift escalation in the past few years. Its growth is projected to rise from $107.13 billion in 2024 to $125.84 billion in 2025, demonstrating a compound annual growth rate (CAGR) of 17.5%. The expansion observed in the historic period can be traced back to the escalating demand for video banking services, the rise in personalized banking offerings to customers, the exponential growth in digital banking services, the increasing requirement for video in financial services, and the management of a virtual workforce._x000D_

_x000D_

What's the Long-Term Growth Forecast for the Video Banking Service Market Size Through 2029?_x000D_

The market for video banking services is anticipated to experience a swift expansion in the coming years, reaching a total of $237.58 billion by 2029, with an impressive compound annual growth rate (CAGR) of 17.2%. Several factors are driving the growth during the forecast period, including an increased interest in advancing digital technology within financial and banking institutions, the increased reliance of numerous banks on video banking services, the widespread use of mobile phones, the surge in internet access, and fast-paced advancements in banking industry automation. Key trending factors during this forecast period include technological progression within banking, fortifying security and compliance features for video banking, the adoption of various cutting-edge technologies, platforms for cloud-based collaboration, and innovative services._x000D_

_x000D_

View the full report here: _x000D_

https://www.thebusinessresearchcompany.com/report/video-banking-service-global-market-report_x000D_

_x000D_

What Are the Key Growth Drivers Fueling the Video Banking Service Market Expansion?_x000D_

The advancement in the usage of mobile phones is set to boost the video banking service market. The surge in mobile phones usage can be attributed to the factors like convenience, portability and versatility in its functionality, thereby facilitating easy communication, access to information, and entertainment on the move. For example, Uswitch Limited, a financial credit firm situated in the UK, stated in February 2024 that by March 2022, the total count of active mobile subscriptions in the UK, excluding machine-to-machine (M2M) connections, reached 83.25 million. This represents a nearly 2% growth when compared to March 2021. Hence, the increased usage of mobile phones serves as a catalyst for the video banking service market's expansion._x000D_

_x000D_

Get your free sample here:_x000D_

https://www.thebusinessresearchcompany.com/sample.aspx?id=16819&type=smp_x000D_

_x000D_

What Are the Key Trends Driving Video Banking Service Market Growth?_x000D_

Top companies in the video banking service market are concentrating on the creation of innovative services, like face-to-face communication with video bankers, to boost customer connectivity and reach. The term 'face-to-face interactions with video banking services' refers to real-time video conversations allowing customers to interact directly with bank officials, mirroring a physical meeting for banking dealings and advice. For example, AU Small Finance Bank Limited, a finance service provider from India, in August 2023, unveiled a 24x7 video banking service. This service enables clients to connect directly with bankers via video calls at any hour and on any day, inclusive of weekends and holidays. The objective of this service is to offer an uninterrupted, customized banking experience to clients, especially those located in regions with scarce infrastructure and resources._x000D_

_x000D_

How Is the Video Banking Service Market Segmented?_x000D_

The video banking service market covered in this report is segmented - _x000D_

_x000D_

1) By Component: Solution, Service_x000D_

2) By Deployment Mode: On-Premise, Cloud_x000D_

3) By Application: Banks, Credit Unions, Other Applications_x000D_

_x000D_

Subsegments:_x000D_

1) By Solution: Video Banking Software, Video Conferencing Platform, Video Authentication Tools, Video Collaboration Systems _x000D_

2) By Service: Consultation And Support Services, Installation And Integration Services, Managed Services, Training And Maintenance Services_x000D_

_x000D_

Tailor your insights and customize the full report here:_x000D_

https://www.thebusinessresearchcompany.com/customise?id=16819&type=smp_x000D_

_x000D_

Which Companies Are Leading the Charge in Video Banking Service Market Innovation?_x000D_

Major companies operating in the video banking service market are Bank of America Corporation, Morgan Stanley, American Express Company, Cisco Systems Inc., Barclays PLC, U.S. Bank, MasterCard Inc., NatWest Group Plc, Merrill Lynch & Company Inc., Zoom Video Communications Inc., Tata Communications Limited, Guaranty Trust Bank Limited, AU Small Finance Bank Limited, Yealink Network Technology Co. Ltd., Enghouse Systems, STAR Financial Bank, Pexip AS, Glia Technologies Inc., Vidyard, StonehamBank, TrueConf LLC, Sirma Group _x000D_

_x000D_

Which Regions Are Leading the Global Video Banking Service Market in Revenue?_x000D_

North America was the largest region in the video banking service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the video banking service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa._x000D_

_x000D_

Purchase the full report today:_x000D_

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16819_x000D_

_x000D_

This Report Supports:_x000D_

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions._x000D_

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning._x000D_

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks._x000D_

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Phones Fueling Growth In The Video Banking Service Market: Core Growth Enabler in the Video Banking Service Market, 2025 here

News-ID: 4141393 • Views: …

More Releases from The Business Research Company

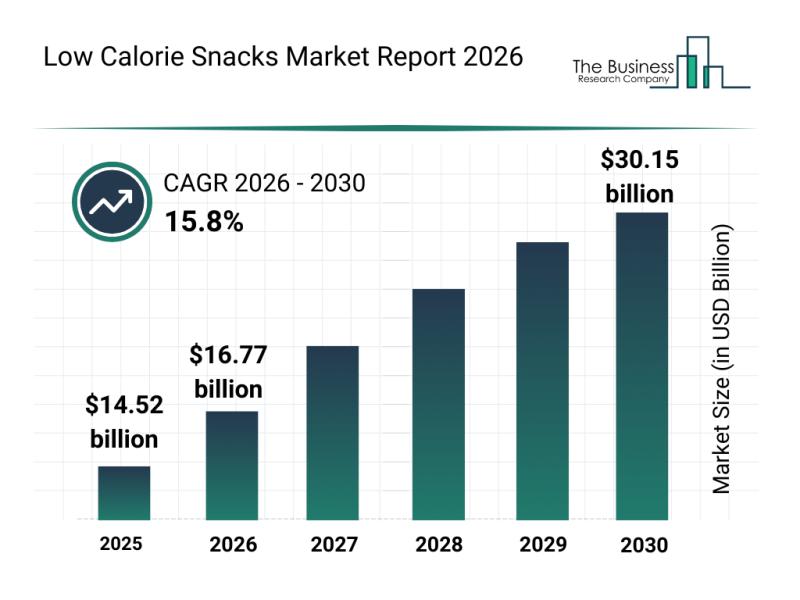

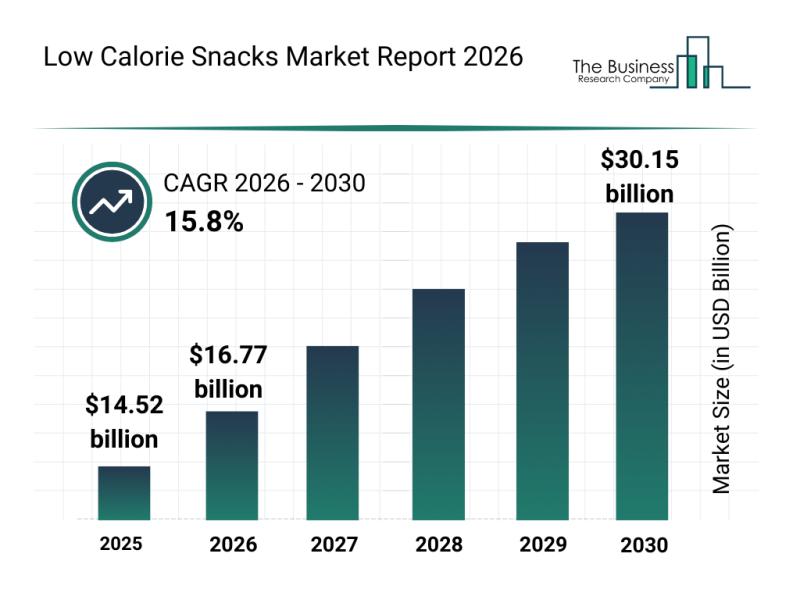

Analysis of Key Market Segments Driving the Low Calorie Snacks Market

The market for low calorie snacks is on a rapid growth trajectory, driven by changing consumer preferences and innovative product developments. As more individuals prioritize healthier eating habits, this sector is evolving with new offerings and expanding retail channels. Let's explore the current market value, prominent players, emerging trends, and key segments shaping the future of low calorie snacks.

Projected Market Size and Growth in the Low Calorie Snacks Market …

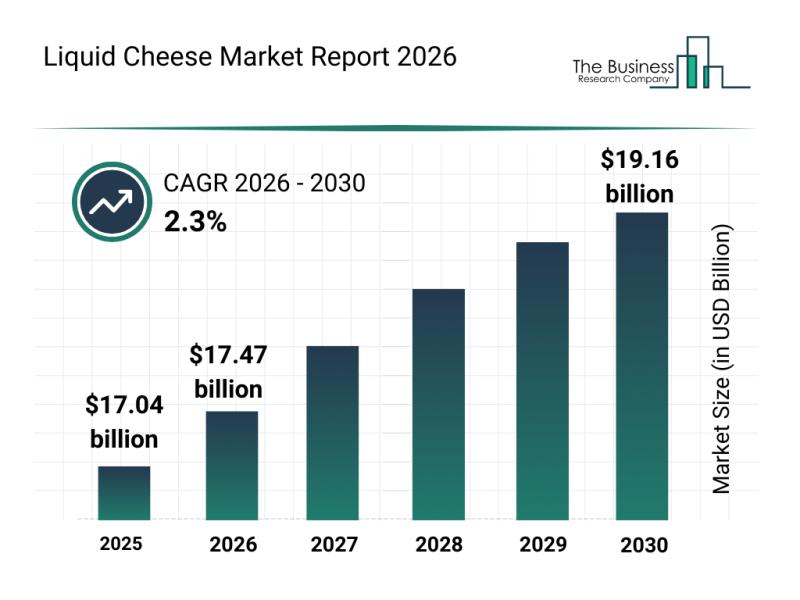

Global Trends Overview: The Rapid Evolution of the Liquid Cheese Market

The liquid cheese market is on a path of steady expansion, driven by evolving consumer preferences and innovations in product offerings. As more people seek convenient and flavorful cheese options, this sector is positioned to experience notable growth over the next several years. Let's explore the current market size, key players, industry trends, and segmentation details shaping the future of liquid cheese.

Projected Growth and Market Value of the Liquid Cheese…

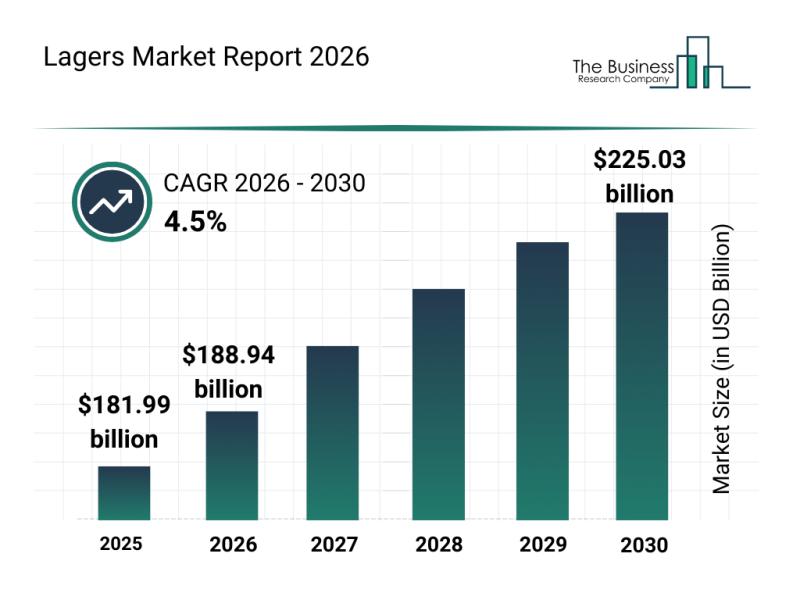

Segmentation, Major Trends, and Competitive Overview of the Lagers Market

The lagers market is set to experience consistent growth over the coming years, driven by evolving consumer tastes and expanding industry investments. As preferences shift toward premium and specialty beers, the market is adapting to meet these new demands, opening up opportunities for product innovation and wider distribution.

Forecasted Expansion of the Lagers Market by 2030

By 2030, the lagers market is projected to reach a value of $225.03 billion,…

Analysis of Key Market Segments Driving the Low Calorie Snacks Market

The market for low calorie snacks is on a rapid growth trajectory, driven by changing consumer preferences and innovative product developments. As more individuals prioritize healthier eating habits, this sector is evolving with new offerings and expanding retail channels. Let's explore the current market value, prominent players, emerging trends, and key segments shaping the future of low calorie snacks.

Projected Market Size and Growth in the Low Calorie Snacks Market …

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…