Press release

Telematics Adoption to Propel Automotive Usage-Based Insurance Market to USD 270.3 Billion by 2032 | Persistence Market Research

The global automotive usage-based insurance (UBI) market is projected to grow from US$ 69.8 Bn in 2025 to US$ 270.3 Bn by 2032, expanding at a remarkable CAGR of 21.3% during the forecast period. Usage-based insurance is a telematics-driven model where premiums are determined based on individual driving behavior, distance traveled, and time of use. This model promotes safe driving habits, rewards low-risk drivers, and offers cost-effective policies compared to traditional insurance structures. Growing adoption of connected car technologies and the increasing availability of in-vehicle telematics are key factors driving market expansion.The UBI market is gaining traction among both insurers and consumers due to its ability to reduce claim costs, improve risk assessment, and enhance customer loyalty through personalized plans. Pay-How-You-Drive (PHYD) and Pay-As-You-Drive (PAYD) are the most widely adopted models, with Manage-How-You-Drive (MHYD) gaining ground as AI-driven analytics become more advanced. North America currently leads the market, supported by widespread telematics penetration, while Asia-Pacific is emerging as the fastest-growing region due to rising vehicle ownership and favorable regulatory support for connected vehicle infrastructure.

Get a Sample Copy of Research Report (Use Corporate Mail id for Quick Response): https://www.persistencemarketresearch.com/samples/29038

✅ Key Highlights from the Report:

➤ The global automotive usage-based insurance market will grow from US$ 69.8 Bn in 2025 to US$ 270.3 Bn by 2032, at a CAGR of 21.3%.

➤ Pay-How-You-Drive (PHYD) is the dominant UBI model, driven by telematics data precision.

➤ North America leads in adoption due to high connected car penetration and insurer readiness.

➤ Asia-Pacific is the fastest-growing market, supported by rapid vehicle digitization and urbanization.

➤ AI and big data analytics are enhancing UBI's accuracy in risk-based premium calculation.

➤ Growing demand for personalized and cost-efficient policies is fueling UBI adoption globally.

📊 Market Segmentation:

The automotive usage-based insurance market can be segmented by insurance type, vehicle type, and technology. By insurance type, PHYD holds the largest share, rewarding safer drivers with lower premiums. PAYD appeals to customers with low annual mileage, while MHYD leverages real-time driving data for continuous premium adjustments.

By vehicle type, passenger cars dominate the market due to high consumer adoption of telematics-based policies, while commercial fleets are increasingly using UBI to monitor driver behavior and reduce operational risks. In terms of technology, embedded telematics systems lead, followed by smartphone-based solutions and aftermarket devices, each offering varying degrees of data accuracy and cost-efficiency.

Explore a wide range of in-depth market insights and detailed reports available on our website for further information and analysis: https://www.persistencemarketresearch.com/market-research/automotive-usage-based-insurance-market.asp

📊 Regional Insights:

North America remains the largest regional market, driven by mature insurance infrastructure, strong telematics adoption, and favorable regulatory frameworks. Insurers in the U.S. and Canada are actively promoting UBI plans as a way to improve driver safety and reduce claim costs.

Asia-Pacific is expected to witness the fastest growth, fueled by increasing connected vehicle sales, government initiatives for road safety, and the rising penetration of telematics services in countries like China, India, and Japan. Europe is also showing steady adoption, supported by strict safety regulations and advanced connected car ecosystems.

Market Drivers

The rapid integration of telematics into vehicles is a key driver for the UBI market. As more vehicles come equipped with real-time monitoring systems, insurers can gather accurate data on speed, braking patterns, mileage, and driving locations to offer customized premiums. This not only benefits safe drivers with cost savings but also enables insurers to better assess and manage risk. Increasing smartphone penetration is also expanding access to UBI, as mobile apps can collect and transmit driving data without the need for dedicated hardware.

Growing consumer demand for personalized services and cost-effective insurance models further fuels market expansion. UBI aligns with broader trends in the automotive industry toward connectivity, digitization, and customer-centric solutions. Fleet operators are also adopting UBI to monitor driver performance, reduce accidents, and lower operational expenses. The convergence of AI, IoT, and big data analytics is enhancing the accuracy and efficiency of UBI programs, making them increasingly attractive to both insurers and policyholders.

Market Restraints

High initial setup costs for telematics infrastructure and the need for advanced data analytics capabilities pose challenges for new entrants and smaller insurers. Collecting, storing, and processing large volumes of driving data requires significant investment in technology and skilled personnel. Additionally, consumer concerns over privacy and data security can hinder adoption, as drivers may be reluctant to share continuous location and behavior data with insurers.

Regulatory complexities across different regions also act as barriers. Variations in insurance laws, data protection regulations, and telematics standards can make it challenging for insurers to roll out standardized UBI programs globally. Technical issues such as inconsistent data accuracy from aftermarket devices and potential connectivity disruptions can also limit the reliability of UBI-based premium calculations.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/29038

Market Opportunities

Rising adoption of connected and autonomous vehicles offers a significant growth opportunity for the UBI market. As cars become more digitally integrated, insurers can access richer datasets to create highly tailored policies and enhance risk assessment accuracy. Emerging markets with growing vehicle ownership and increasing telematics adoption also present untapped potential for insurers to introduce innovative UBI models.

The integration of UBI with broader mobility-as-a-service (MaaS) platforms could further expand its reach, enabling insurers to serve ride-sharing fleets, subscription-based car services, and on-demand mobility providers. Additionally, advancements in AI and predictive analytics will allow insurers to offer real-time pricing adjustments and proactive driver coaching, improving customer engagement while reducing accident rates.

👉 Frequently Asked Questions (FAQs):

➤ How big is the automotive usage-based insurance market in 2025 and 2032?

➤ Who are the key players in the global UBI market?

➤ What is the projected growth rate of the automotive usage-based insurance market?

➤ What is the market forecast for UBI through 2032?

➤ Which region is estimated to dominate the industry during the forecast period?

📌 Key Players

✦ Progressive Corporation

✦ Allstate Corporation

✦ AXA Group

✦ Generali Group

✦ State Farm Mutual Automobile Insurance Company

✦ Liberty Mutual Insurance

✦ Octo Telematics S.p.A

■ In 2025, Progressive expanded its UBI program with AI-powered real-time feedback for policyholders to encourage safer driving habits.

■ Octo Telematics launched a next-gen telematics platform enabling insurers to deliver instant premium adjustments based on live driving data.

✅ Explore more related market insights and reports by visiting our website.

KSA Tire Market: https://www.persistencemarketresearch.com/market-research/ksa-tire-market.asp

Automotive Fuel System Market: https://www.persistencemarketresearch.com/market-research/automotive-fuel-system-market.asp

Lithium Iron Phosphate Batteries Market: https://www.persistencemarketresearch.com/market-research/lithium-iron-phosphate-batteries-market.asp

☎️ Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Telematics Adoption to Propel Automotive Usage-Based Insurance Market to USD 270.3 Billion by 2032 | Persistence Market Research here

News-ID: 4141181 • Views: …

More Releases from Persistence Market Research

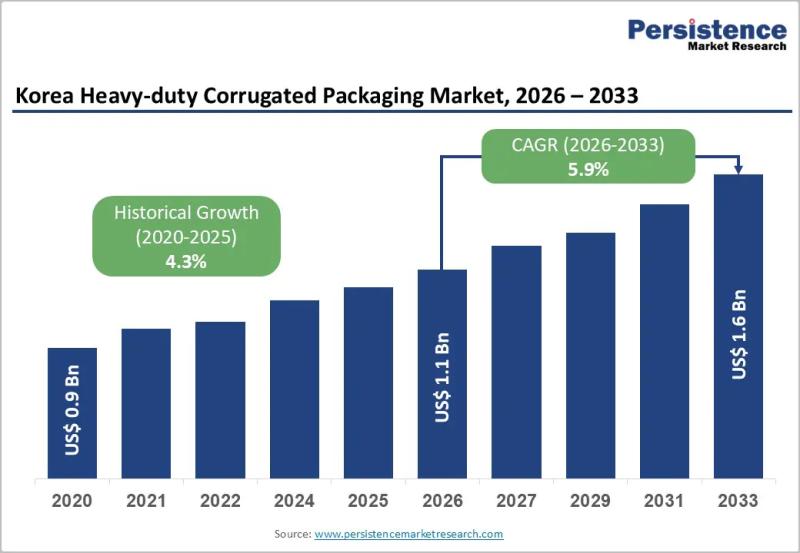

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…