Press release

Voice Banking Market Expected to Achieve 16.7% CAGR by 2029: Growth Forecast Insights

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Voice Banking Market Size By 2025?

In the past few years, the voice banking market has experienced substantial growth. It is estimated to increase from $1.61 billion in 2024 to approximately $1.88 billion in 2025, with a compound annual growth rate (CAGR) of 17.1%. The notable growth in the historic period can be credited to heightened usage of IoT and smart home technologies, the rising popularity of multilingual voice assistants, expanding smartphone accessibility, improved security features, and the digital revolution within the banking industry.

How Big Is the Voice Banking Market Size Expected to Grow by 2029?

Expectations are high for the voice banking market, which is predicted to grow significantly in the coming years. By 2029, the sector's size is forecasted to reach a staggering $3.49 billion, marking a compound annual growth rate (CAGR) of 16.7%. The anticipated growth for the forecast period is largely owing to the rise in the use of AI-powered virtual assistants, a surge in smart speaker devices, increasing consumer preference for convenience, and an upswing in the incorporation of AI and utilization of telehealth services. Key trends in the forecast period will be advancements in voice synthesis technologies, a rising demand for tailor-made voice banking solutions, continuous research aiming at enhancing the quality and reliability of stored voices, increased acceptance and improvement of voice banking technologies, and the adoption of AI and machine learning.

View the full report here:

https://www.thebusinessresearchcompany.com/report/voice-banking-global-market-report

Which Key Market Drivers Powering Voice Banking Market Expansion and Growth?

With the increasing popularity of devices enabled with voice assistance, the voice banking market is anticipated to witness significant growth. These hardware devices, armed with voice recognition and processing abilities, enable users to communicate with them through voice commands. They range from smart speakers, smartphones integrated with voice assistants to smart home hubs. The surge in demand for such devices stems from their convenience, hands-free nature, smart home system compatibility, and the advantages of enhanced voice recognition technologies. Voice banking lets users create a unique digital voice profile for voice assistance-enabled devices, making communications more personal and boosting the usability. For example, Statistics Canada reported in July 2023, that the uptake of Internet-connected smart home devices rose from 42% in 2020 to 47% in 2022, and smart speakers, at 30%, were the most preferred device. As such, the growing demand for voice assistance-enabled devices is fuelling the advancement of the voice banking market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16822&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Voice Banking Market?

Leading entities in the voice banking market are making strides in creating state-of-the-art solutions, such as AI-driven voice-assistance for banking. The aim of these developments is to intensify user experience and offer more comprehensive solutions for those with cognitive impairments. These AI-driven voice-assisted banking facilities employ artificial intelligence (AI) and voice recognition to provide an array of banking services via voice guidance. For example, Glia, a US-based firm specializing in customer interaction technology, introduced a voice banking solution for the Glia Interaction Platform in April 2023. The Glia Interaction Platform is a powerful customer interaction tool aimed at assisting businesses in offering streamlined and personalized customer encounters across various channels, with a particular focus on the financial services industry. The novel feature enhances the capabilities of AI-powered Glia Virtual Assistants (GVAs) to encompass support for dial-in phone consultations. This improved service offers a cohesive, native virtual helper across the call center and digital channels, allowing for the automation of voice and chat interactions. The Voice GVAs from Glia provide a constant 24/7 service, efficiently overseeing after-hours calls and high-demand intervals by addressing customer queries and smoothly transferring them to live support when required. This replaces the outmoded touch-tone menu-based IVR and Phone Banking systems in financial institutions with cutting-edge conversational AI technology.

What Are the Emerging Segments in the Voice Banking Market?

The voice banking market covered in this report is segmented -

1) By Component: Solution, Services

2) By Technology: Machine Learning, Deep Learning, Natural Language Processing, Other Technologies

3) By Deployment Mode: On-Premise, Cloud

4) By Application: Banks, Non-Banking Financial Companies (NBFCs), Credit Unions, Other Applications

Subsegments:

1) By Solution: Voice Recognition Software, Speech-to-Text Systems, Voice Authentication And Security Solutions, Voice Analytics Tools

2) By Services: Consulting Services, Integration And Implementation Services, Training And Support Services, Managed Services

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=16822&type=smp

Who Are the Global Leaders in the Voice Banking Market?

Major companies operating in the voice banking market are Hongkong and Shanghai Banking Corporation Limited, NatWest Group, U.S. Bank, Lloyds Bank plc, ICICI Bank, Ally Financial Inc., Emirates NBD Bank, NCR Corporation, IndusInd Bank, Axis Bank, Verbio Technologies S.L, DBS Bank India Limited, Uniphore, Central 1 Credit Union, SoundHound AI Inc., Acapela Group, kasisto, BankBuddy, Vibepay, United Bank of India

Which are the Top Profitable Regional Markets for the Voice Banking Industry?

North America was the largest region in the voice banking market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the voice banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16822

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Voice Banking Market Expected to Achieve 16.7% CAGR by 2029: Growth Forecast Insights here

News-ID: 4141059 • Views: …

More Releases from The Business Research Company

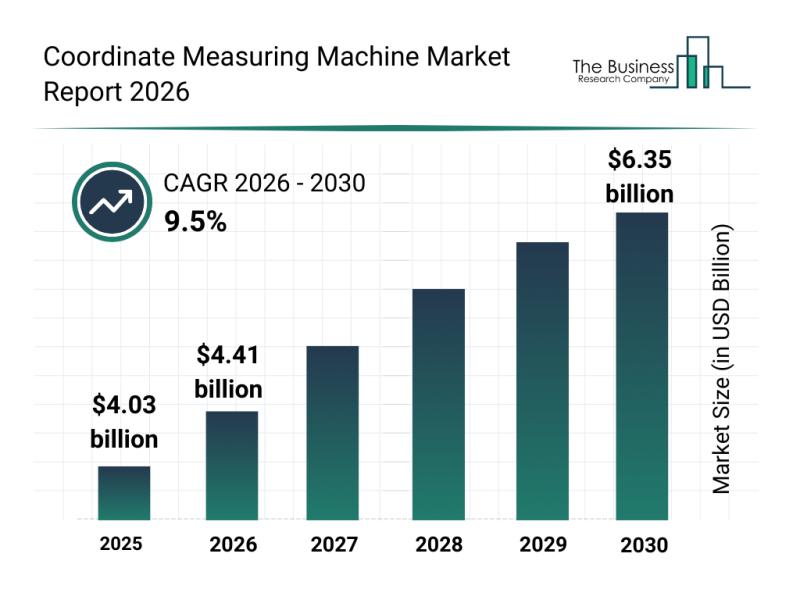

Future Perspective: Key Trends Shaping the Coordinate Measuring Machine Market U …

The coordinate measuring machine (CMM) market is set for substantial growth as industries increasingly rely on precise measurement technologies to enhance manufacturing processes. With advancements in automation and smart manufacturing, the market is evolving rapidly, driven by new applications and technological integrations. Let's explore the current market size, dominant players, key trends, and segmentation details shaping this sector's future.

Projected Market Expansion and Growth Drivers in the Coordinate Measuring Machine Market…

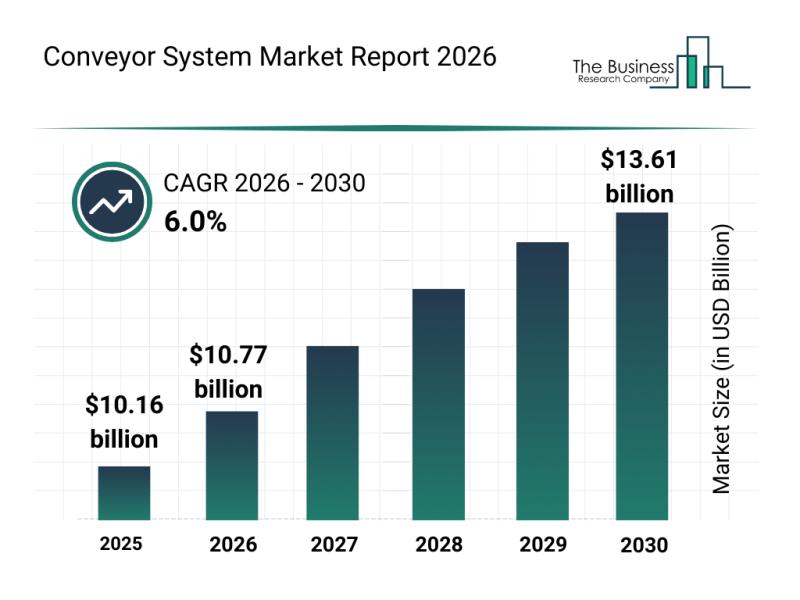

In-Depth Study of Segments, Industry Developments, and Key Players in the Convey …

The conveyor system market is poised for significant expansion as industries increasingly adopt automation and smart technologies to streamline operations. This report delves into the market's projected growth, key players shaping the sector, notable trends driving innovation, and the primary segments defining the competitive landscape.

Projected Market Size and Growth Trajectory of the Conveyor System Market

The conveyor system market is anticipated to reach a valuation of $13.61 billion by 2030,…

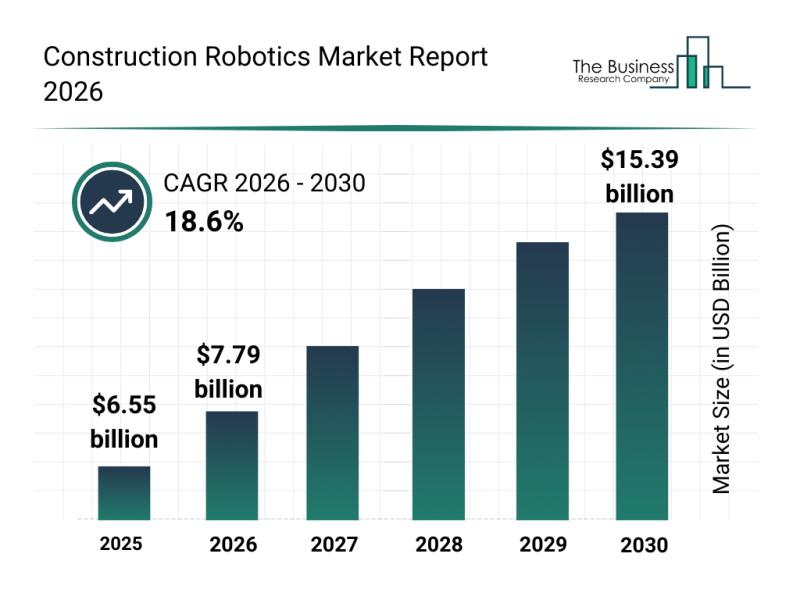

Leading Companies Reinforcing Their Presence in the Construction Robotics Market

The construction robotics industry is on the brink of significant expansion, driven by advancements in technology and increasing demand for automation in building projects. As construction sites become more digitized and smart city initiatives gain momentum, robotics are playing a crucial role in transforming how infrastructure is developed. Let's explore the current market outlook, key players, emerging trends, and segmentation within this rapidly evolving sector.

Anticipated Market Growth for Construction Robotics…

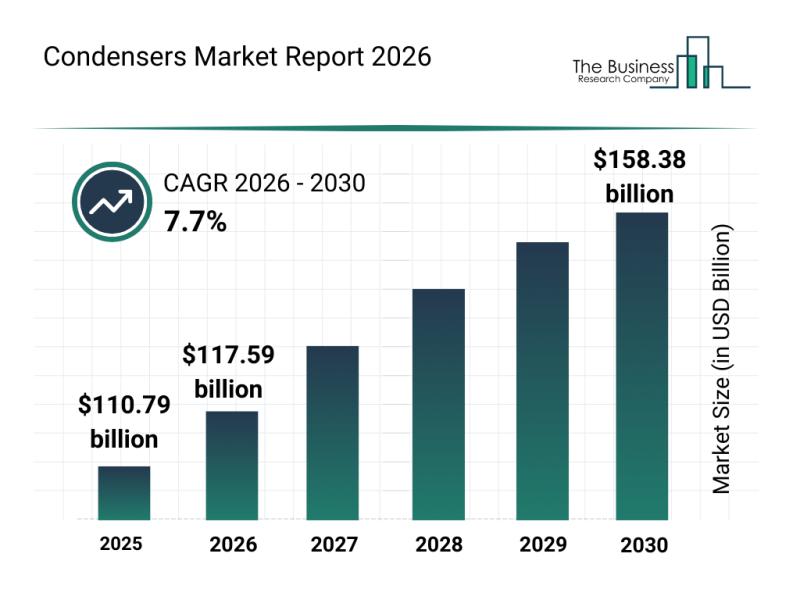

Emerging Factors Driving Rapid Growth in the Condensers Market

The condensers market is set to experience significant expansion over the coming years, driven by technological advancements and growing demand across various industries. This overview explores the market's expected size, key players, ongoing trends, and the primary segments that define its structure.

Projected Growth and Size of the Condensers Market by 2030

The condensers market is anticipated to grow substantially, reaching a market value of $158.38 billion by 2030. This growth…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…