Press release

Future of the Private Equity Market: Trends, Innovations, and Key Forecasts Through 2034

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Private Equity Market Size Growth Forecast: What to Expect by 2025?

The size of the private equity market has seen a swift expansion in the recent past. The market, which was worth $480.8 billion in 2024, is projected to elevate to $531.09 billion in 2025, registering a compound annual growth rate (CAGR) of 10.5%. Factors such as accelerated globalization and interconnectivity, enhanced consumer expenditure and business prospects, rising demand for contemporary infrastructure, heightened financial expenses, and an increasing urgency for diversification have contributed to the growth witnessed in the historic period.

How Will the Private Equity Market Size Evolve and Grow by 2029?

Anticipations are high for a quick expansion of the private equity market in the coming years, projected to hit $781.36 billion in 2029 with a compound annual growth rate (CAGR) of 10.1%. The anticipated surge within the forecast period can be associated with a surge in investments in digital health startups, elevated interest rates, escalating competition from strategic investors, the emergence of a startup culture, and a spike in entrepreneurial activities. Noteworthy trends for the projected period include increased investments in technology, technological progress, the use of big data analytics, the incorporation of artificial intelligence (AI) and machine learning (ML), and the inclusion of robotic process automation.

View the full report here:

https://www.thebusinessresearchcompany.com/report/private-equity-global-market-report

What Drivers Are Propelling the Growth of Private Equity Market Forward?

The private equity market's expansion is predicted to surge due to a rise in the number of startups. A startup refers to a nascent company or organization in the first stages of growth, typically dedicated to introducing a distinct product, service or technology to the marketplace. The burgeoning startup population is attributable to greater funding accessibility and an increasing penchant for innovative, flexible working arrangements. Private equity companies multiply, attain fiscal solidity, and enhance their prospects for enduring success. For instance, Startups.co.uk, a UK-centric business consulting website, indicated that in the year 2023, the UK welcomed 39,966 new enterprises, marking a 6.5% increment from 2022. Consequently, the escalating quantity of startups is fuelling the expansion of the private equity market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18706&type=smp

Which Emerging Trends Are Transforming the Private Equity Market in 2025?

Key players in the private equity market are concentrating on producing innovative products like private equity secondary products. The aim is to offer investors improved liquidity options, diversify their investment portfolios, and exploit beneficial opportunities within private equity funds and companies. Private equity secondaries or the secondary market for private equity involves the trade of pre-existing investor commitments to private equity funds. This auxiliary market gives investors the chance to dispose of their shares in private equity funds before the fund's tenure concludes, creating liquidity in a typically inelastic asset class. For example, in February 2024, Collar Capital, a financial services company based in Brazil, introduced the Coller Secondaries Private Equity Opportunities Fund ('C-SPEF'). It's a tender offer fund specifically tailored for accredited wealthy investors. This exclusive private equity secondaries offer creates a new route for individuals to invest in private markets. It offers easy entry to the asset class through a diverse, institutionally-grade portfolio. C-SPEF strives to yield a captivating mix of attractive outright and risk-adjusted returns, diversification, and improved liquidity compared to standard private equity funds. For the initial investors, c-SPEF has refrained from charging a performance fee and has abandoned its management fee for the first year.

What Are the Key Segments in the Private Equity Market?

The private equity market covered in this report is segmented -

1) By Fund Type: Buyout, Venture Capitals (VCs), Real Estate, Infrastructure, Other Fund Types

2) By Investor Type: Institutional Investors, High-Net-Worth Individuals (HNWIs), Family Offices, Fund Of Funds

3) By Industry: Healthcare, Technology, Consumer Goods, Energy And Infrastructure, Financial Services, Other Industries

Subsegments:

1) By Buyout: Leveraged Buyouts (LBOs), Management Buyouts (MBOs), Public-to-Private Buyouts

2) By Venture Capitals (VCs): Seed Stage Funds, Early Stage Funds, Growth Stage Funds

3) By Real Estate: Residential Real Estate Funds, Commercial Real Estate Funds, Industrial Real Estate Funds

4) By Infrastructure: Renewable Energy Funds, Transport Infrastructure Funds, Telecommunications Infrastructure Funds

5) By Other Fund Types: Distressed Asset Funds, Mezzanine Funds, Special Situations Funds

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=18706&type=smp

Who Are the Key Players Shaping the Private Equity Market's Competitive Landscape?

Major companies operating in the private equity market are Berkshire Hathaway Inc., Brookfield Corporation, Blackstone Inc., Clayton Dubilier& Rice Information(CDR) LLC, EQT AB, KKR & Co. Inc., The Carlyle Group Inc., Hellman & Friedman LLC, Warburg Pincus LLC, TPG Capital (TPG) Inc., General Atlantic Service Company L.P, Silver Lake Technology Management L.L.C., Vista Equity Partners, Advent International Corporation, Permira, Bain Capital LP, Francisco Partners Management L.P, L Catterton, CVC Capital Partners, Insight Partners

What Geographic Markets Are Powering Growth in the Private Equity Market?

North America was the largest region in the private equity market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the private equity market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18706

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future of the Private Equity Market: Trends, Innovations, and Key Forecasts Through 2034 here

News-ID: 4139717 • Views: …

More Releases from The Business Research Company

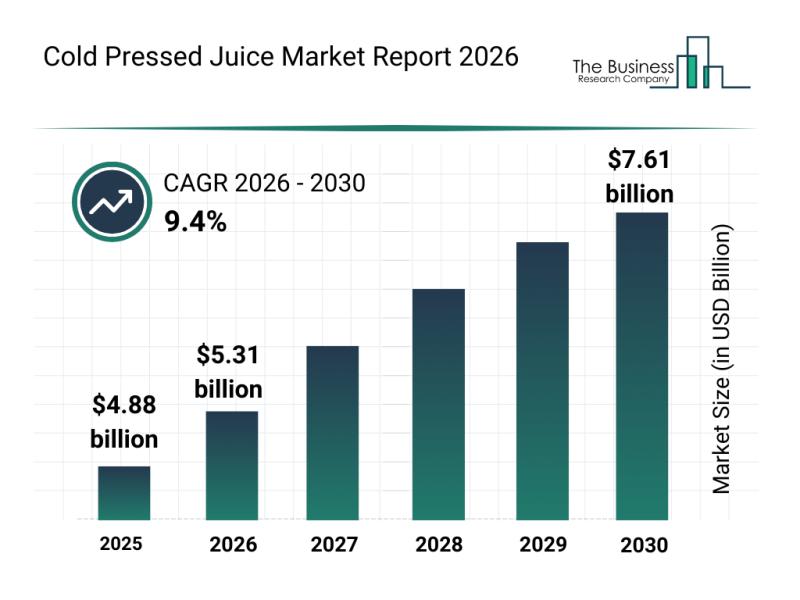

Emerging Sub-Segments Transforming the Cold Pressed Juice Market Landscape

The cold pressed juice market is on the verge of significant expansion as consumers increasingly seek healthier and more functional beverage options. Shifting preferences towards immunity-boosting drinks and sustainability are driving innovation and growth in this sector. Let's explore the current market size, influential players, emerging trends, and segment breakdowns shaping the future of cold pressed juices.

Cold Pressed Juice Market Size and Growth Expectations Through 2030

The market for…

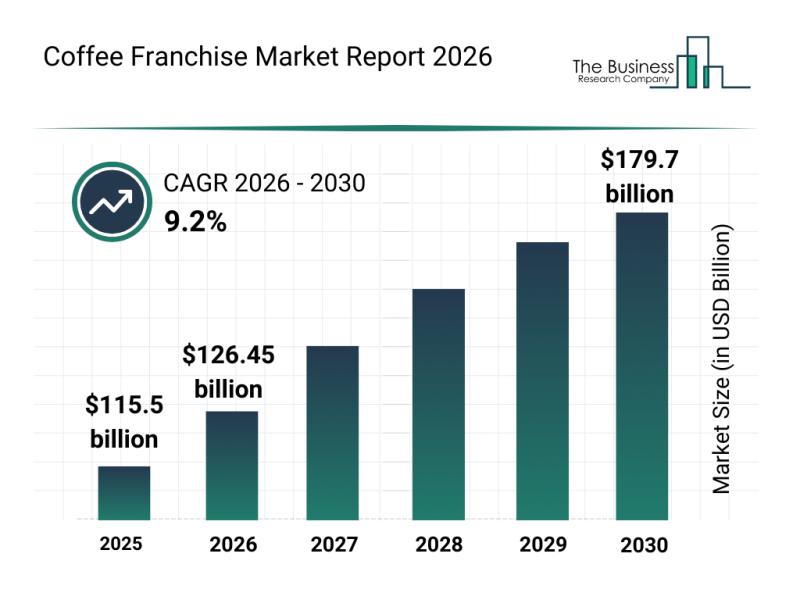

Top Companies and Industry Competition in the Coffee Franchise Market

The coffee franchise industry is positioned for significant expansion in the coming years, driven by evolving consumer preferences and strategic market initiatives. Increasing demand for high-quality coffee experiences and innovative business models is shaping the future landscape. Let's explore the current market size, leading companies, key trends, and major segments that define this dynamic sector.

Projected Growth and Market Size of the Coffee Franchise Market by 2030

The coffee franchise…

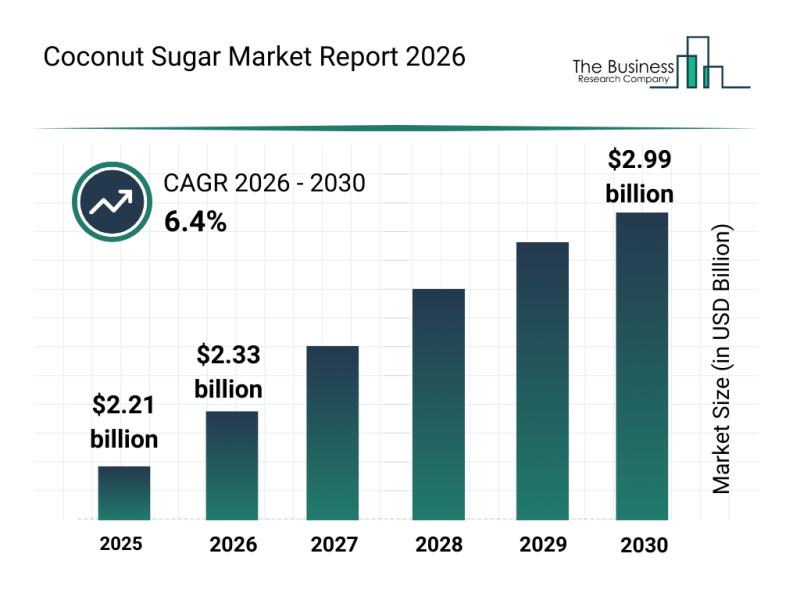

Coconut Sugar Market Overview: Major Segments, Strategic Developments, and Leadi …

The coconut sugar market is gaining significant momentum and is poised for notable expansion over the coming years. Driven by evolving consumer preferences and increasing interest in healthier and sustainable sweeteners, this market presents promising opportunities for businesses and consumers alike. Let's explore the market's size, key players, emerging trends, and segmentation in detail.

Projected Expansion of the Coconut Sugar Market Size Through 2030

The coconut sugar market is forecasted…

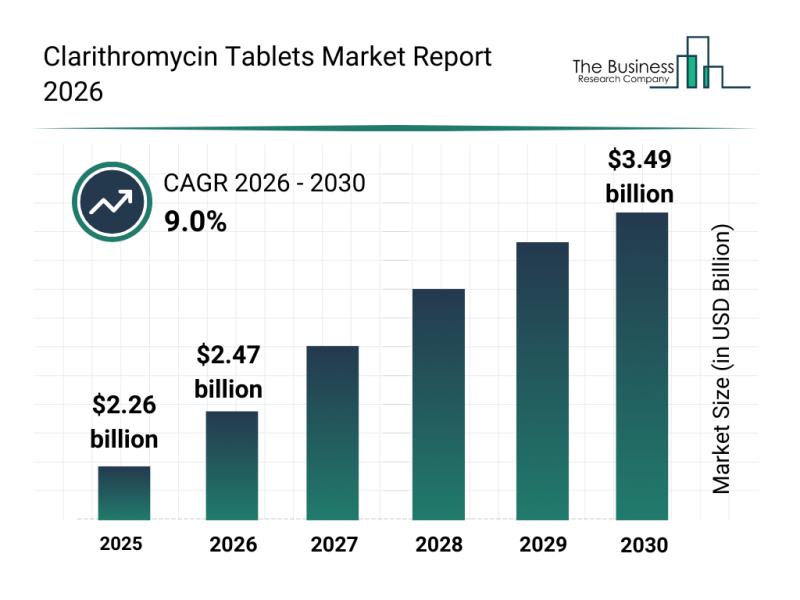

Emerging Sub-Segments Transforming the Clarithromycin Tablets Market Landscape

The clarithromycin tablets market is poised for notable expansion in the coming years, driven by several healthcare and pharmaceutical developments. As demand for effective antibiotic treatments rises globally, this sector is attracting considerable attention from manufacturers and healthcare providers alike. Let's explore the market's size, key players, prevailing trends, and segmentation to understand its current landscape and future potential.

Projected Market Valuation and Growth Trajectory for Clarithromycin Tablets

The clarithromycin…

More Releases for Fund

Broad-Based Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong F …

The Broad-Based Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Broad-Based Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Index Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E Fund, …

The Index Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Index Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Exchange-Traded Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fun …

The Exchange-Traded Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Exchange-Traded Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Equity Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Equity Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Equity Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Bond Mutual Fund Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, E …

The Bond Mutual Fund research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Bond Mutual Fund market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

Money Market Funds Market 2022: Industry Manufacturers Forecasts- Tianhong Fund, …

The Money Market Funds research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Money Market Funds market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…