Press release

Top Rated Senior Mortgage Loan Officer Duane Buziak Unveils DigitalHelocs.com, a One-Stop Resource for Fast, Simple Home Equity Line of Credits

This convenient resource offers a seamless, convenient resource where people everywhere can apply for a HELOC and get underwriting and approvals in five minutes or lessIndustry leading mortgage loan officer Duanze Buziak has just unveiled his newest resource to make securing home equity line of credits (HELOCs) easier than ever. With the launch of https://digitalhelocs.com/, Buziak introduces a streamlined website where clients can gain access to underwriting and approvals in just five minutes or less.

Image: https://www.globalnewslines.com/uploads/2025/08/ae630d94a731fcf9be2702f8f605460f.jpg

HELOCs offer a revolving line of credit in which homeowners borrow against their home equity. This is an excellent option for homeowners planning renovations; parents looking to fund college tuition; real estate investors; self-employed borrowers who need capital; and more. HELOCs offer lower interest rates than personal loans or credit cards and offer cash faster than other options. HELOC terms are also flexible; in many cases, lenders offer interest-free payments during the draw period.

Buziak, who is the creator of FreePreQuals.com [file:///C:/Users/heath/Downloads/FreePreQuals.com] and InvestorsParadise.com [file:///C:/Users/heath/Downloads/FreePreQuals.com], is thrilled to release his latest tool for anyone seeking a HELOC. "Whether you're planning home improvements, consolidating debt, or funding education, HELOCs can be a practical and cost-effective solution when managed wisely," said Buziak.

The https://digitalhelocs.com/ website allows people apply for a HELOC completely online in minutes. The process is simple, with no hidden terms or fine print to sift through, and can be done in minutes. In fact, same day qualifications are often offered with underwriting and approvals in five minutes or less. Buziak and his team make gaining access to a HELOC easier than ever, with no guesswork and results in minimal time.

Image: https://www.globalnewslines.com/uploads/2025/08/821439598ea4fbc95522477e7e8f32bc.jpg

"We believe that with the right tools and education, homeowners can take control of their financial future, using HELOCs as a strategic tool rather than a financial burden," said Buziak.

Anyone can visit the DigitalHelocs.com website now to discover if a HELOC is a viable solution for them. Online bookings are now available. Learn more by visiting https://digitalhelocs.com/.

ABOUT DUANE BUZIAK

Duane Buziak is a nationally top rated senior mortgage loan officer and Virginia Broker of the Year. He offers free, no obligation pre-approvals seven days per week, fast closings, and soft credit checks to provide the most financially viable and convenient options for clients. Follow on social media:

TikTok: @duanebuziakmortgage

Facebook: @duanebuziaktheoneandonly

Instagram: @duanebuziakmortgagemaestro

Media Contact

Contact Person: Duane Buziak

Email: Send Email [http://www.universalpressrelease.com/?pr=top-rated-senior-mortgage-loan-officer-duane-buziak-unveils-digitalhelocscom-a-onestop-resource-for-fast-simple-home-equity-line-of-credits]

City: GLEN ALLEN

State: VIRGINIA

Country: United States

Website: https://digitalhelocs.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. GetNews makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top Rated Senior Mortgage Loan Officer Duane Buziak Unveils DigitalHelocs.com, a One-Stop Resource for Fast, Simple Home Equity Line of Credits here

News-ID: 4138787 • Views: …

More Releases from Getnews

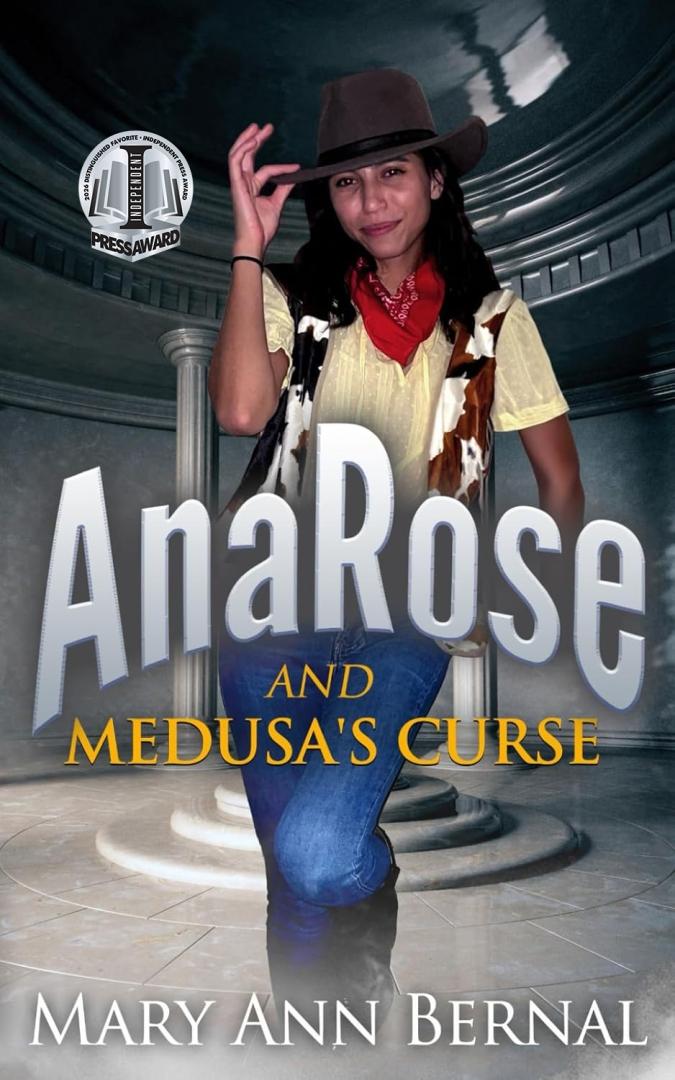

Mary Ann Bernal's AnaRose and Medusa's Curse Honored as Distinguished Favorite b …

Image: https://www.globalnewslines.com/uploads/2026/02/1770094491.jpg

Action-adventure novella earns national recognition for excellence in independent publishing

Omaha, NE - AnaRose and Medusa's Curse by Mary Ann Bernal has been named a Distinguished Favorite in the Novella category by the Independent Press Award (IPA), one of the most respected global award programs for independent authors, publishers, and illustrators. The IPA recognizes outstanding literary works based on overall excellence, with winners selected by a panel of industry professionals,…

First Choice Chiropractic Expands Injury Evaluation and Care Coordination Servic …

Image: https://www.globalnewslines.com/uploads/2026/02/1770125666.jpg

First Choice Chiropractic announced enhancements to clinical intake, documentation practices, and care coordination aimed at supporting patients with musculoskeletal injuries and pain-related limitations. The updates focus on clearer evaluation pathways, improved communication, and consistent follow-up scheduling to support recovery planning.

Strengthened intake and clinical assessment

The clinic has refined its intake process to better capture injury history, functional limitations, and relevant health factors at the first visit. Standardized screening steps and…

Author's new book "Sharp Turns Ahead" receives a warm literary welcome

Image: https://www.globalnewslines.com/uploads/2026/02/1770134144.jpg

Readers' Favorite announces the review of the Fiction - Anthology book "Sharp Turns Ahead" by Daniel P. Douglas, currently available at http://www.amazon.com/gp/product/B0GHRV91XK.

Readers' Favorite is one of the largest book review and award contest sites on the Internet. They have earned the respect of renowned publishers like Random House, Simon & Schuster, and Harper Collins, and have received the "Best Websites for Authors" and "Honoring Excellence" awards from the Association…

Readers' Favorite announces the review of the Fiction - Historical - Event/Era b …

Image: https://www.globalnewslines.com/uploads/2026/02/1770133973.jpg

Readers' Favorite announces the review of the Fiction - Historical - Event/Era book "Ballot" by Dan Mulvagh, currently available at http://www.amazon.com/gp/product/1669882764.

Readers' Favorite is one of the largest book review and award contest sites on the Internet. They have earned the respect of renowned publishers like Random House, Simon & Schuster, and Harper Collins, and have received the "Best Websites for Authors" and "Honoring Excellence" awards from the Association of…

More Releases for HELOC

Mountaintop Capital Partners Boosts HELOC Access Amid 7.81% National Rates for U …

Leading HELOC Lenders Offer Competitive Home Equity Line of Credit Rates as Demand Rises for Investors and Small-Medium Businesses Needing Flexible Funding

Mountaintop Capital Partners LLC today announced expanded HELOC services tailored for U.S. investors, business owners, and companies from small startups to large enterprises seeking home equity loans. With current HELOC rates today averaging 7.81% and holding near two-year lows, this timing aligns with surging homeowner equity exceeding $35 trillion,…

Jose Flores, Owner of Lending Solutions in Sacramento, Launches Enhanced HELOC P …

Image: https://www.globalnewslines.com/uploads/2025/06/1751246203.jpg

"A HELOC empowers families to make smart decisions for their future - without sacrificing the hardearned mortgage rate they already have." - Jose Flores, Owner, Lending Solutions.

Jose Flores, Owner of Lending Solutions in Sacramento, California, introduces the company's enhanced HELOC program as a smarter way to access home equity in today's high-rate market. Unlike costly refinancing, a HELOC lets homeowners preserve low mortgage rates, borrow flexibly, and fund renovations,…

Lendgo Launches to Simplify HELOC Access, Empowering Homeowners with Financial F …

In an era where homeowners seek smarter ways to tap into their home equity, Lendgo is officially launching as the go-to platform for comparing and securing Home Equity Lines of Credit (HELOC). Designed to simplify and streamline the borrowing process, Lendgo empowers homeowners to make confident financial decisions-while accessing some of the most competitive HELOC rates in the country.

HELOCs have become a critical tool for financing life's major expenses-from home…

Transforming Home Equity: Lendgo Launches to Streamline HELOC Access for Homeown …

Lendgo, the premier platform dedicated to helping homeowners secure Home Equity Lines of Credit (HELOC), proudly announces its official launch. Lendgo aims to provide homeowners with greater financial flexibility by connecting them to top lenders offering the most competitive interest rates available.

A HELOC is an invaluable financial tool, allowing homeowners to leverage their home equity for purposes such as home improvements, education expenses, debt consolidation, or unexpected financial needs. However,…

Revolutionizing Home Equity: Lendgo Launches to Simplify HELOC Access for Homeow …

Lendgo, a premier platform dedicated to helping homeowners secure Home Equity Lines of Credit (HELOC), is excited to announce its official launch. By connecting homeowners with top lenders offering the most competitive interest rates, Lendgo empowers users with greater financial flexibility and smarter borrowing options.

A HELOC is a powerful financial tool, enabling homeowners to tap into their home equity for home improvements, education expenses, debt consolidation, or unexpected costs. However,…

Extra Payment vs. HELOC to Pay Off A Mortgage

Many homeowners are now discovering a new method of paying off a mortgage faster. A concept that uses a Home Equity Line of Credit (HELOC) to pay off a 30-year mortgage faster. But this concept isn't new. A bank in Australia first introduced it to the United States in the early 2000s. In fact, this concept is widely used in Australia. Australian homeowners are using it to pay off their…