Press release

2025 Payday Loans Market Outlook: Key Indicators Shaping Growth Through 2034

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Payday Loans Industry Market Size Be by 2025?

In the past few years, the payday loans industry has witnessed significant growth. It is poised to rise from its value of $35.47 billion in 2024, to reach $37.51 billion in 2025, with a compound annual growth rate (CAGR) pegged at 5.8%. The historical surge in this industry is as a result of increased financial instability, limited access to conventional credit, economic slumps, increase in unemployment rate, regulatory shifts and the emergence and rise of digital lending platforms.

What's the Long-Term Growth Forecast for the Payday Loans Market Size Through 2029?

Expectations are high for a robust expansion in the payday loans market in the coming years, with its value predicted to rise to $46.24 billion by 2029, reflecting a compound annual growth rate (CAGR) of 5.4%. Factors attributing to this growth in the forecasted period include escalating economic instability, growing unemployment figures, changing patterns in consumer borrowing, alterations in regulation, fluctuations in interest rates, and a surging demand for short-term financial solutions. Likely trends for the forecast period are enhancements in digital lending platforms, improved borrower education initiatives, the integration of artificial intelligence in risk evaluation, the creation of more adaptable repayment alternatives, and the use of alternative credit scoring.

View the full report here:

https://www.thebusinessresearchcompany.com/report/payday-loans-global-market-report

What Are the Key Growth Drivers Fueling the Payday Loans Market Expansion?

An increased cost of living is anticipated to spur the expansion of the payday loan market in the future. This rise is attributable to escalating housing costs, local taxes, food and transportation costs, healthcare expenditure, and the overall economic situation in a certain area. The cost of living refers to the sum total necessary to meet primary expenses such as housing, sustenance, transportation, and healthcare, among others, to uphold a certain standard of living in a specific region. In response to heightened expenses, people may choose immediate, short-term financial solutions such as payday loans to fill payroll gaps or to tackle unforeseen expenditures. For example, data from the UK's House of Commons Library shows that inflation rate in the United Kingdom was below 1% in early 2021, but subsequently surged to 11.1% in October 2022. Hence, the surge in the cost of living is fuelling the expansion of the payday loan market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18694&type=smp

What Are the Key Trends Driving Payday Loans Market Growth?

In an effort to improve services and accommodate the increasing digital customer base, a majority of key players in the payday loan market are creating pioneering solutions like online platforms. Such platforms are aimed at convenience, permitting freelance workers to request cash advances rapidly and simply. The platform is optimized for performance, enabling users to swiftly input their data and receive a response. For example, in May 2024, PDLOANS247, an online loan provider from the US, introduced a Freelance Cash Advance Solution. This online platform is uniquely crafted to help freelancers, gig economy workers, and small business proprietors. It offers advance payments of up to $5,000, thereby providing a quick route for people to access funds for various purposes, from business costs to personal requirements.

How Is the Payday Loans Market Segmented?

The payday loans market covered in this report is segmented -

1) By Type: Storefront Payday Loans, Online Payday Loans

2) By Marital Status: Married, Single

3) By Customer Age: Less Than 21, 21-30, 31-40, 41-50, More Than 50

Subsegments:

1) By Storefront Payday Loans: In-Store Transactions, Instant Cash Payday Loans, Local and Regional Lenders

2) By Online Payday Loans: Short-Term Online Payday Loans, Peer-to-Peer Lending Platforms, Instant Approval Online Loans

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=18694&type=smp

Which Companies Are Leading the Charge in Payday Loans Market Innovation?

Major companies operating in the payday loans market are Check Into Cash, Kotak Mahindra Bank Limited, OneMain Holdings Inc., Advance America, ACE Cash Express, Opportunity Financial LLC, Check `n Go, AmeriCash Loans, Check City, LoanMart, NetCredit, MoneyKey, Rise Credit, Speedy Cash, Speedy Cash, Fig Loans, Possible Finance, Balance Credit, Plain Green Loans, Lending Bear, Spotloan, 24CashToday, Big Picture Loans, Cash America, CashNetUSA, Checksmart

Which Regions Are Leading the Global Payday Loans Market in Revenue?

North America was the largest region in the payday loans market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the payday loans market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18694

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2025 Payday Loans Market Outlook: Key Indicators Shaping Growth Through 2034 here

News-ID: 4137948 • Views: …

More Releases from The Business Research Company

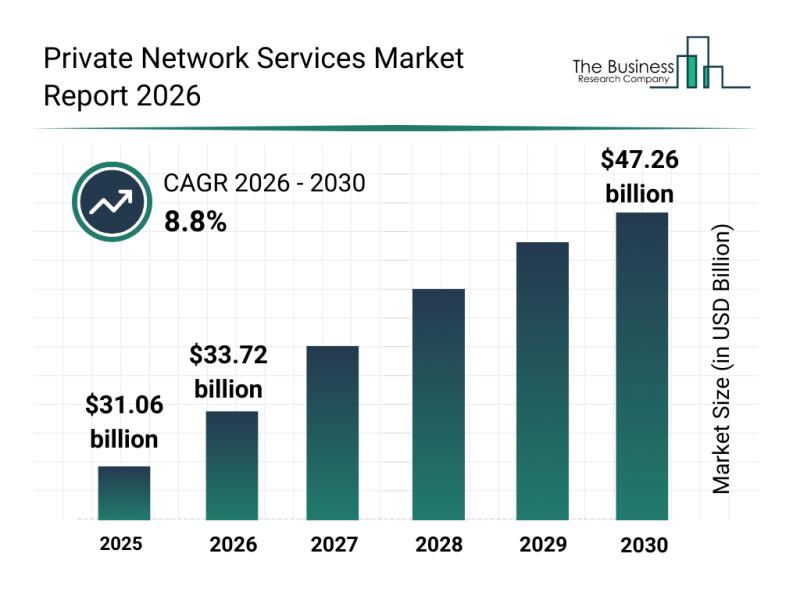

Leading Companies Fueling Innovation and Growth in the Private Network Services …

The private network services sector is set to experience remarkable growth as demand for secure, high-performance connectivity continues to rise across various industries. With advancements in wireless technology and evolving network needs, this market is positioning itself for widespread adoption and innovation over the coming years. Let's explore the market size, key players, driving trends, and segmentation to better understand what lies ahead.

Private Network Services Market Size and Growth Outlook…

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Po …

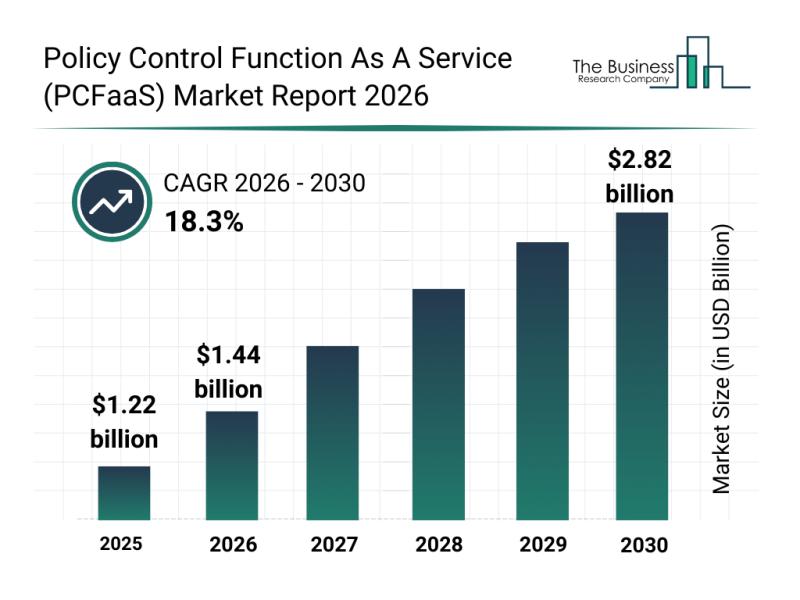

The policy control function as a service (PCFaaS) market is on track for substantial expansion over the coming years, driven by technological advancements and increasing demand in telecommunications. This sector is transforming rapidly as operators adapt to next-generation network requirements and cloud-native approaches. Let's delve into the market's expected valuation, key players, emerging trends, and notable segmentations shaping its future.

Significant Growth Forecast for the Policy Control Function As A Service…

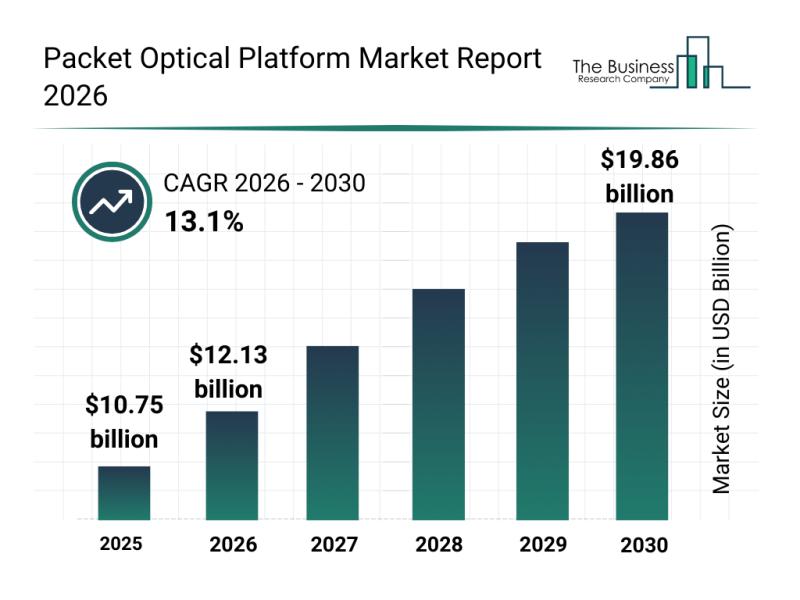

Top Players and Competitive Dynamics in the Packet Optical Platform Market

The packet optical platform market is positioned for significant expansion in the coming years, driven by advances in network technology and increasing demand for high-capacity data transmission. As digital infrastructure evolves, this sector is set to play a crucial role in supporting the growing needs of data centers, telecom providers, and cloud services. Let's explore the market's projected size, key players, emerging trends, and the segments contributing to its growth.

Forecasted…

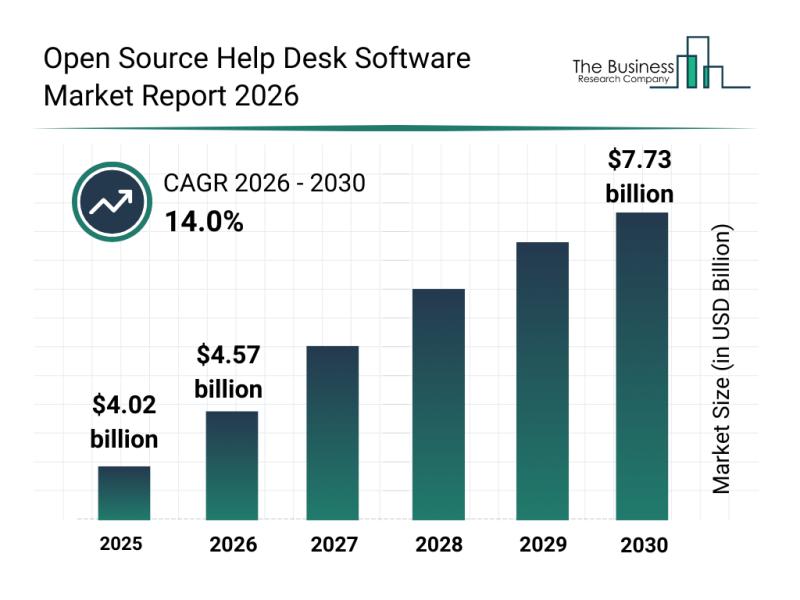

Analysis of Segmentation, Market Trends, and Competitive Landscape in the Open S …

The open source help desk software market is set to experience significant expansion in the coming years, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital customer support, this market is positioned for notable growth through 2030. Below is an in-depth exploration of the market size, leading players, key trends, and segmentation insights.

Projected Market Size and Growth Rate of the Open Source Help Desk Software Market…

More Releases for Loans

Online Payday Loans Texas & USA | Online Installment Loans for Bad Credit | Loom …

https://www.loomloans.com

Loom Loans: Your Gateway to Financial Flexibility Across the United States

Have you been searching for $255 payday loans online same day, online payday loans Texas, or maybe even online installment loans for bad credit? Look no further; Loom Loans can help! Understanding that time is often of the essence when it comes to financial needs, our service specializes in linking applicants to available loans, allowing you to find the right…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Online Loans at GoodCheddar Make Comparing Loans Easier in Canada

GoodCheddar offers a personal finance solution that is about helping consumers find the answers they need when it comes to personal loans. Expanding its reach in the consumer marketplace, GoodCheddar.com aims to lower the barriers of borrowing by making options more accessible to Canadians.

When a consumer needs a personal loan, it can be a big financial decision. GoodCheddar empowers consumers in their decisions and helps them make smart financial…

Loans Now Website Educates Consumers on Bad Credit Loans

JACKSONVILLE, FL – MAY 6, 2019–Bad credit can make people feel hopeless when they face issues out of their control like car crashes and medical emergencies. Personal loan provider Loans Now educates consumers so that they can get the help they need.

Loans Now’s website serves as an extensive resource meant to inform potential borrowers about how to borrow money responsibly. Its representatives work with borrowers to find the loan that’s…

Guaranteed Personal Loans: Instant Approval Loans

Real-personal-loans.com is today devoted to offering instant approval loan for people with low income to see to it that they kind out their financial conditions soon after they harass. This is a very convenient solution compared with the old times where system for the financial loan was a very frustrating process and people could spend days to get the cash. Application will only require a few clicks and the creditors…