Press release

Increasing Number Of SMEs Is Driving The Growth Of The Microfinance: Pivotal Factor Influencing Microfinance Market Growth in 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Microfinance Market Size Growth Forecast: What to Expect by 2025?

In the past few years, the microfinance market has seen significant expansion. It is forecasted to escalate from $215.51 billion in 2024 to $240.49 billion in 2025, with a compound annual growth rate (CAGR) of 11.6%. Factors contributing to this growth during the historic phase include: greater use of digital technology, the focus on commercialization and sustainability, a heightened emphasis on response lending, broader access to loan services, and a surge in the utilization of online lending platforms.

How Will the Microfinance Market Size Evolve and Grow by 2029?

The size of the microfinance market is projected to see a significant increase in the coming years, rising to a value of $368.02 billion by 2029, with an estimated compound annual growth rate (CAGR) of 11.2%. The expected expansion during this forecast period is largely due to factors such as the development of regulatory systems, a heightened focus on ecological sustainability, an upward trend in socially conscious investment, an increased demand for microfinance loans, as well as an overall rise in financial inclusion. Emerging trends within this period are predicted to feature aspects such as the implementation of cloud computing, the use of biometrics and digital identities, the introduction of microinsurance and parametric insurance, the inclusion of embedded payments and insurance, and the standardisation of digital proceedings.

View the full report here:

https://www.thebusinessresearchcompany.com/report/microfinance-global-market-report

What Drivers Are Propelling the Growth of Microfinance Market Forward?

The microfinance market's growth is anticipated to be spurred forward by the escalating number of small and medium-sized enterprises (SMEs). These are firms that are distinguished by their relatively smaller scale in terms of revenue, assets, and workforce size. A rise in entrepreneurial activity, advancements in technology that lower entry obstacles, favorable government regulations, and expanded global market reach are all contributing to the burgeoning number of SMEs. Microfinance plays a crucial role in supporting SMEs by providing them essential access to small loans and financial services, which assist in procuring capital, managing cash flow, and mitigating risk. For example, a report by Startups.co.uk, a UK platform that delivers online advice and resources, revealed that new SME establishments increased by 19.5% to 39,966 in 2023, a 6.5% rise from 2022. Whereas, overall incorporations saw a humble growth of 2% to 778,219 in 2022. As a result, the rising number of small and medium-sized enterprises (SMEs) is fuelling the expansion of the microfinance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18671&type=smp

Which Emerging Trends Are Transforming the Microfinance Market in 2025?

Leading firms in the microfinance market channel their efforts toward the creation of innovative solutions featuring technological developments, such as digital platforms. These advancements are meant to strengthen accessibility, enhance operations, and boost financial inclusion among sections of the community that lack these services. Digital platforms act as online systems that allow for interaction, connection, and trade of services, goods, or information between users. Besides, they make business transactions, communication, and content sharing a breeze. One related example is the Public Tech Platform for Frictionless Credit started by The Reserve Bank of India (RBI) in August 2023. This program is meant to streamline the delivery of credit by financial institutions to micro, small, and medium enterprises (MSMEs), which in turn promotes financial inclusion.

What Are the Key Segments in the Microfinance Market?

The microfinance market covered in this report is segmented -

1) By Service Type: Group And Individual Micro Credit, Leasing, Micro Investment Funds, Insurance, Savings And Checking Accounts, Other Service Types

2) By Providers: Banks, Micro Finance Institutions (MFI), NBFC (Non-Banking Financial Institutions), Other Provider

3) By Purpose: Agriculture, Manufacturing Or Production, Trade And Services, Household, Other Purposes

4) By End-Users: Small Enterprises, Micro Enterprises, Solo Entrepreneurs Or Self-Employed

Subsegments:

1) By Group And Individual Micro Credit: Group Lending Programs Or Individual Micro Loans

2) By Leasing: Equipment Leasing Or Vehicle Leasing Or Real Estate Leasing

3) By Micro Investment Funds: Equity Funds Or Debt Funds Or Hybrid Funds

4) By Insurance: Micro Life Insurance Or Micro Health Insurance Or Micro Property Insurance

5) By Savings And Checking Accounts: Micro Savings Accounts Or Micro Checking Accounts

6) By Other Service Types: Remittance Services Or Payment Solutions Or Financial Literacy Programs

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=18671&type=smp

Who Are the Key Players Shaping the Microfinance Market's Competitive Landscape?

Major companies operating in the microfinance market are Bank Rakyat Indonesia (BRI), Oliver Wyman Group, Bandhan Bank Limited, LendingClub Corporation, ASA International Group PLC, Accion International, Annapurna Finance Private Limited, PRASAC Microfinance Institution Ltd., Prosper Marketplace Inc, Madura Microfinance Ltd., Compartamos Banco, Pro Mujer International, Oikocredit International, Ujjivan Financial Services, Fundación Génesis Empresarial (FGE), Kiva Microfunds, Gojo & Company Inc., FINCA International, Fonkoze Financial Services S.A., Cashpor Micro Credit, Opportunity International, BSS Microfinance Limited, Asirvad Microfinance Limited

What Geographic Markets Are Powering Growth in the Microfinance Market?

Asia-Pacific was the largest region in the microfinance market in 2024, and is expected to be the fastest-growing region in the forecast period. The regions covered in the microfinance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18671

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Increasing Number Of SMEs Is Driving The Growth Of The Microfinance: Pivotal Factor Influencing Microfinance Market Growth in 2025 here

News-ID: 4137825 • Views: …

More Releases from The Business Research Company

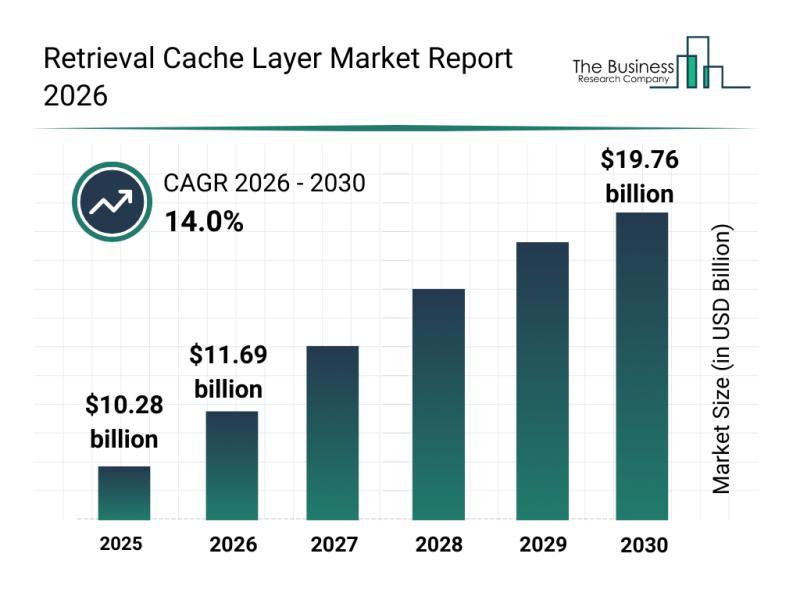

Competitive Analysis: Leading Companies and New Entrants in the Retrieval Cache …

Understanding the future potential of the retrieval cache layer market reveals exciting growth possibilities driven by advancements in technology and increasing industry demands. This sector is set to evolve significantly as companies innovate and expand their capabilities to meet the rising needs of AI workloads, edge computing, and real-time data processing. Let's explore the market size projections, key players, emerging trends, and market segmentation to get a comprehensive view of…

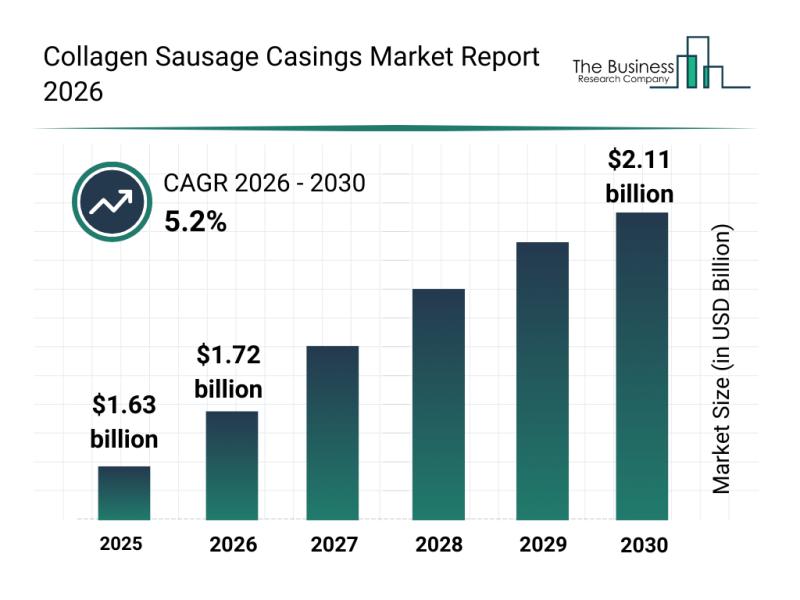

In-Depth Examination of Segments, Industry Trends, and Key Players in the Collag …

The collagen sausage casings market is positioned for significant expansion as consumer preferences and industry practices evolve. Growing demand for convenience foods and advancements in production methods are playing key roles in shaping this sector's future. Let's explore the current market size, leading players, trending innovations, and major segments that define the collagen sausage casings landscape.

Projected Market Size and Growth for Collagen Sausage Casings

The collagen sausage casings market…

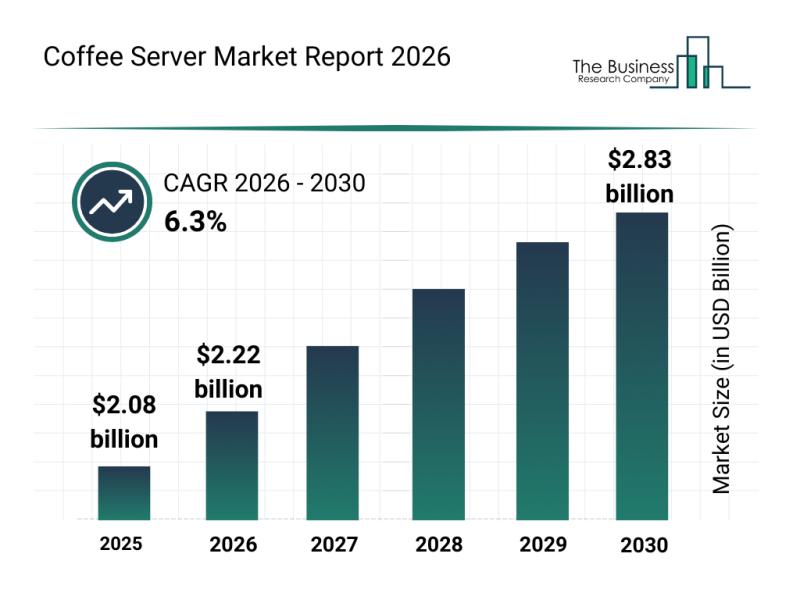

Leading Companies Fueling Growth and Innovation in the Coffee Server Market

The coffee server market is on track for impressive expansion over the coming years, driven by evolving consumer preferences and industry innovations. As coffee culture continues to thrive globally, the need for functional, stylish, and sustainable coffee serving solutions is becoming increasingly important. Let's explore the market size, leading players, emerging trends, and key segments shaping the future of the coffee server industry.

Forecasting the Coffee Server Market Growth and Size…

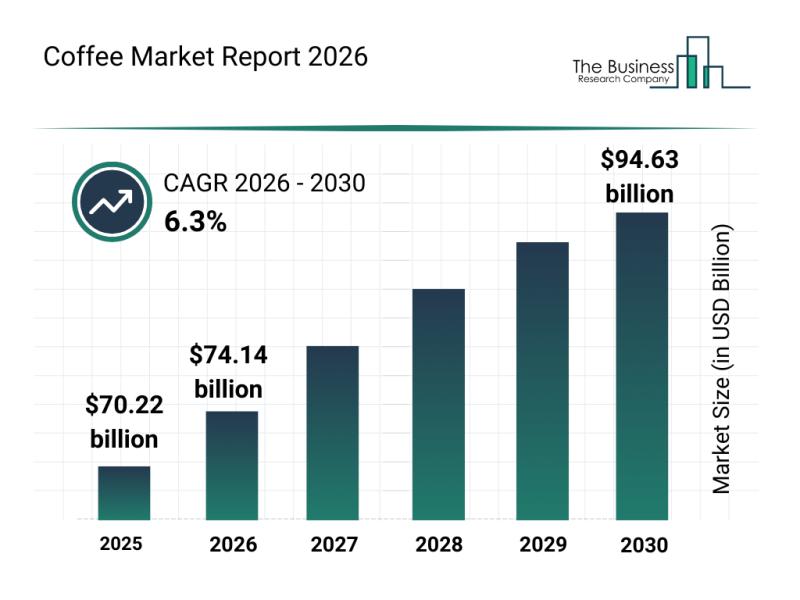

Key Strategic Developments and Emerging Changes Shaping the Coffee Market Landsc …

The coffee industry is on track for substantial growth, driven by evolving consumer preferences and innovative product developments. As coffee continues to hold a vital place in daily routines globally, the market is adapting to meet new demands and broaden its appeal. Let's explore the projected market size, key players, emerging trends, and detailed segments that define the coffee sector's trajectory.

Forecasted Expansion and Market Size of the Coffee Market by…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…