Press release

Crop Insurance Market Projected to Reach USD 100.69 Billion by 2030, Driven by Climate Risks and Expanding Subsidy Programs

Mordor Intelligence has published a new report on the "Crop Insurance Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction

The global Crop Insurance Market is gaining momentum as climate unpredictability, farm income volatility, and expanding government interventions encourage the adoption of financial risk mitigation tools across the agriculture sector. In 2025, the market is valued at USD 52.28 billion and is anticipated to grow to USD 100.69 billion by 2030, reflecting a robust compound annual growth rate (CAGR) of 11.23%.

Farmers globally are under increasing pressure from erratic weather patterns, pest outbreaks, and rising input costs. Crop insurance has become a central pillar in stabilizing farmer incomes and ensuring food production continuity. Whether backed by governments or private insurers, crop insurance mechanisms are now viewed not only as financial products but as essential safeguards for sustainable farming. The expansion of distribution channels, including digital platforms and rural banking networks, is also helping extend crop insurance access to millions of underserved smallholder farmers.

Report Overview: https://www.mordorintelligence.com/industry-reports/crop-insurance-market?utm_source=openpr

Key Trends

1. Climate Volatility as a Primary Risk Factor

Climate unpredictability is one of the leading factors driving the crop insurance market. With farming operations facing frequent disruptions due to floods, droughts, storms, and unseasonal weather events, the financial impact on crop yields is escalating. This uncertainty has made farmers more reliant on insurance schemes to safeguard their output and income. Climate risk modeling and data-driven underwriting are becoming core components of crop insurance product development.

2. Government Subsidies Expanding Market Coverage

Subsidized premiums are playing a crucial role in increasing adoption. In many countries, governments are partnering with private insurers to co-fund crop insurance programs. Such schemes make coverage more affordable, especially for smallholder and medium-scale farmers. Notably, Asia-Pacific markets such as India and China have implemented large-scale government-supported programs that have significantly improved penetration rates in rural areas.

3. Growth in Index-Based and Parametric Insurance Products

As the market evolves, there is a growing preference for parametric insurance models where claims are triggered by predefined indices such as rainfall volume or temperature levels. These products reduce delays in claim settlement and lower administrative costs. Index-based models are particularly suited to remote or low-infrastructure areas, where traditional claim verification processes may be time-consuming or impractical.

4. Rising Role of Technology in Insurance Distribution

Digital platforms and remote sensing tools are transforming how crop insurance is delivered. Mobile-based applications now enable farmers to purchase policies, receive notifications, and initiate claims remotely. Additionally, satellite imagery and geospatial data are being used for real-time monitoring, underwriting, and post-disaster assessment. This has made policy administration more efficient and transparent.

5. Increased Focus on Smallholder Inclusion

Efforts to improve the financial inclusion of small-scale farmers are intensifying. These farmers are often the most vulnerable to climate shocks yet the least likely to be insured. Insurance providers are developing micro-insurance products with simplified structures and low premiums. Government and NGO interventions are also helping build awareness and trust in formal risk transfer tools among these groups.

6. Expansion of Multi-Peril Crop Insurance (MPCI)

Multi-peril coverage is becoming more common as farmers seek protection from a broad range of risks rather than single-event policies. MPCI products typically cover drought, flood, disease, and pest attacks, and are particularly attractive in regions where agricultural risks are interlinked. Insurers are increasingly offering customizable plans to cater to varying needs based on crop type, geography, and farm size.

7. Integration of Banks and Agri-Credit Institutions in Distribution

Banks and agricultural credit institutions are playing a significant role in expanding the reach of crop insurance. Bundling insurance with farm loans ensures that financial institutions are protected while enabling farmers to access credit with more confidence. This model is proving especially effective in developing markets where rural banking networks are well established.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/crop-insurance-market?utm_source=openpr

Market Segmentation

The Crop Insurance Market is segmented across several parameters, each reflecting diverse risk profiles, insurance needs, and delivery mechanisms across global agricultural systems.

By Insurance Type:

Multi-Peril Crop Insurance (MPCI): Covers multiple risks including weather, pests, and disease.

Actual Production History (APH): Based on a farmer's historical yield data to determine the level of protection.

Others: Includes yield index, weather index, and revenue-based models.

By Risk Covered:

Sowing/Germination Failure: Provides compensation if crops fail to establish due to early-season drought or flood.

Standing-Crop Loss: Covers damage during the crop's growth period from weather events or pests.

Post-Harvest and Localized Calamities: Includes coverage for damage after harvest or due to specific localized disasters.

By Distribution Channel:

Banks and Ag-Credit Institutions: Act as intermediaries, bundling insurance with agricultural loans.

Direct: Policies purchased directly from insurers via websites, mobile platforms, or field offices.

Others: Includes brokers, cooperatives, and rural agents.

By Provider Type:

Public/Government Providers: Operate under national schemes or as government-run agencies.

Private Providers: Commercial insurers offering standalone or customized policies.

Others: Includes NGOs and hybrid public-private ventures.

By Crop Type:

Cereals & Grains: Rice, wheat, maize, and others form the bulk of insurance demand globally.

Fruits & Vegetables: High-value crops often require specialized coverage.

Commercial Crops: Includes sugarcane, cotton, coffee, and others prone to climate sensitivity.

By Farm Size:

Smallholder Farms: Typically require low-premium, low-coverage micro-insurance products.

Medium Farms: Often participate in subsidized schemes or bundled insurance-credit models.

Large Farms: Tend to opt for customized, high-value commercial insurance policies.

By Region:

North America: A mature market with strong government frameworks like the US Federal Crop Insurance Program.

Asia-Pacific: Fastest-growing region due to large farming populations and expanding subsidy programs.

Europe: Adoption driven by Common Agricultural Policy (CAP) funds and climate-smart agriculture initiatives.

Latin America & Middle East and Africa: Emerging regions with growing interest in index-based and risk-transfer solutions for farmers.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players

Several leading insurers are actively involved in expanding the reach, depth, and flexibility of crop insurance across key markets. The competition includes government-linked entities and large international commercial providers:

PICC (People's Insurance Company of China): A dominant player in China's agriculture insurance space, operating under government-backed subsidy frameworks.

Chubb Ltd.: Offers comprehensive agricultural insurance products across North and South America, with a focus on multi-peril coverage.

QBE Insurance Group: Based in Australia, QBE provides a wide range of agricultural insurance solutions, including parametric models and farm revenue coverage.

Tokio Marine HCC: Active in North America and Europe, offering specialized insurance products for crop, livestock, and farm operations.

Zurich Insurance Group: A key player in global crop insurance, leveraging technology-driven assessment tools and sustainable agriculture risk models.

These companies are investing in digitalization, risk assessment models, and strategic partnerships to enhance outreach and product accuracy, especially in underinsured regions.

Explore more insights on Crop Insurance Market competitive landscape: https://www.mordorintelligence.com/industry-reports/crop-insurance-market/companies?utm_source=openpr

Conclusion

The Crop Insurance Market is undergoing significant expansion as farmers increasingly turn to insurance to mitigate growing climate and financial risks. Government subsidies, public-private partnerships, and digital tools are making crop insurance more accessible across different geographies and farm sizes. As global agriculture confronts the twin challenges of climate uncertainty and income volatility, crop insurance continues to serve as a vital risk management mechanism supporting both farmers and food systems. The next few years are likely to see greater innovation, improved coverage models, and deeper integration with credit and rural development programs.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/crop-insurance-market?utm_source=openpr

Industry Related Reports

Travel Insurance Market: The Global Travel Insurance Market Report is Segmented by Cover Type (Single-Trip Travel Insurance, Annual Multi-Trip Travel Insurance, and More), Distribution Channel (Insurance Companies, Insurance Intermediaries, and More), End User/Traveller Type (Family Travellers, Business Travellers, and More), and Geography (North America, Europe, Asia-Pacific, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/travel-insurance-market?utm_source=openpr

United States Health And Medical Insurance Market: The US Health and Medical Insurance Market is Segmented by Coverage Type (Employer-Sponsored, Individual (ACA / Non-Group), and More), Plan Type (HMO, PPO, EPO, and More), Insurance Type (Major Medical (Comprehensive), Medicare Supplement, and More), Distribution Channel (Direct To Consumer, Brokers & Agents, and More), and Region (Northeast, Midwest, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-health-and-medical-insurance-market?utm_source=openpr

United States Motor Insurance Market: The United States Motor Insurance Market is Segmented by Coverage Type (Liability, Collision, Comprehensive, Personal Injury Protection (PIP) and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Motorcycles, and More), Policy Type (Commercial, Personal), Distribution Channel (Agency, Direct, Bancassurance, and More), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/united-sates-motor-insurance-market?utm_source=openpr

US Dental Insurance Market: The US Dental Insurance Market report segments the industry into By Coverage (Dental Health Maintenance Organizations, Dental Preferred Provider Organizations, Dental Indemnity Plans, Dental Exclusive Provider Organizations, Dental Point Of Service), By Procedure (Preventive, Major, Basic), By Industries (Chemicals, Refineries, Metal And Mining, Food And Beverages, Others), and By Demographics (Senior Citizens, Adults, Minors).

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-dental-insurance-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crop Insurance Market Projected to Reach USD 100.69 Billion by 2030, Driven by Climate Risks and Expanding Subsidy Programs here

News-ID: 4137366 • Views: …

More Releases from Mordor Intelligence

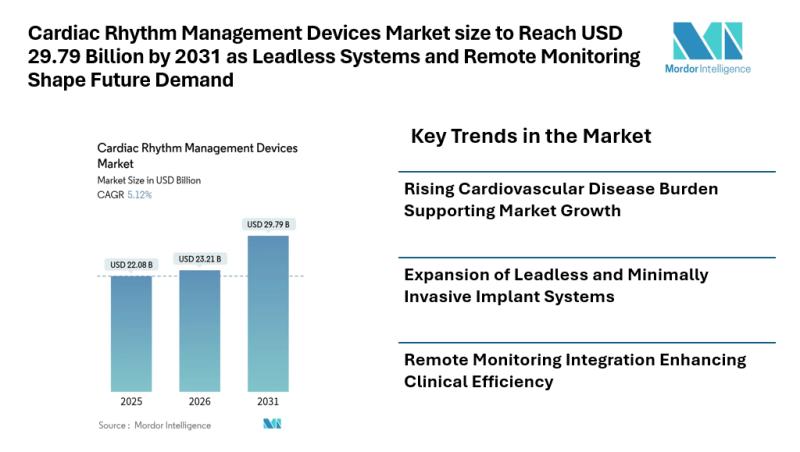

Cardiac Rhythm Management Devices Market size to Reach USD 29.79 Billion by 2031 …

Mordor Intelligence has published a new report on the cardiac rhythm management devices market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Cardiac Rhythm Management Devices Market Overview

According to Mordor Intelligence, the cardiac rhythm management devices market is set to expand from USD 22.08 billion in 2025 to USD 23.21 billion in 2026 and is projected to reach USD 29.79 billion by 2031, registering a…

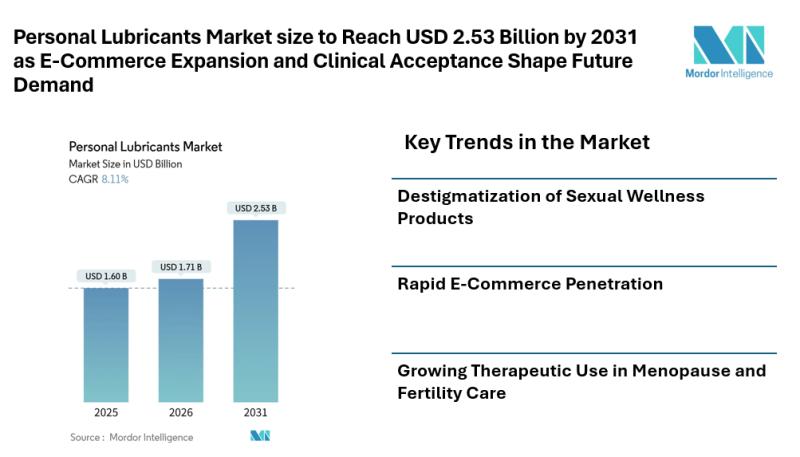

Personal Lubricants Market size to Reach USD 2.53 Billion by 2031 as E-Commerce …

Mordor Intelligence has published a new report on the personal lubricants market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the personal lubricants market size is estimated at USD 1.71 billion in 2026 and is projected to reach USD 2.53 billion by 2031, registering a CAGR of 8.11% during the forecast period. These steady personal lubricants market growth reflects wider…

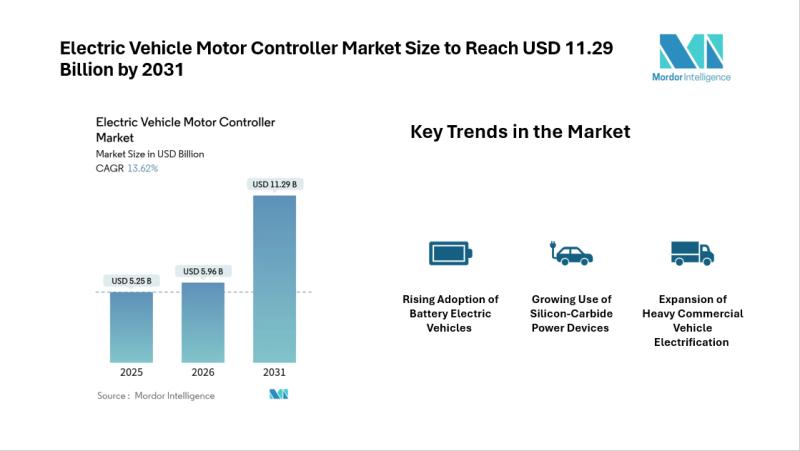

Electric Vehicle Motor Controller Market Size to Reach USD 11.29 Billion by 2031 …

Electric Vehicle Motor Controller Market Overview

According to Mordor Intelligence, the electric vehicle motor controller market size is projected to reach USD 11.29 billion by 2031, growing from USD 5.96 billion in 2026 at a CAGR of 13.62% during the forecast period. The electric vehicle motor controller market forecast reflects steady expansion supported by stricter emission regulations, rising battery electric vehicle adoption, and the increasing use of silicon-carbide power devices.…

Beverage Market Size to Reach USD 2.67 Trillion by 2031, Driven by Health and Su …

Introduction: Beverage Market Growth Outlook

According to a research report by Mordor Intelligence, the global Beverage Market is projected to grow from an estimated USD 2.03 trillion in 2026 to USD 2.67 trillion by 2031, reflecting a steady CAGR of 5.65% over the forecast period. This growth is supported by increasing consumer awareness around health, wellness, and sustainable consumption, along with the rising demand for premium and functional beverages. Non-alcoholic…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…