Press release

Insurance Aggregators Industry Outlook 2025-2029: Market Set to Cross $106.24 Billion Milestone

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Insurance Aggregators Market Size By 2025?

In recent years, the size of the insurance aggregators market has witnessed a major surge, rising from $35.73 billion in 2024 to an anticipated $44.53 billion in 2025, showing a compound annual growth rate (CAGR) of 24.6%. This significant growth rate during the past several years can be ascribed to a variety of factors such as the growth in the number of aggregators and digital brokers, heightened internet usage, growing influence of digital platforms, and the increase in healthcare spending.

How Big Is the Insurance Aggregators Market Size Expected to Grow by 2029?

Expectations are high for a substantial expansion in the insurance aggregators market size in the forthcoming years, projecting it to reach $106.24 billion by 2029, fueled by a compound annual growth rate (CAGR) of 24.3%. This momentum in the forecast period can be traced back to factors like the rise in customer behavior analysis to enhance business outcomes, increasing count of aggregators and digital brokers, growth in internet usage, amplified digital influence, and enhanced ability to make decisions. Essential trends to look out for during the forecast period encompass the deployment of analytic solutions, utilization of business intelligence (BI) tools, a system hinged on comparative quotes, and widened advertising for better visibility.

View the full report here:

https://www.thebusinessresearchcompany.com/report/insurance-aggregators-global-market-report

Which Key Market Drivers Powering Insurance Aggregators Market Expansion and Growth?

The influx of digital brokers is expected to stimulate the growth of the insurance aggregator market. Digital brokers are firms or platforms that employ technology to expedite the transaction of financial assets such as stocks, bonds, commodities, currencies, among other securities. Triggered by the need for insurance aggregators, these brokers heighten market competition by offering the best prices and unique deals from insurance companies, thus effectively enthralling and keeping clients. To amplify their services, insurance aggregators engage digital brokers, who command sophisticated broker capabilities and robo-advisor properties, to provide consumers with an extensive range of products. For instance, as per The Insurance Business, a Canadian publication in the insurance field, the average growth for the fifteen Fast Brokerages surged 144% in the last two years by March 2024. Meanwhile, the four Fast Starters, being in operation for three years or less, achieved an average growth rate of 452%. Therefore, the ever-growing number of digital brokers is spearheading the expansion of the insurance aggregator market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16712&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Insurance Aggregators Market?

Top firms functioning in the insurance aggregator market are emphasizing the incorporation of advanced technologies such as AI-enabled health insurance schemes to improve customization and comparison capabilities, thus refining the consumer experience. An AI-infused health insurance plan operates through leveraging artificial intelligence in enhancing areas like risk evaluation, processing of claims, tailored suggestions, detection of fraud, as well as in customer service. For example, ICICI Lombard, an insurance entity based in India, introduced 'Elevate' in July 2024. This health insurance scheme by ICICI Lombard provides customized protection with aspects such as infinite insurance coverage, unlimited claim submissions, and reduced waiting intervals for pre-existing health conditions. It employs AI technology for proficient claim processing and also incorporates wellness schemes for endorsing a healthy lifestyle. The primary goal of Elevate is to offer a comprehensive financial shield and lessen the burden associated with managing healthcare expenses.

What Are the Emerging Segments in the Insurance Aggregators Market?

The insurance aggregators market covered in this report is segmented -

1) By Insurance Type: Life Insurance, Automotive Insurance, Health Insurance, Other Insurance Types

2) By Enterprise Type: Lead Generators, Call-Center Agencies, Digital Agencies

3) By Enterprise Size: Large Enterprise, Small And Medium Enterprises (SMEs)

4) By Distribution Channel: Online, Offline

Subsegments:

1) By Life Insurance: Term Life Insurance, Whole Life Insurance, Endowment Policies, Universal Life Insurance

2) By Automotive Insurance: Vehicle Insurance, Collision Insurance, Comprehensive Coverage, Liability Insurance

3) By Health Insurance: Individual Health Insurance, Family Health Insurance, Critical Illness Insurance, Dental and Vision Insurance

4) By Other Insurance Types: Travel Insurance, Property Insurance, Pet Insurance, Business Insurance, Homeowners Insurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=16712&type=smp

Who Are the Global Leaders in the Insurance Aggregators Market?

Major companies operating in the insurance aggregators market are InsuranceDekho Services Private Limited, One97 Communications Limited, Acko General Insurance Limited, TurtleMint Technologies Private Limited, CHECK24 Vergleichsportal GmbH, Go Digit General Insurance Limited, The Zebra Insurance Services LLC, Gocompare.com Limited, Hippo Comparative Services (Pty) Ltd, Huize Holding Limited, OneInsure Online Solutions Private Limited, Policybazaar Insurance Web Aggregator Private Limited, RenewBuy Insurance Services Private Limited, Acierto.com S.L.U., Toffee Insurance Broking Private Limited, Rastreator.com Correduría de Seguros S.L.U., PolicyX.com Insurance Web Aggregator Private Limited, Insurify Insurance Services Inc., LesFurets.com SAS, Covernest Insurance Web Aggregator Private Limited, Singsaver Insurance Brokers Pte. Ltd., GoBear Limited, LeLynx SAS, MoneyHero Insurance Brokers Limited, SureHits LLC, Tarifcheck.de AG

Which are the Top Profitable Regional Markets for the Insurance Aggregators Industry?

North America was the largest region in the insurance aggregators market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the insurance aggregators market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16712

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Aggregators Industry Outlook 2025-2029: Market Set to Cross $106.24 Billion Milestone here

News-ID: 4136298 • Views: …

More Releases from The Business Research Company

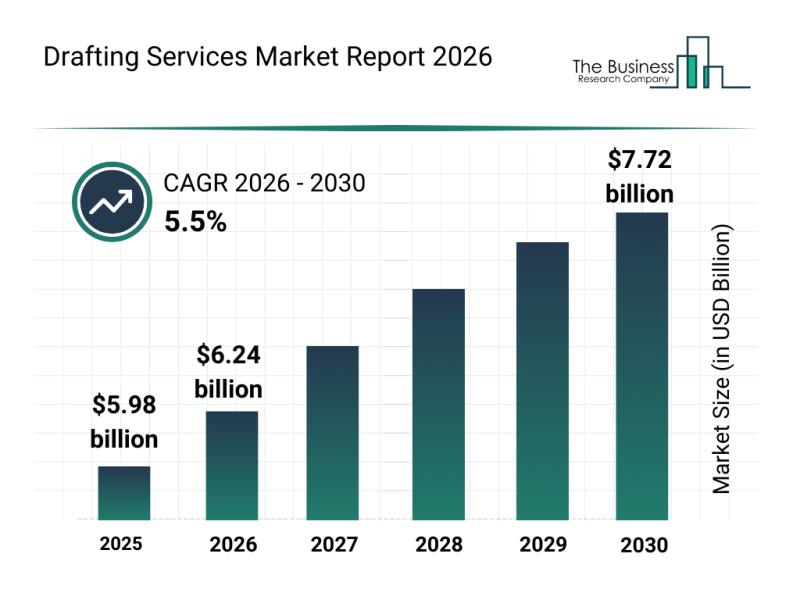

Future Perspective: Key Trends Shaping the Drafting Services Market Until 2030

The drafting services industry is poised for considerable expansion in the coming years as technological advancements and evolving construction needs drive demand. With a wide range of applications across sectors, this market is set to experience steady growth fueled by innovation and increasing adoption of digital tools. Let's explore the current market size, influential factors, key players, emerging trends, and segmentation in this dynamic field.

Projected Growth and Market Size of…

Emerging Sub-Segments Transforming the Digital Rights Management Market Landscap …

The digital rights management (DRM) market is positioned for remarkable expansion in the coming years, driven by technological advancements and increasing concerns over content security. As digital media consumption grows and new platforms emerge, DRM solutions are becoming essential to protect intellectual property and ensure the authorized use of digital assets. Let's explore the current market size, key players, prevailing trends, and the main segments shaping the future of this…

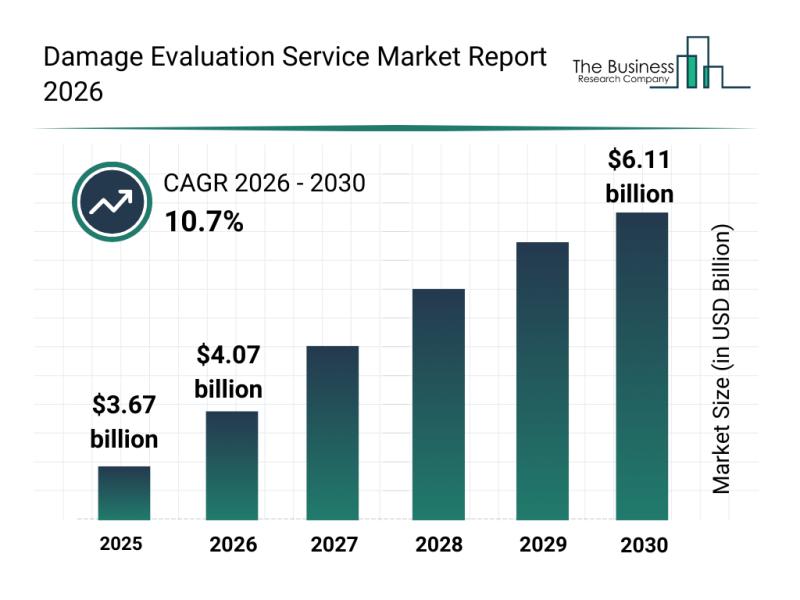

Market Trend Insights: The Impact of Recent Advances on the Damage Evaluation Se …

The damage evaluation service market is on the brink of substantial growth as advancements in technology and increasing demand for efficient damage assessment methods gain momentum. This sector is evolving rapidly with the integration of innovative tools and techniques that enhance accuracy and speed in evaluating damages across various industries.

Forecasted Market Size and Growth Trajectory of the Damage Evaluation Service Market

The damage evaluation service market is projected to…

Corporate Training Market: Segmentation Analysis, Market Trends, and Competitive …

The corporate training sector is on a path of significant growth as organizations increasingly recognize the importance of continuous employee development. With rapid technological advances and shifting workforce needs, this market is expected to expand steadily, driven by innovative solutions and evolving learning preferences. Below, we explore the market's size projections, key players, emerging trends, and segmentation insights to provide a comprehensive overview of the corporate training landscape.

Projected Growth and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…