Press release

Financial Protection Market Poised to Hit $89.18 Billion by 2029 with Accelerating Growth Trends

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Financial Protection Market Size Growth Forecast: What to Expect by 2025?

The market size for financial protection has seen robust growth in the past few years. Projected to increase from $65.29 billion in 2024 to $69.68 billion in 2025, it suggests a Compound Annual Growth Rate (CAGR) of 6.7%. Factors contributing to this growth during the historical period include regulatory changes, demographic trends, economic recessions, advances in technology, healthcare reforms, and a rise in consumer awareness about financial threats.

How Will the Financial Protection Market Size Evolve and Grow by 2029?

In the coming years, a substantial increase is projected in the financial protection market, predicted to reach a value of $89.18 billion in 2029, growing at a CAGR of 6.4%. Causes for this growth during the predicted period include the rapid digital evolution, escalating cyber threats, the rising implementation of parametric insurance, the development of ESG-focused products, the incorporation of AI in insurance procedures, and microinsurance expansion in developing markets. Some primary trends for this forecast period cover personalized insurance solutions based on big data analytics, an amplified focus on sustainable and ESG-aligned products, the integration of blockchain for secure transactions, increased offerings in parametric insurance, growth in cyber insurance for digital risk reduction, and the utilization of AI for improved customer interaction.

View the full report here:

https://www.thebusinessresearchcompany.com/report/financial-protection-global-market-report

What Drivers Are Propelling the Growth of Financial Protection Market Forward?

The expansion of the financial protection market can be attributed to the growing volume of digital financial transactions. These transactions, encompassing any financial activities conducted via digital platforms, such as online websites, mobile gadgets or other electronic channels, are witnessing an increase due to the widespread adoption of digital banking facilities. These services not only provide increased convenience, accessibility, and efficiency, but also ensure the robust security of digital financial transactions through the implementation of sophisticated algorithms designed to thwart fraudulent activities. For example, in March 2024, global registered mobile money accounts for GSM Association, a non-profit industry group based in the UK, reached 1.75 billion, indicating a 12% rise from 2022. Mobile money services saw their total transaction volume skyrocket to 85 billion, equating to a 23% year-on-year increase. Furthermore, the average revenue per user in the mobile money sector witnessed a significant jump, climbing from $2.2 in September 2022 to $3.2 by June 2023, marking a 40% rise. This growth underscores an industry shift towards more frequent, smaller transactions. Consequently, the burgeon in digital financial transactions serves as a key factor propelling the growth of the financial protection market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18610&type=smp

Which Emerging Trends Are Transforming the Financial Protection Market in 2025?

Leading firms in the financial protection industry are creating unique solutions like integrated financial protection plans to upgrade consumer experience, simplify procedures, and provide extensive coverage that caters to a range of financial risks and requirements. An integrated financial protection plan consolidates various financial security measures including insurance, investment, and risk management into a single offering. For instance, Guardian Life Insurance Company, a company situated in the United States, launched SafeGuard360 in February 2023. It delivers a broad range of insurance options to accommodate different needs such as life insurance, disability income insurance, and coverage for serious illnesses. This comprehensive approach guarantees that policyholders have a backup in several sectors of their financial existence. The main mission of SafeGuard360 is to secure the financial futures of the policyholders and their families, providing comfort during challenging times in their lives.

What Are the Key Segments in the Financial Protection Market?

The financial protection market covered in this report is segmented -

1) By Type: Long Term Financial Protection, Short Term Financial Protection

2) By Policy Coverage: Payment Protection, Mortgage Payment Protection

3) By End-Users: Men, Women

Subsegments:

1) By Long Term Financial Protection: Life Insurance, Long-Term Disability Insurance, Retirement Plans (Pensions, Annuities), Critical Illness Insurance, Permanent Health Insurance, Long-Term Care Insurance

2) By Short Term Financial Protection: Short-Term Disability Insurance, Short-Term Health Insurance, Accidental Death And Dismemberment (Ad And D) Insurance, Temporary Income Protection Plans, Travel Insurance (Emergency Medical, Trip Cancellation), Unemployment Insurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=18610&type=smp

Who Are the Key Players Shaping the Financial Protection Market's Competitive Landscape?

Major companies operating in the financial protection market are Ping An Insurance (Group) Company of China Ltd., Cigna Corporation, Allianz SE, MetLife Inc., Dai-ichi Life Holdings Inc., China Pacific Insurance (Group) Co. Ltd., Nationwide Mutual Insurance Company, Prudential Financial Inc., American International Group, Tokio Marine Holdings Inc., Zurich Insurance Group, Sompo Holdings Inc., Mapfre S.A., Hartford Financial Services Group Inc., AIA Group Limited, Aflac Incorporated, Lincoln National Corporation, Sun Life Financial Inc., Principal Financial Group, Samsung Life Insurance, Manulife Financial Corporation, FWD Group, Great-West Lifeco Inc., Legal & General Group plc, Standard Life Aberdeen plc, Aviva plc

What Geographic Markets Are Powering Growth in the Financial Protection Market?

North America was the largest region in the financial protection market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the financial protection market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18610

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Protection Market Poised to Hit $89.18 Billion by 2029 with Accelerating Growth Trends here

News-ID: 4134814 • Views: …

More Releases from The Business Research Company

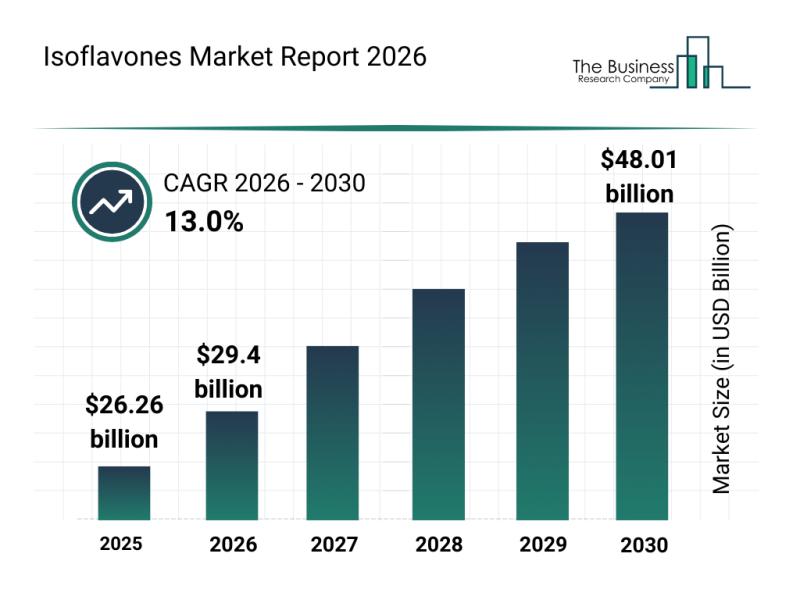

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

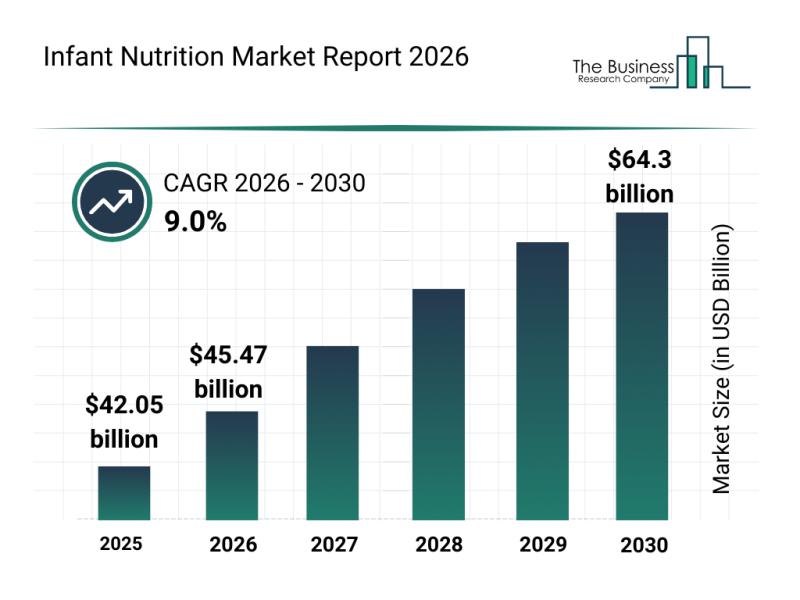

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

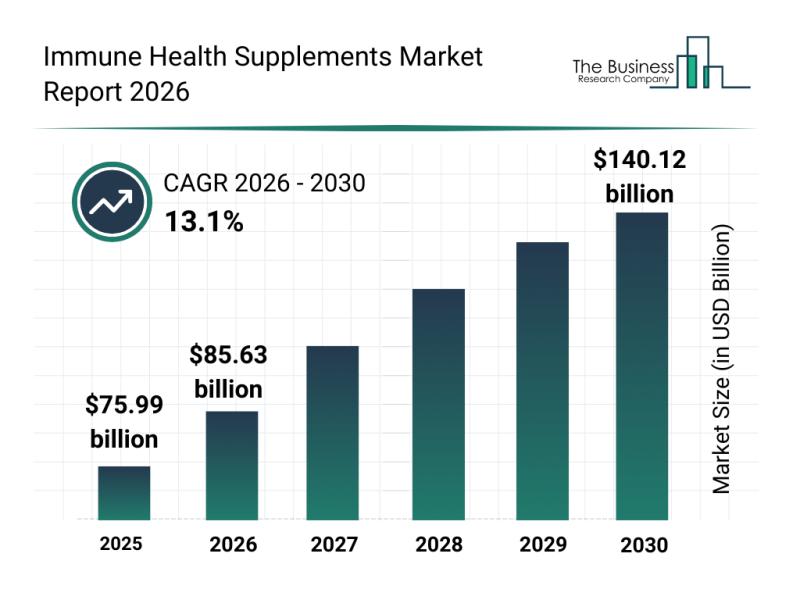

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

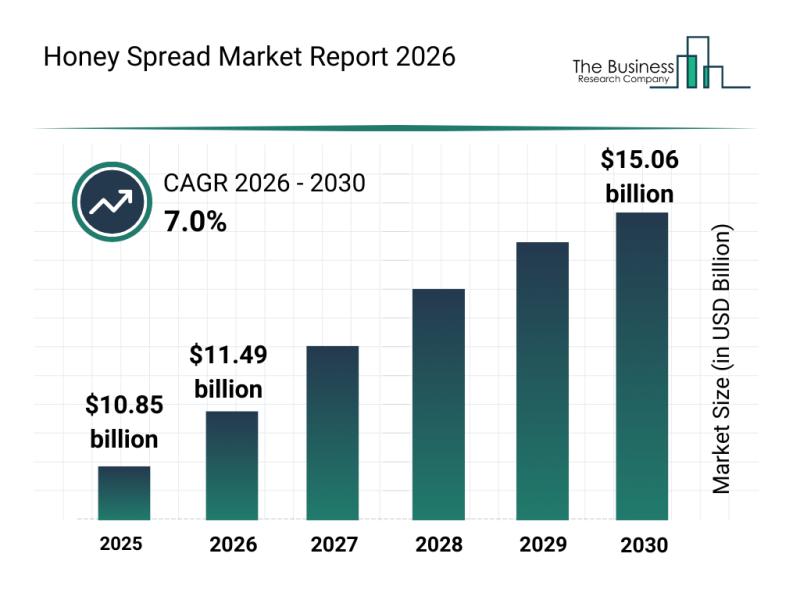

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…