Press release

Global Financial Leasing Services Market Projected to Grow at 10.5% CAGR, Reaching $365.74 Billion by 2029

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Financial Leasing Services Industry Market Size Be by 2025?

In recent times, the market size for financial leasing services has experienced rapid expansion. The sector, valued at $221.11 billion in 2024, is forecasted to further increase to $245.05 billion in 2025, demonstrating a compound annual growth rate (CAGR) of 10.8%. Factors contributing to this growth during the historical period include economic growth, taxation benefits, effectiveness in asset utilization, specific industry demands, and a heightened emphasis on risk management.

What's the Long-Term Growth Forecast for the Financial Leasing Services Market Size Through 2029?

In the coming years, the financial leasing services market size is anticipated to experience swift expansion, increasing to a value of $365.74 billion by 2029, with a compound annual growth rate (CAGR) of 10.5%. The predicted growth during this period is largely due to factors such as sustainability efforts, green initiatives, augmented infrastructure investments, urbanization and the emergence of smart cities, optimization of the global supply chain, and the growing preference for asset-light models. Key trends to observe during this forecast period would include the rise of digital transformation and automation, the widening scope of fintech solutions, increased leasing by small and medium-sized enterprises, the advent of circular economy practices, and an increased focus on customization and personalization.

View the full report here:

https://www.thebusinessresearchcompany.com/report/financial-leasing-services-global-market-report

What Are the Key Growth Drivers Fueling the Financial Leasing Services Market Expansion?

The rise in the number of small to medium-sized businesses is anticipated to stimulate the expansion of the financial leasing services sector. SMEs, as they are often referred to, are enterprises that have a certain cap on the number of workers and revenue, with these caps varying depending on the guidelines or standards set by individual countries or organisations. The population of such businesses is on the rise, largely due to an increase in entrepreneurial undertakings and favourable policies that promote the development and innovation of these businesses. Financial leasing services provide these SMEs the means to obtain necessary machinery and assets in a way that lessens the burden of initial expenses and enhances the handling of cash flow. For instance, in May 2024, data from the House of Commons Library, a governmental organization in the UK, showed an increase in the number of private-sector businesses in the country, from 5,509 in 2022 to 5,555 in 2023. This development indicates a growth of 46 enterprises, symbolising a moderate yet encouraging development in the growth of the private sector throughout the year. Hence, the rising population of SMEs is fuelling the growth in the financial leasing services market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18609&type=smp

What Are the Key Trends Driving Financial Leasing Services Market Growth?

Prominent companies in the financial leasing services market are concentrating on strategic alliances to create innovative leasing solutions customized for big and medium-sized corporations. These partnerships provide these companies an opportunity to take advantage of each other's skills, expand service provisions and enhance access to specialized financing alternatives. For example, Eaton, a company based in the U.S. that focuses on smart power management solutions, teamed up with BNP Paribas Leasing Solutions in April 2024. The objective of this partnership is to present custom financing solutions that aid businesses in shifting towards environmentally friendly energy practices without compromising the cash flow. This cooperation will secure access to finance for critical infrastructure such as energy storage and electric vehicle charging stations; thereby offering businesses avenues to cut down energy expenses and boost operational continuity.

How Is the Financial Leasing Services Market Segmented?

The financial leasing services market covered in this report is segmented -

1) By Type: Capital Lease, Operating Lease, Other Types

2) By Provider: Banks, Non-Banks

3) By Application: Transportation, Aviation, Information Technology (IT) And Telecommunication, Manufacturing, Healthcare, Construction, Other Applications

Subsegments:

1) By Capital Lease: Direct Capital Lease, Sale And Leaseback Agreements, Leveraged Lease, Finance Lease, Synthetic Lease

2) By Operating Lease: Short-term Operating Lease, Long-Term Operating Lease, Equipment Leasing, Vehicle Leasing, Real Estate Leasing

3) By Other Types: Leaseback Financing, Sub-Leasing, Cross-Border Leasing, Synthetic Lease, Tax-Lease Financing

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=18609&type=smp

Which Companies Are Leading the Charge in Financial Leasing Services Market Innovation?

Major companies operating in the financial leasing services market are JPMorgan Chase & Co, Bank of America Corporation, Banco Santander S.A, Wells Fargo & Company, Siemens AG, Citigroup Inc, International Business Machines Corporation, Royal Bank Of Canada, HSBC Holdings plc, Barclays plc, Société Générale Equipment Finance, U.S. Bancorp, Nordea Bank AB, KBC Lease, Bank of Beijing Co. Ltd., ABN AMRO Bank N.V., First American Equipment Finance, Macquarie Equipment Finance LLC, General Electric Capital Corporation, De Lage Landen International B.V., Deutsche Leasing AG, Crédit Agricole Leasing & Factoring, Hannover Leasing GmbH & Co. KG, BNP Paribas Lease Group S.A.

Which Regions Are Leading the Global Financial Leasing Services Market in Revenue?

North America was the largest region in the financial leasing services market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the financial leasing services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18609

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Financial Leasing Services Market Projected to Grow at 10.5% CAGR, Reaching $365.74 Billion by 2029 here

News-ID: 4134395 • Views: …

More Releases from The Business Research Company

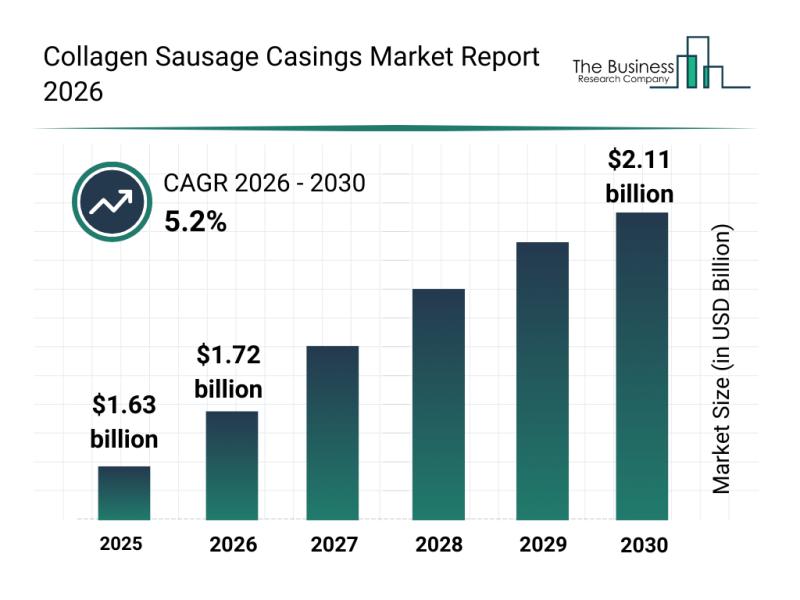

In-Depth Examination of Segments, Industry Trends, and Key Players in the Collag …

The collagen sausage casings market is positioned for significant expansion as consumer preferences and industry practices evolve. Growing demand for convenience foods and advancements in production methods are playing key roles in shaping this sector's future. Let's explore the current market size, leading players, trending innovations, and major segments that define the collagen sausage casings landscape.

Projected Market Size and Growth for Collagen Sausage Casings

The collagen sausage casings market…

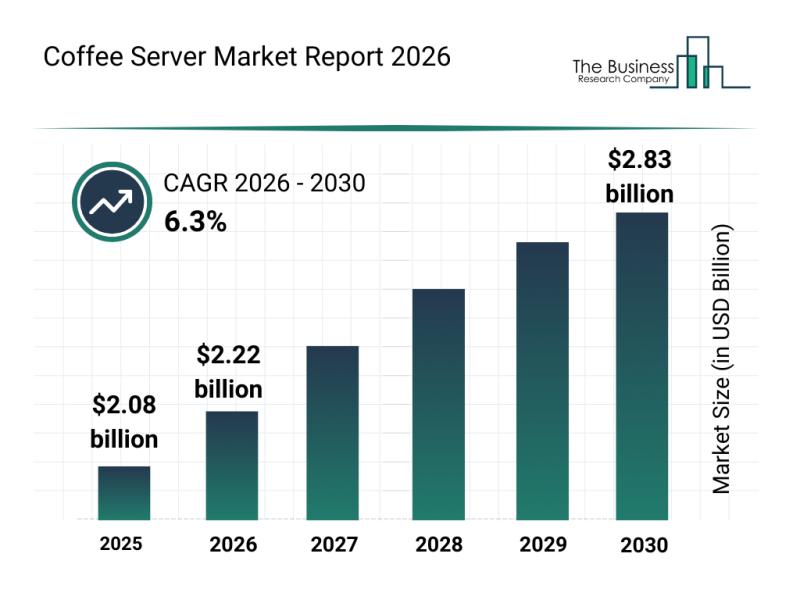

Leading Companies Fueling Growth and Innovation in the Coffee Server Market

The coffee server market is on track for impressive expansion over the coming years, driven by evolving consumer preferences and industry innovations. As coffee culture continues to thrive globally, the need for functional, stylish, and sustainable coffee serving solutions is becoming increasingly important. Let's explore the market size, leading players, emerging trends, and key segments shaping the future of the coffee server industry.

Forecasting the Coffee Server Market Growth and Size…

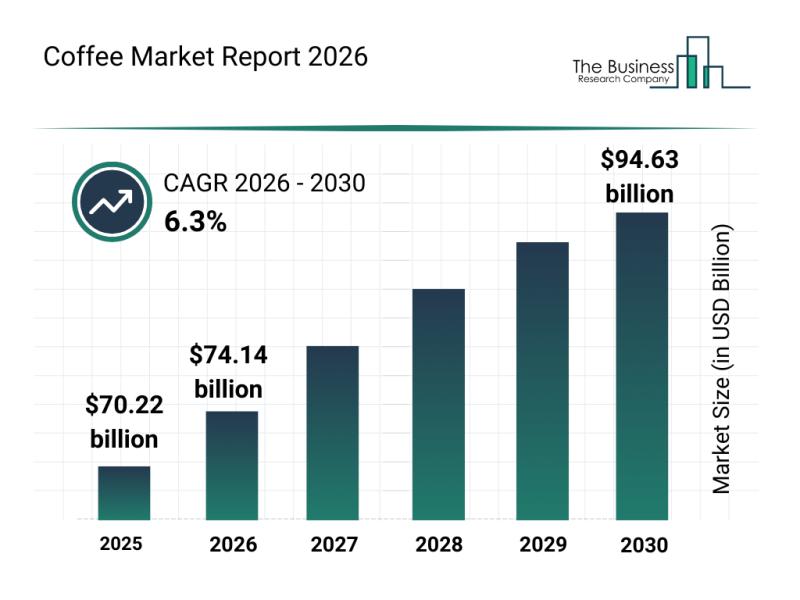

Key Strategic Developments and Emerging Changes Shaping the Coffee Market Landsc …

The coffee industry is on track for substantial growth, driven by evolving consumer preferences and innovative product developments. As coffee continues to hold a vital place in daily routines globally, the market is adapting to meet new demands and broaden its appeal. Let's explore the projected market size, key players, emerging trends, and detailed segments that define the coffee sector's trajectory.

Forecasted Expansion and Market Size of the Coffee Market by…

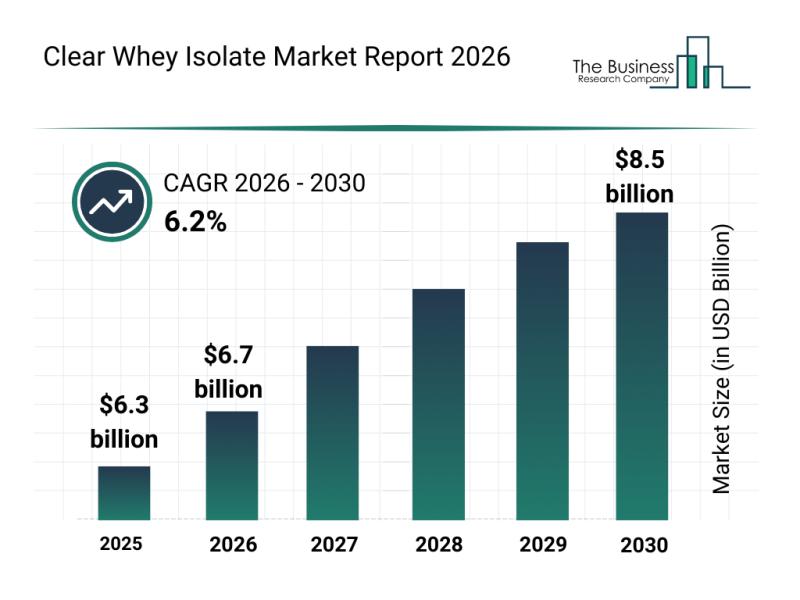

In-Depth Examination of Segments, Industry Developments, and Key Competitors in …

The clear whey isolate market is gaining significant traction as consumers increasingly seek high-quality protein options with clean labels and functional benefits. This market is set to experience notable growth driven by innovation in product formats and a growing preference for healthier nutrition solutions. Below, we explore the market outlook, key players, emerging trends, and segment dynamics shaping this industry's future.

Strong Growth Expected for the Clear Whey Isolate Market by…

More Releases for Leasing

Financial Leasing Market: A Compelling Long-Term Growth Story | Minsheng Financi …

The latest 94+ page survey report on Financial Leasing Market is released by HTF MI covering various players of the industry selected from global geographies like North America, US, Canada, Mexico, Europe, Germany, France, U.K., Italy, Russia, Nordic Countries, Benelux, Rest of Europe, Asia, China, Japan, South Korea, Southeast Asia, India, Rest of Asia, South America, Brazil, Argentina, Rest of South America, Middle East & Africa, Turkey, Israel, Saudi Arabia,…

Financial Leasing Market 2019 Global Major Players: CDB Leasing, ICBC Financial …

The Global Financial Leasing Industry, 2019-2024 Market Research Report is a professional and in-depth study on the current state of the Global Financial Leasing industry with a focus on the Global market. The report provides key statistics on the market status of the Financial Leasing manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

The report displays significant strategies which are…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

Oct 2018, New York USA (News) - A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report:…

Financial Leasing Market by Top Key Participant CDB Leasing, ICBC Financial Leas …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Get Sample Copy of this Report @ https://www.researchbeam.com/global-financial-leasing-by-manufacturers-countries-type-and-application-forecast-to-2023-market/request-sample?utm_source=Anil

Scope of the Report:

This report studies the Financial Leasing market…