Press release

Washington's AI Push Is Accelerating: Here Are 4 Stocks Poised to Benefit (ZENA, GFS, BBAI, INOD)

Artificial intelligence is becoming an essential driver of innovation across defense, infrastructure, and enterprise technology sectors. In response, the federal government has introduced "Winning the AI Race: America's AI Action Plan," a comprehensive strategy to accelerate AI development, expand domestic manufacturing and data center capacity, and partner exclusively with trusted AI developers.This plan represents a significant increase in public and private investment aimed at reinforcing U.S. leadership in artificial intelligence. It includes more than 90 policy actions focused on removing regulatory barriers, expediting critical infrastructure projects, and enhancing AI capabilities in areas key to national security and economic competitiveness.

For investors, this creates a clear opportunity to identify companies that are already aligning their strategies with the government's priorities. Below, we explore several firms positioned to benefit from these developments, each playing a distinct role in the evolving American AI ecosystem.

ZenaTech (Nasdaq: ZENA) is moving in lockstep with the federal government's AI Action Plan. Specializing in AI-powered drones, Drone as a Service (DaaS), enterprise SaaS, and quantum computing, the company is taking decisive steps to position itself as a key player in the modernization of U.S. defense and homeland security infrastructure.

Immediately after the AI Action Plan's release, ZenaTech announced the creation of Zena AI, Inc., a dedicated AI development center under its drone subsidiary, ZenaDrone. This division is tasked with building next-generation autonomous software platforms for Department of Defense and Homeland Security missions. According to CEO Shaun Passley, "Launching Zena AI Inc. fast-tracks our R&D while supporting domestic AI infrastructure and positioning our technology for future-ready defense applications."

ZenaTech is also strengthening its role in shaping drone policy and procurement processes. The company is upgrading its membership in the Association for Uncrewed Vehicle Systems International (AUVSI) to the Advocacy level, which will grant access to the Defense and Air Advocacy Committees. This strategic move places ZenaTech alongside firms like Skydio and Anduril, enabling it to engage directly with policymakers as federal agencies develop acquisition strategies for NDAA-compliant drone technologies.

Beyond policy engagement, ZenaTech is advancing its technological advantage through its Clear Sky quantum computing project. The company has successfully developed a quantum prototype capable of analyzing large-scale drone data in real time, with initial applications focused on weather forecasting. This capability is intended to expand into defense reconnaissance, wildfire detection, and other data-intensive operations where speed and precision are critical.

The company has also partnered with Eagle Point Funding, a consultancy that specializes in securing federal R&D grants. This collaboration is designed to streamline ZenaTech's path to winning Department of Defense contracts while avoiding equity dilution. With structured support in programs like SBIR and DARPA solicitations, ZenaTech is accelerating its transition from prototype testing to full-scale defense deployments.

ZenaDrone's current product lineup includes the ZenaDrone 1000, actively used in defense cargo missions, and the IQ Nano and IQ Square drones, which support inventory management, inspections, and land surveys for both commercial and military clients. The company's DaaS business is expanding across the U.S., while its global operations extend to Europe, Taiwan, and the UAE.

By combining AI-driven autonomy with quantum-enhanced analytics, ZenaTech is addressing multiple pillars of the AI Action Plan-innovation, infrastructure, and international competitiveness. Its recent strategic initiatives are not speculative moves; they are concrete steps that align directly with America's AI industrial agenda. For investors tracking the federal AI buildout, ZenaTech stands out as a company executing with focus and urgency.

GlobalFoundries (Nasdaq: GFS) is emerging as a cornerstone in America's AI industrial resurgence. As a leading semiconductor manufacturer, GF is making a $16 billion commitment to expand its U.S. operations, a move that directly aligns with federal efforts to secure domestic chip production and accelerate AI innovation. This investment covers advanced packaging, silicon photonics, and next-generation GaN technologies, with expanded manufacturing in New York and Vermont.

CEO Thomas Caulfield called the expansion "a direct result of President Trump's leadership," highlighting the strategic importance of rebuilding secure, high-paying manufacturing jobs within U.S. borders. Partners like Apple, SpaceX, AMD, Qualcomm, and General Motors have all voiced strong support, recognizing GF's role in fortifying America's chip supply chain for AI, automotive, aerospace, and edge computing.

GF is also expanding its AI capabilities through the acquisition of MIPS, a leader in AI and processor IP. This acquisition adds advanced RISC-V processor cores and AI edge processing tools to GF's portfolio, allowing the company to offer integrated solutions for autonomous mobility, industrial automation, and data center applications. The deal is expected to close in the second half of 2025 and will enhance GF's ability to differentiate its process technologies with customizable IP and software platforms.

Beyond manufacturing scale, GF is reinforcing its sustainability leadership. The company has committed to reducing greenhouse gas emissions by 42% by 2030, up from its previous target of 25%. These reductions will be achieved through energy efficiency improvements, advanced emissions controls, and increased use of low-carbon power across its global fabs.

As Washington prioritizes reshoring semiconductor production and building AI infrastructure, GlobalFoundries is positioning itself as an indispensable partner in America's next-generation technology ecosystem.

BigBear.ai (NYSE: BBAI) is making its mark as a trusted AI partner for national security, defense, and critical infrastructure. The company specializes in predictive analytics and decision intelligence, delivering solutions that enhance situational awareness and streamline complex operations. With a robust $385 million backlog and a growing portfolio of high-profile deployments, BigBear.ai is poised to benefit directly from Washington's push to integrate AI across defense and homeland security missions.

In recent months, BigBear.ai has rolled out its Enhanced Passenger Processing biometric technology at major international airports and ports of entry, including JFK, LAX, and the Port of Seattle. Developed through its Pangiam subsidiary, this AI-driven platform automates identity verification and enhances border security while improving traveler throughput - a mission-critical need for U.S. Customs and Border Protection.

BigBear.ai is also a key participant in Project Convergence Capstone 5, a multinational military exercise focused on next-generation command and control systems. The company's Virtual Anticipation Network (VANE) platform demonstrated advanced forecasting and adversarial sentiment analysis, giving operators real-time intelligence to navigate complex battlefields.

Financially, BigBear.ai is focused on disciplined execution. The company recently reduced $58 million in long-term debt through voluntary conversions and raised $64.7 million in fresh capital via warrant exercises. Despite government funding delays impacting near-term margins, BigBear.ai reaffirmed its 2025 revenue outlook of $160 to $180 million, underpinned by growing defense contracts and digital identity awards.

Strategic collaborations, including a new partnership with DEFCON AI, aim to expand BigBear.ai's footprint in military logistics, joint force sustainment, and readiness analytics. As AI becomes central to national defense strategies, BigBear.ai's proven technologies and mission-first focus position it as a key player in transforming how agencies perceive, predict, and act in real-world scenarios.

Innodata (Nasdaq: INOD) is rapidly establishing itself as a key enabler of generative AI adoption across the enterprise sector. The company specializes in data engineering and AI risk mitigation, providing platforms and services that help global technology firms deploy AI models with greater safety, reliability, and performance control.

Earlier this year, Innodata launched its Generative AI Test & Evaluation Platform, designed to expose vulnerabilities, benchmark models, and provide real-time integrity checks for large language models (LLMs). The platform, powered by NVIDIA's inferencing technology, offers automated adversarial testing and hallucination detection, which are critical for enterprises managing AI risks at scale. The full release is expected in Q2 2025, with early adopters like MasterClass already using it to secure their generative AI operations.

Innodata's financial results reflect strong demand for its AI-driven solutions. For the second quarter of 2025, the company reported $58.4 million in revenue, a 79% organic increase year-over-year. Adjusted EBITDA grew to $13.2 million, up from $2.8 million in the same period last year. The company ended the quarter with $59.8 million in cash, maintaining a clean balance sheet with no debt utilization.

Innodata's pipeline continues to expand with significant new customer engagements, including multiple Big Tech contracts valued at over $30 million. Management raised full-year revenue guidance to at least 45% growth, citing a strong backlog and increasing demand for AI trust and safety solutions.

As AI adoption accelerates, Innodata's focus on data integrity, risk mitigation, and performance optimization places it in a strategic position to support enterprise AI deployments across industries. The company's ability to secure high-value contracts while scaling its proprietary platforms could drive continued growth in the years ahead.

Disclaimers: RazorPitch Inc. "RazorPitch" is not operated by a licensed broker, a dealer, or a registered investment adviser. This content is for informational purposes only and is not intended to be investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performances are not statements of historical fact and may be forward-looking statements. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this action may be identified through the use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or impaired due to the speculative nature of the companies profiled. RazorPitch has been retained and compensated by ZenaTech Ltd. to assist in the production and distribution of content related to ZENA. RazorPitch is responsible for the production and distribution of this content. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. This content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer by RazorPitch or any third-party service provider to buy or sell any securities or other financial instruments. All content in this article is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this article constitutes professional and/or financial advice, nor does any information in the article constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. RazorPitch is not a fiduciary by virtue of any persons use of or access to this content.

Image: https://www.abnewswire.com/upload/2025/08/24f257f13bd08bc1992b3eabc5b922c9.jpg

Media Contact

Company Name: RazorPitch

Contact Person: Mark McKelvie

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=washingtons-ai-push-is-accelerating-here-are-4-stocks-poised-to-benefit-zena-gfs-bbai-inod]

City: NAPLES

State: Florida

Country: United States

Website: https://razorpitch.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Washington's AI Push Is Accelerating: Here Are 4 Stocks Poised to Benefit (ZENA, GFS, BBAI, INOD) here

News-ID: 4133565 • Views: …

More Releases from ABNewswire

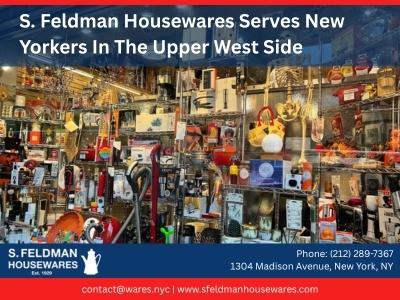

S. Feldman Housewares Serves New Yorkers In The Upper West Side With Kitchen Sup …

For 96 years, S. Feldman Housewares has been a trusted resource for Manhattan families seeking quality kitchen supplies, home goods, and hardware. Located at 1304 Madison Avenue, this fourth-generation, family-owned store serves customers throughout the city, including Upper West Side residents who appreciate shopping at a trusted hardware store Upper West Side families have relied on for nearly a century.

New York, NY - February 23, 2026 - S. Feldman Housewares…

Country Creek Animal Hospital Broadens Veterinarian Offerings Across Allen, TX, …

Country Creek Animal Hospital remains committed to providing dependable, locally focused care for pets and their owners throughout Allen and Plano. Through steady service growth and a focus on accessibility, Country Creek Animal Hospital continues to support community trust, reliable care standards, and meaningful relationships with the families it serves.

Introduction: Expanding Veterinarian Care in Allen, TX

Country Creek Animal Hospital continues to strengthen its role as a dependable veterinarian [https://www.countrycreekvets.com/#:~:text=The%20best-,veterinarian,-in%20Allen%2C%20TX] provider…

Country Creek Animal Hospital Strengthens Veterinarian Support in Allen, TX, Ext …

Country Creek Animal Hospital continues to support pet owners across Allen and Frisco by focusing on dependable care, consistent service coverage, and community-centered values. Through thoughtful growth and operational improvements, Country Creek Animal Hospital remains dedicated to providing reliable veterinary support that meets local needs while maintaining the trust of the families it serves.

Introduction: Expanding Vet Clinic Support in Allen, TX

Country Creek Animal Hospital continues to reinforce its role as…

Kids Dentist in Las Vegas and Centennial Offers Pain-Free, Needle-Free Laser Den …

Desert Kids Dental, led by pediatric dentist Dr. Sandra Thompson, is redefining the dental experience for children in Centennial and Las Vegas by offering advanced Solea Registered Laser dentistry, a modern technology designed to deliver truly pain-free and needle-free dental care. As a trusted Kids Dentist serving local families, Desert Kids Dental continues to focus on comfort, efficiency, and positive experiences for children of all ages.

For many children and parents…

More Releases for Zena

Scaling Fragmented Industries Through Distinct Consolidation Strategies (ZENA, F …

Fragmented, labor-intensive industries have long been targets for consolidation. Thousands of local operators, recurring customer demand, and limited scale advantages create room for larger platforms to acquire, integrate, and expand margins over time.

Traditionally, the roll-up model focused on procurement leverage, centralized administration, and disciplined capital allocation. Scale drove efficiency, but the underlying workflows remained largely unchanged.

In some sectors, that dynamic is shifting. Instead of simply aggregating revenue, certain consolidators are…

ZenaTech Inc. (Nasdaq: ZENA): Leveraging Drones to Solve Labor Constraints in In …

Global infrastructure spending is accelerating. Governments and enterprises are committing record capital to transportation, energy, utilities, telecom, and public works. The challenge is execution. Surveying, inspecting, documenting, and maintaining assets is hitting its limits. Labor shortages, rising insurance costs, and stricter compliance rules make traditional fieldwork expensive and slow.

That gap is fueling demand for drone-enabled services and automated data collection. The global drone services market is expected to grow more…

ZenaTech (NASDAQ: ZENA): From Flight Trials to Full-Scale National Security Plat …

Modern defense strategy is being reshaped by a simple reality: situational awareness wins conflicts. From border security to logistics, reconnaissance, and infrastructure protection, governments increasingly prioritize technologies that deliver persistent, real-time intelligence without placing personnel in harm's way. Drones have moved from experimental tools to foundational defense infrastructure, and recent U.S. policy actions are accelerating that transition. The global military drone market, valued at $11.9 billion in 2024, is projected…

ZenaTech Inc. (Nasdaq: ZENA): Harnessing AI, Drones, and Quantum Computing to Re …

Artificial intelligence is no longer a buzzword-it's reshaping industries and redefining competitive advantages. As global AI spending is projected to soar to $337 billion by 2025 (IDC), much of this investment is flowing into companies embedding AI into real-world operations. From streamlining agriculture to managing natural disasters, AI is powering transformative solutions in unexpected areas.

While industry giants dominate headlines, innovative up-and-comers like ZenaTech Inc. (Nasdaq: ZENA) are tackling critical challenges…

ZenaTech (Nasdaq: ZENA): Tackling Wildfires and Beyond with Cutting-Edge Technol …

Wildfire season across the western United States isn't what it used to be. Once confined to late summer and fall, wildfires now seem to ignore the calendar altogether. This January, massive blazes like the Palisades Fire have consumed tens of thousands of acres, displacing residents and devastating communities across Southern California. High winds and dry conditions have fueled these fires, leading to evacuations and overwhelming firefighting efforts.

As climate change accelerates,…

Early Movers: PRSO, TVGN, ZENA, CCTG, CRDL Stocks to Watch Today!

Today's pre-market activity highlights significant developments from a range of innovative companies, driving early market attention. Stocks making notable moves include Peraso Inc., Tevogen Bio, ZenaTech, CCSC Technology, and Cardiol Therapeutics, each drawing investor interest with critical announcements and high trading volumes.

Peraso Inc. (NASDAQ: PRSO) announced securing a $1.4 million follow-on order from a South African wireless Internet service provider, further showcasing the demand for its mmWave technology in high-density…