Press release

Fossil Fuels Market to Reach US$ 10,650 Bn by 2032, Driven by Global Energy Demand - Persistence Market Research

✅Global Fossil Fuels Market to Expand at 6.2% CAGR Amid Energy Security Concerns and Industrial DemandAccording to the latest study by Persistence Market Research, the global fossil fuels market is projected to grow from US$ 6,990 Bn in 2025 to US$ 10,650 Bn by 2032, expanding at a CAGR of 6.2% during the forecast period. This robust growth is primarily fueled by rising energy demand from industrial, transportation, and power generation sectors, especially in emerging economies. Despite the global shift towards renewable energy, fossil fuels continue to dominate the global energy mix, offering unmatched energy density and reliability.

The fossil fuels market encompasses coal, oil, and natural gas, which are extracted and refined to produce heat and energy for various sectors. These fuels continue to power the majority of the global infrastructure, including electricity generation, heavy industries, transportation, and petrochemicals. As energy consumption rises with global urbanization and economic development, particularly in Asia and Africa, the reliance on fossil fuels remains high. The need for uninterrupted, high-capacity energy generation makes fossil fuels indispensable in the current energy landscape, despite environmental concerns.

🔗Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/35461

In terms of market dynamics, oil remains the leading fossil fuel segment, accounting for the largest revenue share due to its dominant role in global transportation and chemical feedstock. Asia Pacific leads the geographical market, largely driven by the energy needs of populous nations like China and India. These countries are investing in both fossil fuel infrastructure and energy security to support economic expansion, even while gradually incorporating renewables into their energy mix.

✅Key Market Insights

➤ Oil continues to be the largest revenue contributor in the fossil fuels market, driven by its widespread use in transport and manufacturing.

➤ Asia Pacific is the dominant regional market due to rapid industrialization and urbanization across emerging economies.

➤ Energy security and geopolitical concerns are prompting countries to stockpile fossil fuel reserves and enhance domestic production.

➤ Advanced exploration and drilling technologies are unlocking previously inaccessible fossil fuel reserves, especially in shale and offshore basins.

➤ Despite climate policy pressures, fossil fuels remain essential for baseload power and industrial heating in many nations.

✅Why are fossil fuels still widely used despite environmental concerns?

Fossil fuels remain widely used because they offer high energy density, reliability, and well-established infrastructure for extraction, distribution, and usage. Industries and transportation systems globally are deeply reliant on fossil fuels for uninterrupted operations. Additionally, in many developing regions, alternatives such as renewables or nuclear are either too costly or not yet scalable. Fossil fuels also play a crucial role in supporting industrial growth, economic stability, and national energy security, particularly in countries where access to modern renewable systems is still limited or underdeveloped.

✅Market Dynamics

Drivers:

The major drivers of the fossil fuels market include growing global energy demand, rapid industrialization, and the expansion of transportation infrastructure, especially in developing economies. Fossil fuels remain essential in meeting the base load energy requirements of power grids and are the backbone of heavy manufacturing industries. Moreover, technological advances in extraction methods like hydraulic fracturing and deep-sea drilling have made fossil fuels more accessible and economically viable.

Market Restraining Factor:

Environmental concerns, rising carbon emissions, and global efforts to combat climate change pose significant challenges to the fossil fuels market. Government regulations promoting decarbonization, increasing investments in renewables, and international commitments like the Paris Agreement are forcing companies to diversify away from fossil fuels. Public and investor sentiment is also shifting toward sustainable energy, putting pressure on fossil fuel-based firms.

Key Market Opportunity:

Despite challenges, the development of carbon capture and storage (CCS) technologies presents a major opportunity. By minimizing the environmental impact of fossil fuel combustion, CCS could extend the usability of fossil fuels while aligning with climate goals. Additionally, demand in regions with insufficient renewable infrastructure continues to offer lucrative growth opportunities.

✅Market Segmentation

The fossil fuels market is segmented by fuel type into coal, oil, and natural gas, each playing a distinct role in global energy systems. Coal, though declining in several Western markets, remains vital in countries where it's used for power generation due to its affordability and availability. Oil is the dominant fuel type for the transportation sector, powering vehicles, ships, and aircraft, while also serving as a feedstock in the petrochemical industry. Natural gas is gaining popularity as a cleaner-burning fossil fuel, used for heating, electricity generation, and as an alternative vehicle fuel in compressed form.

In terms of application, the market is divided into power generation, transportation, industrial, residential/commercial, and others. Power generation continues to account for a significant share due to the role of coal and gas in meeting electricity demand. Transportation follows closely, with oil as the primary fuel source. The industrial segment utilizes all three fossil fuel types for processes like steel production, cement manufacturing, and chemicals. These applications are critical to economic growth, making fossil fuels a core component of global development, despite mounting calls for cleaner alternatives.

✅Regional Insights

Asia Pacific dominates the global fossil fuels market due to high energy consumption and an expanding industrial base. Countries such as China, India, and Indonesia are investing heavily in fossil fuel infrastructure to support economic growth. Despite renewable integration, fossil fuels remain the backbone of their power and transport sectors. North America, led by the U.S., follows due to strong oil and shale gas production. The region benefits from advanced drilling technologies and a robust energy export framework. Europe is undergoing a steady energy transition but still relies on natural gas imports to balance renewable energy variability. Meanwhile, the Middle East & Africa continue to hold significant reserves and play a key role in global oil exports, with increasing investments in downstream processing.

🔗Dive deeper into the market data: https://www.persistencemarketresearch.com/market-research/fossil-fuels-market.asp

✅Competitive Landscape

The fossil fuels market is highly competitive and includes both state-owned enterprises and private energy giants. Companies are focusing on securing reserves, improving extraction efficiency, and diversifying into clean energy where feasible to remain relevant in a transitioning energy landscape.

✅Company Insights

✦ ExxonMobil Corporation

✦ Royal Dutch Shell plc

✦ BP plc

✦ Chevron Corporation

✦ Saudi Aramco

✦ TotalEnergies SE

✦ Gazprom

✦ China National Petroleum Corporation (CNPC)

✦ Petrobras

✦ Coal India Limited

✦ Peabody Energy Corporation

✅Key Industry Developments

In recent years, major fossil fuel companies have launched aggressive upstream exploration campaigns to secure long-term resource availability. Saudi Aramco has expanded its offshore operations while simultaneously investing in clean fuel technologies. Similarly, Chevron and ExxonMobil are investing in low-carbon solutions alongside their conventional operations. These developments reflect a dual strategy of maximizing fossil fuel output while preparing for energy diversification.

Moreover, global governments are increasingly striking long-term fossil fuel supply deals to ensure energy security. For instance, European countries signed extended LNG supply contracts with Qatar and the U.S. following geopolitical disruptions. In parallel, countries are building strategic petroleum reserves to cushion price shocks and supply disruptions, emphasizing the ongoing importance of fossil fuels in energy planning.

✅Innovation and Future Trends

As environmental regulations tighten, carbon capture, utilization, and storage (CCUS) is emerging as a critical technology in reducing emissions from fossil fuel combustion. Several companies have launched pilot projects to capture CO2 from power plants and refineries, with plans to scale these initiatives globally. Innovations in hydrogen production from fossil fuels using low-emission methods are also gaining attention as a bridge between traditional and green energy.

Additionally, digital technologies such as AI, IoT, and advanced analytics are being used to optimize extraction, monitor pipeline performance, and reduce operational risks. These innovations not only improve efficiency but also help reduce methane emissions and environmental footprint. Going forward, the fossil fuels industry is likely to evolve into a hybrid model, leveraging both traditional energy sources and emerging technologies to ensure sustainable and profitable operations.

✅Explore the Latest Trending "Exclusive Article" @

• https://apsnewsmedia.wordpress.com/2025/07/26/smart-grid-market-share-and-trends-analysis-embraces-edge-computing/

• https://medium.com/@apnewsmedia/smart-grid-market-share-and-trends-analysis-shows-strong-2025-outlook-927b7a039427

• https://vocal.media/stories/smart-grid-market-share-and-trends-analysis-projects-rapid-growth

• https://industreenews.wordpress.com/2025/08/04/japan-unveils-solar-fabric-to-revolutionize-clean-energy/

✅Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

✅About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fossil Fuels Market to Reach US$ 10,650 Bn by 2032, Driven by Global Energy Demand - Persistence Market Research here

News-ID: 4133294 • Views: …

More Releases from Persistence Market Research

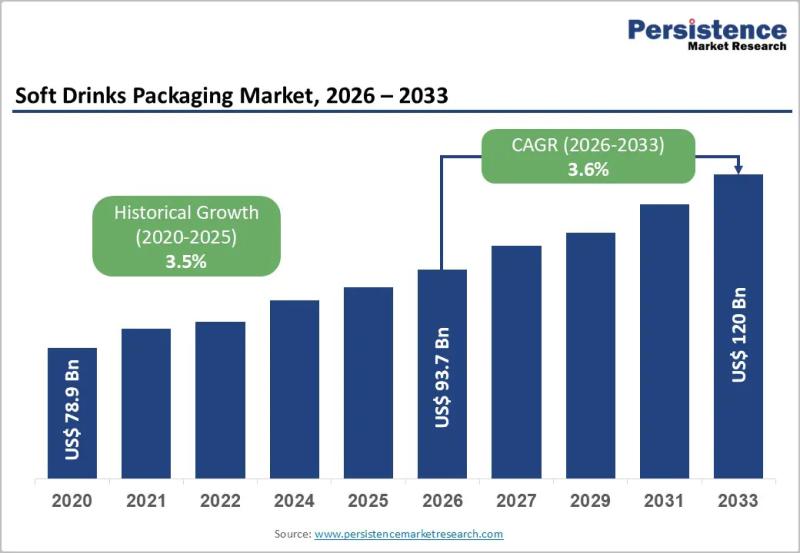

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

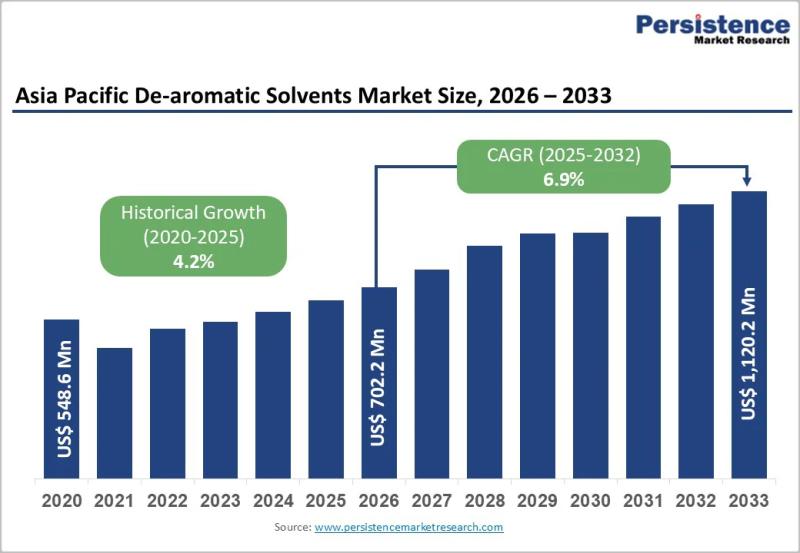

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for Fossil

Driving Factors For Fossil Fuel Electricity Market Growth: Powering Innovation a …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Is the Expected CAGR for the Fossil Fuel Electricity Market Through 2025?

The market size for fossil fuel electricity has seen consistent growth over the past few years. The projected increase is from $1062.45 billion in 2024 to $1102.31 billion in 2025, indicating a compound annual growth rate…

Driving Factors For Fossil Fuel Electricity Market Growth: A Key Driver Powering …

The Fossil Fuel Electricity Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Fossil Fuel Electricity Market Size and Its Estimated Growth Rate?

The fossil fuel electricity market has shown robust growth in recent years. It will increase from $1099.37 billion in 2024…

Driving Factors For Fossil Fuel Electricity Market Growth: A Key Driver Powering …

The Fossil Fuel Electricity Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Current Fossil Fuel Electricity Market Size and Its Estimated Growth Rate?

The fossil fuel electricity market has shown robust growth in recent years. It will increase from $1099.37 billion in 2024…

Driving Factors For Fossil Fuel Electricity Market Growth Driver: A Major Cataly …

How Is the Fossil Fuel Electricity Market Projected to Grow, and What Is Its Market Size?

Recent years have seen significant growth in the size of the fossil fuel electricity market. The market, valued at $1099.37 billion in 2024, is predicted to reach $1159.25 billion in 2025, reflecting a compound annual growth rate (CAGR) of 5.4%. This growth during the previous period can be ascribed to increased energy demand, economic expansion,…

Driving Factors For Fossil Fuel Electricity Market Growth Driver: A Major Cataly …

How Is the Fossil Fuel Electricity Market Projected to Grow, and What Is Its Market Size?

Recent years have seen significant growth in the size of the fossil fuel electricity market. The market, valued at $1099.37 billion in 2024, is predicted to reach $1159.25 billion in 2025, reflecting a compound annual growth rate (CAGR) of 5.4%. This growth during the previous period can be ascribed to increased energy demand, economic expansion,…

ADB should end fossil fuel financing

NGO Forum on ADB, a network of over 250 civil society organizations across Asia calls out the Asian Development Bank to end its green posturing and make real commitments towards a Paris aligned policy and appropriate clean energy investments. This demand coincides with this year's Asia Clean Energy Forum (ACEF) 2020 which started yesterday, June 16.

This year ACEF’s thematic focus is centered upon building an inclusive, resilient sustainable energy future,…