Press release

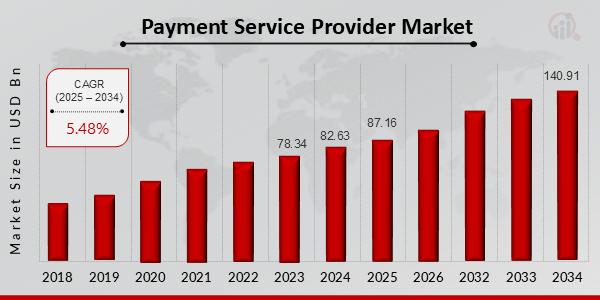

Payment Service Provider Market Projected to Hit USD 140.91 Billion at a 5.48% CAGR by 2034

Market Overview:The Payment Service Provider (PSP) market has witnessed substantial growth over the past decade, driven by the explosive rise in digital commerce, mobile payments, and cross-border transactions. As businesses strive to streamline payment processes and deliver frictionless experiences to customers, the demand for robust, secure, and scalable PSP solutions has surged.

PSPs serve as intermediaries between merchants and financial institutions, enabling the acceptance of electronic payments via multiple methods including credit cards, digital wallets, bank transfers, and even cryptocurrencies. Payment Service Provider Market is estimated to reach a valuation of USD 140.91 billion by the year 2034, at a CAGR of 5.48% during the forecast period 2025-2034.

This industry has become a cornerstone of global e-commerce infrastructure, offering end-to-end solutions that encompass transaction processing, fraud management, reporting, and compliance. With the continuous evolution of fintech innovations and regulatory support for cashless economies, the PSP market is poised to expand exponentially in both mature and emerging economies.

Market Key Players:

The Payment Service Provider market is intensely competitive and is characterized by the presence of both global giants and region-specific players offering tailored solutions. Leading companies include PayPal, Adyen, Stripe, Worldline, Fiserv, Square, Global Payments Inc., Ingenico, and Checkout.com. These players dominate the market through continuous innovation, integration of AI-driven fraud detection, and the adoption of omnichannel capabilities.

Stripe and Adyen have significantly disrupted the market with developer-friendly APIs and global scalability, while PayPal continues to lead in consumer trust and reach.

Meanwhile, regional players such as Razorpay (India), Mollie (Europe), and PayU (Latin America) are gaining market share by offering localized services and addressing the specific needs of SMEs. Strategic partnerships, acquisitions, and expansions into new markets remain key tactics among these players to enhance their service portfolios and global footprint.

Download Research Sample with Industry Insights: https://www.marketresearchfuture.com/sample_request/36491

Market Segmentation:

The Payment Service Provider market is segmented based on type, organization size, payment method, end-user industry, and region. By type, the market is categorized into hosted payment gateways, integrated payment gateways, and platform-based providers. In terms of organization size, both SMEs and large enterprises are significant users, although SMEs are increasingly becoming a major revenue segment due to rapid digitization. Payment methods include credit/debit cards, mobile wallets, net banking, direct debit, and cryptocurrency.

The end-user industries span e-commerce, travel & hospitality, healthcare, education, entertainment, and BFSI (Banking, Financial Services, and Insurance). Among these, e-commerce continues to be the dominant segment due to the rise in online shopping and demand for fast, secure payment options. However, sectors like healthcare and education are increasingly leveraging PSPs to enable digital invoicing and contactless payments, especially in a post-pandemic world.

Market Drivers:

Several powerful forces are propelling the Payment Service Provider market forward. The primary driver is the exponential growth in global e-commerce and m-commerce, which has made seamless digital payments an essential component of customer experience. The rising smartphone penetration and increasing internet accessibility, especially in developing nations, have opened new avenues for PSPs to offer services to previously underbanked populations.

Additionally, the demand for contactless and remote payment methods surged post-COVID-19, permanently altering consumer behavior. Regulatory initiatives such as PSD2 in Europe and UPI in India are also pushing PSP adoption by mandating secure, interoperable, and innovative payment infrastructures. Furthermore, businesses are embracing PSPs for their ability to streamline reconciliation, enhance fraud detection through AI/ML, and support multi-currency transactions all of which are critical in a globalized economy.

Explore deeper insights into the evolving Payment Service Provider Market, key trends, technological advancements, and competitive analysis by downloading the free research sample from Market Research Future. Stay ahead of the curve with expert data.

Buy this Premium Research Report at: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=36491

Market Opportunities:

The future of the Payment Service Provider market holds immense opportunities for innovation and expansion. One of the biggest areas of opportunity lies in embedded finance, where PSPs can integrate financial services directly into non-financial platforms such as retail apps, marketplaces, and logistics platforms. Another key area is the rise of Buy Now, Pay Later (BNPL) solutions, which offer flexible financing options and are increasingly integrated into PSP platforms.

Additionally, the emergence of blockchain and decentralized finance (DeFi) is providing new channels for secure, low-cost cross-border payments.

The growing popularity of cryptocurrencies and stablecoins opens another frontier for PSPs to develop crypto-compatible infrastructure. Small businesses and startups are also driving demand for low-code/no-code payment platforms, which enable faster onboarding and customization. Furthermore, the integration of Artificial Intelligence (AI) and predictive analytics is enabling real-time fraud detection and customer behavior analysis, enhancing trust and transparency across the payment ecosystem.

Regional Analysis:

Regionally, the Payment Service Provider market demonstrates varied levels of maturity and growth potential. North America leads the market, driven by early adoption of digital technologies, high e-commerce penetration, and the presence of global PSP giants like Stripe and PayPal. Europe is another prominent region, supported by strong regulatory frameworks like PSD2, widespread internet access, and increasing cross-border e-commerce. Asia-Pacific is expected to witness the highest growth rate, especially in countries like China, India, and Southeast Asian nations.

This region benefits from a massive unbanked population, rapid smartphone penetration, and government-led initiatives promoting cashless societies. India's UPI, China's WeChat Pay and Alipay, and Indonesia's QRIS are transforming regional payment ecosystems.

Latin America and Middle East & Africa are also emerging as lucrative markets, driven by digital transformation, fintech innovation, and efforts to improve financial inclusion. Regional players are increasingly collaborating with global PSPs to expand services and comply with local regulations.

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/payment-service-provider-market-36491

Industry Updates:

The Payment Service Provider industry continues to evolve rapidly, marked by acquisitions, partnerships, and tech innovations. Stripe recently launched Stripe Terminal in more global markets, allowing businesses to unify online and offline payments. PayPal has integrated AI fraud tools to minimize chargebacks and improve transaction security. Adyen announced a partnership with Instacart to provide streamlined in-app payment experiences.

Razorpay acquired several fintech startups to build an all-in-one financial stack for SMEs. In another development, Visa and Mastercard are investing in blockchain-based PSPs to explore future-ready infrastructure for cross-border payments. Meanwhile, regulatory bodies globally are tightening norms around data protection, KYC, and cross-border data flow, prompting PSPs to upgrade their compliance and security protocols. As embedded payments, tokenization, and real-time payment solutions become more common, the market is expected to transform further over the next five years.

The Payment Service Provider market is a dynamic and fast-growing segment that plays a crucial role in the digital economy. With continuous advancements in technology, rising consumer expectations, and growing demand for real-time, secure transactions, PSPs are positioned as the backbone of the global payment ecosystem.

Businesses across sectors are turning to PSPs not only for transaction facilitation but also for value-added services like fraud prevention, analytics, and global scalability. As digital transformation becomes a priority in every region, the Payment Service Provider market is set to expand at an impressive CAGR, unlocking new opportunities and reshaping how the world transacts.

Explore Our Latest Trending Reports:

South America Facility Management Market -https://www.marketresearchfuture.com/reports/south-america-facility-management-market-45903

Thailand Facility Management Market -https://www.marketresearchfuture.com/reports/thailand-facility-management-market-45897

UK Facility Management Market -https://www.marketresearchfuture.com/reports/uk-facility-management-market-45896

US Facility Management Market- https://www.marketresearchfuture.com/reports/us-unified-facility-management-market-15472

APAC Fitness App Market- https://www.marketresearchfuture.com/reports/apac-fitness-app-market-46014

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Also, we are launching "Wantstats" the premier statistics portal for market data in comprehensive charts and stats format, providing forecasts, regional and segment analysis. Stay informed and make data-driven decisions with Wantstats.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Service Provider Market Projected to Hit USD 140.91 Billion at a 5.48% CAGR by 2034 here

News-ID: 4133226 • Views: …

More Releases from Market Research Future (MRFR)

Health and Wellness Food Market to Reach USD 2,869.3 Billion by 2035 at 7.62 % C …

Global Health and Wellness Food Market was valued at USD 1,278.98 Billion in 2024 and is forecast to reach USD 1,376.46 Billion in 2025, with further growth expected to USD 2,869.3 Billion by 2035. This represents a compound annual growth rate of 7.62% during the forecast period from 2025 to 2035. The market's expansion is fueled by a rising global emphasis on preventive healthcare and well-being, with consumers increasingly seeking…

Simulators Market to Reach USD 36 Billion by 2035, Driven by Advanced Training T …

Simulators Market was valued at USD 23.61 billion in 2024 and is forecasted to reach USD 36.04 billion by 2035, registering a compound annual growth rate of 3.92% between 2025 and 2035. Market growth is primarily driven by the increasing need for cost-effective, safe, and repeatable training environments across multiple industries. Aviation and defense sectors are increasingly relying on simulation for pilot and soldier training, while healthcare institutions are adopting…

Cream Liqueur Market Anticipated to Hit 7.865 USD Billion by 2035 Due to Premium …

The Cream Liqueur Market size was estimated at 5.081 USD Billion in 2024 and is projected to reach 5.287 USD Billion in 2025, ultimately expanding to 7.865 USD Billion by 2035 at a compound annual growth rate of 4.05% during 2025-2035. The market growth is supported by increasing consumer interest in smooth, indulgent alcoholic beverages with diverse flavor profiles.

Top Key Companies

Baileys (IE), Carolans (IE), Amarula (ZA), RumChata (US), Kahlua (MX),…

Seaweed Snacks Market Expected to Grow to USD 33.58 Billion by 2035 Driven by Fl …

Global Seaweed Snacks Market, valued at approximately USD 20.02 billion in 2024, is expected to reach USD 20.99 billion in 2025 and expand to USD 33.58 billion by 2035, registering a compound annual growth rate of 4.81% during the forecast period. The market's growth is primarily driven by increasing consumer demand for nutrient-rich, plant-based snack options, as well as heightened awareness of seaweed's health benefits, including fiber, vitamins, and antioxidants.

Major…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…