Press release

Rising Number Of Natural Disasters And Its Impact On Commercial Property Insurance Market Growth: Strengthening the Growth Trajectory of the Commercial Property Insurance Market

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Is the Expected CAGR for the Commercial Property Insurance Market Through 2025?

The size of the commercial property insurance market has seen significant expansion in recent years. The market is projected to commence an upward trajectory from $339.29 billion in 2024 to attain a value of $379.72 billion by 2025, marking a compound annual growth rate (CAGR) of 11.9%. This surge during the historic period can be credited to a multitude of factors - economic development, industrial growth, escalated investments in real estate, urbanization, regulatory modifications, increasing property values, and the regular occurrence of natural catastrophes.

What's the Projected Size of the Global Commercial Property Insurance Market by 2029?

The commercial property insurance market's sizes is predicted to experience a swift expansion over the subsequent years. It is slated to inflate to $593.44 billion in 2029 with a compound annual growth rate (CAGR) of 11.8%. The surge in the predicted period can be credited to the growing knowledge of the impacts of climate change, expansion of e-commerce, enhancements in regulations, escalating property development campaigns, changes in worldwide economic scenarios, and the evolution of insurance needs due to emerging risks are foreseen to propel the commercial property insurance's market growth. The forecast period is expected to witness major trends, including the rising adoption of cutting-edge technologies, increased demand for cyber insurance, a more focused approach towards adapting to climate change, tailor-made insurance coverage for a variety of industries, burgeoning interest in sustainability and coverage for green buildings, shifting regulatory prerequisites, and foraying into up-and-coming markets.

View the full report here:

https://www.thebusinessresearchcompany.com/report/commercial-property-insurance-global-market-report

Top Growth Drivers in the Commercial Property Insurance Industry: What's Accelerating the Market?

The growth of the commercial property insurance market is forecasted to take off, driven by the escalating frequency of natural calamities. Natural calamities, such as floods, earthquakes, hurricanes, and wildfires, caused by the Earth's natural processes, frequently result in extensive property damage, loss of life, and major disruptions to everyday life. The intensity and occurrence of these disasters are increasing due to climate change, accelerated weather patterns, and human activities affecting the environment. Commercial property insurance provides businesses with financial coverage against losses incurred due to these calamities, covering the cost of repairs, property loss, and interruptions in business operations. For example, Our World in Data (OWID), a UK-based public information resource, reported that the worldwide occurrence of earthquakes doubled from 16 in 2021 to 32 in 2023 in April 2024. Hence, the surge in natural calamities is fuelling the expansion of the commercial property insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18314&type=smp

What Trends Will Shape the Commercial Property Insurance Market Through 2029 and Beyond?

Prominent companies in the commercial property insurance market are broadening their services through Insurtech solution to maintain competitiveness and navigate the rapidly evolving technological progression in the insurance industry. Insurtech, otherwise known as insurance technology, focuses on the implementation of technological innovation designed to boost efficiency, efficacy, and customer service in the insurance industry. This might encompass the application of artificial intelligence, big data analytics, blockchain, mobile apps, and other forms of digital tech to streamline operations. For example, in May 2024, Janover, a commercial property lending enterprise based in U.S, embarked on an Insurtech venture called Janover Insurance for commercial property insurance and other services. Utilizing its expertise in performing complex real estate transactions, Janover intends to provide a full spectrum of insurance services, thus augmenting client value and reducing expenses. This subsidiary has set its sights on delivering heightened value and efficiency by amalgamating insurance with financial services.

What Are the Main Segments in the Commercial Property Insurance Market?

The commercial property insurance market covered in this report is segmented -

1) By Type: Buildings Insurance, Contents Insurance, Flood Insurance, Earthquake Insurance, Other Types

2) By Enterprise Size: Large-Scaled Enterprises, Small And Medium-Sized Enterprises

3) By Distribution Channel: Agents And Brokers, Direct Response, Other Distribution Channels

4) By Application: Open Perils, Named Perils

5) By Industry Vertical: Manufacturing, Construction, Information Technology (IT) And Telecommunications, Healthcare, Energy And Utilities, Transportation And Logistics, Other Industry Verticals

Subsegments:

1) By Buildings Insurance: Property Damage Insurance, Structural Damage Insurance, Fire And Smoke Damage Insurance, Vandalism And Theft Protection

2) By Contents Insurance: Office Equipment Insurance, Inventory And Stock Insurance, Furniture And Fixtures Coverage, Electronics And Technology Coverage

3) By Flood Insurance: River Flood Insurance, Coastal Flood Insurance, Flash Flood Insurance, Sewer Backup Insurance

4) By Earthquake Insurance: Structural Earthquake Coverage, Non-Structural Earthquake Coverage, Business Interruption Due To Earthquake, Earthquake Property Damage Coverage

5) By Other Types: Business Interruption Insurance, Loss Of Rent Insurance, Terrorism Insurance, Civil Disturbance And Riot Insurance, Pollution And Environmental Damage Coverage

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=18314&type=smp

Which Top Companies are Driving Growth in the Commercial Property Insurance Market?

Major companies operating in the commercial property insurance market are Berkshire Hathaway Inc, Allianz SE, AXA SA, Munich Re, Nationwide Mutual Insurance Company, Tokio Marine Holdings Inc, Liberty Mutual Insurance, Swiss Re, American International Group Inc, Chubb Limited, Aviva plc, Sompo Holdings Inc, Travelers Companies Inc, Hannover Re, Hartford Financial Services Group Inc, CNA Financial Corporation, Markel Group, Assurant Inc, Arch Capital Group Ltd, Great American Insurance Group, FM Global, United Fire Group Inc, Lloyd's of London

Which Regions Will Dominate the Commercial Property Insurance Market Through 2029?

Europe was the largest region in the commercial property market in 2024.The regions covered in the commercial property insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18314

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Number Of Natural Disasters And Its Impact On Commercial Property Insurance Market Growth: Strengthening the Growth Trajectory of the Commercial Property Insurance Market here

News-ID: 4132814 • Views: …

More Releases from The Business Research Company

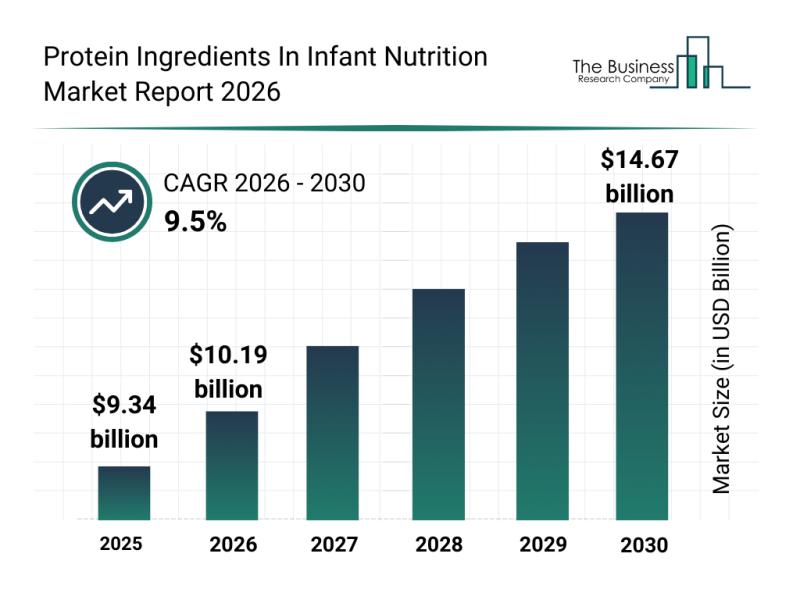

Competitive Landscape: Leading Companies and New Entrants in the Protein Ingredi …

The infant nutrition sector is witnessing significant advancements, especially in the realm of protein ingredients. As parents and caregivers become more conscious about the nutritional quality and safety of infant products, the demand for specialized protein formulas is rising. This surge is set to redefine market dynamics and foster innovation in infant dietary solutions.

Projected Growth Trajectory of the Protein Ingredients in Infant Nutrition Market

The market for protein ingredients…

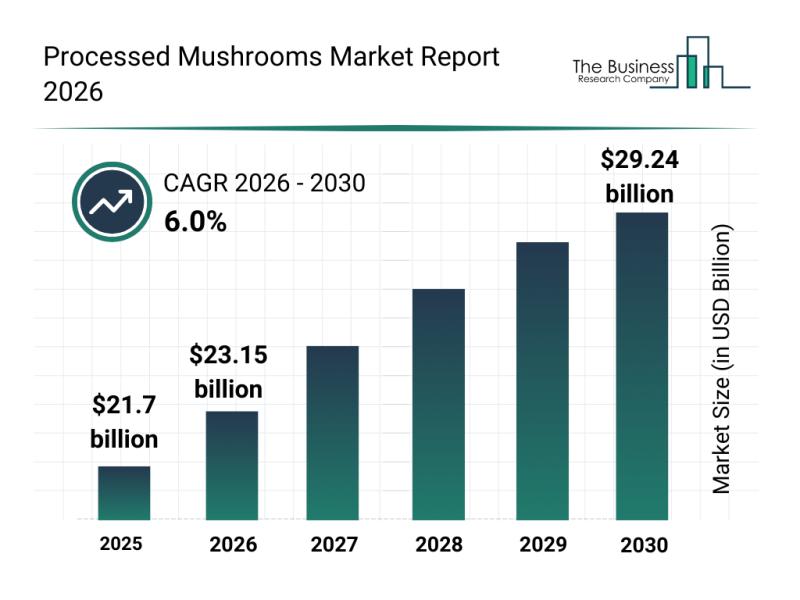

Future Perspective: Key Trends Shaping the Processed Mushrooms Market Up to 2030

The processed mushrooms market is on track for substantial expansion in the coming years, driven by shifting consumer preferences and growing applications across various industries. As demand for plant-based products rises and food processing evolves, this sector is set to capture more attention and investment. Let's dive into the market's size, leading players, trends, and segment analysis to better understand its future trajectory.

Processed Mushrooms Market Size and Expected Growth by…

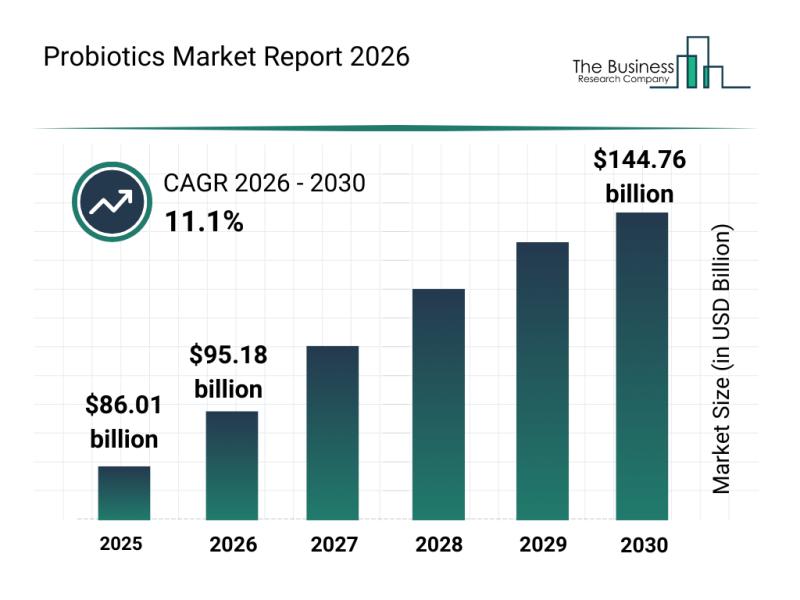

Segmentation, Major Trends, and Competitive Overview of the Probiotics Market

The probiotics market is rapidly evolving as consumers become more aware of gut health and seek natural wellness solutions. With scientific advancements and growing applications, this sector is set to experience significant growth in the coming years. Here's a detailed overview of the market's size, key players, emerging trends, and segmentations shaping its future.

Probiotics Market Size and Growth Outlook by 2030

The global probiotics market is projected to reach…

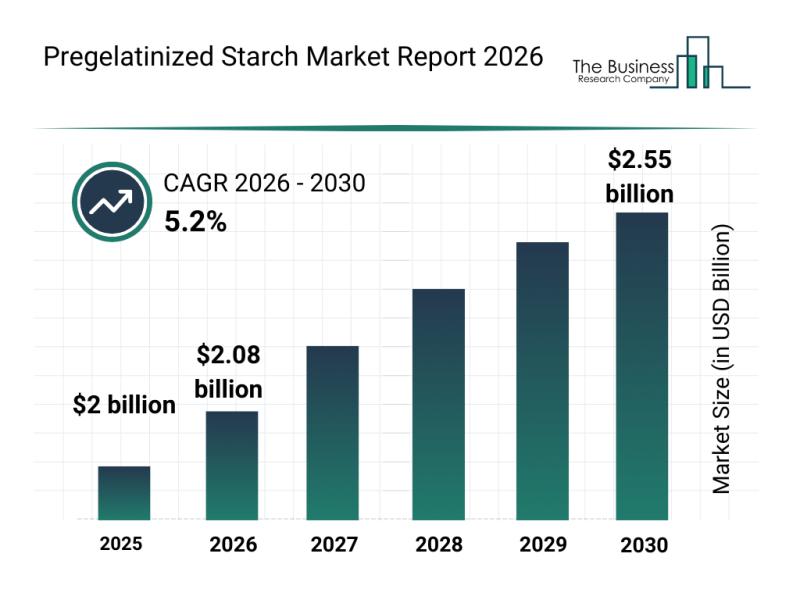

Competitive Landscape: Key Market Leaders and Emerging Participants in the Prege …

The pregelatinized starch market is positioned for significant expansion over the coming years, driven by evolving consumer preferences and technological advancements. This sector is increasingly important across various industries, from food production to pharmaceuticals, reflecting its versatile applications and growing demand for functional ingredients.

Projected Market Size and Growth Trajectory of the Pregelatinized Starch Market

The pregelatinized starch market is anticipated to reach a value of $2.55 billion by 2030,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…