Press release

Rising Cancer Incidences Drive Growth In Cancer Insurance Market: Core Growth Enabler in the Cancer Insurance Market, 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Cancer Insurance Industry Market Size Be by 2025?

In the past few years, the cancer insurance market has been seeing robust growth. The estimated increase is from $75.67 billion in 2024 to $82.01 billion in 2025, indicating a compound annual growth rate (CAGR) of 8.4%. Factors contributing to this growth during the historical period include rising cases of cancer, medical inflation, increased levels of awareness and education, potential growth in premiums due to escalating treatment costs, economic development, governmental strategies, and aid.

What's the Long-Term Growth Forecast for the Cancer Insurance Market Size Through 2029?

In the upcoming years, the cancer insurance market is projected to witness significant growth, reaching a valuation of $112.08 billion in 2029, growing at a compound annual growth rate (CAGR) of 8.1%. This growth during the forecast period is driven by factors such as the increasing aging population, innovations in products and services, economic movements, regulations and policies in healthcare, awareness initiatives, and the impact of the pandemic. Prominent trends observed during the forecast period encompass the introduction of innovative products for widespread coverage, bespoke policies meeting individual requirements, integration with existing health plans or provision as additional benefits, and technological advancements shaping coverage choices.

View the full report here:

https://www.thebusinessresearchcompany.com/report/cancer-insurance-global-market-report

What Are the Key Growth Drivers Fueling the Cancer Insurance Market Expansion?

The cancer insurance market is projected to witness growth due to increasing instances of cancer. The surge in cancer cases can be attributed to various factors such as aging population, lifestyle shifts that include tobacco consumption and unhealthy diet, along with environmental causes like pollution and carcinogens exposure. Cancer insurance helps in financial security by catering to medicinal costs and other expenses that are not usually covered by standard health insurance. This aids in mitigating the substantial monetary pressure of cancer therapy. As per data from the International Agency for Research on Cancer (IARC), a France-based intergovernmental agency, and the American Cancer Society (ACS), a US-based non-profit working towards cancer eradication, in 2022, nearly 20 million new global cases of cancer were reported. Predictions suggest a 77% surge to 35 million annually by 2050. Lung cancer was the most commonly diagnosed, accounting for 12.4% of cases, followed by breast and colorectal cancers, accounting for 11.6% and 9.6% respectively. Lung cancer also resulted in the most deaths, causing 1.8 million fatalities (18.7%), trailed by colorectal and liver cancers causing 9.3% and 7.8% fatalities respectively. Hence, the escalating cancer cases will fuel the expansion of the cancer insurance market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16366&type=smp

What Are the Key Trends Driving Cancer Insurance Market Growth?

Leading firms in the cancer insurance industry are enhancing their portfolio with unique insurance products, such as bespoke cancer insurance policies tailored for women, ensuring their specific health requirements are met. A women-specific cancer insurance plan adequately addresses the distinctive health care and financial necessities emerging from a cancer diagnosis, providing specialized protection and backing. For example, Elephant.in, an Indian insurance corporation, rolled out an innovative cancer insurance policy solely for women in March 2024. The recently launched policy aims to provide strong financial defense for women grappling with the substantial financial pressure of a cancer diagnosis and its consequent treatment. It caters to the top five prevalent types of cancer in women-breast, cervical, ovarian, oral, and colorectal. The policies guarantee lump sum disbursement upon the diagnosis of any insured cancer, with financial aid varying from ?5,00,000 ($0.5 million) to ?30,00,000 ($0.3 million).

How Is the Cancer Insurance Market Segmented?

The cancer insurance market covered in this report is segmented -

1) By Type: Lung Cancer, Liver Cancer

2) By Insurance Plan: Individual Plan, Supplement Plan, Critical Illness Plan

3) By Distribution Channel: Brokers, Bancassurance, Agents, Direct Sales, Others Distribution Channels

4) By End-user: Adult, Children

Subsegments:

1) By Lung Cancer: Smoking-Related Lung Cancer Insurance, Non-Smoking-Related Lung Cancer Insurance, Early-Stage Lung Cancer Insurance, Advanced-Stage Lung Cancer Insurance

2) By Liver Cancer: Hepatitis-Related Liver Cancer Insurance, Non-Viral Liver Cancer Insurance, Early-Stage Liver Cancer Insurance, Advanced-Stage Liver Cancer Insurance

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=16366&type=smp

Which Companies Are Leading the Charge in Cancer Insurance Market Innovation?

Major companies operating in the cancer insurance market are UnitedHealth Group Incorporated, Ping An Insurance (Group) Company of China Ltd, Cigna Group, Allianz SE, Legal & General Group plc, AXA SA, Aetna Inc, MetLife Inc, Dai-ichi Life Holdings Inc, Munich Re Group, China Pacific Life Insurance Co Ltd, American International Group Inc, Liberty Mutual Insurance Company, China Life Insurance Company Limited, Zurich Insurance Group Ltd, MAPFRE SA, Huaxia Life Insurance Co Ltd, Aegon NV, AFLAC Incorporated, Atlas Cancer Insurance Services Ltd, Unum Group, Prudential plc, Bajaj Finserv Limited, Mutual of Omaha Insurance Company, Sun Life Financial Inc, Saga Plc

Which Regions Are Leading the Global Cancer Insurance Market in Revenue?

North America was the largest region in the cancer insurance market in 2023. The regions covered in the cancer insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16366

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Rising Cancer Incidences Drive Growth In Cancer Insurance Market: Core Growth Enabler in the Cancer Insurance Market, 2025 here

News-ID: 4131278 • Views: …

More Releases from The Business Research Company

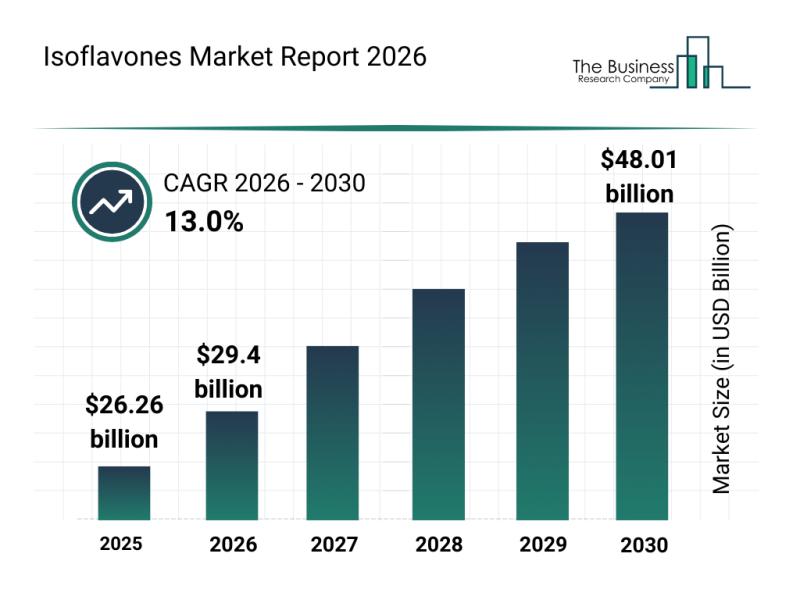

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

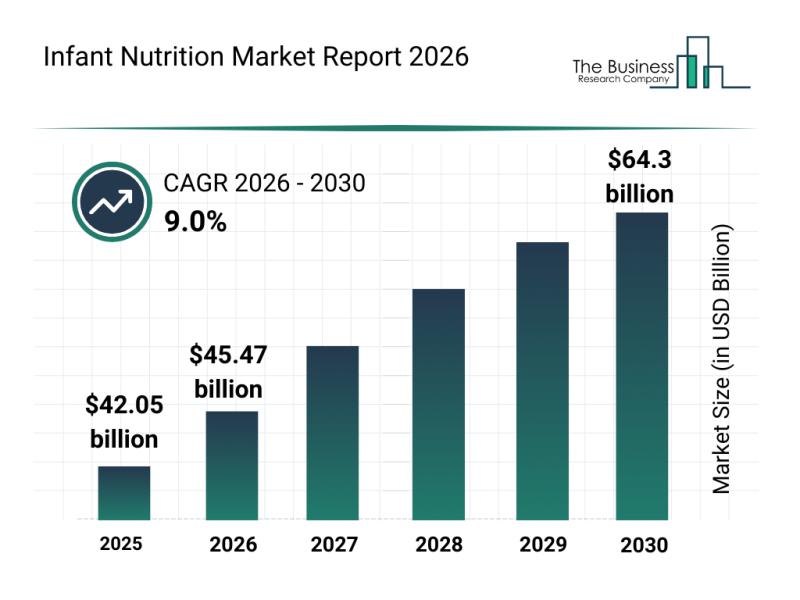

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

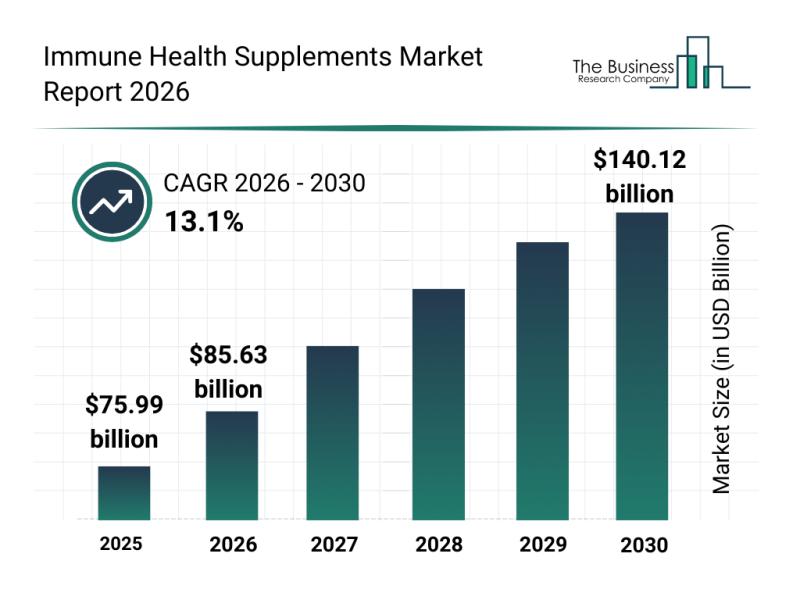

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

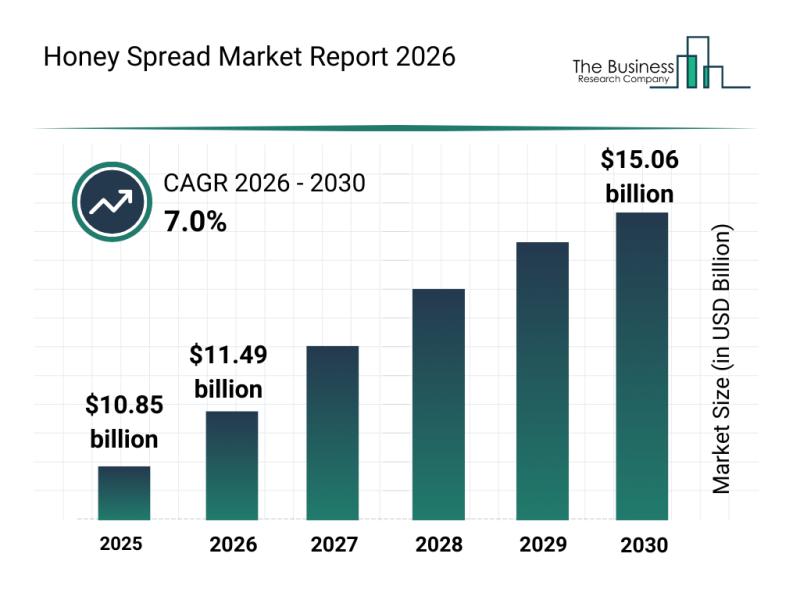

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…