Press release

Business-to-Consumer (B2C) Payment Market: Major Trends Reshaping the Future of the Industry

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.What Will the Business-to-Consumer (B2C) Payment Industry Market Size Be by 2025?

The recent years have witnessed a swift growth in the business-to-consumer (B2C) payment market size. Projected to surge from $2005.58 billion in 2024 to $2306.41 billion in 2025, the market anticipates a compound annual growth rate (CAGR) of 15.0%. Factors such as the rise in smartphone usage, desire for consumer convenience, regulatory backing, improved security measures, and broadened financial services have contributed to this past growth.

What's the Long-Term Growth Forecast for the Business-to-Consumer (B2C) Payment Market Size Through 2029?

The market size for business-to-consumer (B2C) payments is predicted to undergo significant expansion in the coming years. The expected value is projected to reach $3998.86 billion by the year 2029 while rising at a compound annual growth rate (CAGR) of 14.7%. This growth over the forecast period is likely due to increased consumer attention towards financial inclusivity, foundation of sustainability initiatives, emergence of super apps, amplified emphasis on preventing fraudulent payments, and the evolution of subscription and recurring payment models. In the forecast timeframe, we can expect to see major trends such as increased security protocols, the incorporation of artificial intelligence, the integration of blockchain technology and cryptocurrencies, the development of contactless payment systems, and the adoption of mobile wallets.

View the full report here:

https://www.thebusinessresearchcompany.com/report/business-to-consumer-b2c-payment-global-market-report

What Are the Key Growth Drivers Fueling the Business-to-Consumer (B2C) Payment Market Expansion?

The proliferation of internet-based banking services is projected to spur the B2C payment market's growth. These services allow clients to manage their financial affairs, such as transactions, and accounts from anywhere through the internet. The growing appeal of banking services, cost-effectiveness, and secure digital transactions have caused this surge in demand for online banking. B2C payment solutions integrated into these services ensure that consumers can make safe and convenient transactions for bill payments, purchases, and fund transfers from their bank accounts to businesses. For instance, Open Banking Limited, a UK-based company that provides a trusted framework for linking banks, fintech, and technical providers, reported a significant growth in open banking transactions in March 2023. The numbers increased to 68.2 million from 25.2 million in 2021, marking a consistent monthly growth rate of roughly 10%. Furthermore, in December 2022, open banking payments counted to 7.7 million, totaling 68 million for the year, an annual increase of over 100%. Therefore, the proliferation of online banking services is expected to fuel the B2C payment market's growth.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=16637&type=smp

What Are the Key Trends Driving Business-to-Consumer (B2C) Payment Market Growth?

Leading companies in the B2C payment market are pivoting their focus towards digital wallet ecosystems, with the aim of improving user comfort, security and ease of access when handling transactional and financial activities. This e-wallet solution is a digital platform through which users can deposit, navigate, and utilize their funds for both online and physical store purchases via electronic devices. For instance, SumUp, a financial technology firm based in the UK, in September 2022, unveiled SumUp Pay, their new digital wallet, available in the UK, Germany, and Italy through the Apple and Google app stores. This pioneering e-wallet seeks to assist consumers in economizing on daily expenditures and provides small enterprises with an accessible rewards scheme. The app allows users to amass rewards from daily expenditure, with the loyalty program propelling users to support local businesses. With its all-encompassing loyalty e-wallet, SumUp Pay provides a simple payment solution for bills, purchases, and money transfers, while giving users rewards on every penny spent.

How Is the Business-to-Consumer (B2C) Payment Market Segmented?

The business-to-consumer (B2C) payment market covered in this report is segmented -

1) By Type: Cards, Digital Wallet, Other Types

2) By Technology: Near Field Communication (NFC), Direct Mobile Billing, Mobile Web Payment, Short Message Service (SMS), Interactive Voice Response System, Mobile App, Other Technologies

3) By Industry Vertical: Banking, Financial Services And Insurance (BFSI), Healthcare, Hospitality And Tourism, Transportation and Logistics, Retail And E-commerce, Energy And Utilities, Other Industry Verticals

Subsegments:

1) By Cards: Credit Cards, Debit Cards, Prepaid Cards, Virtual Cards

2) By Digital Wallet: Mobile Wallets, E-Wallets, Cryptocurrency Wallets, QR Code Payments

3) By Other Types: Bank Transfers, Buy Now, Pay Later (BNPL) Solutions, Cash On Delivery (COD), Contactless Payments

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=16637&type=smp

Which Companies Are Leading the Charge in Business-to-Consumer (B2C) Payment Market Innovation?

Major companies operating in the business-to-consumer (B2C) payment market are Bank of America Corporation, American Express Company, Capital One Financial Corporation, Visa Inc., PayPal Holdings Inc., Mastercard Incorporated, Fiserv Inc., WeChat Pay, Stripe Inc., Adyen N.V., Worldpay Inc., Klarna Bank AB, Paysafe Group Limited, Affirm Holdings Inc., Revolut Ltd., Wise, Payoneer Inc., Afterpay Limited, Verifone Inc., Skrill Limited, Neteller, Samsung Pay, Alipay Hong Kong Limited, Zelle

Which Regions Are Leading the Global Business-to-Consumer (B2C) Payment Market in Revenue?

North America was the largest region in the business-to-consumer (B2C) payment market in 2023. The regions covered in the business-to-consumer (B2C) payment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=16637

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business-to-Consumer (B2C) Payment Market: Major Trends Reshaping the Future of the Industry here

News-ID: 4130792 • Views: …

More Releases from The Business Research Company

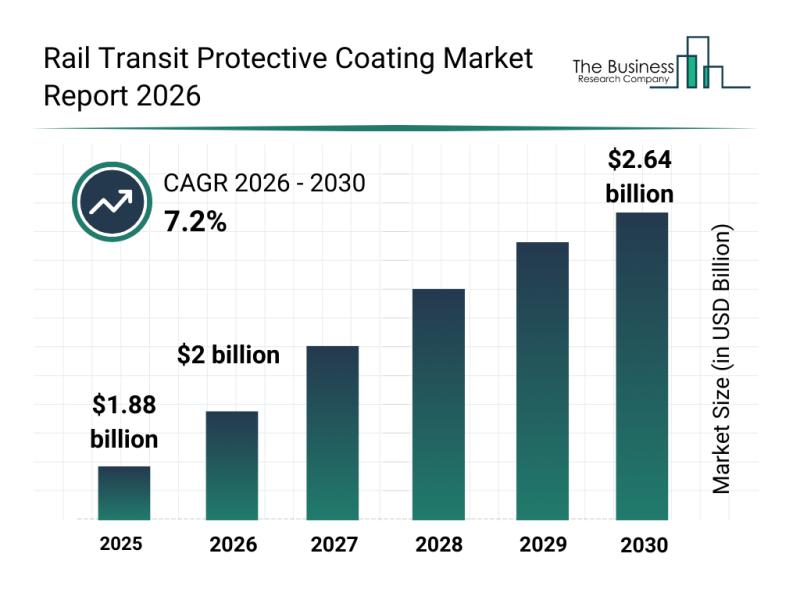

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

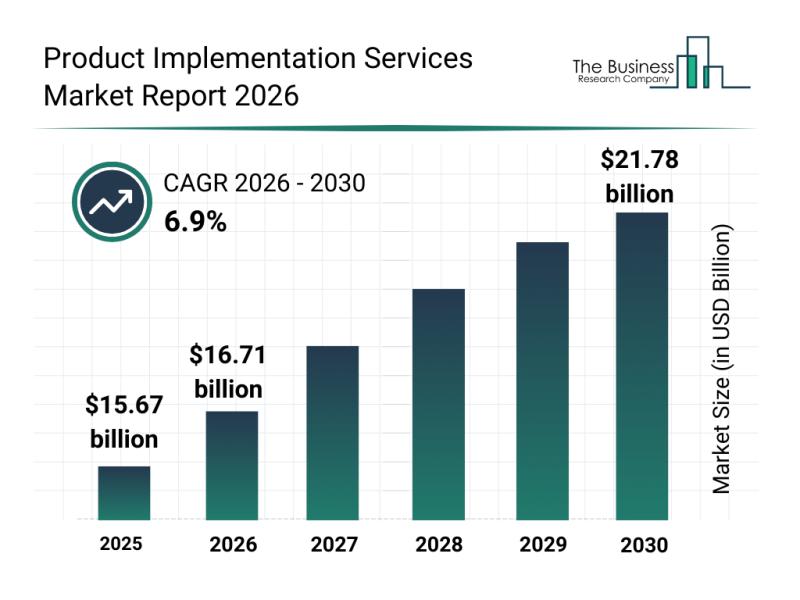

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

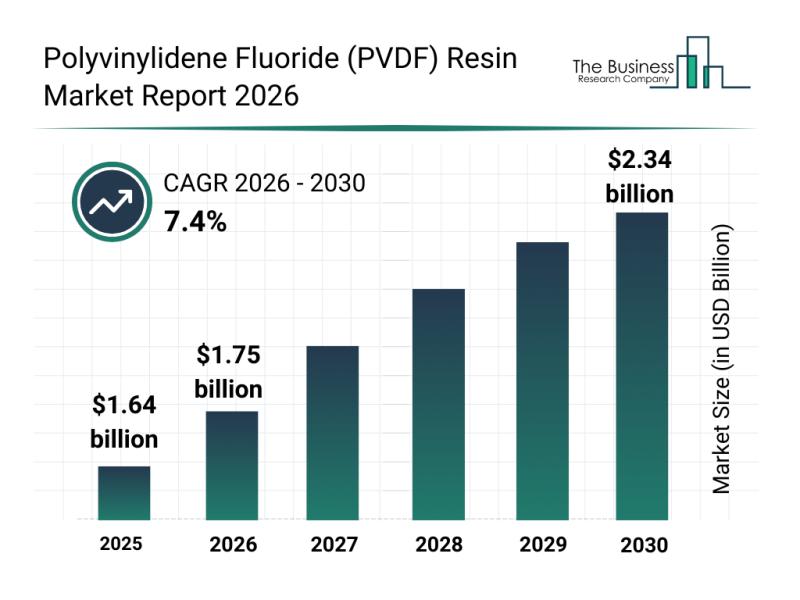

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

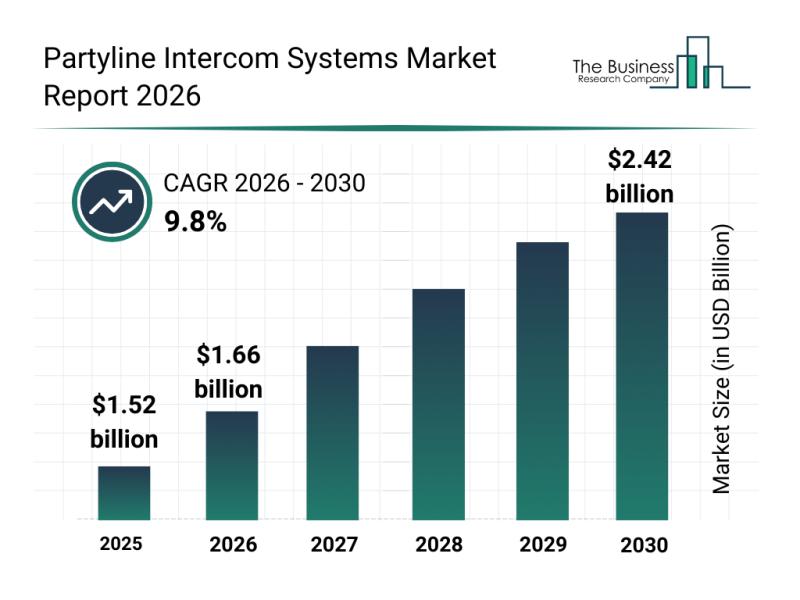

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…