Press release

Autonomous Cargo Delivery Market to Reach $956M by 2031 at 30.7% CAGR, Led by MightyFly and Elroy Air

The global autonomous cargo delivery market is experiencing unprecedented growth, driven by technological innovation, regional logistics demand, and rising interest from major logistics and aerospace companies. According to the latest market research report from QYResearch, the sector is projected to grow from USD 150 million in 2024 to USD 956 million by 2031, representing a compound annual growth rate (CAGR) of 30.7% from 2025 to 2031.Autonomous cargo delivery refers to the use of unmanned aerial vehicles (UAVs), ground robots, and other automated systems to transport goods without direct human intervention. These systems rely on advanced technologies such as artificial intelligence, automation, IoT sensors, and integrated navigation systems.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/4823904

Key Companies and Recent Developments

Several companies are at the forefront of innovation in this rapidly advancing industry. Leading manufacturers include:

• MightyFly

• Elroy Air

• Sabrewing Aircraft

• FedEx

• Pipistrel

• Dronamics

• Pyka

• F-drones

Among them, MightyFly was the market leader in 2024, achieving the highest sales revenue in the segment. The company continues to expand its reach, leveraging its long-range VTOL (vertical takeoff and landing) cargo drones for trunk logistics applications. Similarly, Elroy Air and Dronamics have reported successful cross-regional trial flights with autonomous aircraft, indicating strong future scalability.

Top Autonomous Cargo Delivery Products - Specs & Data

1. MightyFly - Cento (Hybrid electric eVTOL Cargo Drone)

• Payload capacity: up to 100 lb (45 kg)-500 lb (225 kg) depending on model.

• Maximum range: ~600 miles (≈965 km) on hybrid electric power.

• Cruise speed: up to 150 mph (~240 km/h).

• Design: hybrid electric VTOL with 8 VTOL propellers and 1 pusher propeller; carbon fiber composite fuselage.

• FAA-approved flight corridor and evaluation by U.S. Air Force AFWERX program (2025).

2. Elroy Air - Chaparral C1 (Hybrid electric VTOL Cargo Aircraft)

• Payload capacity: 300-500 lb (≈136-227 kg) in modular cargo pod.

• Range: up to 300 miles (≈482 km).

• Cruise speed: ~143 mph (~230 km/h).

• Propulsion: hybrid-electric system with 8 VTOL lift fans and 4 forward-thrust propulsors.

• Selected for evaluation by U.S. Marines and commercial logistics partners (2024-2025).

3. Sabrewing Aircraft - Rhaegal RG 1 (Cargo UAV, VTOL & CTOL)

• Payload capacity: VTOL up to 2,454 kg (≈5,400 lb); CTOL up to 4,545 kg (≈10,000 lb).

• Range: VTOL ~1,850 km; CTOL ~579 km with full load.

• Cruise speed: ~333 km/h (~180 KTAS) at 22,000 ft; max VNE 445 km/h (~240 KTAS).

• Dimensions: wingspan ~17 m, length ~14.6 m, cargo volume ~16 m3.

• Record: lifted 374 kg (829 lb) payload on first hover flight (2022), setting new UAV record.

4. Dronamics - Black Swan (Fixed wing Long range Cargo Drone)

• Payload capacity: 350 kg (≈770 lb); internal cargo volume ~3.5 m3 (~125 cu ft).

• Range: approx. 2,500 km (≈1,550 mi).

• Speed: up to ~200 km/h (~125 mph) at ~20,000 ft.

• Dimensions: wingspan ~16 m, fuselage ~8 m, height ~4 m.

• Notable: positioned as the world's first cargo drone airline; operating in Europe as of 2025.

5. FedEx - Roxo (Delivery Robot)

• Payload capacity: approx. 100 lb (~45 kg).

• Weight: approx. 450 lb (~204 kg).

• Dimensions: ~51.5′′ high × 39′′ long × 29′′ wide.

• Features: zero emission, battery powered, self-balancing and pedestrian friendly design.

• Use case: tested in last mile delivery scenarios in multiple pilot cities globally.

Market Segmentation

The market is segmented by technology type and application:

By Type

• Delivery Drones

• Delivery Robots

By Application

• Trunk Logistics

• Branch Logistics

• Other

Regional Trends

North America

North America continues to lead the global autonomous cargo delivery industry in 2025. The U.S., Canada, and Mexico serve as innovation hubs, with policy backing and active public road trials. In Texas, Aurora Innovation launched the first commercial Class 8 driverless trucking service in April 2025, operating between Dallas and Houston without a human driver. By July, its three-truck fleet had completed over 1,200 fully driverless miles and was accumulating more than 20,000 autonomous miles, now performing 12 trips daily-including nighttime runs-thanks to its proprietary FirstLight LiDAR capable of detecting objects up to 500 m in the dark, and reacting up to 11 seconds faster than human drivers.

Asia-Pacific

In the Asia-Pacific region, rapid e commerce growth, dense urban corridors, and progressive low altitude regulations have accelerated autonomous delivery adoption. In July 2025, EHang (through its joint venture Wanyi Tianxia) flew the VT 20 eVTOL cargo drone on an intercity route between Zhuhai and Guangzhou-covering over 103 miles round-trip (≈83 km one way) in about 55 minutes. The flight carried fresh seafood and medical samples, cutting 40 minutes off road delivery time and significantly avoiding traffic congestion during peak hours.

Europe

Europe is witnessing rising momentum as well. Germany and the U.K. have expanded test corridors for delivery drones and urban air mobility, accompanied by pilot programs in last-mile robotics. Regulatory frameworks are emerging, especially in Germany where SAE Level 4 autonomy is being legalized. Pilot deployments by logistics firms and postal services in urban centers of Berlin and London reflect increasing public and private investment in autonomous cargo systems-both aerial and ground-based.

Common Drivers Across Regions

Across these regions, several thematic trends stand out:

• Round the clock operations: Aurora's shift to day and night trucking operations in Texas more than doubles asset utilization and accelerates path to commercial viability.

• Time sensitive payloads: Use cases like medical samples in the EHang flight show unmatched speed and reliability for perishable or critical cargo.

• Regulatory momentum: Governments are gradually approving low altitude drone corridors and Level 4 truck autonomy, though inconsistency across jurisdictions remains a challenge.

• Safety and efficiency: Autonomous systems offer fatigue free operations, faster reaction times, and more predictable scheduling, appealing to freight operators battling driver shortages and high labor costs.

Together, these regional developments illustrate a shift from experimental pilots to operational deployments, with increasing commercial readiness in North America, high scalability in Asia-Pacific, and steady regulatory progress in Europe. Autonomous cargo delivery is now transitioning from niche technology to practical logistics infrastructure across continents.

Emerging Trends

Several industry-wide trends are shaping the future of autonomous cargo delivery:

• Integration of AI-based decision-making systems for navigation, obstacle avoidance, and fleet management.

• Development of long-range hybrid electric cargo aircraft for cross-city and regional deliveries.

• Increased interest in last-mile delivery robots for urban logistics optimization.

• Government support for low-altitude air corridors, especially in Asia-Pacific.

Request for Pre-Order Enquiry On This Report https://www.qyresearch.com/customize/4823904

Verified Downstream Client Companies

This list includes companies that have publicly confirmed usage of autonomous cargo delivery solutions (drones or robots) as customers or pilots with known providers, as of 2024-2025.

• Walmart

• Kroger

• Tyson Foods

• UPS / WakeMed Hospital

• DoorDash

• Uber Eats

• Royal Mail

• Manna Aero

• Matternet

• Amazon Prime Air

• Flirtey

• DroneUp

With its impressive CAGR of 30.7%, the autonomous cargo delivery market is evolving from niche applications to mainstream logistics solutions. Backed by global players and regional policy initiatives, the industry is poised to redefine freight delivery efficiency, sustainability, and scale over the next decade.

Contact Details

Tel: +1 626 2952 442 ; +41 765899438(Tel & Whatsapp); +86-1082945717

Email: john@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About us:

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Autonomous Cargo Delivery Market to Reach $956M by 2031 at 30.7% CAGR, Led by MightyFly and Elroy Air here

News-ID: 4130358 • Views: …

More Releases from QYResearch Europe

Global Aerospace Grade Smart Assembly Lines Market 2024 USD 4251 Million to 2031 …

According to recent report from QYResearch, the global market for aerospace-grade smart assembly lines stood at US$4,251 million in 2024 and is projected to reach US$8,712 million by 2031 at a 10.2% CAGR (2025-2031). In 2024, approximately 670 lines were produced globally at an average selling price (ASP) of about US$6.343 million per line. These highly automated systems integrate AI, industrial robotics, advanced sensing, and digital control to deliver repeatable,…

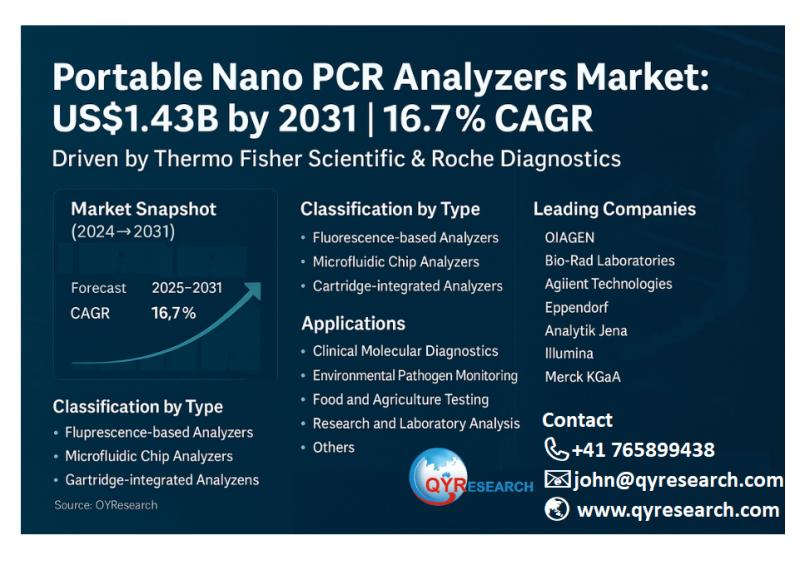

Portable Nano PCR Analyzers Market Growth to US$1.43 Billion by 2031 with 16.7% …

According to the latest QYResearch Report, the global market for Portable Nano PCR Analyzers was valued at US$484 million in 2024 and is expected to reach US$1,427 million by 2031, growing at a CAGR of 16.7% during the forecast period of 2025-2031. Global production in 2024 reached around 96,800 units, with an average price of about US$5,000 per unit. These portable devices utilize nanotechnology-enhanced PCR processes for rapid on-site genetic…

Global Multiphase Flow Conveying Equipment Market to Reach USD 10.88 Billion by …

The global market for Multiphase Flow Conveying Equipment is transitioning from a specialized engineering niche to a core enabler of industrial efficiency across upstream energy, chemicals, mining, and wastewater sectors. According to QYResearch 2025 edition of Multiphase Flow Conveying Equipment - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031, the market was valued at US$7,380 million in 2024 and is projected to reach US$10,879 million by 2031,…

Global Smart Eye-Tracking Medical Devices Market Size Reaches US$3.0 Billion by …

The global Smart Eye-Tracking Medical Devices market has entered a stage of accelerated clinical adoption and product diversification. According to QYResearch 2025 Global Smart Eye-Tracking Medical Devices Market Research Report, the market was valued at US$973 million in 2024 and is projected to reach US$3,009 million by 2031, growing at a CAGR of 17.5% from 2025 to 2031. Global output in 2024 reached approximately 64,900 units, with an average price…

More Releases for VTOL

Global Fixed Wing VTOL Aircraft Market Size & Trends

According to a new market research report published by Global Market Estimates, the global fixed wing VTOL aircraft market is projected to grow at a CAGR of 23.8% from 2023 to 2028.

The growth of the global fixed wing VTOL aircraft market is driven by increasing applications, such as surveillance, reconnaissance, agriculture, logistics, and search and rescue, rise of urban air mobility concepts, advancements in aerospace technologies, and increasing investments from…

VTOL UAV Market Current Scenario and Future Prospects

The Latest Released VTOL UAV market study has evaluated the future growth potential of VTOL UAV market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges,…

MILVUS with VTOL Fixed Wing UAV | PRENEU

PRENEU Co., Ltd. is a brand specializing in the production of drones and is relentlessly committed to meeting market needs and improving technology. PRENEU started its business in the drone market by launching drone flight controllers in 2017 under the corporate mission of providing customers with customized value-added drone through the convergence of its original IoT sensor technology and aviation technology.

Starting with the distribution of drones for training purposes, PRENEU…

Multipurpose VTOL Fixed Wing UAV | PRENEU

PRENEU is a brand specializing in the production of drones and is relentlessly committed to meeting market needs and improving technology. PRENEU started its activities in the drone market by launching DRONEiT in 2017, with the mission of providing customers personalized added value through the convergence of its original IoT sensor technology and aeronautical technology with various other industries.

Starting with the distribution of drones for training purposes, PRENEW has expanded…

UAV Drone with VTOL Fixed Wing function | PRENEU

PRENEU is a brand specialized in drones manufacturer and is ceaselessly challenging and striving to meet market needs and improve technology.

PRENEU started business in the drone market by launching DRONEiT in 2017, with the mission to provide customers with customized value added through the convergence of its original IoT sensor technology and aviation technology with various other industries.

Starting with the distribution of drones for training purposes, PRENEW have expanded its…

VTOL Smart Commercial Drones Market 2021 | Detailed Report

The VTOL Smart Commercial Drones research report undoubtedly meets the strategic and specific needs of the businesses and companies. The report acts as a perfect window that provides an explanation of market classification, market definition, applications, market trends, and engagement. The competitive landscape is studied here in terms of product range, strategies, and prospects of the market’s key players. Furthermore, the report offers insightful market data and information about the…