Press release

Foreign Exchange Market to Reach USD 1.18 Trillion by 2030, Driven by Online Trading Channels and Dynamic Derivatives Landscape

Mordor Intelligence has published a new report on the "Foreign Exchange Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction

Mordor Intelligence, in its latest foreign exchange market report, forecasts the market to grow from USD 0.89 trillion in 2025 to USD 1.18 trillion by 2030, registering a CAGR of 5.83% during the forecast period. The foreign exchange (forex or FX) market continues to be the largest and most liquid financial market in the world, and its growth is being shaped by increased adoption of digital trading platforms, regulatory adjustments, and changing demand from institutional and retail participants.

Market momentum is bolstered by increased activity in spot trading, forex options, and swaps, across both traditional banking channels and emerging fintech interfaces. As the forex market operates 24 hours a day across global financial centers, it remains critical for international trade, cross-border investment, and monetary policy alignment.

Report Overview: https://www.mordorintelligence.com/industry-reports/foreign-exchange-market?utm_source=openpr

Key Trends

1. Rise in Online and Algorithmic Trading

The FX market has witnessed a steady migration from manual trading to online and algorithm-driven platforms. This shift is largely due to demand for speed, precision, and round-the-clock access to currency markets. Online trading channels are now preferred by both institutional and retail investors due to their ability to execute high-frequency trades, offer real-time data analytics, and reduce transaction costs. Sophisticated trading bots and AI-supported algorithms are enabling participants to respond instantly to market movements, news flows, and arbitrage opportunities.

2. Growth in OTC Derivatives and Structured Products

In addition to spot transactions, other over-the-counter (OTC) instruments such as forex swaps, options, and outright forwards are gaining traction. These instruments are vital tools for hedging currency risk, especially for corporations and large financial institutions engaged in international trade. Currency swaps, in particular, have become an effective instrument for managing cross-currency liabilities and liquidity mismatches, while options offer flexibility in uncertain market conditions. This diversification of forex instruments is deepening market participation and liquidity.

3. Shifting Role of Non-Banking Institutions

Non-bank financial institutions-including hedge funds, proprietary trading firms, and asset managers-are becoming increasingly significant players in the FX market. These entities bring additional liquidity, but also influence pricing and volatility patterns. As their strategies often rely on leveraged trading and rapid execution, they contribute to short-term market fluctuations while also creating new revenue avenues for platforms and brokerages offering tailored forex services.

4. Regulatory Focus on Transparency and Reporting

Financial authorities around the globe continue to strengthen oversight mechanisms in response to concerns about systemic risk, benchmark manipulation, and transparency in FX markets. The implementation of reporting requirements and central clearing mandates for certain forex derivatives is leading to better price discovery and market discipline. At the same time, these regulations are nudging traditional players toward technology investments and operational upgrades to comply with emerging global standards.

5. Currency Volatility Driving Hedging Demand

Macroeconomic uncertainty, geopolitical tensions, inflationary pressures, and diverging central bank policies are causing higher levels of currency volatility. For exporters, importers, and multinational corporations, this environment increases the need for risk management solutions through forward contracts, swaps, and options. Market players are also reassessing exposure to emerging market currencies, which exhibit high yield potential but often come with regulatory and liquidity risks.

6. Regional Trading Hubs Expanding Influence

While London and New York remain dominant forex hubs, financial centers such as Singapore, Hong Kong, and Dubai are gaining strategic importance due to time zone advantages, progressive regulations, and growing regional capital flows. These hubs serve as key links between major global markets and emerging economies, facilitating seamless currency conversions and cross-border investment.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/foreign-exchange-market?utm_source=openpr

Market Segmentation

The foreign exchange market is segmented by instrument type, counterparty, trading channel, and geography. Each of these segments plays a distinct role in shaping the overall market dynamics:

By Instrument Type:

Spot Forex: Immediate exchange of currencies, highly liquid, and widely used by retail and institutional traders.

Forex Swaps: Two-part contracts for exchanging currencies at a future date, used extensively for hedging.

Outright Forwards: Customized forward contracts for future currency exchange at a predetermined rate.

Currency Swaps: Used by central banks and corporations to manage interest rate and currency risk.

Forex Options: Contracts offering the right, but not obligation, to exchange currencies at a future rate.

Other OTC Derivatives: Include structured products tailored for specific risk-return profiles.

By Counterparty:

Reporting Dealers: Large global banks and financial institutions that provide liquidity and pricing to clients.

Other Financial Institutions: Includes hedge funds, pension funds, and asset managers.

Non-Financial Customers: Corporates, exporters/importers, and government entities involved in currency transactions for operational needs.

By Channel:

Online: Includes electronic trading platforms, apps, and algorithm-based interfaces that offer high-speed execution.

Offline: Traditional trading via phone calls or in-person interactions, still prevalent among large institutions for complex transactions.

By Geography:

North America: High concentration of institutional players and tech-enabled platforms.

Europe: Maintains a strong foothold with London as a global hub.

Asia-Pacific: Rapidly growing participation, especially in emerging economies like India and China.

South America, Middle East, and Africa: Developing infrastructure, growing retail participation, and currency risk hedging demand.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players

The foreign exchange market is supported by a mix of global banks, financial service providers, and proprietary trading firms. Key players are consistently enhancing their infrastructure and service offerings to remain competitive:

JPMorgan Chase & Co.: A leading liquidity provider with a global footprint and a comprehensive forex product suite. The firm continues to invest in algorithmic trading capabilities and market analytics.

Citigroup Inc.: Offers extensive forex services through its global markets division, catering to a wide array of institutional clients. The bank's electronic trading infrastructure is among the most robust in the industry.

UBS Group AG: Known for strong client relationships and integrated FX solutions that span spot trading, derivatives, and structured products.

Deutsche Bank AG: One of the top players in FX trading volumes globally, with a focus on both corporate and institutional forex services.

XTX Markets Ltd.: A leading non-bank liquidity provider, XTX uses advanced quantitative techniques and infrastructure to serve market participants efficiently. The firm is known for its innovation in pricing and execution models.

These organizations play a crucial role in market-making, risk management, and execution services across global markets, ensuring depth and stability in currency trading operations.

Explore more insights on foreign exchange market competitive landscape: https://www.mordorintelligence.com/industry-reports/foreign-exchange-market/companies?utm_source=openpr

Conclusion

The foreign exchange market continues to evolve in response to shifting macroeconomic trends, regulatory landscapes, and trading technologies. With increasing demand for derivative instruments, greater participation by non-bank entities, and a surge in digital trading platforms, the FX ecosystem is becoming more interconnected and diversified. As currency volatility remains a constant in global trade and investment, the role of forex markets in managing financial risk and facilitating cross-border transactions remains critical for economies, businesses, and investors alike.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/foreign-exchange-market?utm_source=openpr

Industry Related Reports

Clearing Houses and Settlements Market: The clearing houses and settlements market is segmented by type (outward clearing house, inward clearing house), by service (TARGET2, SEPA, EBICS, other services (EURO1, CCBM), and by geography (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa).

Get more insights: https://www.mordorintelligence.com/industry-reports/clearing-houses-and-settlements-market?utm_source=openpr

Capital Exchange Ecosystem Market: The Capital Exchange Ecosystem Market report segments the industry into Market Composition (Primary, Secondary), Capital Market (Stocks, Bonds), Stock Type (Common and Preferred, Growth Stock, Value Stock, Defensive Stock), and Bond Type (Government, Corporate, Municiple, Mortgage, Other Bond Types)

Get more insights: https://www.mordorintelligence.com/industry-reports/capital-market-exchange-ecosystem?utm_source=openpr

Private Credit Market: The Private Credit Market Report Segmented by Financing (Direct Lending, Mezzanine Financing, Distressed Debt, and Specialty Finance), by End-User (Small and Medium Enterprises (SMEs) and Large Corporations), and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East & Africa).

Get more insights: https://www.mordorintelligence.com/industry-reports/private-credit-market?utm_source=openpr

Impact Investing Market: The Impact Investing Market Report is Segmented by Asset Class (Private Equity, Private Debt, Natural and Real Assets, and More), by Investor Type (Institutional Investors and Individual Investors), by End-Use Sector (Renewable Energy, Sustainable Agriculture, Micro-Finance & MSME Lending, and More), and by Geography (North America, South America, Europe, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/impact-investing-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Foreign Exchange Market to Reach USD 1.18 Trillion by 2030, Driven by Online Trading Channels and Dynamic Derivatives Landscape here

News-ID: 4130161 • Views: …

More Releases from Mordor Intelligence

Soy Protein Market Size to Reach USD 229.4 billion by 2031, Driven by Plant-Base …

Soy Protein Market Growth Outlook

The soybean market is estimated at USD 169.9 billion in 2026, up from USD 160 billion in 2025, and is projected to reach USD 229.4 billion by 2031, growing at a CAGR of 6.19%. Strong demand for high-protein animal feed, accelerating biofuel adoption, and steady expansion of plant-based foods are reshaping global supply chains and processing strategies. Attractive crushing margins, supported by soybean oil's rising role…

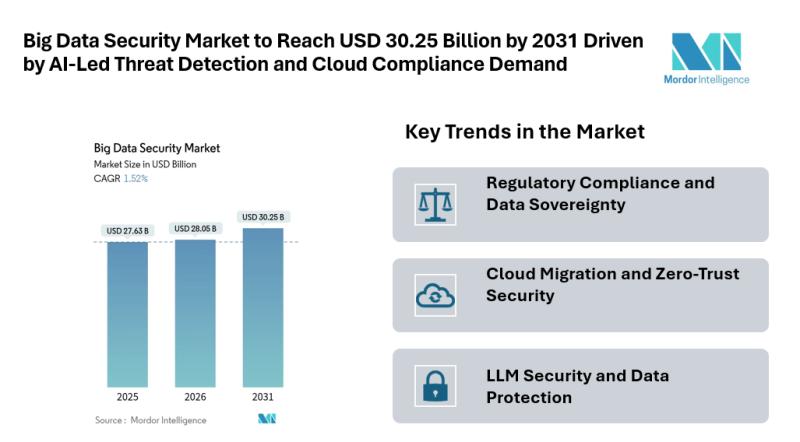

Big Data Security Market to Reach USD 30.25 Billion by 2031 Driven by AI-Led Thr …

Mordor Intelligence has published a new report on the big data security market, offering a comprehensive analysis of trends, growth drivers, and future projections

Big Data Security Market Outlook

According to Mordor Intelligence, the big data security market is projected to grow from USD 27.63 billion in 2025 to USD 28.05 billion in 2026, and further reach USD 30.25 billion by 2031, registering a 1.52% CAGR during 2026-2031. The steady…

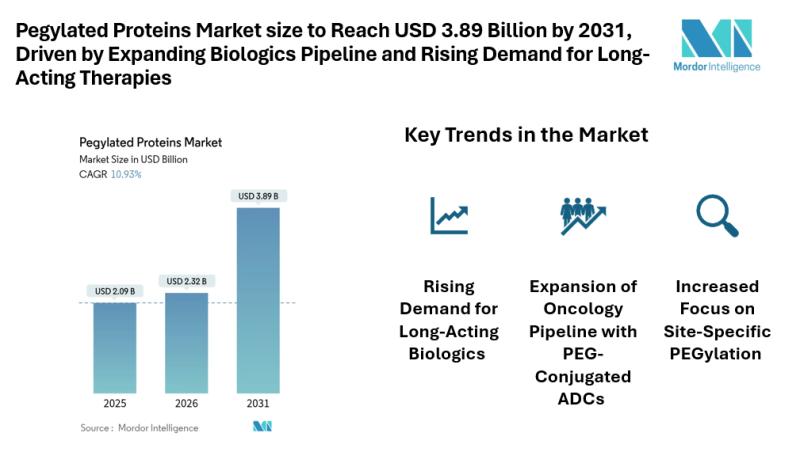

Pegylated Proteins Market size to Reach USD 3.89 Billion by 2031, Driven by Expa …

Mordor Intelligence has published a new report on the pegylated proteins market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Pegylated Proteins Market Analysis

According to Mordor Intelligence, the pegylated proteins market was valued at USD 2.09 billion in 2025 and is projected to grow from USD 2.32 billion in 2026 to reach USD 3.89 billion by 2031, registering a CAGR of 10.93% during the forecast period.…

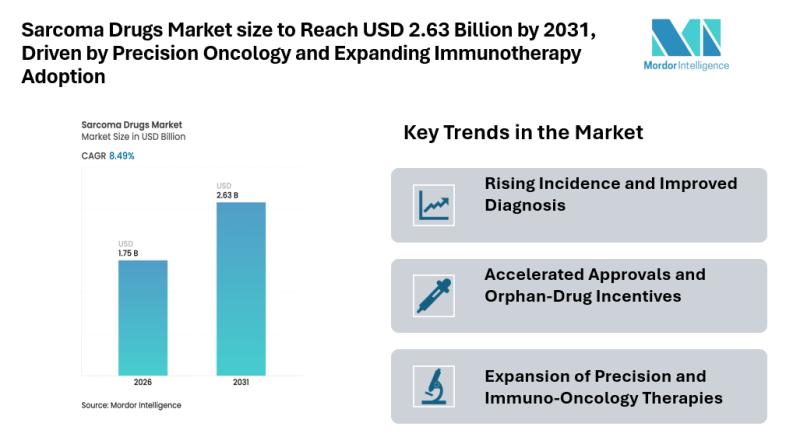

Sarcoma Drugs Market size to Reach USD 2.63 Billion by 2031, Driven by Precision …

Mordor Intelligence has published a new report on the sarcoma drugs market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Sarcoma Drugs Market Overview

According to Mordor Intelligence, the sarcoma drugs market size is estimated at USD 1.75 billion in 2026 and is projected to reach USD 2.63 billion by 2031, growing at a CAGR of 8.49% during the forecast period. The steady rise in the…

More Releases for America

Stabilit America Highlights Applications of Fiberglass Roof Panels with Stabilit …

Roofing materials are very important in the realm of modern construction, as they should be long lasting, economical and attractive. Fiberglass roof panels are a few of the numerous choices among several alternatives that have received a reputation of being versatile, long life, and adaptable in various sectors. They are favored by the architects, contractors, and property developers due to their lightweight construction, resistance to weather factors, and the ease…

Deodorants Market Report by Region (North America, EMEA, Latin America, Asia)

2025 - Pristine Market Insights, a leading market research firm, announced the release of its latest and comprehensive market research report on Deodorants market. The report spans over 500 pages and delivers 10-year market forecast in US dollars (or custom currencies upon request). It provides in-depth analysis of market dynamics (drivers, opportunities, restraints), PESTLE insights, latest industry trends, and demand factors. The report includes segmented market value, share (%), compound…

Sequestrant Market Report by Region (North America, EMEA, Latin America, Asia)

2025 - Pristine Market Insights, a leading market research firm, announced the release of its latest and comprehensive market research report on Sequestrant market. The report spans over 500 pages and delivers 10-year market forecast in US dollars (or custom currencies upon request). It provides in-depth analysis of market dynamics (drivers, opportunities, restraints), PESTLE insights, latest industry trends, and demand factors. The report includes segmented market value, share (%), compound…

Buttermilk Market Study by Region (North America, Latin America, Europe, Asia, M …

2025 - Pristine Market Insights, a leading market research firm, announced the release of its latest and comprehensive market research report on Buttermilk market. The report spans over 500 pages and delivers 10-year market forecast in US dollars (or custom currencies upon request). It provides in-depth analysis of market dynamics (drivers, opportunities, restraints), PESTLE insights, latest industry trends, and demand factors. The report includes segmented market value, share (%),…

Textiles Market Analysis Report, Regional Outlook - Europe, North America, South …

Adroit Market Research has announced the addition of the “Global Textiles Market Size Status and Forecast 2025”, The report classifies the global Textiles in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth.

This report studies the global Textiles Speaker market, analyzes and researches the Textiles Speaker development status and forecast in Europe, North America, Central America, South America, Asia Pacific…

Global Gaucher Disease Market 2018 Covering North America, South America, Europe

Gaucher Disease Market

Summary

The Global Gaucher Disease Market is defined by the presence of some of the leading competitors operating in the market, including the well-established players and new entrants, and the suppliers, vendors, and distributors. The key players are continuously focusing on expanding their geographic reach and broadening their customer base, in order to expand their product portfolio and come up with new advancements.

Gaucher Disease market size to maintain the average annual growth…