Press release

Community Lenders Expand Payday Loans for Unemployed with New Criteria

Community lenders are widening access to payday loans for unemployed (https://www.loanowl.com.au/payday-loan) Australians by introducing more flexible approval criteria. These changes aim to support those facing temporary income gaps.Due to the significant changes in Australia's unemployment rate, community lenders have had to modify their lending standards, and regulators are issuing new alerts regarding exploitative tactics in the payday lending industry. A worrying trend has been shown by recent data: the unemployment rate has risen from 3.5% to 4.1%, with an increase of over 100,000 persons since mid-2022.

In response to the March 2025 report by the Australian Securities and Investments Commission, which revealed concerning industry practices, respectable community-focused lenders are providing unemployed Australians with more access alternatives.

This discovery occurs at a crucial moment, as 82% of jobless individuals report having trouble finding employment, putting vulnerable households under hitherto unheard-of financial strain when they apply for payday loans for unemployment.

• ASIC Warning Signals Industry Transformation

The corporate watchdog has found that the payday lending industry is systematically manipulated. According to ASIC's research, lenders were purposefully moving applicants from $700-$2,000 small loans to $2,000-$5,000 medium-sized loans, which have much less consumer protections.

The statistics tell a stark story. Small loan credit contracts fell from 80% of all loans in December 2022 to less than 60% by August 2023. ASIC suspects this represents a calculated strategy to circumvent stricter regulations protecting vulnerable consumers.

•• Expert Insight

ASIC Commissioner Alan Kirkland stated: "Consumers who access these products are often financially vulnerable. ASIC has a strong record of taking enforcement action in response to lending practices that cause harm to vulnerable consumers."

This market has a significant size. The substantial impact on jobless borrowers in need of emergency cash is evidenced by the $1.3 billion in small and medium-sized loans given to Australian consumers in 2023-2024.

Financial comparison sites like Loan Owl (https://www.loanowl.com.au/) and other industry watchers have observed a rise in the number of inquiries from jobless Australians looking for acceptable financing solutions.

• Expanded Access for Unemployed Borrowers

Despite regulatory concerns, progressive community lenders have modified their assessment criteria to accommodate unemployed applicants. The primary change involves recognising Centrelink payments and government benefits as legitimate income sources for loan qualification.

•• Key Eligibility Requirements

-- Australian residency and minimum age of 18 years

-- Valid government identification documents

-- Active bank account receiving regular income payments

-- Documented proof of income source, including government benefits

-- Comprehensive bank statements covering 90-day period

-- Verified permanent address for minimum three months

Several lenders now approve loans up to $5,000 for applicants receiving 100% of their income from Centrelink, though these arrangements typically involve higher fees and reduced loan amounts compared to employment-based lending.

•• Alternative Income Sources Now Recognised

-- JobSeeker and unemployment benefit payments

-- Disability Support Pension payments

-- Aged Pension and Commonwealth support

-- Documented freelance or casual employment

-- Verified rental income from property investments

-- Confirmed job offers with specified commencement dates

Most reputable lenders maintain a preference for applicants where less than 50% of total income derives from government benefits, although exceptions exist for smaller loan amounts when considering payday loans for unemployed applicants.

• Understanding True Costs vs Alternatives

Before considering payday loan options, unemployed Australians must understand the genuine financial implications and explore potentially significant cost-saving alternatives.

•• Payday Loan Cost Structure

Licensed lenders charge an establishment fee of 20% of the borrowed amount plus a monthly fee of 4%. The following table illustrates real-world costs:

Loan Amount

Establishment Fee

Monthly Fee

Total Repayment (12 months)

$2,000

$400

$80

$3,360

$1,500

$300

$60

$2,520

$1,000

$200

$40

$1,680

•• Case Study: Strategic Alternative Selection

Sarah, a native of Melbourne, first looked into online payday loans for jobless people after her washing machine broke. She learned about the No Interest Loan Scheme through her neighborhood community center after talking to a counselor and looking through financial comparison websites.

As a consequence, Sarah avoided $816 in needless expenses and kept her financial stability while she was unemployed by repaying precisely $1,200 with no additional fees.

• Superior Alternative Option

For qualified Australians, the federal government's No Interest Loans Scheme (NILS), which offers loans up to $3,000 with no interest, fees, or levies, is becoming a competitive alternative to expensive short-term borrowing.

Couples making less than $100,000 annually or single applicants making less than $70,000 are eligible for the program. Regardless of their financial situation, survivors of domestic abuse may also be eligible.

Repayment terms of up to two years and worldwide accessibility through neighborhood community centers are two of NILS's key advantages.

Advocates for consumers point out that the program is a safer and more cost-effective choice for people in need, especially those without jobs, and that it may save borrowers hundreds of dollars in costs when compared to conventional payday loans.

• Rising Unemployment Drives Credit Demand

According to the Reserve Bank of Australia, the national unemployment rate is expected to reach 4.5% by the end of 2025, indicating that unemployed Australians are experiencing increasing financial difficulty.

This prediction foretells ongoing difficulties for households looking for work, which raises the possibility of depending on short-term credit to cover necessities.

With job openings dropping from 473,000 in mid-2022 to 330,000 by August 2024, the labor market has significantly deteriorated. There are currently 4.9 applicants for every open position, up from 2.9 two years ago, indicating that competition has increased.

Financial experts caution that payday loans (https://www.loanowl.com.au/payday-loan) may exacerbate financial stress and frequently trap borrowers in recurring debt cycles as the average time to find appropriate work increases. Before turning to pricey credit goods, all other support choices should be thoroughly investigated.

• Identifying Predatory Practices

Following ASIC's warnings, unemployed borrowers must exercise heightened caution in lender selection. All legitimate credit providers must maintain current Australian Credit Licences, verifiable through ASIC's Professional Registers Search.

•• Warning Indicators of Predatory Lending

Regulators and consumer advocates are urging Australians to remain vigilant against predatory lending practices, particularly as short-term credit options become more widely available. Several key warning signs have been identified.

These include lenders that promise approval regardless of the applicant's financial status or that won't give a clear explanation of all costs and expenses.

Additional warning signs include providing credit that surpasses 10% of a borrower's after-tax income, purposefully ignoring any discussion of alternative financial options, and using pressure methods to get borrowers to take on bigger loan amounts than necessary.

Authorities advise customers to carefully consider any loan offer and to get independent counsel if there are any red flags.

Financial comparison platforms have reported increased consumer inquiries about verification processes, with many borrowers now cross-referencing lender credentials before proceeding with applications.

• Responsible Borrowing Framework

Financial counsellors unanimously recommend exhausting alternative resources before considering payday loan options. When circumstances render payday borrowing unavoidable, industry experts suggest the following framework:

•• Practical Steps

1. Limit borrowing to absolute minimum required amount

2. Select shortest manageable repayment term

3. Establish comprehensive repayment strategy before application

4. Review all contractual terms and conditions thoroughly

5. Seek immediate assistance if repayment difficulties emerge

Payday lenders with licenses are subject to responsible lending requirements, which forbid them from making loans they have a reasonable belief borrowers will find difficult to return. Community legal centers offer free legal counsel to consumers who think lenders have violated these duties.

• Strategic Financial Decision Making

The payday lending environment for unemployed Australians continues evolving rapidly. While community lenders expand accessibility, regulatory oversight intensifies to protect vulnerable consumer segments.

Financial counsellors provide expert assistance accessing emergency relief programs, negotiating creditor arrangements, and developing sustainable financial strategies tailored to individual circumstances.

For eligible applicants, NILS loans deliver identical emergency funding without devastating fee structures. Even brief delays to access these alternatives can generate thousands of dollars in cost savings.

• Key Insight

It is not necessary for temporary unemployment to result in irreversible financial harm. There are extensive support networks in place to assist in navigating present issues without entering into predatory lending agreements that make financial difficulties worse during times of vulnerability.

Seeking expert financial help is not a sign of personal failure but rather of strategic financial management. Every financial journey encounters obstacles, and established resources exist to provide support through challenging circumstances toward improved financial stability and security.

Office 7602 182-184 High Street North East Ham London E6 2JA

Finixio Digital is a UK-based remote-first Marketing & SEO Agency helping clients worldwide. In only a few short years, we have grown to become a leading Marketing, SEO, and Content agency.

Contact:

Mail: Media.finixiodigital@gmail.com

Phone: +44 7577 509325

https://sportsurger.org/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Community Lenders Expand Payday Loans for Unemployed with New Criteria here

News-ID: 4128097 • Views: …

More Releases from Finixio Digital

How to Choose a Bucking Unit for Tubing & Casing Connections: A Practical Buyer' …

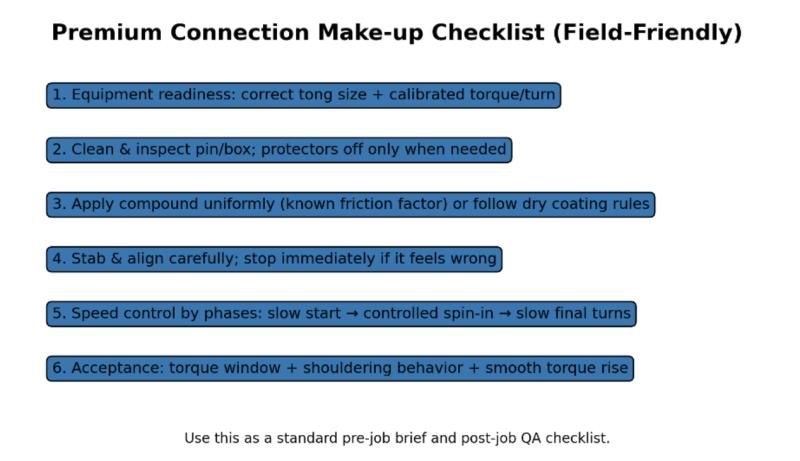

A field-ready checklist to improve repeatability, reduce rework, and support QA documentation.

When teams evaluate a https://galipequipment.com/bucking-unit/ the first comparison is usually torque range. That matters, but it is not the only factor that determines whether your connection work stays consistent over time. In real operations, the biggest costs often come from rework, inconsistent make-up behavior, damaged surfaces, and unclear documentation when customers request proof.

This guide breaks down what to evaluate…

Roller Shutters: The Ultimate Guide to Security, Energy Savings & Weather Protec …

Roller shutters are one of the smartest investments you can make for your home or business. These strong, versatile window and door coverings provide security, insulation, noise reduction, and weather protection all in one package. Whether you're looking to lower energy bills, keep intruders out, or protect your property from storms, roller shutters (https://qldshade.com.au/roller-shutters/) deliver real results.

● What Are Roller Shutters?

Roller shutters are protective coverings made from horizontal slats (called…

Online Blinds Australia: Buy Custom Blinds Online & Save 40-60%

Looking to buy blinds online in Australia? You're making a smart choice. Shopping for online blinds Australia (https://aussieonlineblinds.com.au/) saves you 40-60% compared to retail stores, and you get custom-made window coverings delivered straight to your door. This guide shows you everything you need to know to choose, order, and install the perfect blinds for your home.

● Why Buy Blinds Online in Australia?

When you buy blinds online in Australia, you skip…

Hiddence.net: Premium Anonymous VPS & VDS Hosting

In today's world of constant digital surveillance, finding a hosting provider that combines high-performance hardware with genuine privacy is rare. Hiddence.net (http://Hiddence.net) redefines hosting by offering powerful VPS and VDS solutions designed to keep your identity completely anonymous. Whether you're running privacy-focused projects, mission-critical applications, or specialized workloads, Hiddence ensures your digital footprint remains fully protected-without sacrificing speed or reliability.

● Privacy Meets Performance

Most hosting providers require personal information during…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…