Press release

Mobile Payments Market: Overview, Key Drivers, Competitive Landscape, Segmentation, and Regional Analysis (2022 - 2032)

According to a research report published by Spherical Insights & Consulting, The Global Mobile Payments Market Size is to grow from USD 942.3 Billion in 2022 to USD 2983.9 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 12.22% during the projected period.The Mobile Payments global market research studies offer an in-depth analysis of current industry trends, development models, and methodology. Production processes, development platforms, and the actual product models are some of the variables that have a direct impact on the market. The aforementioned characteristics can drastically vary in response to even minor changes in the product profile. The study provides a thorough explanation of each of these elements of Electronics, ICT & Media.

Request To Download Free Sample copy of the report @ https://www.sphericalinsights.com/request-sample/3446

Market Overview

Any financial transaction made to purchase a good or service using a portable electronic device-such as a tablet or cell phone is referred to as a mobile payment. Mobile payment technology can also be used to send money to friends and family using apps like Venmo and PayPal. Consumers can use mobile payment apps or their credit card to check out on mobile e-commerce websites.

The global market is Mobile Payments Market robust growth due to:

1. Rising Smartphone Penetration

Increasing global smartphone adoption is making mobile payments more accessible, especially in emerging markets.

2. Expansion of E-commerce

The surge in online shopping, especially post-pandemic, has accelerated the demand for seamless mobile payment solutions.

3. Growing Internet Connectivity

Wider availability of 4G/5G networks and affordable data plans are enabling users to transact digitally from anywhere.

Buy Now this report: https://www.sphericalinsights.com/checkout/3446

The mobile web payment segment is anticipated to have the biggest market share for global mobile payment market over the projected period.

The global mobile payments market is divided into segments based on technology: NFC, direct mobile billing, mobile web payment, SMS, interactive voice response systems, mobile apps, and others. The mobile web payment segment is projected to expand at the fastest rate in the global mobile payments market throughout the forecast period. The growing acceptance of m-commerce fosters the segment's growth as well. The mobile web payment platforms' URLs and accurate bookmarking make it easier for users to visit or recommend the website.

The B2B segment is predicted to expand at the fastest rate possible in the global mobile payment market throughout the course of the forecast.

The global mobile payments market is classified into B2B, B2C, and B2G. B2B segment are projected to expand at the fastest rate in the global mobile payments market during the forecast period. This is because there is room for growth, as seen by the large investments that venture capital and investment firms are making in B2B payments. Rupifi, a provider of business-to-business payment applications, raised $25 million in January 2022 through a series-A funding round led by Bessemer Venture Partners and Tiger Global Management, LLC.

List of Key Companies

• Google (Alphabet Inc.)

• Samsung Electronics Co. Ltd.

• Visa Inc.

• WeChat (Tencent Holdings Limited)

• Apple Inc.

• Alibaba Group Holdings Limited

• Amazon.com Inc.

• American Express Company

• M Pesa

• Money Gram International

• PayPal Holdings Inc.

Market Challenges

1. Security and Fraud Concerns

Mobile payment platforms are frequent targets for cyberattacks, phishing, malware, and identity theft.

2. Fragmented Regulatory Landscape

The mobile payments ecosystem is governed by inconsistent and evolving regulations across different countries.

3. Limited Infrastructure in Developing Regions

In low-income or rural areas, inadequate internet connectivity, lack of smartphones, and unreliable electricity supply limit the use of mobile payment systems.

4. Consumer Trust and Awareness Issues

In some markets, especially among older demographics, there's skepticism toward digital payments due to fear of fraud or lack of digital literacy.

Research Objectives

1. To Analyze Market Size and Forecast Growth Trends

Quantitatively assess the current size of the global mobile payments market and project its growth trajectory over the forecast period.

2. To Identify and Evaluate Key Market Drivers and Restraints

Investigate the factors propelling market growth, such as smartphone penetration, internet connectivity, and digital government initiatives.

Recent Development

In July 2023, In India, Samsung unveiled the Galaxy Watch 6 series, which is now capable of NFC payments using Samsung Wallet. The Tap & Pay feature allows users to make mobile payments. For Indian customers, the launch of near-field communication payments through Samsung Wallet is a game-changing feature that would likely accelerate the uptake of mobile payments in the nation.

Access Full Report: https://www.sphericalinsights.com/reports/mobile-payments-market

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Mobile Payments Market based on the below-mentioned segments:

Global Mobile Payments Market, By Technology

• NFC

• Direct Mobile Billing

• Mobile Web Payment

• SMS

• Interactive Voice Response System

• Mobile App

• others

Global Mobile Payments Market, By Type

• B2B

• B2C

• B2G

Global Mobile Payments Market, By Location

• Remote

• Proximity

Regional Segment Analysis of the Global Mobile Payments Market

North America (U.S., Canada, Mexico)

Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Rest of APAC)

South America (Brazil and the Rest of South America)

The Middle East and Africa (UAE, South Africa, Rest of MEA)

What's covered in the report?

1. Overview of the Mobile Payments Market.

2. The current and forecasted regional (North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa) market size data for the Mobile Payments Market, based on segment.

3. Mobile Payments Market trends.

4. Mobile Payments Market drivers.

5. Analysis of major company profiles.

FIVE FORCES ANALYSIS

1. Threat of New Entrants - Moderate

Barriers to entry such as the need for strong cybersecurity infrastructure, regulatory compliance, and access to banking networks make it moderately difficult for new players to enter.

2. Bargaining Power of Suppliers - Low to Moderate

The suppliers in this market typically include technology vendors (cloud infrastructure, payment gateway providers) and financial institutions.

3. Bargaining Power of Buyers - High

Consumers and merchants have a wide array of mobile payment solutions to choose from, including Apple Pay, Google Pay, PayPal, Venmo, Alipay, and local wallets.

4. Threat of Substitutes - Moderate to High

Substitutes include credit/debit card payments, cash transactions, internet banking, and alternative fintech solutions like BNPL (Buy Now, Pay Later).

5. Industry Rivalry - High

The mobile payments market is highly competitive with the presence of global tech giants, banks, telecom companies, and regional fintech startups.

PESTLE ANALYSIS

1. Political Factors

Government support for digital economies is a major driver. Initiatives like India's Digital India, China's cashless society vision, and EU's Digital Finance Strategy promote mobile payments.

2. Economic Factors

The growth of the global e-commerce industry and increased consumer spending have strengthened demand for digital and mobile payments.

3. Social Factors

Rapid urbanization, the rise of the millennial and Gen Z population, and growing digital literacy are accelerating the shift toward mobile-first payment behavior.

4. Technological Factors

Advancements in biometric authentication, blockchain, tokenization, and AI-based fraud detection are enhancing mobile payment security and trust.

5. Legal Factors

Global and regional data protection laws (e.g., GDPR in Europe, CCPA in California) are compelling payment providers to prioritize data privacy and transparency.

Table of Content (TOC)

• Introduction

1. Objectives of the Study

2. Market Definition

3. Research Scope

• Research Methodology and Assumptions

• Executive Summary

• Premium Insights

1. Porter's Five Forces Analysis

2. Value Chain Analysis

3. Top Investment Pockets

1. Market Attractiveness Analysis By Product Type

2. Market Attractiveness Analysis By Type

3. Market Attractiveness Analysis By Segment Type

4. Market Attractiveness Analysis By Region

4. Industry Trends

• Market Dynamics

1. Market Evaluation

2. Drivers

1. Increasing development in sector

3. Restraints

4. Opportunities

5. Challenges

• Global Mobile Payments Market Analysis and Projection, By Product Type

• Global Mobile Payments Market Analysis and Projection, By Type

• Global Mobile Payments Market Analysis and Projection, By Segment Type

• Global Mobile Payments Market Analysis and Projection, By Regional Analysis

1. Segment Overview

2. North America

1. U.S.

2. Canada

3. Mexico

3. Europe

1. Germany

2. France

3. U.K.

4. Italy

5. Spain

4. Asia-Pacific

1. Japan

2. China

3. India

5. South America

1. Brazil

6. Middle East and Africa

1. UAE

2. South Africa

• Global Mobile Payments Market-Competitive Landscape

1. Overview

2. Market Share of Key Players in the Global Mobile Payments Market

1. Global Company Market Share

2. North America Company Market Share

3. Europe Company Market Share

4. APAC Company Market Share

3. Competitive Situations and Trends

1. Coverage Launches and Developments

2. Partnerships, Collaborations, and Agreements

3. Mergers & Acquisitions

4. Expansions

• Company Profiles

1. Company1

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

2. Company2

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

3. Company3

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

Industry Related Reports

Global Dust Monitor Market Size,

https://www.sphericalinsights.com/reports/dust-monitor-market

Global Online Gaming Market Size

https://www.sphericalinsights.com/reports/online-gaming-market

Global Projector Screen Market Size

https://www.sphericalinsights.com/reports/projector-screen-market

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payments Market: Overview, Key Drivers, Competitive Landscape, Segmentation, and Regional Analysis (2022 - 2032) here

News-ID: 4126169 • Views: …

More Releases from Spherical Insights LLP

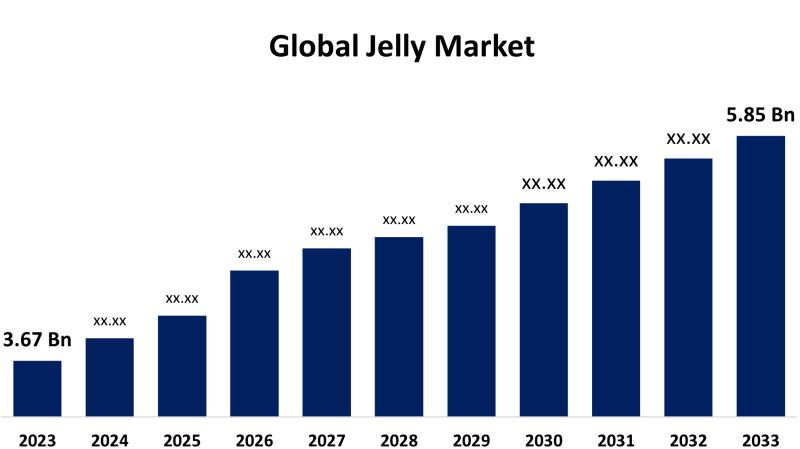

Global Jelly Market Size, Share, Forecasts 2023 - 2033 | Top key players: Bonne …

According to a research report published by Spherical Insights & Consulting, the Global Jelly Market is Expected to Grow from USD 3.67 Billion in 2023 to USD 5.85 Billion by 2033, at a CAGR of 4.77% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8511

The jelly industry comprises the international sector dealing with the manufacture, distribution, and sale of jelly products. Such products cover…

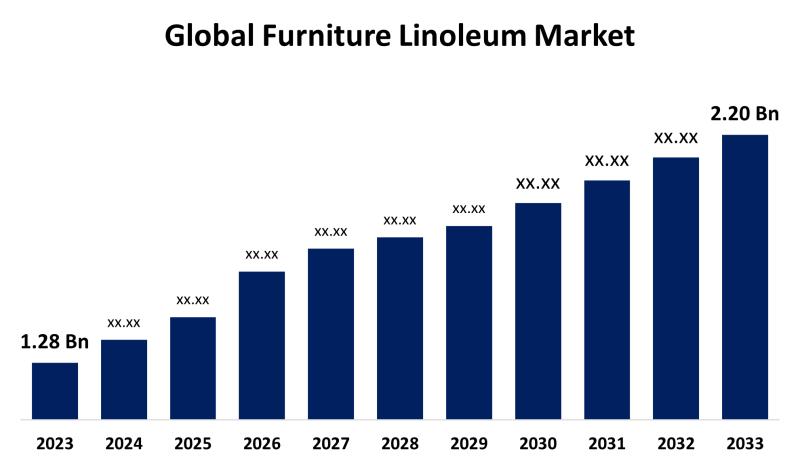

Global Furniture Linoleum Market Size, Share, Forecasts 2023 - 2033 | Top key pl …

According to a research report published by Spherical Insights & Consulting, the Global Furniture Linoleum Market Size is Estimated to Grow from USD 1.28 billion in 2023 to USD 2.20 billion by 2033, Growing at a CAGR of 5.57% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8455

The industry engaged in the manufacture, marketing, and distribution of linoleum products, especially made for furniture…

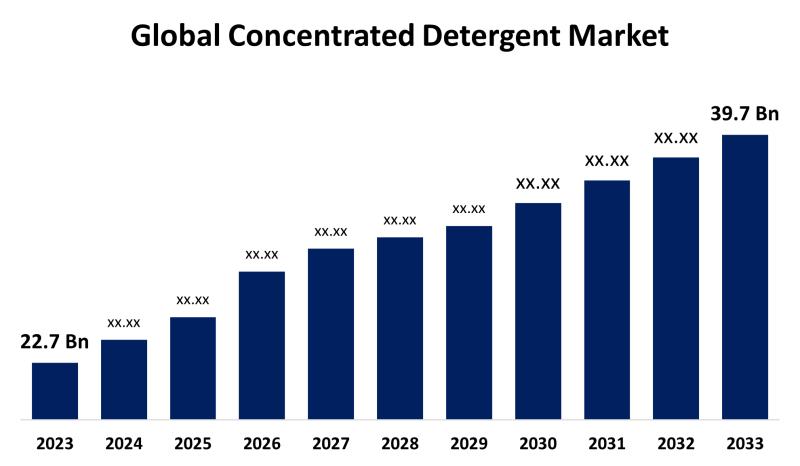

Global Concentrated Detergent Market Size, Share, Forecasts 2023 - 2033 | Top ke …

According to a research report published by Spherical Insights & Consulting, the Global Concentrated Detergent Market Size Expected to Grow from USD 22.7 Billion in 2023 to USD 39.7 Billion by 2033, at a CAGR of 5.75% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8439

The division of the detergent industry that produces and markets highly concentrated…

Global Wireless Home Weather Station Market Size, Share, Forecast 2023 - 2033 | …

According to a research report published by Spherical Insights & Consulting, the Global Wireless Home Weather Station Market Size is Expected to Grow from USD 249 Million in 2023 to USD 508 Million by 2033, at a CAGR of 7.39% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report @ -

https://www.sphericalinsights.com/request-sample/7694

A system that measures and sends environmental data from outside to within, including temperature,…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…