Press release

Tapping into the Future: Mobile Payment Market Growth & Forecast 2025-2032

Meticulous Research®-leading global market research company, published a research report titled, 'Mobile Payment Market by Method (Mobile Wallets, QR Code, Mobile Commerce, Mobile Point of Sale), Application (B2B, B2C, B2G), Location (Remote, Proximity), End-user (BFSI, Retail & E-commerce, Healthcare), and Geography - Global Forecast to 2032.According to this latest publication from Meticulous Research®, the global mobile payment market is projected to reach $3,929 billion by 2032, at a CAGR of 27.2% from 2025-2032.The growth of the mobile payment market is driven by the growing digitalization of payment services through smartphones and growing government initiatives for cashless payment. However, the lack of infrastructure in developing countries restraints the growth of the market. Additionally, the increasing integration of near-field communication (NFC) technology in mobile payment for secure and contactless transactions is expected to create growth opportunities for market players. However, concerns over data breaches and identity theft present major challenges impacting market growth. Additionally, the increasing adoption of artificial intelligence-based applications in payment and the rising use of digital payment platforms at tourist destinations are emerging trends in the market.

Download Sample Report Here: https://www.meticulousresearch.com/download-sample-report/cp_id=5977

Key Players

The key players operating in the mobile payment market (Markt für mobile Zahlungen) are MoneyGram Payment Systems, Inc. (U.S.), Apple Inc. (U.S.), Google LLC (A Subsidiary of Alphabet Inc.) (U.S.), Mastercard Inc (U.S.), Alibaba Group Holding Limited (China), PayPal Holdings, Inc. (U.S.), Samsung Electronics Co., Ltd. (South Korea), Visa Inc. (U.S.), Tencent Holdings Ltd (China), Amazon.com, Inc. (U.S.), American Express Company (U.S.), M-Pesa (Vodafone Group Plc) (U.K.), One MobiKwik Systems Limited (India), Orange S.A. (France), and Oxigen Services (India) Pvt. Ltd (India).

Drivers of Mobile Payments Market Globally:

Several interconnected drivers are fueling the rapid expansion of mobile payment systems around the world. First and foremost is the widespread penetration of smartphones. As of recent data, approximately 87% of households globally own smartphones, a figure steadily increasing as devices become more affordable and internet access broadens across emerging markets. Smartphones now serve as primary payment conduits, enabling consumers to transact instantly from anywhere.

Another powerful catalyst is the surge in e-commerce across many regions. Consumers increasingly seek fast, seamless, and secure transaction options while shopping online, and mobile payments fulfill these requirements perfectly. The convenience of mobile wallets integrated into e-commerce platforms enhances customer experience and drives repeated usage.

Financial inclusion initiatives also play a crucial role. Mobile payments offer unbanked and underbanked populations access to digital financial services, often through user-friendly apps developed by fintech companies and supported by government policies promoting cashless ecosystems. Furthermore, the COVID-19 pandemic has accelerated demand for contactless payments, as safety and hygiene concerns discourage cash use in physical stores.

Browse in depth: https://www.meticulousresearch.com/product/mobile-payment-market-5977

Technological Advancements Powering Mobile Payment Adoption:

The adoption of mobile payment methods has been significantly impacted by several evolving technologies. Among these, Near Field Communication (NFC) has emerged as a dominant technology for contactless payments. NFC allows encrypted data transfer between smartphones and payment terminals without direct physical contact, enabling quick and secure transactions. NFC technology is anticipated to grow at an annual rate nearing 40% over the next several years, driven by increasing integration with loyalty programs and wearable devices.

Other key technological innovations include biometric authentication (such as fingerprint and facial recognition), which enhances security and user trust by protecting against fraud. Tokenization-which replaces sensitive data with non-sensitive equivalents during transactions-also plays a vital role in safeguarding user information.

Further, the rise of Artificial Intelligence (AI) in payments is revolutionizing how transactions are processed and monitored. AI enables real-time fraud detection and personalized customer engagement by analyzing user behavior patterns, which enhances security and loyalty. Additionally, advancements in 5G connectivity and blockchain technologies promise to improve the speed, reliability, and transparency of mobile payment systems in the coming years.

Regions Expected to Witness the Fastest Mobile Payments Growth:

While mobile payments are a global phenomenon, growth rates vary significantly by region. The Asia Pacific region currently dominates the market with a substantial share, fueled by massive adoption in countries like China and India. UPI (Unified Payments Interface) in India and PIX in Brazil are stellar examples of real-time payment rail systems that have rapidly expanded mobile payment usage.

Emerging markets in Southeast Asia, Latin America, and Africa are also expected to experience the fastest mobile payments growth, supported by expanding smartphone penetration, youthful populations embracing digital technology, and government-backed cashless policies.

North America and Europe continue to progress steadily, led by innovations in urban transit payments, integration of NFC, and growing demand for secure, contactless options. The United States market, for instance, expects strong B2B mobile payment adoption alongside consumer use, driven by fintech collaborations and evolving regulatory frameworks that encourage safer mobile transactions.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1294

Key Questions Answered in the Report:

• Which are the high-growth market segments in terms of method, application, location, and end-user?

• What is the historical market size for global mobile payment?

• What are the market forecasts and estimates for 2025-2032?

• What are the major drivers, restraints, opportunities, challenges, and trends in the global mobile payment market?

Related Reports:

Payment Security Market: https://www.meticulousresearch.com/product/payment-security-market-5237

Mobile Security Market: https://www.meticulousresearch.com/product/mobile-security-market-5403

Digital Payment Market: https://www.meticulousresearch.com/product/digital-payment-market-5410

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tapping into the Future: Mobile Payment Market Growth & Forecast 2025-2032 here

News-ID: 4126052 • Views: …

More Releases from Meticulous Research®

Global IoT Medical Devices Market Size, Share, Growth Analysis, and Forecast (20 …

The global IoT medical devices market is experiencing unprecedented growth, with a valuation of USD 57.4 billion in 2025. It is projected to reach approximately USD 467.2 billion by 2036, growing from USD 68.5 billion in 2026 at a CAGR of 21.2% over the forecast period. This rapid expansion is driven by the global shift toward connected and data-driven healthcare, the rise of remote patient monitoring, and the adoption of…

Global Transformers Market Size, Share, Growth Trends & Forecast (2026-2036)

The global transformers market has emerged as a pivotal segment within the broader electrical equipment and energy infrastructure industry, reflecting the accelerating need for efficient, reliable, and high-performance power systems worldwide. In 2025, the market was valued at approximately USD 58.9 billion, and it is projected to grow to around USD 62.2 billion in 2026. Over the forecast period from 2026 to 2036, the market is expected to expand significantly,…

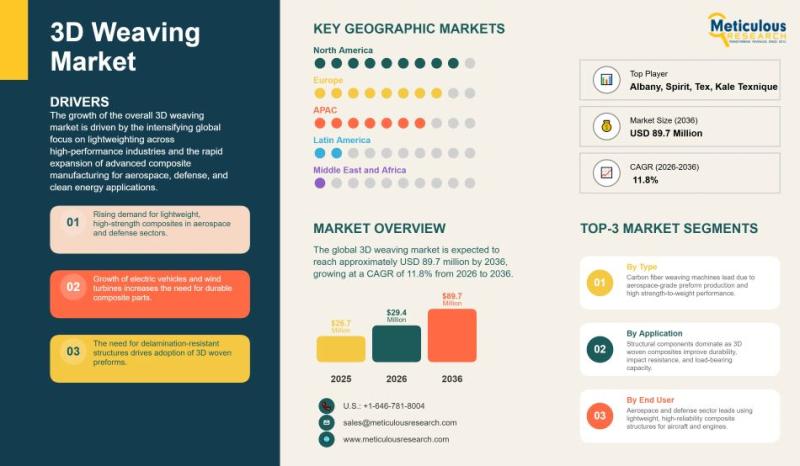

Global 3D Weaving Market Size, Share & Growth Forecast (2026-2036)

The global 3D weaving market has been experiencing significant growth in recent years, driven by the increasing demand for lightweight, high-performance materials across various industries. In 2025, the market was valued at USD 26.7 million, reflecting the growing adoption of 3D weaving technology in sectors such as aerospace, defense, automotive, and clean energy. This market is projected to expand considerably over the coming decade, reaching approximately USD 29.4 million in…

Global Food Inspection Device Market Size, Growth Analysis & Forecast (2026-2036 …

The global food inspection device market has emerged as a critical component of modern food production, reflecting the increasing importance of consumer safety, regulatory compliance, and operational efficiency in the food industry. Valued at USD 3.35 billion in 2025, the market is projected to grow substantially over the coming decade, reaching approximately USD 8.33 billion by 2036, up from USD 3.57 billion in 2026, at a compound annual growth rate…

More Releases for Mobile

Global Mobile Wallet Market, Global Mobile Wallet Industry, Market Revenue, Mark …

The digital wallet is the engine of mobile commerce and also agreements an evolutionary path to decrease the friction in the transaction and optimize consumer satisfaction. The users are interested towards gorgeous cash backs and loyalty coupons suggested by dissimilar mobile wallet corporates. The mobile wallet market in the report denotes to payment services functioned under financial regulation and functioned through a mobile device instead of paying with cheques, cash, or credit cards.…

Asia - Mobile Infrastructure and Mobile Broadband

Bharat Book Bureau Provides the Trending Market Research Report on "Asia - Mobile Infrastructure and Mobile Broadband" under Telecom category. The report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Executive Summary

Leading Asian nations prepare for 5G rollouts

Asia’s mobile subscriber market is now witnessing moderate growth in a fast maturing market. Whilst there are still developing markets continuing to grow their mobile subscriber base at…

Mobile Virtual Network Operator (MVNO) Market Analysis by Top Key Players Tracfo …

The mobile virtual network operator (MVNO) is also referred to as the mobile other licensed operator (MOLO), or the virtual network operator (VNO), is the remote service of communication which does not claim the remote network infrastructure on which it gives the customer the services.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2835705?utm_source=RK&utm_medium=OPR

The MVNO goes into the business agreement with the mobile network operator for acquiring more access to…

Mobile Virtual Network Operator (MVNO) Market Comprehensive Study 2018: Boost Mo …

Global Mobile Virtual Network Operator (MVNO) market report provides a thorough synopsis on the study for market and how it is changing the industry. The data and the information regarding the industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts. Mobile Virtual Network Operator (MVNO) Market report includes historic data, present market trends,…

Asia - Mobile Infrastructure And Mobile Broadband

Asian mobile broadband market continues to grow strongly

With 3.9 billion mobile subscribers and over 50% of the mobile subscribers in the world, spread across a diverse range of markets, the region is already rapidly advancing in the adoption of mobile broadband services. Mobile broadband as a proportion of the total Asian mobile broadband subscriber base, has increased from 2% in 2008 to 18% in 2013, 27% in 2014, 33% in…

Mobile Money Market Trends, Public Demand and Worldwide Strategy - Mobile Commer …

The mobile money market report provides an analysis of the global mobile money market for the period 2014 – 2024, wherein 2015 is the base year and the period from 2016 to 2024 is the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends playing a major role in the growth of the mobile money market over the forecast period. It…