Press release

Detecting and Preventing Money Laundering: A Deep Dive into Each Stage

Introduction: The Hidden Risk in Every TransactionMoney laundering is one of the most persistent threats facing the global financial system. Criminals use increasingly complex methods to disguise illegally obtained funds, making it essential for financial institutions, regulators, and compliance professionals to understand how laundering works and how to stop it.

By dissecting the three stages of money laundering, https://mena.idenfodirect.com/blog/three-stages-of-money-laundering-placement-layering-integration/ organizations can more effectively detect red flags, deploy the right technology, and stay compliant with anti-money laundering (AML) regulations.

In this article, we'll take a detailed look at each stage, explain how laundering happens, and provide practical tips to prevent and detect it before it damages your business and reputation.

What Are the Three Stages of Money Laundering?

Money laundering typically follows a three-step process:

Placement

Layering

Integration

Each stage serves a specific purpose in the criminal's effort to convert "dirty money" into clean, usable assets.

Stage 1: Placement Getting Illicit Funds into the System

What it is:

The placement stage is the first step, where illicit funds are introduced into the financial system. This is often the riskiest point for criminals, as large or suspicious cash deposits can trigger regulatory scrutiny.

Common methods include:

Depositing small amounts into different accounts (structuring/smurfing)

Using cash to buy high-value items (jewelry, art, cars)

Channeling money through casinos, currency exchanges, or shell companies

Repaying fake loans using illegal funds

Red Flags to Watch:

Frequent large cash deposits

Unusual purchase of financial instruments (e.g., money orders)

Customers unwilling to provide source of funds

Deposits inconsistent with the customer's profile

How to Prevent Placement:

Implement robust Know Your Customer (KYC) and Customer Due Diligence (CDD) processes

Enforce transaction limits and monitor for patterns

Train staff to identify suspicious deposit behavior

Use automated alerts and AI-driven transaction monitoring tools

Stage 2: Layering Obscuring the Money Trail

What it is:

Layering involves separating the illicit money from its origin by moving it through a complex series of transactions. This makes it difficult for law enforcement and regulators to trace the source.

Common techniques include:

International wire transfers across multiple jurisdictions

Converting cash into crypto assets

Setting up shell companies or offshore accounts

Making frequent, unexplained withdrawals or transfers

Red Flags to Watch:

Unusual international activity in countries known for lax AML laws

Multiple transfers to unrelated third parties

Inconsistent transaction volumes

Immediate movement of funds after deposit

How to Prevent Layering:

Monitor cross-border transactions in real time

Use geo-risk scoring and automated AML tools

Flag accounts with erratic or high-volume transactions

Require enhanced due diligence for high-risk customers or regions

Stage 3: Integration Reintroducing Funds as "Clean"

What it is:

Integration is the final step where laundered money is reinvested into the legitimate economy. At this point, the funds may appear to be from legitimate sources.

Common schemes include:

Investing in real estate or luxury assets

Funding legitimate businesses

Claiming income from fake companies

Making loans and collecting repayments from colluding parties

Red Flags to Watch:

Business transactions without clear economic justification

High-value asset purchases with minimal documentation

Loan structures that lack legitimate contracts or interest

Sudden spikes in revenue for small or dormant businesses

How to Prevent Integration:

Conduct Enhanced Due Diligence (EDD) on large transactions or asset purchases

Use AI-powered adverse media screening and beneficial ownership verification

Implement strong KYB (Know Your Business) controls

Work with legal and compliance teams to monitor unusually structured deals

The Role of Technology in Detecting Money Laundering

As criminals evolve, so must compliance teams. Modern AML technology helps institutions stay one step ahead with:

Real-time transaction monitoring

AI-driven anomaly detection

PEP and sanctions list screening

Adverse media and risk scoring

Smart alerts that reduce false positives

Implementing intelligent AML systems can make the difference between proactive protection and reactive damage control.

Summary of the Three Stages of Money Laundering

Stage

Description

Detection Focus

Placement

Introducing illegal funds into the system

Cash transactions, deposits, purchases

Layering

Obscuring the origin through layers

Transfers, offshoring, crypto, shell firms

Integration

Reintroducing funds as legitimate

Investments, asset purchases, fake loans

Conclusion: Stay Ahead of Financial Crime

Understanding the three stages of money laundering placement, layering, and integration is critical for effective risk management and regulatory compliance.

By deploying the right tools, training your teams, and building risk-aware processes, your organization can detect suspicious activity early, protect its reputation, and stay compliant with global AML laws.

In today's digital world, money laundering is more complex than ever. Make sure your defense is just as smart.

FAQs

Q: Which stage of money laundering is easiest to detect?

A: Placement is typically easiest to detect due to the direct interaction with the financial system and the physical movement of funds.

Q: Can AML software detect all laundering activities?

A: While AI and software significantly enhance detection, human oversight and regular audits remain crucial for accuracy and compliance.

Q: Are small businesses also at risk of facilitating money laundering?

A: Yes, especially if they lack proper KYC/AML controls or handle high volumes of cash transactions.

P.O Bagarji Town Bagarji Village Ghumra Thesil New Sukkur District Sukkur Province Sindh Pakistan 65200.

Wiki Blogs News always keeps careful online users to provide purposeful information and to keep belief to provide solution based information.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Detecting and Preventing Money Laundering: A Deep Dive into Each Stage here

News-ID: 4121479 • Views: …

More Releases from Wikiblogsnews

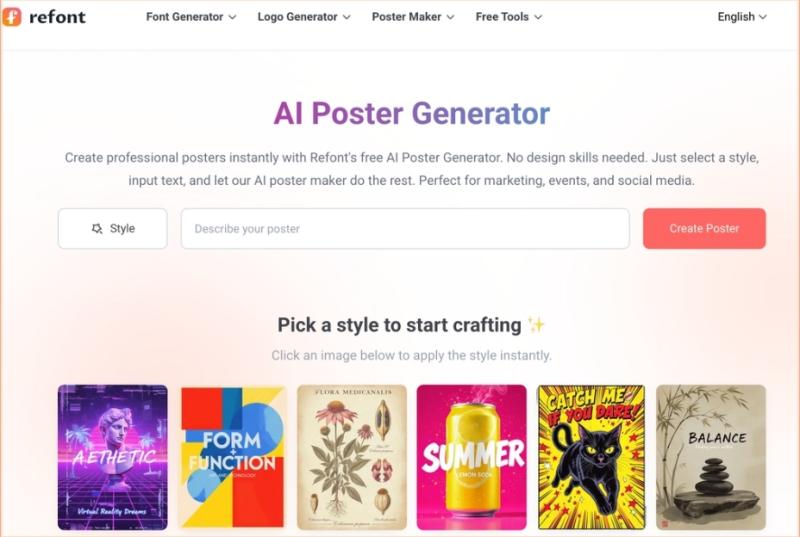

Tired of the Design Bottleneck? How I Finally Found a Practical AI Poster Genera …

If you're anything like me, you've probably spent more hours than you'd like to admit fighting with design software. We've all been there: you have a killer idea for a promotion, a social post, or a brand announcement, but by the time you've messed around with layers, alignment, and hunting for stock photos, the inspiration is gone and so is half your afternoon.

I've tried the early wave of generative AI…

Best Exotic Car Rental in Miami: Experience Luxury Without Overspending

Miami has a way of turning every drive into a cinematic experience. Picture yourself cruising down Ocean Drive at sunset with the gentle ocean breeze mixing in with the roar of your high-performance engine, smiling people looking over your car. For those who seek this experience, the best exotic car rental in Miami is your ticket to unlocking this fantasy.

But there's a catch: Miami's luxury car scene is flooded, and…

Cheap Exotic Car Rental in Miami: Drive Luxury Without Overpaying

Miami is a city made for style, speed, and excitement. Exotic cars fit perfectly into this glamorous backdrop, but many travelers immediately assume renting one is out of reach. The good news? Cheap exotic car rentals in Miami are not only possible-they're easier than most think.

When I first looked into it, I expected outrageous prices-until I stumbled upon a guide from a local rental specialist that broke down how everyday…

Top 5 Best Front and Rear Dash Cam Options for Maximum Road Safety

As a driver, ensuring your safety on the road is paramount. One way to do this is by investing in a reliable dash cam that can provide evidence in case of an accident or incident.https://wolfbox.com/collections/dash-cam-front-and-rear is ideal for capturing footage of the road ahead and behind your vehicle. Here are the top 5 best front and rear dash cam options for maximum road safety.

*1. WOLFBOX Mirror Dash Cam: The All-in-One…

More Releases for Money

Miracle Money Magnets Review: Reprogram Your Money Vibration for Lasting Wealth

Miracle Money Magnets is a mindset transformation program created by Croix Sather that focuses on raising your personal money vibration to attract financial abundance effortlessly. The course teaches how subconscious beliefs, emotional resistance, and daily language patterns create blocks that repel wealth, and provides simple steps to reset them for consistent money flow. Priced accessibly at an introductory $7, it promises to shift users from financial struggle to prosperity by…

Just Between Friends Can Help Save Money & Make Money

Image: https://www.getnews.info/uploads/314b3c2c783a4157e147efd33935356f.jpg

Kids are expensive. Just Between Friends can help you save money and make money.

At Just Between Friends, we understand that children grow fast, which can quickly become expensive for parents.

That's why we host a community event twice a year, where families can sell the things their children no longer use and buy what they need at 50-90% below retail.

Discover a sense of Pride and Purpose when participating at Just…

The Money Wave Reviews (Controversial Or Fake 2023) The Money Wave Price Legitim …

Self-improvement and wealth promotion the The Money Wave has come to light as an innovative concept drawing the attention of thousands around the world. This revolutionary approach, grounded in the latest neuroscience research and antiquated wisdom, will unlock the potential hidden within our brains and allow our brains to generate prosperity and wealth effortlessly. It was developed in the lab of the Dr. Thomas Summers, a top neuroscientist who is…

Mobile Money Market to Witness Huge Growth by 2029 | Orange Money, Epress Union, …

The Latest research study released by HTF MI "Global Mobile Money Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying the importance of different factors that aid market growth. Some of the Major Companies covered in this Research are MTN…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…