Press release

Online Payment Gateway Market Set for Robust Growth, Driven by Digital Transformation and Security Innovations, Projects USD 318.74 Billion by 2034

The global online payment gateway market is poised for significant expansion, projected to reach a valuation of USD 318.74 billion by 2034, up from USD 127.45 billion in 2024. This growth trajectory, reflecting a Compound Annual Growth Rate (CAGR) of 9.60% from 2024 to 2034, underscores the accelerating shift towards digital transactions and the increasing demand for secure, efficient payment solutions worldwide. The market's evolution is heavily influenced by the burgeoning virtual payment ecosystem, fueled by IoT-based payments and continuous technological advancements.Surge in Market Demand: Explore Comprehensive Trends and Analysis in Our Full Report! https://www.futuremarketinsights.com/reports/online-payment-gateway-market

Market Dynamics and Growth Catalysts

The online payment gateway market's robust growth is fundamentally driven by the escalating popularity of online payment methods and widespread high-speed internet penetration. Payment gateways serve as crucial conduits, securely connecting customers and merchants, thereby minimizing financial losses through fraud prevention and ensuring seamless transaction experiences. Key drivers include the surge in mobile payments, exponential growth in eCommerce sales, and a global pivot towards digital channels for money transfers. Businesses are increasingly adopting these gateways to facilitate secure online transactions, enhance customer experience, and eliminate the need for traditional physical queues.

While the market's historical CAGR from 2019 to 2023 stood at a robust 10.0%, the projected slight moderation to 9.60% for the upcoming decade indicates a maturing market. This maturation is characterized by increased transaction data volumes and the widespread adoption of diverse online payment methods, including credit cards and mobile wallets. Despite this, the expansion is consistently propelled by high internet usage and extravagant eCommerce sales. However, the omnipresent risk of online fraud and cyber-attacks remains a significant challenge, necessitating continuous innovation in security measures. The COVID-19 pandemic, paradoxically, provided a positive impetus, accelerating online payment adoption and eCommerce growth despite lockdowns, with UPI's post-pandemic rise further stimulating the digital sector.

Key Trends and Technological Advancements Shaping the Landscape

Several transformative trends are influencing the online payment gateway market. The widespread adoption of QR codes has streamlined online transactions, allowing consumers to make quick and easy payments via smartphones and IoT devices across various payment apps. This convenience, coupled with cashback and reward schemes offered by major players like Gpay, PayPal Holdings, and AmazonPay, has significantly boosted their popularity. Enhanced security features such as fingerprint and face scanners are also being integrated to combat fraudulent activities.

Furthermore, the eCommerce industry continues to be a primary catalyst for payment gateway adoption. The boom in online retail, particularly mobile commerce, necessitates robust security features like tokenization, fraud detection, and encryption to meet evolving consumer and business expectations. The rising demand for secure, effective solutions is pushing the enterprise forward.

Another significant trend is the adoption of biometric payment cards, which are gaining traction due to technological refinements and broader contactless payment acceptance. These cards offer elevated transaction limits compared to NFC cards, enhancing security and efficiency. The collaboration between banks, financial institutions, and biometric payment service providers is creating new opportunities for online payment gateways, reducing administrative costs for retailers and improving checkout experiences.

Segmental Insights: Hosted Gateways and Large Enterprises Lead

Within the market, hosted payment gateways are dominant, commanding nearly 39.4% of the market share in 2024. Their popularity stems from their convenience, security, and ease of use, as they redirect customers to a third-party payment service provider for processing, offering a reliable solution for businesses across various industries.

Concurrently, large enterprises (500 to 999 employees) are increasingly leveraging online payment tools, accounting for approximately 26.7% of the market share in 2024. This segment's growth signifies a clear shift towards cashless transactions, with online payment gateways becoming integral for banking dashboards, e-transaction apps, and tokenized transactions, simplifying payment infrastructure for financial institutions.

Regional Growth Hotspots

Geographically, the market exhibits varied growth dynamics. China is anticipated to lead with an impressive CAGR of 11.70% between 2024 and 2034, driven by its transforming retail sector, mobile payment integration (AliPay, WeChat Pay), and at-home delivery trends. The United States follows with a strong 9.60% CAGR, propelled by rapid remote commerce development, smartphone adoption across demographics, and the increasing traction of mobile transaction platforms like PayPal and Apple Pay.

Australia and New Zealand (ANZ) are projected for robust growth at a 9.10% CAGR, fueled by technological improvements and rising demand for mobile payments and banking channels. Japan, credited with inventing NFC and QR codes, is set for a 6.00% CAGR, with contactless payments accelerating post-pandemic. Germany's BFSI industry is driving demand for online transaction gateways, with a 5.30% CAGR, as major banks and digital transaction management suppliers focus on secure software solutions.

Competitive Landscape and Strategic Imperatives

The online payment gateway market is highly competitive, featuring major players such as Adyen, Amazon Payments Inc., Authorize.Net, Bitpay, Inc., Braintree, PayPal Holdings, Inc., PayU Group, Stripe, Verifone Holdings, Inc., Wepay, Inc., Square, Worldpay, 2Checkout, and Razorpay. These market participants are heavily investing in innovation, research, and development to uncover new applications within the BFSI industry. Their strategies revolve around ensuring safety, quality, and customer satisfaction to expand their customer base.

Companies are introducing advanced features like automatic reminders, customized processes, seamless document production, and automated tracking to enhance their digital transaction solutions. A significant focus is also placed on developing solutions that comply with various global security standards and agreement audits. Strategic collaborations, mergers and acquisitions, and company expansions are key tactics employed to strengthen market positioning and capture a larger share of the evolving digital payments ecosystem. Recent activities, such as NOWPayments' stablecoin usage trends analysis, Euronet's acquisition of Infinitium Holdings for enhanced security, Tap Payments' Mada certification, and ANZ Worldline Payment Solutions' joint venture, highlight the dynamic and competitive nature of the market.

Key Segments

By Getaway Type:

Hosted Payment Gateway

Self-hosted Payment Gateway

API/Non-hosted Payment Gateway

By Enterprise Size:

Small Offices (1 to 9 employees)

Small Enterprises (10 to 99 employees)

Medium-sized Enterprise (100 to 499 employees)

Large Enterprises (500 to 999 employees)

Very Large Enterprises (1,000+ employees)

By Region:

North America

Latin America

Europe

East Asia

South Asia

Oceania

Middle East and Africa

Explore Key Trends in the Market: Request Your Sample Report! https://www.futuremarketinsights.com/reports/sample/rep-gb-4331

Have a Look at Related Research Reports:

Online Clothing Rental Market: https://www.futuremarketinsights.com/reports/online-clothing-rental-market

Online Home Rental Market: https://www.futuremarketinsights.com/reports/online-home-rental-market

Online Food Delivery Services Market: https://www.futuremarketinsights.com/reports/online-food-delivery-services-market

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Payment Gateway Market Set for Robust Growth, Driven by Digital Transformation and Security Innovations, Projects USD 318.74 Billion by 2034 here

News-ID: 4120197 • Views: …

More Releases from Future Market Insights Inc.

Olive Phenolic Complexes for Metabolic Health Market to Surpass USD 2,420 Millio …

The global olive phenolic complexes for metabolic health market is set for robust expansion, rising from USD 710 million in 2026 to USD 2,420 million by 2036, reflecting a strong compound annual growth rate (CAGR) of 12.4%. Growth momentum is fueled by rising global awareness of metabolic health and increasing adoption of plant-based bioactive compounds in preventive nutrition.

Olive phenolic complexes, rich in bioactive compounds such as oleuropein and hydroxytyrosol, are…

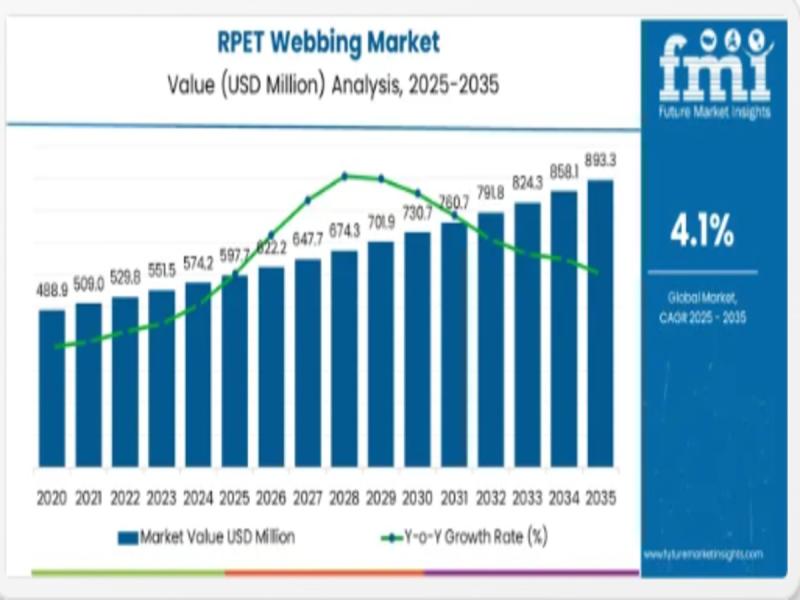

Global RPET Webbing Market Set to Surge to Nearly USD 893 Million by 2035 as Sus …

The global Recycled Polyethylene Terephthalate (RPET) webbing market is projected to expand from an estimated USD 597.7 million in 2025 to approximately USD 893.2 million by 2035, reflecting robust momentum in recycled materials adoption across key industrial and consumer sectors and underscoring sustainability as a core manufacturing imperative. The market is expected to grow at a compound annual growth rate (CAGR) of 4.1 % during this forecast period, driven by…

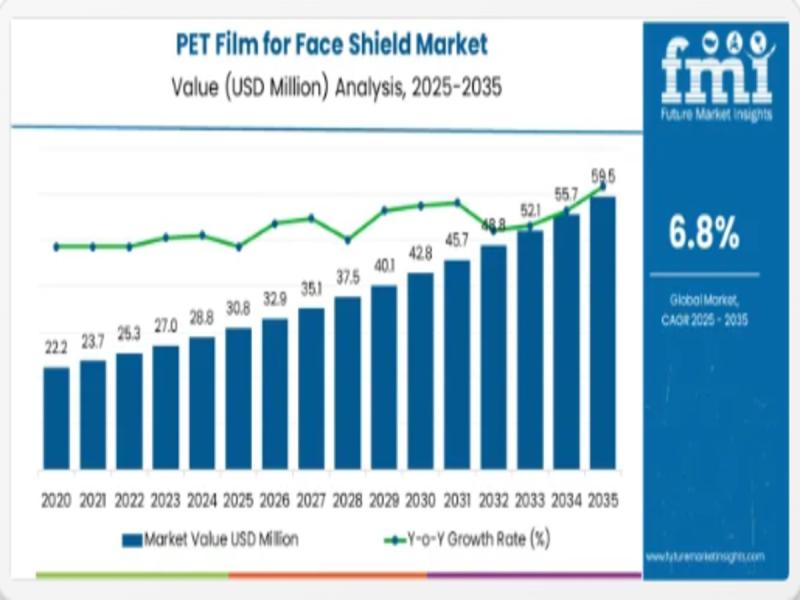

PET Film for Face Shield Market - Strategic Growth, Innovation & Forecasted Surg …

The global PET film for face shield market is set to expand from an estimated USD 30.8 million in 2025 to approximately USD 59.5 million by 2035, representing strong demand for high-clarity protective materials across healthcare and industrial safety sectors with a compound annual growth rate (CAGR) of 6.8% over the decade. This growth underscores the rising prioritization of personal protective equipment (PPE) globally, especially where transparent barrier films combine…

Middle East and North Africa Frozen Food Market Poised for Steady Growth Through …

Middle East and North Africa Frozen Food Market

The Middle East and North Africa (MENA) frozen food market is set for consistent and resilient growth over the next decade, supported by shifting consumer lifestyles, expanding modern retail infrastructure, and rising demand for long-shelf-life food solutions suited to the region's climate. The market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 1.8 billion…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…