Press release

Energy Trading and Risk Management (ETRM) Market Outlook 2025-2031: Emerging Trends, Growth Opportunities, and Regional Forecasts

The report titled, "Global Energy Trading and Risk Management (ETRM) Market Insights, Forecast to 2031" has been recently published by QY Research. The global Energy Trading and Risk Management (ETRM) market is broadly studied in the report with large focus on market competition, segmentation, geographical expansion, and other important aspects. The analysts who have prepared the report are highly experienced in market research and possess vast knowledge about the global Energy Trading and Risk Management (ETRM) market. The report includes deep analysis of microeconomic and macroeconomic factors impacting the growth of the global Energy Trading and Risk Management (ETRM) market. It also offers analysis of production, sales, and consumption growth in the global Energy Trading and Risk Management (ETRM) market. With the help of exhaustive research studies provided in the report, readers can easily become familiar with key dynamics of the global Energy Trading and Risk Management (ETRM) market, including drivers, restraints, and opportunities.The global Energy Trading and Risk Management (ETRM) market was valued at US$ 1558 million in 2024 and is anticipated to reach US$ 2070 million by 2031, witnessing a CAGR of 4.2% during the forecast period 2025-2031.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart): https://www.qyresearch.in/request-sample/service-software-global-energy-trading-and-risk-management-etrm-market-insights-industry-share-sales-projections-and-demand-outlook-2025-2031

Global Energy Trading and Risk Management (ETRM) key players include OpenLink, FIS, Publicis.Sapient, Trayport, etc. Global top five players hold a share about 60%.

North America is the largest market, with a share about 45%, followed by Europe and Asia-Pacific, having a total share about 50 percent.

In terms of product, Vendor License and Service is the largest segment, with a share about 80%. And in terms of application, the largest application is Oil and Products, followed by Power, Natural Gas, etc.

The trends analysis offered in the report will help players operating in the global Energy Trading and Risk Management (ETRM) market to cash in on lucrative business opportunities. The regional analysis included in the report will help players to explore untapped markets and increase their market presence in key regions. Most importantly, the report offers crucial market information and data that will prepare players to effectively strategize for their business to gain significant profits. On the whole, it comes out as a powerful tool that players can use to gain a competitive edge in the global Energy Trading and Risk Management (ETRM) market.

Market: Drivers and Restrains

In this chapter, the report provides a complete explanation of the drivers in the market. It highlights the key drivers of the market that are expected to contribute majorly towards market growth. It covers different industries, which are expanding in the same field, identifies the leading applications, and determines which one will play a major role. The report also factors in some of the new technologies and development introduced by manufacturers that are expected to act as notable drivers for the global Energy Trading and Risk Management (ETRM) market.

The chapter also gives its reader vital information pertaining to the restrains that might hamper the growth of the Energy Trading and Risk Management (ETRM) market in future. Factors such as changing prices of land, labor and production cost, environmental concerns, new government policies, and trading norms have been discussed in this research report. Furthermore, analysts have also provided a perspective on the potential opportunities present in the global Energy Trading and Risk Management (ETRM) market. It offers a fresh outlook towards turning the threats into viable options to give the business a winning chance.

Competitive Landscape

Competitive landscape is one of the most interesting subjects of any market research study. It provides readers with important information on competition trends, prominent players, and nature of competition. In this report, the authors have profiled some of the top-ranking as well as other players of the global Energy Trading and Risk Management (ETRM) market. In the company profiling section, each player is comprehensively studied while focusing on its market share, recent developments, production, gross revenue, profit margin, and other factors. The competitive analysis shared in the report will help players to improve their strategies to better compete with other companies.

Key Players Mentioned in the Global Energy Trading and Risk Management (ETRM) Market Research Report:

OpenLink

FIS

Sapient

Trayport

Allegro

ABB

Triple Point

SAP

Amphora

Eka Software

All of the segments of the global Energy Trading and Risk Management (ETRM) market analyzed in the report are deeply studied while concentrating on their market share, CAGR, and growth opportunities. The segmentation study provided in the report will help players to identify rewarding growth prospects available in the global Energy Trading and Risk Management (ETRM) market. Furthermore, it offers a clear and thorough evaluation of key segments so that players could bank on profit-making areas of the global Energy Trading and Risk Management (ETRM) market. The analysts have explained each factor contributing to the growth of leading segments. In addition, they have provided a near-accurate prediction of the growth potential of each segment.

Segment by Type

Vendor License and Service

SaaS or Hosted Service

Segment by Application

Power

Natural Gas

Oil and Products

Other

Segment By Region

North America

U.S.

Canada

Europe

Germany

France

U.K.

Italy

Russia

Asia-Pacific

China

Japan

South Korea

India

Australia

China Taiwan

Indonesia

Thailand

Malaysia

Latin America

Mexico

Brazil

Argentina

Middle East & Africa

Turkey

Saudi Arabia

UAE

Energy Trading and Risk Management (ETRM) market research study is incomplete without regional analysis, and we are well aware of it. That is why, the report includes a comprehensive and all-inclusive study that solely concentrates on the geographical growth of the global Energy Trading and Risk Management (ETRM) market. The study also includes accurate estimations about market growth at the global, regional, and country levels. It empowers you to understand why some regional markets are flourishing while others are seeing a decline in growth. It also allows you to focus on geographies that hold the potential to create lucrative prospects in the near future.

Highlights of the Report

(1) Accurate market size and CAGR forecasts for the period 2025-2031.

(2) Identification and in-depth assessment of growth opportunities in key segments and regions.

(3) Detailed company profiling of top players of the global Energy Trading and Risk Management (ETRM) market.

(4) Exhaustive research on innovation and other trends of the global Energy Trading and Risk Management (ETRM) market.

(5) Reliable industry value chain and supply chain analysis.

(6) Comprehensive analysis of important growth drivers, restraints, challenges, and growth prospects.

Request Pre-Order Enquiry or Customized Research on This Report: https://www.qyresearch.in/pre-order-inquiry/service-software-global-energy-trading-and-risk-management-etrm-market-insights-industry-share-sales-projections-and-demand-outlook-2025-2031

Table of Content

1 Energy Trading and Risk Management (ETRM) Market Overview

1.1 Product Definition

1.2 Energy Trading and Risk Management (ETRM) by Type

1.2.1 Global Energy Trading and Risk Management (ETRM) Market Value by Type (2020-2031)

1.2.2 Vendor License and Service

1.2.3 SaaS or Hosted Service

1.3 Energy Trading and Risk Management (ETRM) by Application

1.3.1 Global Energy Trading and Risk Management (ETRM) Market Value by Application 2020-2031)

1.3.2 Power

1.3.3 Natural Gas

1.3.4 Oil and Products

1.3.5 Other

1.4 Global Energy Trading and Risk Management (ETRM) Revenue (2020-2031)

1.5 Assumptions and Limitations

1.6 Study Objectives

1.7 Years Considered

2 Key Insights

2.1 Key Emerging Trends

2.2 Key Developments - Mergers Acquisitions, New Product Launches, Collaborations, Partnerships and Joint Ventures

2.3 Latest Technological Advancements

2.4 Insights on Regulatory Scenarios

2.5 Porters Five Forces Analysis

3 Players Competitive Analysis

3.1 Global Energy Trading and Risk Management (ETRM) Revenue by Player (2020-2025)

3.2 Energy Trading and Risk Management (ETRM) Company Evaluation Quadrant

3.3 Industry Rank

3.3.1 Global Key Players of Energy Trading and Risk Management (ETRM), Industry Ranking, 2023 VS 2024

3.3.2 Global Energy Trading and Risk Management (ETRM) Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3.3 Global Energy Trading and Risk Management (ETRM) Market Concentration Rate

3.3.4 Global 5 and 10 Largest Energy Trading and Risk Management (ETRM) Players Market Share by Revenue

3.4 Energy Trading and Risk Management (ETRM) Market: Overall Company Footprint Analysis

3.4.1 Energy Trading and Risk Management (ETRM) Market: Region Footprint

3.4.2 Energy Trading and Risk Management (ETRM) Market: Company Product Type Footprint

3.4.3 Energy Trading and Risk Management (ETRM) Market: Company Product Application Footprint

3.4.4 Global Key Players of Energy Trading and Risk Management (ETRM), Date of Enter into This Industry

3.5 Competitive Environment

3.5.1 Historical Structure of the Industry

3.5.2 Barriers of Market Entry

3.5.3 Factors of Competition

4 Players Profiles

4.1 OpenLink

4.1.1 OpenLink Company Details

4.1.2 OpenLink Business Overview

4.1.3 OpenLink Energy Trading and Risk Management (ETRM) Introduction

4.1.4 OpenLink Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.1.5 OpenLink Recent Development

4.2 FIS

4.2.1 FIS Company Details

4.2.2 FIS Business Overview

4.2.3 FIS Energy Trading and Risk Management (ETRM) Introduction

4.2.4 FIS Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.2.5 FIS Recent Development

4.3 Sapient

4.3.1 Sapient Company Details

4.3.2 Sapient Business Overview

4.3.3 Sapient Energy Trading and Risk Management (ETRM) Introduction

4.3.4 Sapient Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.3.5 Sapient Recent Development

4.5 Trayport

4.5.1 Trayport Company Details

4.5.2 Trayport Business Overview

4.5.3 Trayport Energy Trading and Risk Management (ETRM) Introduction

4.5.4 Trayport Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.5.5 Trayport Recent Development

4.6 Allegro

4.6.1 Allegro Company Details

4.6.2 Allegro Business Overview

4.6.3 Allegro Energy Trading and Risk Management (ETRM) Introduction

4.6.4 Allegro Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.6.5 Allegro Recent Development

4.7 ABB

4.7.1 ABB Company Details

4.7.2 ABB Business Overview

4.7.3 ABB Energy Trading and Risk Management (ETRM) Introduction

4.7.4 ABB Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.7.5 ABB Recent Development

4.8 Triple Point

4.8.1 Triple Point Company Details

4.8.2 Triple Point Business Overview

4.8.3 Triple Point Energy Trading and Risk Management (ETRM) Introduction

4.8.4 Triple Point Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.8.5 Triple Point Recent Development

4.9 SAP

4.9.1 SAP Company Details

4.9.2 SAP Business Overview

4.9.3 SAP Energy Trading and Risk Management (ETRM) Introduction

4.9.4 SAP Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.9.5 SAP Recent Development

4.10 Amphora

4.10.1 Amphora Company Details

4.10.2 Amphora Business Overview

4.10.3 Amphora Energy Trading and Risk Management (ETRM) Introduction

4.10.4 Amphora Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.10.5 Amphora Recent Development

4.11 Eka Software

4.11.1 Eka Software Company Details

4.11.2 Eka Software Business Overview

4.11.3 Eka Software Energy Trading and Risk Management (ETRM) Introduction

4.11.4 Eka Software Revenue in Energy Trading and Risk Management (ETRM) Business (2020-2025)

4.11.5 Eka Software Recent Development

5 Analysis by Region

5.1 Global Energy Trading and Risk Management (ETRM) Market Size by Region

5.1.1 Global Energy Trading and Risk Management (ETRM) Revenue by Region: 2020 VS 2024 VS 2031

5.1.2 Global Energy Trading and Risk Management (ETRM) Revenue by Region (2020-2025)

5.1.3 Global Energy Trading and Risk Management (ETRM) Revenue by Region (2026-2031)

5.1.4 Global Energy Trading and Risk Management (ETRM) Revenue Market Share by Region (2020-2031)

5.2 North America Energy Trading and Risk Management (ETRM) Revenue (2020-2031)

5.3 Europe Energy Trading and Risk Management (ETRM) Revenue (2020-2031)

5.4 Asia-Pacific Energy Trading and Risk Management (ETRM) Revenue (2020-2031)

5.5 South America Energy Trading and Risk Management (ETRM) Revenue (2020-2031)

5.6 Middle East & Africa Energy Trading and Risk Management (ETRM) Revenue (2020-2031)

6 Market Scenario by Region & Country

6.1 Global Energy Trading and Risk Management (ETRM) Revenue by Region & Country: 2020 Versus 2024 Versus 2031

6.2 Global Energy Trading and Risk Management (ETRM) Revenue by Region & Country (2020-2031)

6.3 North America Energy Trading and Risk Management (ETRM) Market Facts & Figures by Country

6.3.1 North America Energy Trading and Risk Management (ETRM) Revenue by Country: 2020 VS 2024 VS 2031

6.3.2 North America Energy Trading and Risk Management (ETRM) Revenue by Country (2020-2031)

6.3.3 U.S.

6.3.4 Canada

6.4 Europe Energy Trading and Risk Management (ETRM) Market Facts & Figures by Country

6.4.1 Europe Energy Trading and Risk Management (ETRM) Revenue by Country: 2020 VS 2024 VS 2031

6.4.2 Europe Energy Trading and Risk Management (ETRM) Revenue by Country (2020-2031)

6.4.3 Germany

6.4.4 France

6.4.5 U.K.

6.4.6 Italy

6.4.7 Russia

6.5 Asia Pacific Energy Trading and Risk Management (ETRM) Market Facts & Figures by Region

6.5.1 Asia Pacific Energy Trading and Risk Management (ETRM) Market Size by Region: 2020 VS 2024 VS 2031

6.5.2 Asia Pacific Energy Trading and Risk Management (ETRM) Revenue by Region (2020-2031)

6.5.3 China

6.5.4 Japan

6.5.5 South Korea

6.5.6 India

6.5.7 Australia

6.5.8 China Taiwan

6.5.9 Indonesia

6.5.10 Thailand

6.5.11 Malaysia

6.6 South America Energy Trading and Risk Management (ETRM) Market Facts & Figures by Country

6.6.1 South America Energy Trading and Risk Management (ETRM) Market Size by Country: 2020 VS 2024 VS 2031

6.6.2 South America Energy Trading and Risk Management (ETRM) Revenue by Country

6.6.3 Mexico

6.6.4 Brazil

6.6.5 Argentina

6.7 Middle East and Africa Energy Trading and Risk Management (ETRM) Market Facts & Figures by Country

6.7.1 Middle East and Africa Energy Trading and Risk Management (ETRM) Market Size by Country: 2020 VS 2024 VS 2031

6.7.2 Middle East and Africa Energy Trading and Risk Management (ETRM) Revenue by Country

6.7.3 Turkey

6.7.4 Saudi Arabia

6.7.5 UAE

7 Segment by Type

7.1 Global Energy Trading and Risk Management (ETRM) Revenue by Type (2020-2025)

7.2 Global Energy Trading and Risk Management (ETRM) Revenue by Type (2026-2031)

7.3 Global Energy Trading and Risk Management (ETRM) Revenue Market Share by Type (2020-2031)

8 Segment by Application

8.1 Global Energy Trading and Risk Management (ETRM) Revenue by Application (2020-2025)

8.2 Global Energy Trading and Risk Management (ETRM) Revenue by Application (2026-2031)

8.3 Global Energy Trading and Risk Management (ETRM) Revenue Market Share by Application (2020-2031)

9 Industry Chain and Sales Channels Analysis

9.1 Energy Trading and Risk Management (ETRM) Industry Chain Analysis

9.2 Energy Trading and Risk Management (ETRM) Key Raw Materials

9.2.1 Key Raw Materials

9.2.2 Raw Materials Key Suppliers

9.3 Energy Trading and Risk Management (ETRM) Production Mode & Process

9.4 Energy Trading and Risk Management (ETRM) Sales and Marketing

9.4.1 Energy Trading and Risk Management (ETRM) Sales Channels

9.4.2 Energy Trading and Risk Management (ETRM) Distributors

9.5 Energy Trading and Risk Management (ETRM) Customers

10 Research Findings and Conclusion

11 Appendix

11.1 Research Methodology

11.1.1 Methodology/Research Approach

11.1.1.1 Research Programs/Design

11.1.1.2 Market Size Estimation

11.1.1.3 Market Breakdown and Data Triangulation

11.1.2 Data Source

11.1.2.1 Secondary Sources

11.1.2.2 Primary Sources

11.2 Author Details

11.3 Disclaimer

Contact US

QY Research, INC.

India Office -

315Work Avenue, Raheja Woods, Kalyani Nagar,

Pune, Maharashtra 411006, India

Web - https://www.qyresearch.in

Tel: +91-8149736330

Email- ankit@qyresearch.com

About US:

QYResearch is a leading global market research and consulting company established in 2007. With over 17 years' experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Trading and Risk Management (ETRM) Market Outlook 2025-2031: Emerging Trends, Growth Opportunities, and Regional Forecasts here

News-ID: 4119209 • Views: …

More Releases from QY Research India

WBG Power Devices Market Expansion Accelerates, Projected to Reach US$ 17,550 Mi …

Pune, India: The global WBG Power Devices market is brilliantly evaluated in the research study that explores vital aspects such as market competition, segmentation, revenue and production growth, and regional expansion. The authors of the report have provided a thorough assessment of the global WBG Power Devices market on the basis of CAGR, sales, consumption, price, gross margin, and other significant factors. We have studied key players of the global…

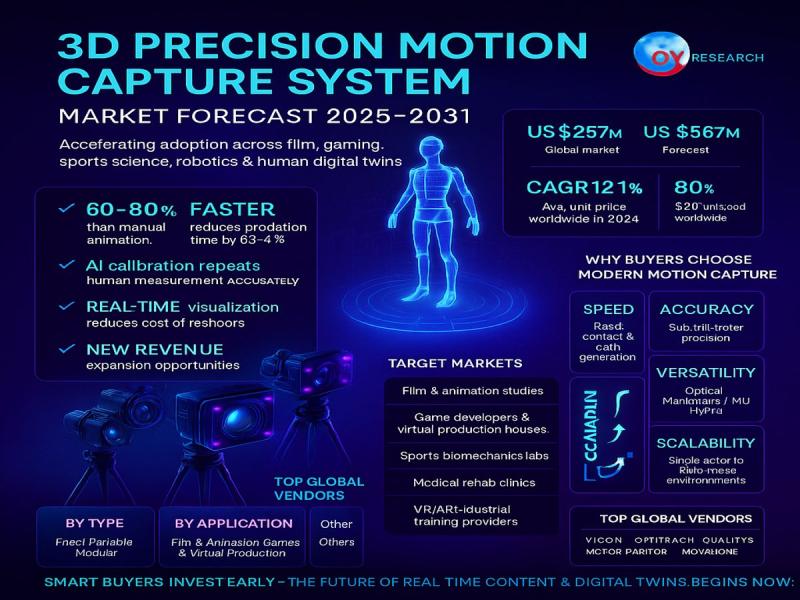

Global 3D Precision Motion Capture System Market Poised for 12.1% CAGR Growth Th …

The report presented here prepares market players to achieve consistent success while effectively dealing with unique challenges in the global 3D Precision Motion Capture System market. The analysts and researchers authoring the report have taken into consideration multiple factors predicted to positively and negatively impact the global 3D Precision Motion Capture System market, including policy risks such as the potential shifts in the 2025 U.S. tariff framework. The report includes…

Fully Hermetic Compressor Market Outlook 2025, Industry Demand, Emerging Applica …

QY Research has recently published a research report titled, "Global Fully Hermetic Compressor Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031", assessing various factors impacting its trajectory. The research study offers deep evaluation of the global Fully Hermetic Compressor market and helps market participants to gain a strong foothold in the industry. It sheds light on critical market dynamics such as drivers, restraints, trends, and opportunities to help…

Engine Exhaust Silencers Market Set for Sustainable Growth by 2031, Key Trends, …

QY Research has recently published a research report titled, "Global Engine Exhaust Silencers Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031", assessing various factors impacting its trajectory. The research study offers deep evaluation of the global Engine Exhaust Silencers market and helps market participants to gain a strong foothold in the industry. It sheds light on critical market dynamics such as drivers, restraints, trends, and opportunities to help…

More Releases for Energy

Green Renewable Energy Market Next Big Thing: Enphase Energy, Bloom Energy, Clea …

Advance Market Analytics published a new research publication on "Green Renewable Energy Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Green Renewable Energy market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the…

Business Energy Solution Market Size in 2023 To 2029 | SSE Energy Solutions, BES …

The large-scale Business Energy Solution market report provides valuable insights for clients looking to forecast investments in emerging markets, expand market share, or launch new products. The report presents multifaceted Business Energy Solution market insights that are simplified using established tools and techniques, making it a credible marketing report. Data is presented in a clear and easy-to-understand manner, with graphs and charts to aid comprehension. The report employs integrated approaches…

Decentralized Energy Storage Market Is Booming Worldwide | Fuelcell Energy, Enph …

A new business intelligence report released by AMA with title "Decentralized Energy Storage Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Decentralized Energy Storage Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics…

Waste-To-Energy Technologies Market Top Growing Companies: Xcel Energy, Novo Ene …

Qurate Business Intelligence’s up-to-date research study on Waste-To-Energy Technologies was performed by highly qualified research professionals and industry experts. This is to provide an in-depth analysis on the Waste-To-Energy Technologies. The report is comprehensive and includes over 120 pages. The global energy market is witnessing a shift toward waste to energy technologies due to growing energy demands worldwide, the rapid depletion of conventional sources of energy, and concerns over…

Waste To Energy Market ||Novo Energy Ltd., Hitachi Zosen, Foster Wheeler A.G., S …

Zion Market Research published a new 110+ pages industry research "Global Waste to Energy Market Set For Rapid Growth, To Reach Value Around USD 42.74 Billion By 2024" is exhaustively researched and analyzed in the report to help market players to improve their business tactics and ensure long-term success. The authors of the report have used easy-to-understand language and uncomplicated statistical images but provided thorough information and detailed data on…

In-Pipe Hydro Systems Market | key player - Lucid Energy, Rentricity, Tecnoturbi …

Looking at the current market trends as well as the promising demand status of the “In-Pipe Hydro Systems Market” it can be projected that the future years will bring out positive outcomes. This research report added by MRRSE on its online portal delivers clear insight about the changing tendencies across the global market. Readers can gather prime facets connected to the target market which includes product, end-use and application; assisting…