Press release

ePayment System Market Set for Explosive Growth, Projecting to Reach USD 816.8 Billion by 2035 Amidst AI, Blockchain, and Quantum Computing Revolution

The global ePayment system market is on the cusp of unprecedented expansion, with projections indicating a leap from USD 138.8 billion in 2025 to a staggering USD 816.8 billion by 2035. This remarkable growth, fueled by a robust Compound Annual Growth Rate (CAGR) of 20.1%, signifies a fundamental shift in global financial transactions, driven by technological advancements, evolving consumer behaviors, and strategic industry innovations.The rapid proliferation of mobile technology, the booming e-commerce sector, and a widespread embrace of cashless and contactless transactions are the primary catalysts for this exponential trajectory. Consumer demand for secure, swift, and convenient digital payment options, coupled with the integration of biometric authentication and the pervasive adoption of digital wallets and mobile payment applications, are accelerating innovation across the financial landscape.

Soaring Demand for Market Information: Uncover Detailed Trends and Insights in Our Report! https://www.futuremarketinsights.com/reports/epayment-system-market

A Decade of Digital Transformation: From 2020 to 2035

The period between 2020 and 2024 witnessed a dramatic acceleration in digital payment adoption, largely spurred by the COVID-19 pandemic, which cemented cashless transactions as the preferred method for businesses and consumers alike. Mobile payment platforms like Apple Pay, Google Pay, and PayPal saw skyrocketing usage, while contactless methods such as NFC cards and QR code scanning became commonplace. The embrace of blockchain and cryptocurrency by industry giants like Visa and Mastercard, alongside government explorations into Central Bank Digital Currencies, underscored a profound shift. Enhanced security, driven by AI-based fraud prevention, biometric verification, and multi-factor authentication, also matured significantly.

Looking ahead, from 2025 to 2035, the ePayment sector is poised for a revolutionary transformation. AI automation will introduce sophisticated financial assistants capable of automating payments and optimizing personal finance. Decentralized Finance (DeFi) platforms, powered by blockchain and smart contracts, promise reduced fees, real-time cross-border settlements, and automated payment contracts. Biometric and voice payments, leveraging facial recognition, palm vein scanning, and voice biometrics, will redefine convenience and security. Furthermore, IoT-enabled devices will unlock automated payments for smart homes and vehicles, while the industry commits to green digital payment infrastructure, including carbon-free data centers. The advent of quantum computing and quantum-resistant cryptography is set to offer unparalleled fraud detection speeds and verifiable, secure transaction proofs, completely reshaping the future of payments.

Competitive Landscape: Major Players Driving Innovation

The ePayment market is characterized by intense competition and continuous innovation. Leading players are strategically positioning themselves to capture market share through enhanced security, reliability, and integrated solutions.

PayPal Holdings Inc. (Estimated Market Share: 20-25%): PayPal maintains its leadership through a comprehensive suite of online and mobile payment solutions, excelling in seamless cross-border transactions and AI-powered fraud protection. Their strategy focuses on widespread accessibility and a strong global network.

Visa Inc. (Estimated Market Share: 15-20%): A cornerstone of digital payments, Visa leads with its robust card-based transaction infrastructure, contactless payment options, and tokenized security. Their focus remains on expanding user convenience and bolstering security protocols globally.

Mastercard Inc. (Estimated Market Share: 12-16%): Mastercard is at the forefront of digital payment innovation, leveraging AI for advanced fraud detection, real-time authentication, and an expanding network of secure global partnerships. They are actively exploring and integrating emerging technologies like blockchain.

Square (Block, Inc.) (Estimated Market Share: 10-14%): Square empowers businesses, particularly SMEs, with accessible mobile payment solutions, innovative point-of-sale systems, and increasingly, cryptocurrency payment integration. Their strength lies in catering to diverse business needs.

Stripe (Estimated Market Share: 6-10%): Stripe is a dominant force in e-commerce payments, offering developer-friendly APIs, seamless global payment processing, and efficient subscription billing mechanisms. Their focus on developer tools and global reach drives their competitive edge.

Other significant players like Amazon Pay, Google Pay, Apple Pay, Alipay, and WeChat Pay, collectively holding 30-40% of the market, are also making substantial contributions, particularly within their respective ecosystems and regional strongholds. Strategic partnerships and significant contract wins, exemplified by recent deals from Visa, Mastercard, PayPal, Square, and Stripe, underscore the industry's commitment to digital transformation and secure transactions across diverse markets.

Growth Trends and Segment Analysis

The "Solution" segment is projected to dominate the ePayment market in 2025, accounting for an estimated 65.8% of the total market share. This dominance is driven by the increasing adoption of digital wallets, AI-powered fraud detection tools, blockchain transactions, and real-time payment processing solutions. The "Services" segment is also poised for significant growth (34.2% share in 2025), fueled by the rising demand for payment integrations, consulting, and managed services to facilitate seamless omnichannel experiences.

Cloud-based deployment is rapidly becoming the industry standard, anticipated to hold 75.4% of the overall market share by 2025. This shift is driven by the flexibility, cost-effectiveness, and scalability offered by cloud-native payment platforms, particularly for AI-based fraud detection and emerging technologies like blockchain and IoT-based transactions. While on-premises solutions will remain relevant for specific industries requiring stringent data control and regulatory compliance, the acceleration of digital transformation will see cloud-based solutions leading the charge.

Regional Insights: A Global Digital Payment Evolution

Every region is contributing to the ePayment market's growth, albeit at varying CAGRs reflecting unique market dynamics and adoption rates.

The USA (CAGR 11.2%): Driven by high fintech adoption, evolving regulatory landscapes, and strong digital wallet growth, with PayPal and Apple Pay leading.

The UK (CAGR 10.5%): Pioneers like Revolut and Monzo, coupled with government policies supporting open banking, are fostering instant payments and cryptocurrency transactions.

France (CAGR 9.8%): Rigorous regulations ensure a secure platform, with incumbents like Worldline and BNP Paribas, alongside new entrants focusing on AI-driven fraud prevention.

Germany (CAGR 9.5%): Digitalization is gaining momentum, with conventional banks offering instant payment processing to retain market share, despite a continued preference for cash among some consumers.

Italy (CAGR 8.9%): Mobile banking and fintech firms like Nexi and Satispay are spearheading the shift towards cardless and mobile payments.

South Korea (CAGR 12.0%): A leader in digital payments, driven by technology-savvy consumers and the dominance of Kakao Pay, Naver Pay, and Samsung Pay.

Japan (CAGR 10.2%): Rising adoption of cashless technologies, supported by brands like Rakuten Pay and PayPay, and government campaigns promoting QR-code payments.

China (CAGR 13.5%): The most lucrative industry, dominated by WeChat Pay and Alipay, with the central bank actively developing

Australia (CAGR 9.3%): Fintech advancements and high smartphone penetration, with brands like Afterpay leading digital growth and a strong embrace of "tap-and-go" technology.

New Zealand (CAGR 8.5%): Consistent growth in digital payments, driven by local businesses advocating cashless options and government-supported fintech projects.

Addressing Challenges and Seizing Opportunities

While the ePayment industry presents immense opportunities, it faces challenges such as cybersecurity risks, regulatory complexities, and digital infrastructure disparities. Robust encryption, multi-factor authentication, and real-time fraud detection systems are crucial to mitigate cyber threats. Adherence to evolving global regulations like GDPR, PCI DSS, and PSD2 is paramount to avoid penalties and build consumer trust. Operational disruptions necessitate robust redundancy measures and contingency plans.

However, these challenges are outweighed by significant opportunities. Increasing internet penetration, government initiatives promoting digital payments, and groundbreaking innovations like blockchain-based systems and AI-driven fraud detection are paving the way for unprecedented industry expansion. The rise of real-time payment systems, embedded finance, and cross-border ePayment solutions are transforming the global payments landscape and enhancing financial inclusion.

As the ePayment market surges forward, fueled by technological ingenuity and evolving consumer demands, it promises a future of seamless, secure, and globally interconnected financial transactions. Businesses that prioritize innovation, security, and a deep understanding of regional nuances will be best positioned to thrive in this dynamic and rapidly expanding market.

Key Segmentation

By Component:

The segmentation is into solutions (payment gateway, payment processing, payment wallet, payment security, and fraud management, and point of sale (POS)) and services (consulting & advisory, integration & implementation, support & maintenance, and managed services).

By Deployment:

The segmentation is into on-premises and cloud.

By Enterprise Size:

The segmentation is into small and medium enterprises (SMEs) as well as large enterprises.

By Industry:

The segmentation is into BFSI, retail, healthcare, media & entertainment, IT & telecom, transportation & logistics, and others.

By Region:

The segmentation is into North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

Explore Key Trends in the Market: Request Your Sample Report! https://www.futuremarketinsights.com/reports/sample/rep-gb-5813

Have a Look at Related Research Reports:

Systems Administration Management Tools Market: https://www.futuremarketinsights.com/reports/systems-administration-management-tools-market

System on Module Market: https://www.futuremarketinsights.com/reports/system-on-module-market

Systemic Mastocytosis Treatment Market: https://www.futuremarketinsights.com/reports/systemic-mastocytosis-treatment-market

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ePayment System Market Set for Explosive Growth, Projecting to Reach USD 816.8 Billion by 2035 Amidst AI, Blockchain, and Quantum Computing Revolution here

News-ID: 4118181 • Views: …

More Releases from Future Market Insights Inc.

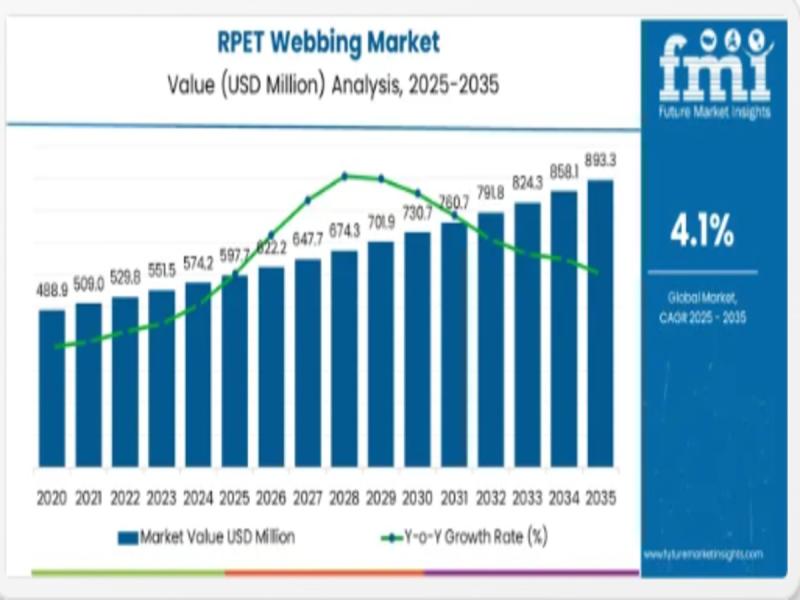

Global RPET Webbing Market Set to Surge to Nearly USD 893 Million by 2035 as Sus …

The global Recycled Polyethylene Terephthalate (RPET) webbing market is projected to expand from an estimated USD 597.7 million in 2025 to approximately USD 893.2 million by 2035, reflecting robust momentum in recycled materials adoption across key industrial and consumer sectors and underscoring sustainability as a core manufacturing imperative. The market is expected to grow at a compound annual growth rate (CAGR) of 4.1 % during this forecast period, driven by…

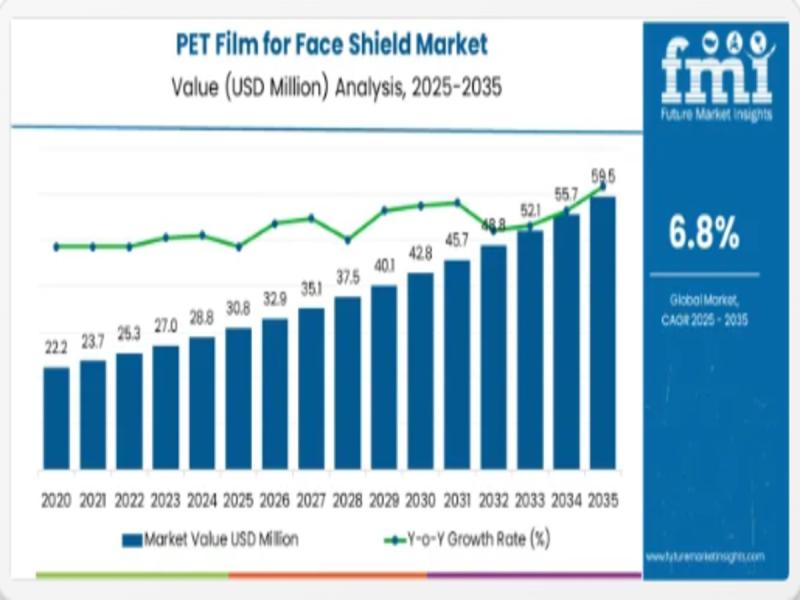

PET Film for Face Shield Market - Strategic Growth, Innovation & Forecasted Surg …

The global PET film for face shield market is set to expand from an estimated USD 30.8 million in 2025 to approximately USD 59.5 million by 2035, representing strong demand for high-clarity protective materials across healthcare and industrial safety sectors with a compound annual growth rate (CAGR) of 6.8% over the decade. This growth underscores the rising prioritization of personal protective equipment (PPE) globally, especially where transparent barrier films combine…

Middle East and North Africa Frozen Food Market Poised for Steady Growth Through …

Middle East and North Africa Frozen Food Market

The Middle East and North Africa (MENA) frozen food market is set for consistent and resilient growth over the next decade, supported by shifting consumer lifestyles, expanding modern retail infrastructure, and rising demand for long-shelf-life food solutions suited to the region's climate. The market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 1.8 billion…

Soluble Corn Fiber Market Forecast and Outlook 2026 to 2036 | FMI

Soluble Corn Fiber Market Outlook

The global soluble corn fiber market is gaining steady momentum as food, beverage, and nutrition manufacturers intensify reformulation strategies aimed at reducing sugar while preserving taste, texture, and consumer appeal. Valued at USD 54.9 billion in 2026, the market is projected to reach USD 78.6 billion by 2036, expanding at a compound annual growth rate (CAGR) of 4.6% over the forecast period.

Soluble corn fiber has evolved…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…