Press release

Asia-Pacific Life and Non-Life Insurance Market to Reach USD 2.59 Trillion by 2030, Driven by Expanding Retail Penetration and Distribution Channels

Mordor Intelligence has published a new report on the "Asia-Pacific Life and Non-Life Insurance Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsIntroduction:

The Asia-Pacific life and non-life insurance market is experiencing consistent growth as the region's demographics shift, disposable incomes rise, and digital channels make insurance more accessible. Estimated at USD 2.00 trillion in 2025, the market is projected to reach USD 2.59 trillion by 2030, reflecting a steady CAGR of 5.26% over the forecast period.

This growth is underpinned by expanding middle-class populations, increased awareness of risk coverage, and evolving regulatory frameworks that are creating a favorable environment for insurers. The region's dual structure of advanced markets such as Japan and Australia, and rapidly developing economies like India, China, and Indonesia, is contributing to a dynamic and diverse insurance landscape.

Report Overview: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-asia-pacific?utm_source=openpr

Key Trends:

Rising Demand for Protection and Savings-Based Products

One of the defining trends in the Asia-Pacific insurance market is the increasing preference for policies that combine savings with life protection. Consumers are actively seeking products that offer long-term financial security, especially in markets like China and India, where insurance is increasingly being viewed as a savings instrument rather than just a protection tool. As life expectancy increases across the region, there is also a growing demand for retirement planning and annuity products.

Digital Distribution and Insurtech Integration

Digitalization is transforming how insurance is distributed and serviced in Asia-Pacific. The growing adoption of smartphones, internet penetration, and e-commerce platforms has enabled insurers to reach a wider audience, particularly in underserved rural areas. Insurtech startups and digital platforms are introducing app-based policy issuance, paperless claims processing, and AI-supported customer service tools. These services are particularly popular among younger, tech-savvy customers who prefer seamless online experiences.

Expanding Role of Bancassurance and Brokers

Bancassurance continues to play a critical role in distributing insurance products, especially in Southeast Asian markets like Malaysia, Indonesia, and Thailand. With banks having wide networks and strong customer trust, insurers are leveraging these partnerships to distribute both life and non-life products. In parallel, independent financial advisors (IFAs) and brokers are becoming more relevant in the high-net-worth segment, where personalized advice and multi-product offerings are in demand.

Health and Non-Life Insurance Gaining Ground

Non-life insurance products, especially health and motor insurance, are growing faster than traditional lines in several Asia-Pacific countries. Increased awareness following the COVID-19 pandemic has driven uptake in individual health policies, while rising car ownership in countries like India and Vietnam has boosted motor insurance. Governments across the region are also launching public-private health insurance schemes, encouraging broader coverage penetration.

Regulatory Support and Financial Inclusion

Regulators in several Asia-Pacific countries are introducing measures to promote financial inclusion and strengthen consumer protection. Initiatives such as simplified policy formats, microinsurance regulations, and digital KYC are making it easier for low-income individuals to access insurance. Additionally, regulators are working to align their markets with global solvency and disclosure standards, which in turn is attracting foreign investments and partnerships in the insurance sector.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/life-non-life-insurance-market-in-asia-pacific?utm_source=openpr

Market Segmentation:

The Asia-Pacific life and non-life insurance market is structured across several dimensions that influence product development, distribution strategy, and customer engagement.

By Insurance Type:

Life Insurance: Includes term life, whole life, endowment, and annuity products aimed at offering long-term financial security.

Non-Life Insurance: Covers health, motor, property, liability, and other general insurance products addressing tangible risks.

By Distribution Channel:

Agency Force: Remains a dominant channel in many Asian countries, especially for complex and high-value policies.

Bancassurance: Provides access to a broad customer base via established banking relationships.

Brokers & IFAs: Serve niche markets, offering customized solutions for affluent and high-net-worth customers.

Others: Includes direct digital sales, telesales, and partnerships with e-commerce and fintech platforms.

By Customer Segment:

Retail / Mass Market: Primarily targeted with standardized policies, especially in motor, health, and term life segments.

High-Net-Worth & Affluent: Offered personalized services including estate planning, investment-linked insurance, and customized risk management.

By Region:

The market spans major economies such as China, India, Japan, South Korea, Australia, and Southeast Asian nations, each with unique regulatory frameworks and market maturity levels.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players:

The Asia-Pacific insurance market is served by a mix of domestic leaders and regional multinationals that maintain strong distribution networks and diversified portfolios.

Ping An Insurance Group: One of China's largest insurance providers, offering a wide range of life, health, and non-life insurance products. The company has made significant investments in digital platforms and insurtech integration to streamline operations and improve customer engagement.

China Life Insurance Co.: With deep penetration across China, this state-backed insurer focuses on long-term savings and life policies, catering largely to the middle-income segment. It plays a key role in government-endorsed insurance schemes and rural outreach initiatives.

AIA Group: Headquartered in Hong Kong, AIA operates in multiple Asia-Pacific markets. It is known for its strong agency network and a broad portfolio that includes health, critical illness, and savings-oriented life products. AIA's strategies are centered on urban millennial customers and financial wellness.

Japan Post Insurance: A major player in Japan's life insurance sector, the company primarily offers savings-based and endowment products. It benefits from an extensive postal network, allowing access to remote regions and elderly populations.

Life Insurance Corporation of India (LIC): As India's largest life insurer, LIC serves millions of policyholders across urban and rural areas. Its wide agent network and government backing give it a significant edge in life and annuity markets.

Explore more insights on Asia-Pacific life and non-life insurance market competitive landscape: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-asia-pacific/companies?utm_source=openpr

Conclusion:

The Asia-Pacific life and non-life insurance market is on a steady upward trajectory, driven by changing consumer preferences, greater financial awareness, and expanding distribution networks. The region's diverse mix of mature and emerging markets presents a unique landscape for insurers to tailor strategies and innovate in product design and delivery. As regulatory frameworks improve and digital platforms continue to evolve, insurers are well-positioned to serve both mass-market and affluent customer segments across urban and rural geographies. The continued rise in protection and health-conscious behaviors will further support long-term market development across the region.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-asia-pacific?utm_source=openpr

Industry Related Reports

Spain Life And Non-Life Insurance Market: The Spain Life and Non-Life Insurance Market is Segmented by Insurance Type (Life Insurance, Non-Life Insurance), by Distribution Channel (Agents & Brokers, Bancassurance, Direct (Tied) Sales, and More), by End-User (Individuals, Corporates, and Public Sector), and Region (Madrid, Catalonia, Andalusia, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-spain?utm_source=openpr

Germany Life And Non-Life Insurance Market: The Germany Life and Non-Life Insurance is Segmented by Insurance Type (Life Insurance (Term, Endowment, Unit Linked and More), Non-Life (Motor, Property, Liability, Health and More), Distribution Channel (Agents, Broker, Bancassurance, and More), End Users (Individuals, Sme's and More) Premium Type (Single, Regular), Provider Type (Private, Mutual and More), and Region

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-germany?utm_source=openpr

Australia Life And Non-life Insurance Market: Australia Life and Non-Life Insurance Market is Segmented by Insurance Type (Life Insurance and Non-Life Insurance), Distribution Channel (Direct, Brokers, Banks, and More), Customer Segment (Individual Policyholders, Small & Medium Enterprises, and More), Premium Frequency (Regular Premium and Single Premium), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-australia?utm_source=openpr

India Life And Non-Life Insurance Market: The India Life and Non-Life Insurance Market is Segmented by (Life Insurance, (endowment, Term-Life, Whole-Life, Unit-Linked and More), Non-Life Insurance (Motor, Health, Fire and Engineering, Marine and Cargo and More), Distribution Channel (Agency, Bancassurance, Direct and More), Customer Type (Individual and Group) and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/life-non-life-insurance-market-in-india?utm_source=openpr

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asia-Pacific Life and Non-Life Insurance Market to Reach USD 2.59 Trillion by 2030, Driven by Expanding Retail Penetration and Distribution Channels here

News-ID: 4117500 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

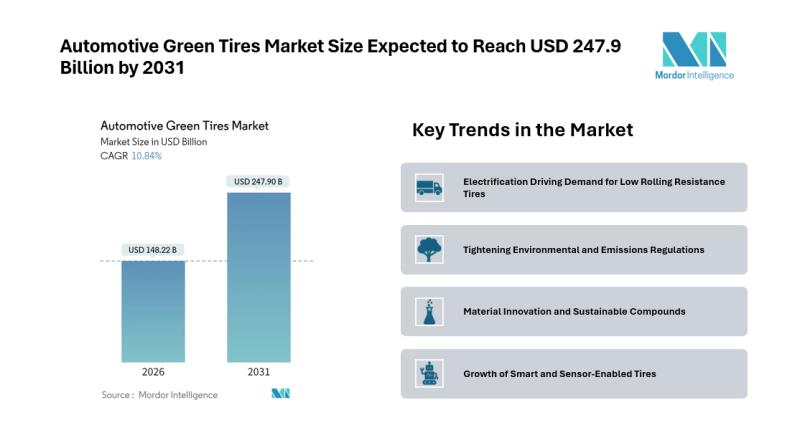

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…