Press release

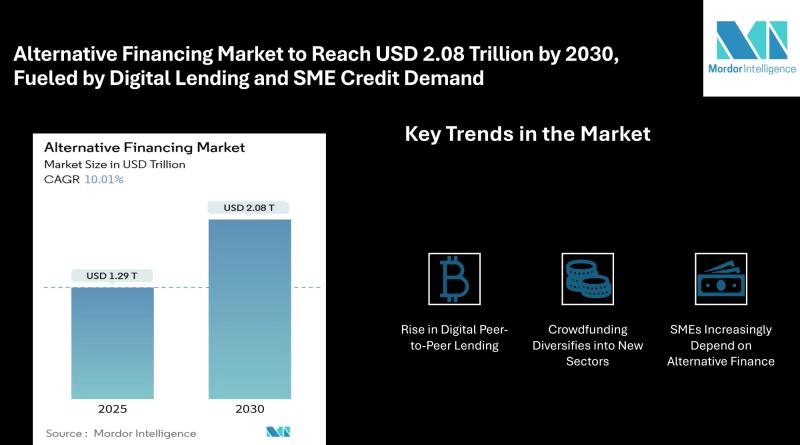

Alternative Financing Market to Reach USD 2.08 Trillion by 2030, Fueled by Digital Lending and SME Credit Demand

Mordor Intelligence has published a new report on the "Alternative Financing Market" offering a comprehensive analysis of trends, growth drivers, and future projectionsFlexible Capital Solutions and Fintech Platforms Support Market Expansion

The alternative financing market is projected to grow significantly over the next five years, increasing from USD 1.29 trillion in 2025 to USD 2.08 trillion by 2030, registering a compound annual growth rate (CAGR) of 10.01%. This growth is fueled by the rising need for flexible, accessible funding options across consumer and business segments, particularly among small and medium enterprises (SMEs). The market continues to expand as fintech platforms disrupt traditional lending by offering tailored solutions through peer-to-peer (P2P) lending, crowdfunding, and other non-bank channels.

As businesses and individuals increasingly seek quicker and less bureaucratic ways to access credit, alternative financing has emerged as a critical tool. In particular, underserved groups such as startups, freelancers, and small enterprises are finding value in these decentralized models of funding, which often bypass the rigid requirements of traditional financial institutions.

Report Overview: https://www.mordorintelligence.com/industry-reports/alternative-financing-market?utm_source=openpr

Key Trends in the Alternative Financing Market

Rise in Digital Peer-to-Peer Lending

Peer-to-peer lending platforms are growing as digital infrastructure improves and financial inclusion becomes a priority across developed and developing markets. These platforms enable direct lending between individuals or from individuals to small businesses, bypassing traditional intermediaries. Advanced risk assessment models and lower interest rates are making P2P lending a preferred choice for borrowers and an attractive asset class for investors seeking higher returns.

Crowdfunding Diversifies into New Sectors

Crowdfunding is no longer limited to creative ventures. Equity crowdfunding is being used by startups and early-stage companies to raise capital from the public, while reward and donation-based crowdfunding platforms have gained visibility for community-driven and philanthropic projects. These platforms provide a means of validating product demand while also attracting initial customers, all without incurring debt or diluting equity significantly.

SMEs Increasingly Depend on Alternative Finance

One of the most important trends in this space is the reliance of SMEs on non-traditional funding. With limited access to bank loans due to stricter collateral and credit requirements, SMEs are increasingly turning to invoice trading, merchant cash advances, and crowdfunding. These solutions allow them to finance working capital, expand operations, or manage cash flow more effectively.

Digital-First Business Models Drive Adoption

The shift to online services, mobile-first banking, and digital payment ecosystems is accelerating the growth of alternative finance. Fintech companies are leveraging automation and data analytics to reduce processing time, improve credit scoring, and enhance user experience. This is especially relevant in regions where smartphone penetration is high and branch-based banking infrastructure is weak or absent.

Growing Investor Confidence in Alternative Assets

Alternative finance is also gaining traction among retail and institutional investors. These markets offer opportunities to diversify portfolios with investment options in consumer loans, SME lending, and startup equity. The development of secondary markets and regulated crowdfunding exchanges is expected to improve liquidity and transparency, encouraging more participation from sophisticated investors.

Geographical Expansion and Regional Focus

Emerging markets are showing notable interest in alternative financing, especially in regions where traditional banking services are limited. Southeast Asia, parts of Latin America, and Sub-Saharan Africa are witnessing increasing adoption of digital lending and crowdfunding due to the lack of legacy infrastructure. Government initiatives to promote financial inclusion are also supporting the growth of alternative financing models.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/alternative-financing-market?utm_source=openpr

Market Segmentation

The alternative financing market is segmented by financing type, end user, and geography. Each segment plays a unique role in shaping the demand and development of non-traditional lending solutions.

By Financing Type:

Peer-To-Peer Lending: Direct lending between individuals or from individual investors to small businesses using online platforms. Popular for unsecured personal loans and business funding.

Crowdfunding:

Equity Crowdfunding: Enables startups and businesses to raise capital in exchange for equity shares.

Reward/Donation Crowdfunding: Used to fund projects or causes, offering backers early product access or recognition in return for contributions.

By End User:

Individual Consumers: Use alternative financing for personal loans, medical expenses, education, and emergency funds.

Small & Medium Enterprises (SMEs): The largest segment in terms of demand, especially for working capital, invoice finance, and growth funding.

Large Enterprises: Utilize select models such as structured crowdfunding or private lending platforms for specialized capital needs.

Others: Includes nonprofit organizations and entrepreneurs in creative or social sectors.

By Geography:

North America: A mature market with a strong regulatory environment and widespread adoption of P2P lending and crowdfunding.

Europe: Driven by transparency mandates and fintech growth, particularly in the UK, Germany, and the Nordics.

Asia-Pacific: Fast-growing due to digital innovation, rising entrepreneurship, and large underbanked populations.

South America, Middle East & Africa: Emerging markets where alternative financing is gradually gaining traction as a tool for financial inclusion and small business development.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players Driving Market Development

The global alternative financing market is supported by a diverse group of platforms catering to various financing models. These companies focus on digital delivery, borrower-lender matchmaking, and seamless user experiences.

LendingClub: One of the pioneers in peer-to-peer lending in the United States, LendingClub has transitioned into a digital bank while maintaining its core marketplace lending model for personal and small business loans.

Funding Circle: A specialist SME lending platform that offers loans to small businesses across the UK, US, Germany, and the Netherlands. It leverages data analytics and automation to make faster credit decisions.

GoFundMe: A leading player in donation-based crowdfunding, GoFundMe allows individuals and communities to raise funds for personal causes, medical needs, or disaster relief.

Kickstarter: Popular in the creative and tech community, Kickstarter enables entrepreneurs and artists to fund their projects through reward-based campaigns, offering early product access or project engagement.

Indiegogo: Similar to Kickstarter but with a broader scope, Indiegogo supports both reward-based and flexible funding models for technology, design, and social impact campaigns.

These companies are investing in data security, real-time loan processing, and risk modeling to maintain trust and scale operations in a competitive environment.

Explore more insights on alternative financing market competitive landscape: https://www.mordorintelligence.com/industry-reports/alternative-financing-market/companies?utm_source=openpr

Conclusion

Alternative financing is emerging as a vital mechanism in today's global financial landscape, offering capital access beyond traditional banking systems. From empowering small businesses to helping individuals meet urgent needs, the sector plays a critical role in addressing funding gaps. As demand for flexible, quick, and digital lending solutions continues to rise, the market is expected to maintain its growth trajectory.

The widespread acceptance of peer-to-peer lending and crowdfunding, along with the increasing credibility of fintech platforms, suggests a long-term shift in how consumers and businesses approach finance. With strong regional growth patterns, improving digital infrastructure, and evolving regulatory support, alternative financing is well-positioned to expand its reach and impact across diverse user segments and geographies.

For complete market analysis, visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/alternative-financing-market?utm_source=openpr

Industry Related Reports

Trade Finance Market: Trade Finance Market is Segmented Based on Service Provider (Banks, Trade Finance Companies, Insurance Companies, and Other Service Providers) and Geography (North America, Europe, The Middle East, South America, and Asia-Pacific).

Get more insights: https://www.mordorintelligence.com/industry-reports/global-trade-finance-market?utm_source=openpr

Gift Card And Incentive Card Market: Gift Card and Incentive Card Market is Segmented by Card Type (Open-Loop Card and Closed-Loop Card), by Format Type (Digital Card and Physical Card), by Consumer Type (Individual (B2C) and Corporate (B2B)), by Distribution Channel (Online and Offline), by Industry of Application (Food and Beverages, and More), and by Region (North America, Europe, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/gift-card-and-incentive-card-market?utm_source=openpr

Factoring Market: The Factoring Market is Segmented by Provider (Banks, and Non-Bank Financial Companies (NBFCs)), Enterprise Size (Large Enterprises, and Small & Medium-Sized Enterprises (SMEs)), Application (Domestic, and International), End-Use Industry (IT & Telecommunication, Manufacturing, and More) and Region (North America, South America, and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/factoring-market?utm_source=openpr

Car Loan Market: The Global Car Loan Market Report is Segmented by Vehicle Type (Passenger Vehicle, Commercial Vehicle), Ownership (New Vehicles, Used Vehicles), Provider Type (Banks, Non-Banking Financial Institutions, Original Equipment Manufacturers, and Other Provider Types), Tenure (Less Than 3 Years, 3-5 Years, and More), and Geography (North America, South America, and More)

Get more insights: https://www.mordorintelligence.com/industry-reports/car-loan-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Alternative Financing Market to Reach USD 2.08 Trillion by 2030, Fueled by Digital Lending and SME Credit Demand here

News-ID: 4117004 • Views: …

More Releases from Mordor Intelligence

Egypt Residential Construction Market to Reach USD 29.96 Billion by 2031 as Gove …

Mordor Intelligence has published a new report on the offering a Egypt Residential Construction comprehensive analysis of trends, growth drivers, and future projections

Egypt Residential Construction Market Overview

According to Mordor Intelligence, the Egypt residential construction market size was valued at USD 18.80 billion in 2025 and expanded to USD 20.32 billion in 2026, with the market forecast to reach USD 29.96 billion by 2031. This growth outlook reflects the…

Canned Meat Market Size to Reach USD 22.69 Billion by 2031 as Protein Demand and …

The global canned meat market size is projected to expand from usd 18.61 billion in 2026 to usd 22.69 billion by 2031, registering a cagr of 4.04% during the forecast period, according to Mordor Intelligence. This steady expansion reflects rising reliance on shelf-stable protein sources, changing household structures, and growing institutional procurement across both developed and emerging economies. The canned meat industry continues to benefit from its dual positioning as…

Canned Alcoholic Beverages Market Size to Reach USD 48.78 Billion by 2030 as RTD …

The Global canned alcoholic beverages market size is projected to expand from USD 34.81 billion in 2025 to USD 48.78 billion by 2030, registering a CAGR of 6.98% during the forecast period, according to Mordor Intelligence. This steady expansion reflects a structural shift in alcohol consumption toward convenient, portable, and premium-ready formats.

The Canned Alcoholic Beverages Industry is benefiting from changing lifestyle patterns, growing demand for ready-to-drink (RTD) options, and increasing…

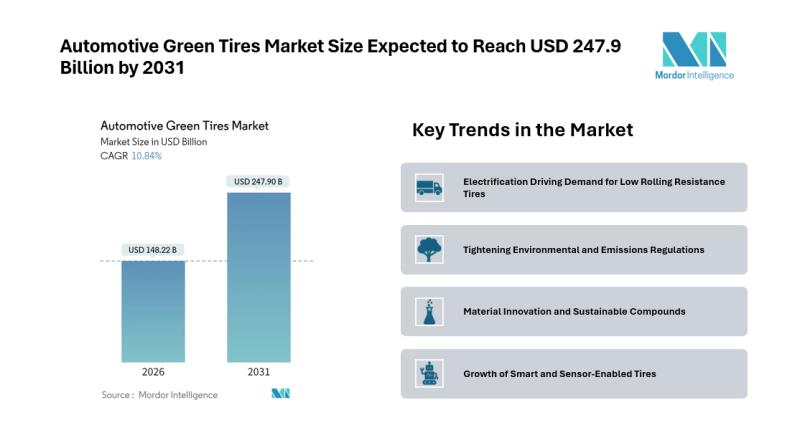

Automotive Green Tires Market Size Expected to Reach USD 247.9 Billion by 2031 - …

Introduction

The Automotive Green Tires Market is gaining traction as sustainability, fuel efficiency, and emissions reduction become central priorities for automotive manufacturers and regulators. According to Mordor Intelligence, the Automotive Green Tires market size is expected to grow from USD 133.73 billion in 2025 to USD 148.22 billion in 2026, and is forecast to reach USD 247.90 billion by 2031, registering a CAGR of 10.84% during the 2026-2031 forecast period.…

More Releases for Car

Car Washing Services Market Is Booming So Rapidly with Mister Car Wash, Zips Car …

The Car Washing Services Market has been fragmented based on the productivity of several companies; therefore, each segment and its sub-segments are analyzed in the research report. Furthermore, the report offers 360 views on historical and upcoming growth based on volume, value, production, and consumption. Moreover, it classifies depend on sub-segments, key segments as per the significant regions and offers an in-depth analysis on the competitive edge of the market.…

Car Wash Service Market Boosting the Growth Worldwide: Auto Bell Car Wash, Miste …

The latest study released on the Global Car Wash Service Market by AMA Research evaluates market size, trend, and forecast to 2027. The Car Wash Service market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key…

Car Rental Services Market Forecast to 2028 Covid-19 Impact and Global Analysis …

Car rental services are a process of hiring/renting a car for a limited period from a rental company. Various companies like Uber Technologies, Europcar rent the vehicles for a short period ranging from few hours to weeks. The different types of cars rented by the company include Luxury Car, executive car, and economical car among others. Additionally, vehicle renting agencies also offer other products such as insurance, entertainment systems, and…

Car Rentals Market Growth Strategies and Innovative Technology Transformation by …

Worldwide Market Reports has announced the addition of the "Car Rentals Market Report 2020-2027 Production, Sales And Consumption Status And Prospects Professional Research", The report classifies the global Car Rentals Market in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth.

The emergence of own-brand digital ordering platform has been trending in the global Car Rentals market. Car Rentals such as…

Luxury Car Leasing Market Competitors Analysis By German Rent A Car, ANI Technol …

�'Global Luxury Car Leasing Market Research Report' the report is complete with an elaborate research undertaken by prominent analysts and a detailed analysis of the global industry place. The Luxury Car Leasing report is fragmented in several features which include manufacturers, region, type, application, market status, market share, growth rate, future trends, market drivers, opportunities, challenges, emerging trends, risks, entry barriers, sales channels, and distributors which are again elaborated in…

Car Wash Market is Thriving Worldwide 2026 | Super Star Car Wash, Autobell Car W …

This Car Wash Market research report offers you an array of insights about Automotive industry and business solutions that will support to stay ahead of the competition. Systematic investment analysis is also underlined in this Car Wash Market report which forecasts impending opportunities for the market players.This market report is the outcome of persistent efforts lead by knowledgeable forecasters, innovative analysts and brilliant researchers who carries out detailed and diligent…