Press release

Surge In Start-Ups And Small Businesses Drives Venture Capital Investment Market: The Driving Engine Behind Venture Capital Investment Market Evolution in 2025

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.Venture Capital Investment Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

There has been a significant expansion in the venture capital investment market in recent years. The projection suggests that it will escalate from $301.78 billion in 2024 to $364.19 billion in 2025, with a compound annual growth rate (CAGR) of 20.7%. Factors such as the development of the entrepreneurial ecosystem, changes in market trends and industry, government-spearheaded policies and incentives, investor confidence and their willingness to take risks, as well as the emergence of new sectors and technologies have all contributed to this historical growth.

Venture Capital Investment Market Size Forecast: What's the Projected Valuation by 2029?

Expectations are high for significant expansion in the venture capital investment market over the coming years. With projections estimating a growth to $764.78 billion in 2029, this would equate to a compound annual growth rate (CAGR) of 20.4%. Several factors are believed to be fueling this forecasted growth, including sustainable and impact investing, innovations in healare, globalization with an emphasis on cross-border investments, diversity and inclusion efforts, resilience, and swift adoption of technology. Emerging trends that are predicted to make waves during the forecast period encompass a burgeoning e-commerce market along with direct-to-consumer brands, a focus on mental health and wellness startups, development in autonomous vehicles and related technology, the growing field of decentralized finance (DeFi), and investments flowing into space tech and aerospace startups.

View the full report here:

https://www.thebusinessresearchcompany.com/report/venture-capital-investment-global-market-report

What Are the Drivers Transforming the Venture Capital Investment Market?

The rise in start-ups and small businesses is anticipated to fuel the expansion of the venture capital investment market in the future. A small business is a private entity that employs fewer people and generates less annual revenue than a regular-sized business or corporation. However, a "startup" refers to an early-stage entrepreneurial venture often set up to solve real-world problems. Venture capital investments serve small businesses and startups by providing them with funds for business expansions, financial supervision, marketing initiatives, financial and business expertise, etc. This assistance enables these businesses to thrive in a fiercely competitive business landscape and challenge other market operators. For instance, a report in July 2024 by the UK's Office of National Statistics highlighted an escalation in formations in 14 out of 16 main industrial segments in Quarter 2 2024 compared to Quarter 2 2023. The business administration and support services industry experienced the most dramatic increase. Consequently, the escalating number of start-ups and small businesses are steering the expansion of the venture capital investment market.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=9199&type=smp

What Long-Term Trends Will Define the Future of the Venture Capital Investment Market?

There's a rising tendency for strategic partnerships in the venture capital investment market, a trend that many significant companies in the market are embracing to fortify their market standing. Illustrating this, IDG Capital Vietnam, an investment firm based in Vietnam, entered into a partnership with METAIN in March 2022. The goal of this partnership is to promote the growth of NFT real estate to draw a wider range of international investors to Vietnam. Notably, METAIN is a co-investment platform for real estate on the blockchain, also based in Vietnam.

Which Segments in the Venture Capital Investment Market Offer the Most Profit Potential?

The venture capital investment market covered in this report is segmented -

1) By Funding Type: First-Time Venture Funding, Follow-On Venture Funding

2) By Fund Size: Under $50 Million, $50 Million To $100 Million, $100 Million To $250 Million, $250 Million To $500 Million, $500 Million To $1 Billion, Above $1 Billion

3) By Industry: Real Estate, Financial Services, Food And Beverages, Healare, Transport And Logistics, It And Information Technology Enabled Services, Education, Other Industries

Subsegments:

1) By First-Time Venture Funding: Seed Funding, Series A Funding

2) By Follow-On Venture Funding: Series B Funding, Series C Funding And Beyond, Bridge Funding

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=9199&type=smp

Which Firms Dominate the Venture Capital Investment Market by Market Share and Revenue in 2025?

Major companies operating in the venture capital investment market include Intel Capital, The Bla?ckstone, Benchmark Capital, Andreessen Horowitz, Sequoia Capital, Viking Global Investors LP, New Enterciates Inc., Greylock Partners, IDG Capital Partners, Khosla Ventures, Bessemer Venture Partners, Kleiner Perkins, Battery Ventures LP, Union Square Ventures, Founders Fund, Tiger Global Management, Innovation Works, First Round Capital, AME Cloud Ventures, Lowercase Capital, GGVC Capital, Alumni Ventures, Index Ventures, Accel Partners, DST Global Funds, Healare Royalty Partners, Pace Capital, Gigafund, Cypress Growth Capital.

Which Regions Offer the Highest Growth Potential in the Venture Capital Investment Market?

North America was the largest region in the venture capital investment market in 2024. The regions covered in the venture capital investment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=9199

This Report Supports:

1. Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2. Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3. Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4. Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 7882 955267,

Asia: +91 88972 63534,

Americas: +1 310-496-7795 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surge In Start-Ups And Small Businesses Drives Venture Capital Investment Market: The Driving Engine Behind Venture Capital Investment Market Evolution in 2025 here

News-ID: 4115573 • Views: …

More Releases from The Business Research Company

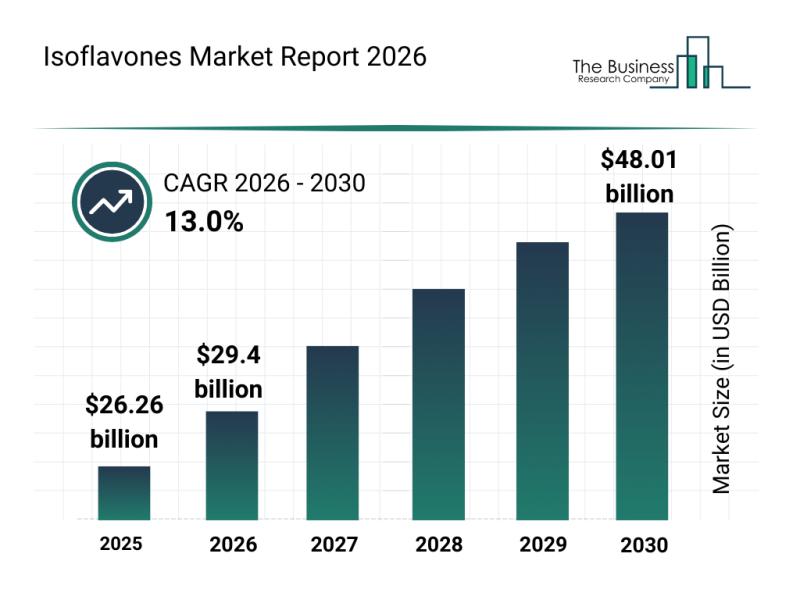

Segment Analysis and Major Growth Areas in the Isoflavones Market

The isoflavones market is poised for remarkable growth over the coming years, driven by increasing consumer awareness and expanding applications across various industries. With rising interest in health supplements and natural ingredients, this market is attracting significant attention from manufacturers and investors alike. Let's delve into the market's size, key players, emerging trends, and segment breakdowns shaping its trajectory.

Projected Market Size and Growth Outlook for Isoflavones

The isoflavones market…

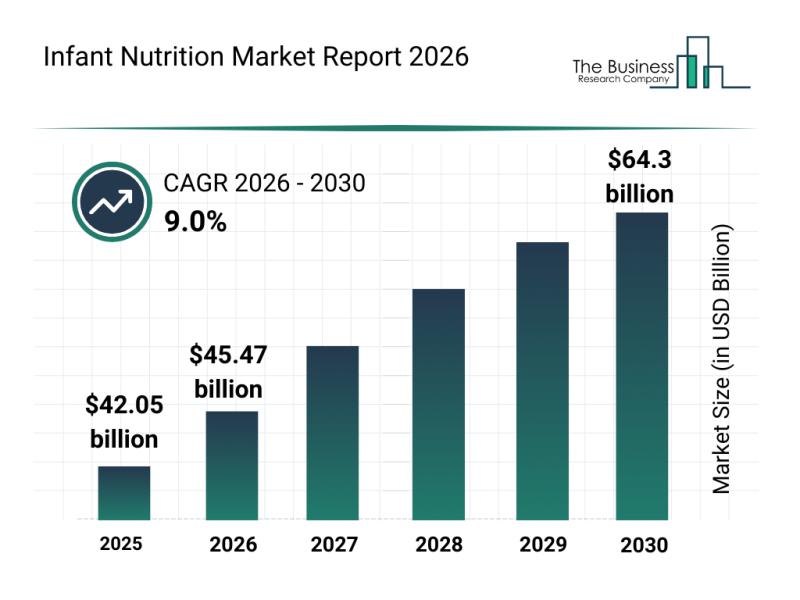

Key Strategic Developments and Emerging Changes Shaping the Infant Nutrition Mar …

The infant nutrition market is on track for substantial expansion in the coming years, driven by evolving consumer preferences and advancements in product offerings. As parents increasingly seek high-quality nutrition solutions tailored to their babies' needs, the sector is poised for remarkable growth through innovative products and diverse distribution channels. Let's explore the market's size projections, key players, emerging trends, and segment breakdowns shaping this dynamic industry.

Projected Growth Trajectory and…

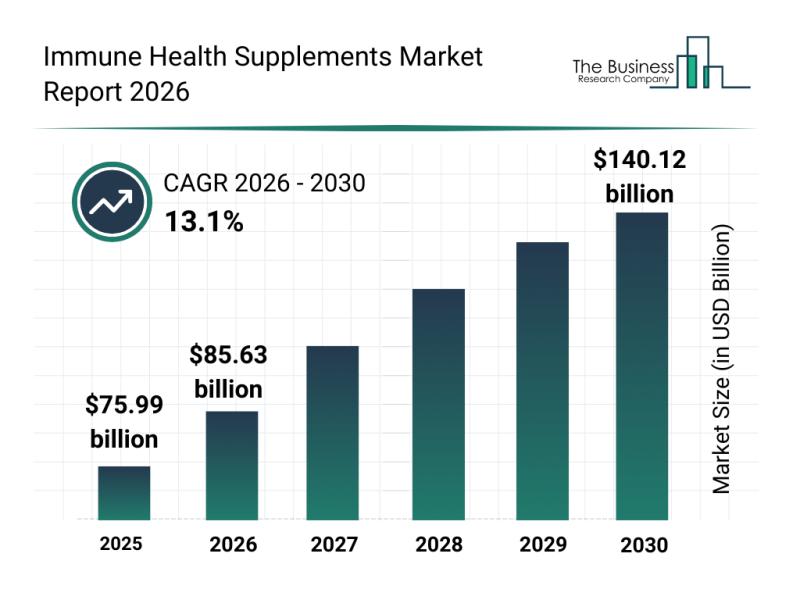

Leading Companies Advancing Innovation and Growth in the Immune Health Supplemen …

The immune health supplements sector is gaining significant traction as consumers increasingly prioritize wellness and preventive care. With a growing interest in personalized nutrition and plant-based options, this market is set to expand rapidly. Let's explore the expected market size, key players, emerging trends, and segmentation that define the future of immune health supplements.

Projected Expansion of the Immune Health Supplements Market by 2030

The immune health supplements market is…

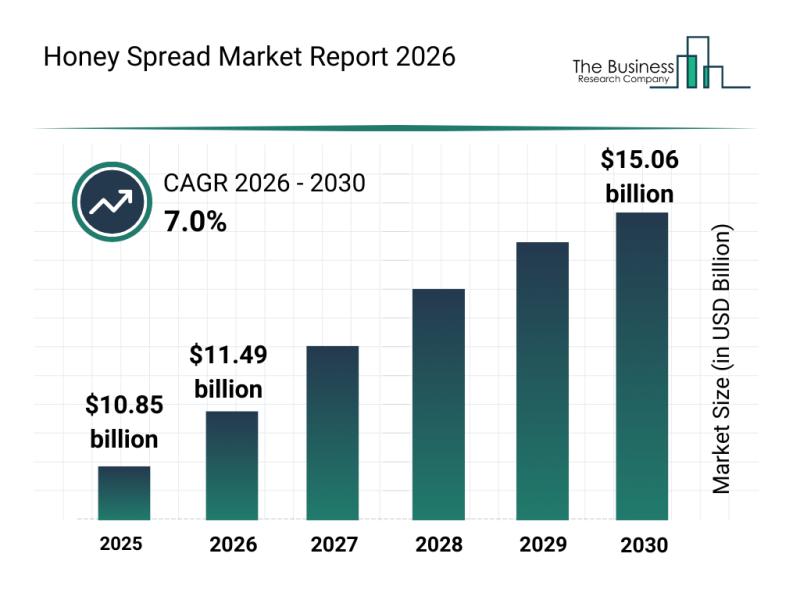

Honey Spread Market Overview: Major Segments, Strategic Developments, and Leadin …

The honey spread market is gaining significant momentum as consumers increasingly seek healthier and more flavorful alternatives to traditional spreads. Growing awareness around natural ingredients and sustainability, combined with e-commerce expansion and innovative product offerings, is set to shape the future of this sector. Below, we explore the market's size, key players, emerging trends, and segmentation to provide a comprehensive outlook through 2030.

Robust Expansion Expected in the Honey Spread Market…

More Releases for Venture

Venture Solar Rebrands As Venture Home, Expanding Mission To Be Customers' Lifel …

After 11 years and 15,000+ solar installations, company evolves to meet growing demand for comprehensive home energy solutions

Venture Solar, a leading solar installation company serving the Northeast and Mid-Atlantic, today announced it is rebranding as Venture Home, reflecting the company's evolution from a solar-focused installer to a comprehensive home electrification partner.

The rebrand comes as the company enters its 11th year in business and marks a strategic shift to address the…

1752VC Launches 14th Venture Fellow & Emerging Angel Cohort, Training the Next G …

1752VC has launched the 14th cohort of its Venture Fellow and Emerging Angel program, an eight-week, hands-on experience designed to help aspiring investors, founders, and professionals gain real-world venture capital skills and access early-stage deal flow.

Santa Monica, CA - November 4, 2025 - 1752VC [http://www.1752.vc] announced the launch of its 14th Venture Fellow cohort, further expanding its nationwide network of more than 250 Fellows-a dynamic community of founders, operators, and…

Announcing G2C Venture Partners

Over a decade of Collaboration Transforms into a Venture Vision

We are thrilled to announce what we have been building behind the scenes - G2C Venture Partners is officially launching today!

As three founders-turned-investors - Sunil Grover, Amar Chokhawala, and Vik Ghai - we are bringing our combined decades of experience and co-investment partnerships to a new kind of venture fund.

We are combining our battle-tested experience, relationship networks, and investment…

Gary Fowler's GSD Venture Studios Redefines Venture Building Through Direct Lead …

GSD Venture Studios is an operational family office that created a 360-degree entrepreneurial ecosystem, taking a laser-precise approach to venture building from early stage to Series C companies.

Image: https://www.getnews.info/uploads/d9f450b06da75bff3aa844e08748b0ef.png

While many startups scrounge for capital, resources, and ideas wherever they can, those poised for success turn to Gary Fowler's GSD Venture Studios [https://www.gsdvs.com/]. With a proven track record of success, a forward-thinking actionable approach, a network of avenues connecting capital…

CleanTech Venture Capital Interest

Keynote speaker to share the vision for CleanTech and Venture Capital Funding at EngEx 2010

SAN DIEGO – CleanTech start-ups are grabbing increased interest and investments from venture capital groups that placed almost $2 billion into eco-friendly companies last year and increased the funding pace with another $773 million during the first quarter of 2010. Clean energy business owners and industry professionals attending EngEx 2010 will hear more about the…

Sep. 5th Venture Capital Event

(EMAILWIRE.COM, July 31, 2007)- New York - Argyle Executive Forum is pleased to present its 2007 Leadership in Venture Capital Forum. The event, to take place in Manhattan, will bring together 135–150 CEOs & Board members of public and private large cap and mid cap corporations, complementary areas of executive leadership (CFOs & COOs), members of the endowment, foundation, and family office community, select advisory firms, and select founders /…