Press release

Global Insurance Fraud Detection Market Size, Share, Forecast 2023 - 2033 | Top key players : BAE Systems plc, SAP SE, Fiserv Inc., Equifax Inc., Experian plc, SAS Institute Inc.

According to a research report published by Spherical Insights & Consulting, the Global insurance fraud detection market size was valued at USD 5.48 Billion in 2023 and is slated to cross USD 43.80 Billion by 2033, growing at a CAGR of 23.10% from 2023 to 2033.The Insurance Fraud Detection global market research studies offer an in-depth analysis of current industry trends, development models, and methodology. Production processes, development platforms, and the actual product models are some of the variables that have a direct impact on the market. The aforementioned characteristics can drastically vary in response to even minor changes in the product profile. The study provides a thorough explanation of each of these elements of Banking & Financial.

Request To Download Free Sample copy of the report @ - https://www.sphericalinsights.com/request-sample/8230

Market Overview

The insurance fraud detection sector consists of businesses that develop and offer software and services aimed at assisting insurance firms in recognizing and preventing fraud. This process is a core part of insurance operation methods designed to identify and prevent duplicitous activities that may cause major financial losses. These types of fraud cases can be detected in various conditions such as counterfeit claims, fraudulent claims, exaggerated claims, exaggerated damages, or fabricated incidents, during the process of fraud detection which is integrated with advanced technology such as AI, Machine learning, and other advanced technological features to identify the pattern and mark doubtful cases.

The global market is Insurance Fraud Detection robust growth due to:

1. Rising Incidence of Insurance Fraud: The increasing volume and sophistication of fraudulent claims across sectors such as health, auto, life, and property insurance are compelling insurers to invest in advanced fraud detection solutions.

2. Adoption of AI and Big Data Analytics: Integration of artificial intelligence (AI), machine learning (ML), and big data analytics enables real-time claim analysis and pattern recognition, significantly enhancing the ability to detect anomalies and reduce false positives.

3. Regulatory Pressures and Compliance Needs: Governments and regulatory bodies are enforcing stricter compliance standards, which is driving insurers to implement proactive fraud detection mechanisms to avoid penalties and reputational damage.

Buy Now this report: https://www.sphericalinsights.com/checkout/8230

The solutions segment secured a dominant share in 2023 and is anticipated to grow at a notable CAGR during the forecast period.

Based on the component, the global insurance fraud detection market is divided into solutions and services. Among these, the solutions segment accounted for the highest share in 2023 and is anticipated to grow at a notable CAGR during the forecast period. The increasing use of state-of-the-art technology by insurance companies looking to strengthen their fraud detection capabilities is responsible for segmental domination. Additionally, in order to enhance the security of client-organization interactions, insurance companies are implementing authentication procedures. Therefore, it is anticipated that authentication will offer an extra layer to confirm payments, account changes, send authentication alerts, and customer acknowledgments or policy approvals. This acceptance is steadily rising and supporting the solutions' segmental domination.

The on-premise segment accounted largest market share in 2023 and is projected to grow at a remarkable CAGR during the forecast period.

Based on the deployment, the global insurance fraud detection market is classified into cloud and on-premise. Among these, the on-premise segment largest market share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This significant shareholding is primarily motivated by the increasing demand for data security and adherence to strict regulations, leading many insurance firms to choose on-premises solutions. These solutions offer companies total control over their confidential data, reducing the chances of breaches and unauthorized access. Additionally, the customizable and integrative capabilities of on-premises deployment enable a tailored approach to fraud detection, aligning perfectly with the organization's unique requirements and existing systems.

List of Key Companies

• Lexisnexis Risk Solutions Inc. (RELX Group plc)

• BAE Systems plc

• SAP SE

• Fiserv Inc.

• Equifax Inc.

• Experian plc

• SAS Institute Inc.

• Fair Isaac Corporation

• International Business Machines Corporation

• FRISS

• ACI Worldwide Inc

• Others

Market Challenges:

• High Implementation Costs

Advanced fraud detection solutions that leverage AI, machine learning, and predictive analytics often require significant investment in infrastructure, software licensing, and skilled personnel. This can be a barrier for small and mid-sized insurance companies, limiting widespread adoption.

• Data Privacy and Compliance Concerns

The use of personal and sensitive customer data for fraud detection must comply with data protection regulations like GDPR, HIPAA, and others. Ensuring compliance while performing effective fraud analytics poses legal and operational challenges.

• Complexity of Detecting Sophisticated Fraud Schemes

Fraudsters are becoming increasingly tech-savvy, using deepfakes, synthetic identities, and social engineering tactics. Keeping pace with these evolving techniques requires continuous system updates and training, which can be both costly and time-consuming.

• Limited Access to Unified and High-Quality Data

Effective fraud detection relies on accurate and comprehensive data from various sources. Fragmented legacy systems and siloed data in insurance companies hinder seamless analysis and pattern recognition, reducing detection accuracy.

• High False Positive Rates

Many traditional detection systems flag a high number of legitimate claims as suspicious, leading to delays, increased workload for investigators, and customer dissatisfaction. Balancing precision and recall remains a persistent challenge.

Research Objectives:

• To Analyze Current Market Trends and Dynamics

Identify and evaluate the key drivers, restraints, and opportunities shaping the insurance fraud detection market, including technological innovations, regulatory developments, and shifts in fraud patterns.

• To Assess the Market Size and Growth Potential

Quantify the current market size and forecast its growth across various segments, including solution types (software, services), deployment models (on-premises, cloud), and application areas (health, auto, life, property insurance).

Recent Development

• In October 2023, Shippo and Cover Genius joined forces to introduce Shippo Total Protection, an innovative solution designed to provide merchants with comprehensive coverage, global protection, and streamlined claims processing to enhance their experience.

Access Full Report: https://www.sphericalinsights.com/reports/insurance-fraud-detection-market

Market Segment:

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global insurance fraud detection market based on the below-mentioned segments:

Global Insurance Fraud Detection Market, By Component

• Solutions

• Services

Global Insurance Fraud Detection Market, By Deployment

• Cloud

• On-Premise

Regional Segment Analysis of the Global Insurance Fraud Detection Market

• North America (U.S., Canada, Mexico)

• Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

• Asia-Pacific (China, Japan, India, Rest of APAC)

• South America (Brazil and the Rest of South America)

• The Middle East and Africa (UAE, South Africa, Rest of MEA)

What's covered in the report?

1. Overview of the Insurance Fraud Detection market.

2. The current and forecasted regional (North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa) market size data for the Insurance Fraud Detection market, based on segment.

3. Insurance Fraud Detection Market trends.

4. Insurance Fraud Detection Market drivers.

5. Analysis of major company profiles.

FIVE FORCES ANALYSIS:

1. Threat of New Entrants - Moderate

• Barriers to Entry: While the growing demand and digitization in the insurance sector create opportunities, high development costs, need for regulatory compliance, and the requirement for AI/ML expertise make entry challenging.

• Opportunities for Niche Players: Startups with innovative analytics or blockchain solutions can find entry points, particularly with SaaS-based models.

2. Bargaining Power of Suppliers - Low to Moderate

• Software and Technology Providers: While AI, cloud, and data analytics vendors power these systems, the market is competitive with many alternatives, reducing individual supplier leverage.

• Dependence on Data: Access to quality data sources (credit bureaus, public records, claim histories) can give some data aggregators influence, but this remains limited due to diversified data streams.

3. Bargaining Power of Buyers - High

• Large Insurance Companies: Big insurers have strong negotiating power due to bulk licensing deals and demand for customized, scalable solutions.

• Demand for Performance and ROI: Buyers expect measurable fraud reduction, low false positives, and seamless integration with existing systems-pressuring vendors to offer high-performance tools at competitive rates.

4. Threat of Substitutes - Low

• Manual Detection Systems: Traditional, human-led investigations are still used but are largely ineffective at scale and increasingly replaced by automation.

• Generic Analytics Tools: General fraud or business intelligence software may be considered alternatives, but they lack the domain-specific capabilities of dedicated fraud detection solutions.

5. Industry Rivalry - High

• Highly Competitive Landscape: The market features global tech giants (like IBM, SAS, FICO) alongside specialized startups and regional vendors, driving intense competition.

• Innovation Race: Vendors constantly evolve their platforms with AI, real-time analytics, and case management enhancements to differentiate themselves.

PESTLE ANALYSIS:

1. Political Factors

• Government Focus on Fraud Prevention: Many governments are actively promoting anti-fraud regulations and digitalization in the insurance sector, encouraging adoption of fraud detection technologies.

• Public Sector Insurance Reforms: Changes in public healthcare or pension insurance systems, especially in emerging markets, impact fraud detection investment and priorities.

2. Economic Factors

• Rising Insurance Penetration: As insurance uptake increases globally, especially in developing regions, so does the risk of fraudulent claims-fueling demand for detection tools.

• Cost of Fraud: Insurance fraud costs billions annually in lost revenue, driving insurers to allocate larger budgets toward fraud prevention technologies.

3. Social Factors

• Digital-First Consumer Behavior: Consumers increasingly prefer digital insurance services, which increases online fraud risks and necessitates sophisticated detection tools.

• Public Awareness and Ethical Behavior: Low public awareness about what constitutes insurance fraud can contribute to "soft fraud." Education and outreach are becoming necessary complements to tech solutions.

4. Technological Factors

• Advancements in AI and Machine Learning: Rapid improvements in real-time analytics, pattern recognition, and anomaly detection are revolutionizing fraud detection capabilities.

• Blockchain and Smart Contracts: Emerging technologies like blockchain offer secure, transparent claims processing, minimizing fraud risks.

5. Legal Factors

• Data Protection and Privacy Regulations: Laws like GDPR and HIPAA restrict how insurers can collect, store, and analyze personal data, which directly impacts fraud detection processes.

• Compliance with Financial Regulations: Insurers must ensure that fraud detection methods comply with financial audit and reporting standards, particularly in regulated sectors like health and life insurance.

6. Environmental Factors

• Climate-Related Claims and Fraud: Increasing natural disasters due to climate change are leading to more insurance claims-and more opportunities for fraud in property and casualty insurance.

• Sustainability in Tech Infrastructure: As insurers invest in cloud-based fraud detection tools, there is growing attention on using energy-efficient and sustainable computing resources.

Table of Content (TOC)

• Introduction

1. Objectives of the Study

2. Market Definition

3. Research Scope

• Research Methodology and Assumptions

• Executive Summary

• Premium Insights

1. Porter's Five Forces Analysis

2. Value Chain Analysis

3. Top Investment Pockets

1. Market Attractiveness Analysis By Product Type

2. Market Attractiveness Analysis By Type

3. Market Attractiveness Analysis By Segment Type

4. Market Attractiveness Analysis By Region

4. Industry Trends

• Market Dynamics

1. Market Evaluation

2. Drivers

1. Increasing development in sector

3. Restraints

4. Opportunities

5. Challenges

• Global Insurance Fraud Detection Market Analysis and Projection, By Product Type

• Global Insurance Fraud Detection Market Analysis and Projection, By Type

• Global Insurance Fraud Detection Market Analysis and Projection, By Segment Type

• Global Insurance Fraud Detection Market Analysis and Projection, By Regional Analysis

1. Segment Overview

2. North America

1. U.S.

2. Canada

3. Mexico

3. Europe

1. Germany

2. France

3. U.K.

4. Italy

5. Spain

4. Asia-Pacific

1. Japan

2. China

3. India

5. South America

1. Brazil

6. Middle East and Africa

1. UAE

2. South Africa

• Global Insurance Fraud Detection Market-Competitive Landscape

1. Overview

2. Market Share of Key Players in the Global Insurance Fraud Detection Market

1. Global Company Market Share

2. North America Company Market Share

3. Europe Company Market Share

4. APAC Company Market Share

3. Competitive Situations and Trends

1. Coverage Launches and Developments

2. Partnerships, Collaborations, and Agreements

3. Mergers & Acquisitions

4. Expansions

• Company Profiles

1. Company1

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

2. Company2

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

3. Company3

1. Business Overview

2. Company Snapshot

3. Company Market Share Analysis

4. Company Coverage Portfolio

5. Recent Developments

6. SWOT Analysis

Industry Related Reports:

Global Online Life Insurance Market Size

https://www.sphericalinsights.com/reports/online-life-insurance-market

Global Digital Banking Platforms (DBP) Market Size

https://www.sphericalinsights.com/reports/digital-banking-platforms-dbp-market

Global Usage-based Insurance Market Size

https://www.sphericalinsights.com/reports/usage-based-insurance-market

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurance Fraud Detection Market Size, Share, Forecast 2023 - 2033 | Top key players : BAE Systems plc, SAP SE, Fiserv Inc., Equifax Inc., Experian plc, SAS Institute Inc. here

News-ID: 4114042 • Views: …

More Releases from Spherical Insights LLP

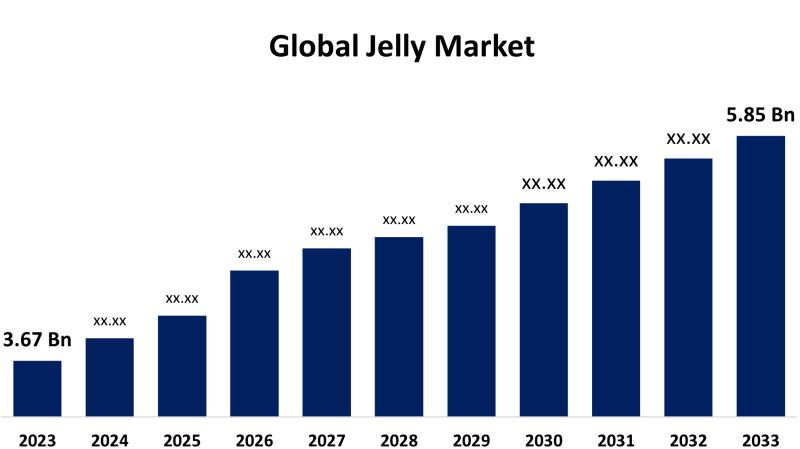

Global Jelly Market Size, Share, Forecasts 2023 - 2033 | Top key players: Bonne …

According to a research report published by Spherical Insights & Consulting, the Global Jelly Market is Expected to Grow from USD 3.67 Billion in 2023 to USD 5.85 Billion by 2033, at a CAGR of 4.77% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8511

The jelly industry comprises the international sector dealing with the manufacture, distribution, and sale of jelly products. Such products cover…

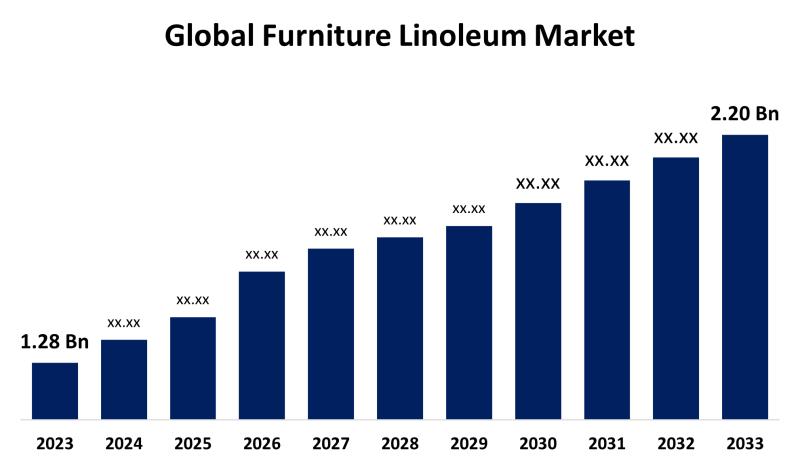

Global Furniture Linoleum Market Size, Share, Forecasts 2023 - 2033 | Top key pl …

According to a research report published by Spherical Insights & Consulting, the Global Furniture Linoleum Market Size is Estimated to Grow from USD 1.28 billion in 2023 to USD 2.20 billion by 2033, Growing at a CAGR of 5.57% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8455

The industry engaged in the manufacture, marketing, and distribution of linoleum products, especially made for furniture…

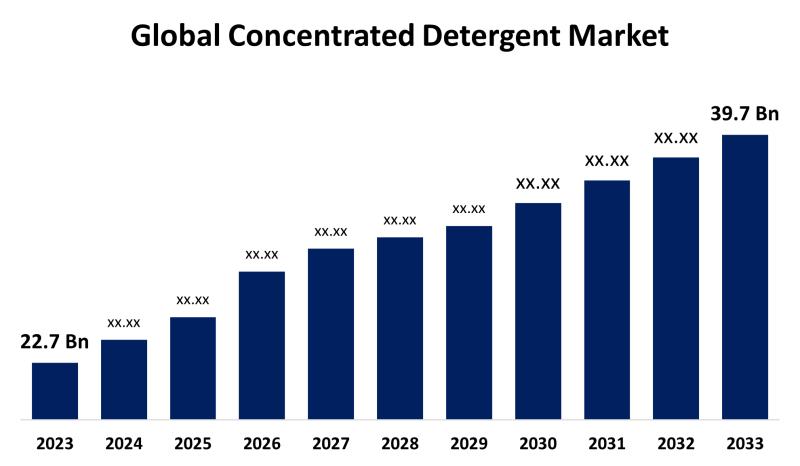

Global Concentrated Detergent Market Size, Share, Forecasts 2023 - 2033 | Top ke …

According to a research report published by Spherical Insights & Consulting, the Global Concentrated Detergent Market Size Expected to Grow from USD 22.7 Billion in 2023 to USD 39.7 Billion by 2033, at a CAGR of 5.75% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report: https://www.sphericalinsights.com/request-sample/8439

The division of the detergent industry that produces and markets highly concentrated…

Global Wireless Home Weather Station Market Size, Share, Forecast 2023 - 2033 | …

According to a research report published by Spherical Insights & Consulting, the Global Wireless Home Weather Station Market Size is Expected to Grow from USD 249 Million in 2023 to USD 508 Million by 2033, at a CAGR of 7.39% during the forecast period 2023-2033.

Request To Download Free Sample copy of the report @ -

https://www.sphericalinsights.com/request-sample/7694

A system that measures and sends environmental data from outside to within, including temperature,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…