Press release

Surplus Lines Insurance Market Likely to Boost Future Growth by 2031 | Chubb, Arch Insurance, Lloyd's of London

HTF MI recently introduced Global Surplus Lines Insurance Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2031). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.Major companies in Surplus Lines Insurance Market are: Lloyd's of London (United Kingdom), Chubb Limited (Switzerland), AXA XL (United States), American International Group (AIG) (United States), Zurich Insurance Group (Switzerland), Markel Corporation (United States), Beazley Group (United Kingdom), Arch Insurance (United States), W. R. Berkley Corporation (United States), Scottsdale Insurance (Nationwide) (United States), Everest Re Group (Bermuda), RLI Corp (United States), Argo Group International Holdings (Bermuda), QBE Insurance Group (Australia), Tokio Marine HCC (Japan), AmTrust Financial Services (United States).

Get Customized Sample Now 👉 https://www.htfmarketintelligence.com/sample-report/global-surplus-lines-insurance-market?utm_source=Krati_OpenPR&utm_id=Krati

According to HTF Market Intelligence, the global Surplus Lines Insurance Market size was valued at USD 79 billion in 2024 and is estimated to reach a revenue of USD 88.1 billion by 2031, with a CAGR of 3.7% from 2025 to 2031.

The Surplus Lines Insurance Market is Segmented by Application (Commercial, Personal) by Insurance Type (Property Insurance, Casualty Insurance, Specialty Lines, Liability Insurance, Marine Insurance, Fire Insurance, Professional Indemnity Insurance, Other) by Distribution Channel (Brokers, Agents, Direct Sales)

Definition:

Surplus lines insurance covers risks that are not underwritten by standard insurers, often due to high risk, unusual nature, or lack of data. It is provided by non-admitted insurers and regulated differently than traditional insurance. Surplus lines are commonly used for emerging technologies, catastrophic risks (like earthquakes), or unique business models. Though not backed by state guaranty funds, surplus lines are vital in insuring high-value or unconventional markets such as marijuana businesses, cyber threats, or construction projects. The market plays a key role in maintaining liquidity and risk coverage in volatile or niche sectors.

Market Trends:

Digitization of surplus lines platforms, growth in parametric insurance models, increasing entry of InsurTechs, and rising demand from gig economy and startups are defining trends. ESG-compliant underwriting is also emerging.

Market Drivers

Increasing frequency of catastrophic events (wildfires, hurricanes), growth in complex business risks (cybersecurity, crypto), and limitations of traditional insurance providers in covering such risks are major growth drivers.

Market Opportunities:

As traditional insurers withdraw from volatile markets, surplus lines offer an essential risk management avenue. Innovations in underwriting, data analytics, and partnerships with reinsurers create expansion paths. Also, untapped markets like climate risk, drone insurance, and space tech open new demand.

Market Challenges:

Regulatory inconsistencies across states, lack of consumer awareness, difficulty in risk pricing, and limited historical data for new or evolving risks create challenges. Capital adequacy for underwriting large risks remains a concern.

Dominating Region:

North America

Fastest-Growing Region:

Latin America

Market Leaders & Development Strategies:

• Ryan Specialty Holdings acquired Accredited Surety & Casualty Company, increasing its capacity in surplus lines surety and commercial bonds. • Brown & Brown Insurance purchased multiple regional surplus-focused agencies in the southeastern U.S. to deepen specialty market penetration. • Hub International expanded its E&S footprint through the acquisition of The Insurance Exchange Inc., targeting construction and high-hazard manufacturing.

Have a query? Market an enquiry before purchase 👉 https://www.htfmarketintelligence.com/enquiry-before-buy/global-surplus-lines-insurance-market?utm_source=Krati_OpenPR&utm_id=Krati

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Surplus Lines Insurance market segments by Types: Property Insurance, Casualty Insurance, Specialty Lines, Liability Insurance, Marine Insurance, Fire Insurance, Professional Indemnity Insurance, Other

Detailed analysis of Surplus Lines Insurance market segments by Applications: Commercial, Personal

Global Surplus Lines Insurance Market -Regional Analysis

• North America: United States of America (US), Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia, and Brazil.

• Middle East & Africa: Kingdom of Saudi Arabia, United Arab Emirates, Turkey, Israel, Egypt, and South Africa.

• Europe: the UK, France, Italy, Germany, Spain, Nordics, BALTIC Countries, Russia, Austria, and the Rest of Europe.

• Asia: India, China, Japan, South Korea, Taiwan, Southeast Asia (Singapore, Thailand, Malaysia, Indonesia, Philippines & Vietnam, etc) & Rest

• Oceania: Australia & New Zealand

Read Detailed Index of full Research Study at 👉 👉 https://www.htfmarketintelligence.com/report/global-surplus-lines-insurance-market

Surplus Lines Insurance Market Research Objectives:

- Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

FIVE FORCES & PESTLE ANALYSIS:

In order to better understand market conditions five forces analysis is conducted that includes the Bargaining power of buyers, Bargaining power of suppliers, Threat of new entrants, Threat of substitutes, and Threat of rivalry.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Buy Now Latest Edition of Global Surplus Lines Insurance Market Report 👉 https://www.htfmarketintelligence.com/buy-now?format=1&report=15731?utm_source=Krati_OpenPR&utm_id=Krati

Points Covered in Table of Content of Global Surplus Lines Insurance Market:

Chapter 01 - Surplus Lines Insurance Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Surplus Lines Insurance Market - Pricing Analysis

Chapter 05 - Global Surplus Lines Insurance Market Background or History

Chapter 06 - Global Surplus Lines Insurance Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Worldwide Surplus Lines Insurance Market

Chapter 08 - Global Surplus Lines Insurance Market Structure & worth Analysis

Chapter 09 - Global Surplus Lines Insurance Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Surplus Lines Insurance Market Research Method

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, Japan, Australia or Southeast Asia.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surplus Lines Insurance Market Likely to Boost Future Growth by 2031 | Chubb, Arch Insurance, Lloyd's of London here

News-ID: 4112440 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Fashion Backpack Market Future Growth & Size Projection

The latest study released on the Global Fashion Backpack Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fashion Backpack study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Ecommerce Platform Market - Global Growth Opportunities 2020-2033

The latest study released on the Global Ecommerce Platform Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Ecommerce Platform study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

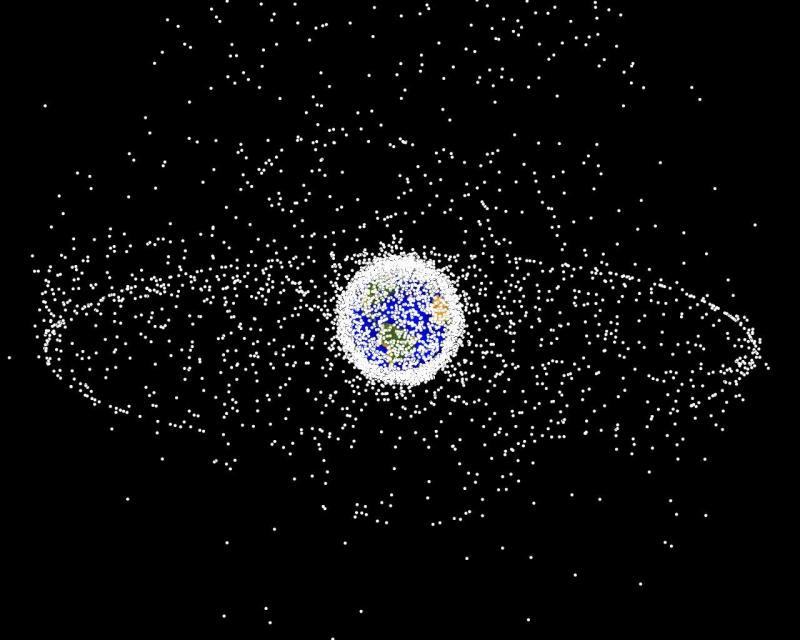

Space Debris Solutions Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Space Debris Solutions Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Space Debris Solutions study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Baby Buggy Market to Witness Unprecedented Growth by 2033

The latest analysis of the worldwide Baby Buggy market by HTF MI Research evaluates the market's size, trends, and forecasts through 2033. Baby Buggy market study includes extensive research data and proofs to give managers, analysts, industry experts, and other key personnel a ready-to-access, self-analyzed study to help understand market trends, growth drivers, opportunities, and upcoming challenges as well as about competitors.

Key Players in This Report Include:

Graco, Chicco, Britax, UPPAbaby,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…